Thailand Disposable Gloves Market (2025-2031) Outlook | Revenue, Industry, Growth, Value, Companies, Forecast, Share, Size, Analysis & Trends

| Product Code: ETC213337 | Publication Date: May 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 60 | No. of Figures: 40 | No. of Tables: 7 |

Thailand Disposable Gloves Market: Import Trend Analysis

Thailand import trend for disposable gloves experienced a significant decline with a Compound Annual Growth Rate (CAGR) of -90.36% during the period of 2020-2024. This drastic reduction in imports can be attributed to shifting demand patterns or market stability issues impacting trade performance within the sector.

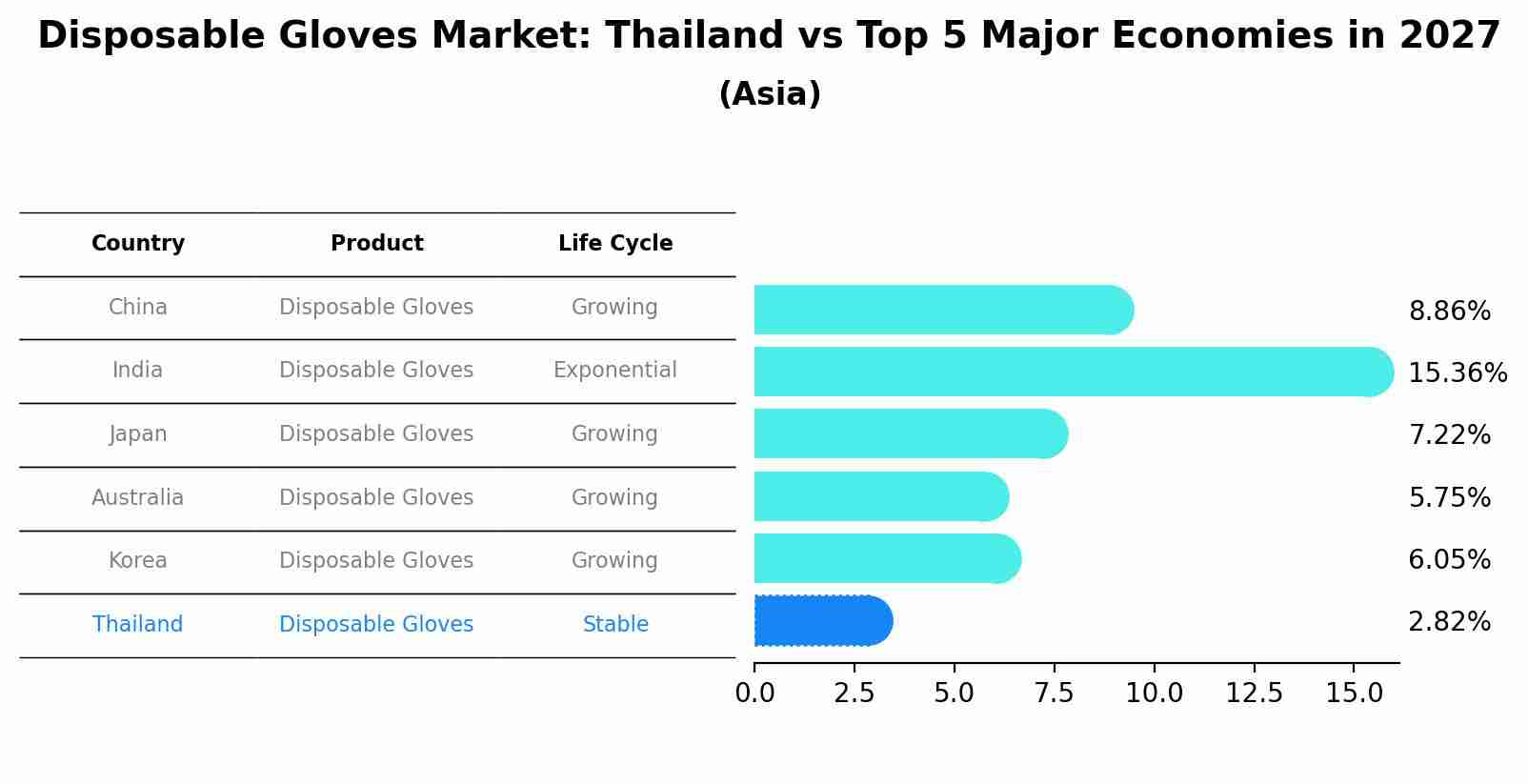

Disposable Gloves Market: Thailand vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Disposable Gloves market in Thailand is projected to expand at a stable growth rate of 2.82% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Thailand Disposable Gloves Market Synopsis

The Thailand disposable gloves market has experienced a surge in demand, particularly due to the global COVID-19 pandemic. Disposable gloves are essential for hygiene and safety in various industries, including healthcare, food processing, and manufacturing. The pandemic has heightened the importance of personal protective equipment, driving both domestic production and imports of disposable gloves. Nitrile and latex gloves are among the most widely used in the market due to their durability and flexibility. The market also faces challenges related to quality control and ensuring compliance with international standards. As the focus on hygiene and safety remains paramount, the disposable gloves market in Thailand is expected to maintain its significance.

Drivers of the Market

The Thailand Disposable Gloves market has seen substantial growth driven by various factors. The ongoing global health crisis, especially the COVID-19 pandemic, has led to increased demand for disposable gloves in healthcare, food handling, and various industries to ensure safety and hygiene. Additionally, heightened awareness of personal hygiene and safety measures has resulted in greater glove usage among the general public. Furthermore, the growth of the food industry, including restaurants and food processing units, has led to a surge in the demand for disposable gloves to maintain sanitation standards. The market is expected to continue expanding as hygiene remains a top priority.

Challenges of the Market

The Thailand disposable gloves market encounters challenges tied to supply chain disruptions and quality control. The COVID-19 pandemic highlighted the importance of a stable and efficient supply chain for personal protective equipment, including disposable gloves. Maintaining consistent quality and ensuring compliance with safety standards are crucial for manufacturers in this market. Additionally, the market can be affected by fluctuations in demand from various industries, such as healthcare and food processing, which may require quick adjustments in production capacity.

COVID-19 Impact on the Market

The Thailand disposable gloves market faced unprecedented demand during the COVID-19 pandemic, driven by the need for personal protective equipment (PPE) in healthcare and non-healthcare sectors. Manufacturers ramped up production to meet the increased demand. However, supply chain disruptions and shortages of raw materials impacted the market at various points during the pandemic. The market responded by diversifying sources of raw materials and implementing safety measures in production facilities. As the pandemic situation improved, demand for disposable gloves in non-healthcare sectors, such as food service and manufacturing, continued to grow due to heightened hygiene awareness.

Key Players in the Market

The Thailand Disposable Gloves Market has seen remarkable growth in recent years. The increasing awareness of hygiene and safety measures, particularly during the COVID-19 pandemic, has driven the demand for disposable gloves across various sectors such as healthcare, food processing, and industrial applications. Leading players in this market include companies like Sri Trang Group, Hartalega Holdings Berhad, and Supermax Corporation Berhad. These companies have established themselves as key players in the market, offering a wide range of high-quality disposable gloves to meet the diverse needs of customers.

Key Highlights of the Report:

- Thailand Disposable Gloves Market Outlook

- Market Size of Thailand Disposable Gloves Market, 2024

- Forecast of Thailand Disposable Gloves Market, 2031

- Historical Data and Forecast of Thailand Disposable Gloves Revenues & Volume for the Period 2021-2031

- Thailand Disposable Gloves Market Trend Evolution

- Thailand Disposable Gloves Market Drivers and Challenges

- Thailand Disposable Gloves Price Trends

- Thailand Disposable Gloves Porter's Five Forces

- Thailand Disposable Gloves Industry Life Cycle

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Natural Rubber Gloves for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Nitrile Gloves for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Vinyl Gloves for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Neoprene for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Polyethylene for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Medical for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Non-medical for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Form for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Powdered for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Non-powdered for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Wholesaling and Direct Selling for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Medical Store for the Period 2021-2031

- Historical Data and Forecast of Thailand Disposable Gloves Market Revenues & Volume By Online Store for the Period 2021-2031

- Thailand Disposable Gloves Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Distribution Channel

- Thailand Disposable Gloves Top Companies Market Share

- Thailand Disposable Gloves Competitive Benchmarking By Technical and Operational Parameters

- Thailand Disposable Gloves Company Profiles

- Thailand Disposable Gloves Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Thailand Disposable Gloves Market Overview |

3.1 Thailand Country Macro Economic Indicators |

3.2 Thailand Disposable Gloves Market Revenues & Volume, 2021 & 2031F |

3.3 Thailand Disposable Gloves Market - Industry Life Cycle |

3.4 Thailand Disposable Gloves Market - Porter's Five Forces |

3.5 Thailand Disposable Gloves Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Thailand Disposable Gloves Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.7 Thailand Disposable Gloves Market Revenues & Volume Share, By Form, 2021 & 2031F |

3.8 Thailand Disposable Gloves Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

4 Thailand Disposable Gloves Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing awareness about hygiene and safety measures |

4.2.2 Growing healthcare industry in Thailand |

4.2.3 Stringent regulations regarding worker safety and hygiene practices |

4.3 Market Restraints |

4.3.1 Fluctuating raw material prices |

4.3.2 Competition from alternative products like reusable gloves |

4.3.3 Environmental concerns related to disposable gloves disposal |

5 Thailand Disposable Gloves Market Trends |

6 Thailand Disposable Gloves Market, By Types |

6.1 Thailand Disposable Gloves Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Thailand Disposable Gloves Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 Thailand Disposable Gloves Market Revenues & Volume, By Natural Rubber Gloves, 2021-2031F |

6.1.4 Thailand Disposable Gloves Market Revenues & Volume, By Nitrile Gloves, 2021-2031F |

6.1.5 Thailand Disposable Gloves Market Revenues & Volume, By Vinyl Gloves, 2021-2031F |

6.1.6 Thailand Disposable Gloves Market Revenues & Volume, By Neoprene, 2021-2031F |

6.1.7 Thailand Disposable Gloves Market Revenues & Volume, By Polyethylene, 2021-2031F |

6.1.8 Thailand Disposable Gloves Market Revenues & Volume, By Others, 2021-2031F |

6.2 Thailand Disposable Gloves Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Thailand Disposable Gloves Market Revenues & Volume, By Medical, 2021-2031F |

6.2.3 Thailand Disposable Gloves Market Revenues & Volume, By Non-medical, 2021-2031F |

6.3 Thailand Disposable Gloves Market, By Form |

6.3.1 Overview and Analysis |

6.3.2 Thailand Disposable Gloves Market Revenues & Volume, By Powdered, 2021-2031F |

6.3.3 Thailand Disposable Gloves Market Revenues & Volume, By Non-powdered, 2021-2031F |

6.4 Thailand Disposable Gloves Market, By Distribution Channel |

6.4.1 Overview and Analysis |

6.4.2 Thailand Disposable Gloves Market Revenues & Volume, By Wholesaling and Direct Selling, 2021-2031F |

6.4.3 Thailand Disposable Gloves Market Revenues & Volume, By Medical Store, 2021-2031F |

6.4.4 Thailand Disposable Gloves Market Revenues & Volume, By Online Store, 2021-2031F |

7 Thailand Disposable Gloves Market Import-Export Trade Statistics |

7.1 Thailand Disposable Gloves Market Export to Major Countries |

7.2 Thailand Disposable Gloves Market Imports from Major Countries |

8 Thailand Disposable Gloves Market Key Performance Indicators |

8.1 Number of healthcare facilities adopting disposable gloves |

8.2 Compliance rate with safety and hygiene regulations |

8.3 Growth in demand from industries requiring disposable gloves |

9 Thailand Disposable Gloves Market - Opportunity Assessment |

9.1 Thailand Disposable Gloves Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Thailand Disposable Gloves Market Opportunity Assessment, By Application, 2021 & 2031F |

9.3 Thailand Disposable Gloves Market Opportunity Assessment, By Form, 2021 & 2031F |

9.4 Thailand Disposable Gloves Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

10 Thailand Disposable Gloves Market - Competitive Landscape |

10.1 Thailand Disposable Gloves Market Revenue Share, By Companies, 2024 |

10.2 Thailand Disposable Gloves Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero