Thailand Surfactants Market (2025-2031) | Outlook, Growth, Share, Size, Industry, Value, Forecast, Companies, Revenue, Trends & Analysis

Market Forecast By Type (Anionic, Non-ionic, Cationic, Amphoteric), By End-Use Industry(Personal Care (shampoos, facial cleansers, body washes, cosmetics), Household (laundry detergent, dishwashing liquids, fabric softeners), Industrial (institutional cleaners, heavy-duty degreasers, metal cleaning) excluding medical equipments, Medical Devices Cleaning, Agrochemicals (wetting agents, adjuvants), Paints & Coatings / Emulsifiers, Others (oilfield, textile, paper, food processing — only if material)) ,By Source (Vacuum Distillation Process, Distillation Hydrogen Treatment, Thin Film Evaporation), And Competitive Landscape

| Product Code: ETC225085 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 95 | No. of Figures: 44 | No. of Tables: 13 |

Thailand Surfactants Market: Import Trend Analysis

Thailand import trend for the surfactants market from 2020 to 2024 experienced a notable decline, with a Compound Annual Growth Rate (CAGR) of -88.69%. This sharp decrease may indicate a significant shift in demand dynamics or market instability affecting trade performance during the period.

Surfactants Market: Thailand vs Top 5 Major Economies in 2027 (Asia)

The Surfactants market in Thailand is projected to grow at a stable growth rate of 3.74% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Topics Covered in Thailand Surfactants Market Report

The Thailand Surfactants Market Report thoroughly covers the market by type, by end-use industry, and by source. The Thailand Surfactants Market Outlook report provides an unbiased and detailed analysis of the ongoing Thailand Surfactants Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Thailand Surfactants Market Synopsis

The Thailand surfactants market experienced significant growth from 2021 to 2025, driven by rapid urbanization, industrial expansion, and rising demand from key consumer and industrial sectors. Urbanization increased from 2022 to 2024, which directly lifted the consumption of household cleaning agents that rely on surfactants for key cleaning and emulsifying functions. The market was further bolstered by the robust recovery of the tourism sector, which welcomed international visitors by October 2025, accelerating demand for industrial-grade surfactants in the commercial cleaning segment.

Strategic foreign direct investment played a critical role, with approved investments in the petrochemicals and chemicals sector reaching more in Q1 2024, expanding the industrial base for surfactant manufacturing and consumption. Concurrently, Thailand's healthcare ecosystem, anchored by a medical device sector and a burgeoning beauty and personal care market, which grew year-on-year to reach a high in 2023, significantly increased the need for specialty and mild surfactants. The combined impact of these factors across the housing, tourism, industrial, healthcare, and personal care sectors solidified the Thailand surfactants market's strong growth trajectory, reinforcing the country's position as a key regional market.

According to 6Wresearch, the Thailand Surfactants Market is projected to grow at a CAGR of 4.6% in revenue and 3.5% in volume from 2025 to 2031, propelled by industrial investments, digital commerce, and sustainability mandates. Thailand's urban population is projected to increase from 2022 to 2030, and the surge in residential housing projects would amplify the demand for surfactants in household cleaning and personal care products. This growth is reinforced by the national Bio-Circular-Green economic model, promoting a shift toward bio-based surfactants derived from local feedstocks.

Concurrently, the beauty and personal care (BPC) sector is another significant long-term driver, with the market projected to surpass by 2030 and strong growth in both mass and premium categories. The high-end BPC segment is set for sustained expansion, with prestige categories such as colour cosmetics and skin care growing between 2024 and 2028. These factors, supported by Thailand’s strong oleochemical base, position Thailand surfactant market for sustained expansion, aligning with both economic ambitions and environmental goals.

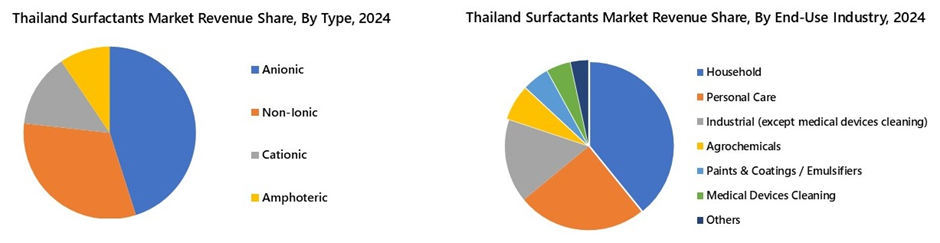

Market Segmentation By Type

Anionic is expected to be the highest revenue and volume-generating segment (2025-2031) due to its continued dominance in high-volume household and industrial formulations and the scaling of modern retail and institutional channels. The segment’s widespread adoption in emerging product formats and expansions in downstream blending capacity would sustain its revenue leadership.

Market Segmentation By End-Use Industry

Household is expected to be the highest revenue and volume-generating end-user segment (2025-2031), supported by continued growth in modern retail penetration, expanding urban households, and rising adoption of convenient and concentrated cleaning products. Large-scale formulation capacity and evolving packaging formats would further reinforce household surfactants as the dominant revenue contributor.

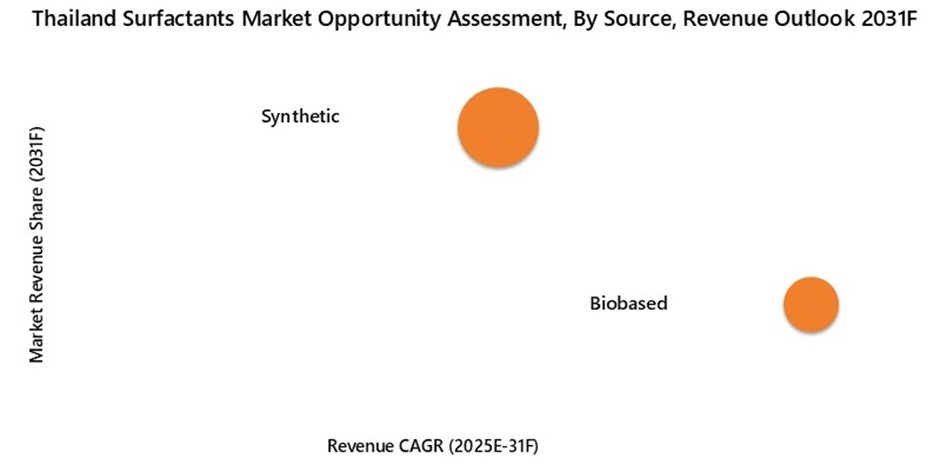

Market Segmentation By Source

Synthetic is expected to be the highest revenue and volume-generating segment by source during 2025-2031, driven by large-scale production of petrochemical-derived surfactants for household, industrial, and personal care formulations. Established supply chains for ethylene oxide, LAB, and other synthetic intermediates would continue to support its dominant revenue position.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Surfactants Market Overview

- Thailand Surfactants Market Outlook

- Thailand Surfactants Market Forecast

- Historical Data and Forecast of Thailand Surfactants Market Revenues and Volume for the Period 2021-2031F

- Historical Data and Forecast of Thailand Surfactants Market Revenues and Volume, By Type, for the Period 2021-2031F

- Historical Data and Forecast of Thailand Surfactants Market Revenues and Volume, By End-Use Industry, for the Period 2021-2031F

- Historical Data and Forecast of Thailand Surfactants Market Revenues, By Source, for the Period 2021-2031F

- Thailand Surfactants Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Thailand Surfactants Market Trends & Evolution

- Market Opportunity Assessment

- Thailand Surfactants Market Revenue Ranking, By Top 3 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Anionic

- Cationic

- Non-Ionic

- Amphoteric

By End-Use Industry

- Personal Care (shampoos, facial cleansers, body washes, cosmetics)

- Household (laundry detergent, dishwashing liquids, fabric softeners)

- Industrial (institutional cleaners, heavy-duty degreasers, metal cleaning) excluding medical equipments

- Medical Devices Cleaning

- Agrochemicals (wetting agents, adjuvants)

- Paints & Coatings / Emulsifiers

- Others (oilfield, textile, paper, food processing — only if material)

By Source

- Vacuum Distillation Process

- Distillation Hydrogen Treatment

- Thin Film Evaporation

Thailand Surfactants Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Global Surfactants Market Overview |

| 3.1. Global Surfactants Market Revenues, 2021-2031F |

| 4. Thailand Surfactants Market Overview |

| 4.1. Thailand Macro Economic Indicators |

| 4.2. Thailand Surfactants Market Revenues and Volume, 2021-2031F |

| 4.3. Thailand Surfactants Market Industry Life Cycle |

| 4.4. Thailand Surfactants Market Porter's Five Forces |

| 5. Thailand Surfactants Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Thailand Surfactants Market Trends & Evolution |

| 7. Thailand Surfactants Market Overview, By Type |

| 7.1. Thailand Surfactants Market Revenue Share and Volume Share, By Type, 2024 & 2031F |

| 7.1.1. Thailand Surfactants Market Revenues and Volume, By Anionic, 2021-2031F |

| 7.1.2. Thailand Surfactants Market Revenues and Volume, By Cationic, 2021-2031F |

| 7.1.3. Thailand Surfactants Market Revenues and Volume, By Non-Ionic, 2021-2031F |

| 7.1.4. Thailand Surfactants Market Revenues and Volume, By Amphoteric, 2021-2031F |

| 8. Thailand Surfactants Market Overview, By End-Use Industry |

| 8.1. Thailand Surfactants Market Revenue Share and Volume Share, By End-Use Industry, 2024 & 2031F |

| 8.1.1. Thailand Surfactants Market Revenues and Volume, By Personal Care, 2021-2031F |

| 8.1.2. Thailand Surfactants Market Revenues and Volume, By Household, 2021-2031F |

| 8.1.3. Thailand Surfactants Market Revenues and Volume, By Industrial (excluding medical devices cleaning), 2021-2031F |

| 8.1.4. Thailand Surfactants Market Revenues and Volume, By Medical Devices Cleaning, 2021-2031F |

| 8.1.5. Thailand Surfactants Market Revenues and Volume, By Agrochemicals, 2021-2031F |

| 8.1.6. Thailand Surfactants Market Revenues and Volume, By Paints & Coatings, 2021-2031F |

| 8.1.7. Thailand Surfactants Market Revenues and Volume, By Others, 2021-2031F |

| 9. Thailand Surfactants Market Overview, By Source |

| 9.1. Thailand Surfactants Market Revenue Share and Volume Share, By Source, 2024 & 2031F |

| 9.1.1. Thailand Surfactants Market Revenues and Volume, By Biobased, 2021-2031F |

| 9.1.2. Thailand Surfactants Market Revenues and Volume, By Synthetic, 2021-2031F |

| 9.2. Thailand Surfactants Market Sourcing Behavior Analysis (Domestic vs Imported) |

| 10. Thailand Surfactants Market Key Performance Indicators |

| 11. Thailand Surfactants Market Price Trends |

| 12. Thailand Surfactants Market Challenges in Supply Chain and Sustainability Readiness |

| 13. Thailand Surfactants Market Value Chain Mapping |

| 14. Thailand Surfactants Market Import Export Trade Statistics |

| 15. Thailand Surfactants Market Opportunity Assessment |

| 15.1. Thailand Surfactants Market Opportunity Assessment, By Type, 2031F |

| 15.2. Thailand Surfactants Market Opportunity Assessment, By End-Use Industry, 2031F |

| 15.3. Thailand Surfactants Market Opportunity Assessment, By Source, 2031F |

| 16. Thailand Surfactants Market Competitive Landscape |

| 16.1. Thailand Surfactants Market Revenue Ranking, By Top 3 Companies, CY2024 |

| 16.2. Thailand Surfactants Market Competitive Benchmarking, By Operating Parameters |

| 16.3. Thailand Surfactants Market Competitive Benchmarking, By Technical Parameters |

| 16.4. Thailand Surfactants Market Positioning and Competitive Strategies |

| 17. Company Profiles |

| 17.1. BASF (Thai) Ltd |

| 17.2. Kao Industrial (Thailand) Co., Ltd. |

| 17.3. Lion Corporation (Thailand) Limited |

| 17.4. Stepan Company |

| 17.5. Dow Thailand Group |

| 17.6. Indorama Ventures Public Company Limited |

| 17.7. Solvay Group |

| 17.8. Evonik Industries |

| 17.9. Croda International Plc |

| 17.10. Sanyo Kasei (Thailand) |

| 17.11. Clariant International Ltd |

| 17.12. Thai Ethoxylate Co., Ltd. (TEX) |

| 17.13. Shell Plc |

| 18. Key Strategic Recommendations |

| 19. Disclaimer |

| List of figures |

| 1. Global Surfactant Market Revenues, 2021-2031F (US$ Million) |

| 2. Thailand Real GDP Growth, YOY Change, 2021-2026F & 2030F (In %) |

| 3. Thailand GDP per capita, current prices, 2021-2026F ($ per capita) |

| 4. Thailand Surfactants Market Revenues & Volume, 2021-2031F ($ Million, Tonnes) |

| 5. Thailand Urban Population, 2022-2030F, (%) |

| 6. Thailand Household Disposable Income data, 2024, (in $ Billion) |

| 7. Thailand’s International Tourist Arrivals, By Top Countries, Jan 2025 – Oct 2025, (In Million) |

| 8. Thailand Tourism’s Contribution in Total GDP, 2023-2034F (In $ Billion, %) |

| 9. Thailand International Visitors Spending, 2023-2034F (In $ Billion) |

| 10. Thailand Domestic Visitors Spending, 2023-2034F (In $ Billion) |

| 11. Thailand Surfactants Market Revenue Share, By Type, 2024 & 2031F |

| 12. Thailand Surfactants Market Volume Share, By Type, 2024 & 2031F |

| 13. Thailand Surfactants Market Revenue Share, By End-Use Industry, 2024 & 2031F |

| 14. Thailand Surfactants Market Volume Share, By End-Use Industry, 2024 & 2031F |

| 15. Thailand Surfactants Market Revenue Share, By Source, 2024 & 2031F |

| 16. Thailand Surfactants Market Volume Share, By Source, 2024 & 2031F |

| 17. Thailand Cosmetics, soap, and skincare products Export Value, 2022 (In $ Million) |

| 18. Sales of Beauty and Personal Care (BPC) in Thailand, By Category, 2023 (in %) |

| 19. Thailand Sales of Beauty & Personal Care 2021-2023 ($ Million) |

| 20. Sale of Skincare Through Distribution Channel in Thailand, 2023 (in %) |

| 21. Thailand’s E-Commerce Market Size from 2022-2024 (in $ Billion) |

| 22. Thailand Medical Device Market Size, 2020-2024 (In Billion $) |

| 23. Thailand Medical Device Total Imports, 2020-2024 (In Billion $) |

| 24. Thailand Surfactants Market Average Selling Price, By Type (US$ Per Ton), 2021-2025E |

| 25. Thailand Anionic Organic Surfactant Imports, By Value, 2022 to 2024 ($ Thousand) |

| 26. Thailand Anionic Organic Surfactant Imports, By Countries, 2024 |

| 27. Thailand Anionic Organic Surfactant Exports By Value, 2022 to 2024 ($ Thousand) |

| 28. Thailand Anionic Organic Surfactant Exports By Countries, 2024 |

| 29. Thailand Cationic Organic Surfactant Imports, By Value, 2022 to 2024 ($ Thousand) |

| 30. Thailand Cationic Organic Surfactant Imports, By Countries, 2024 |

| 31. Thailand Cationic Organic Surfactant Exports By Value, 2022 to 2024 ($ Thousand) |

| 32. Thailand Cationic Organic Surfactant Exports By Countries, 2024 |

| 33. Thailand Non-ionic Surfactant Imports, By Value, 2022 to 2024 ($ Thousand) |

| 34. Thailand Non-ionic Surfactant Imports, By Countries, 2024 |

| 35. Thailand Non-ionic Surfactant Exports By Value, 2022 to 2024 ($ Thousand) |

| 36. Thailand Non-ionic Surfactant Exports By Countries, 2024 |

| 37. Thailand Surfactants Market Opportunity Assessment, By Type, Revenue Outlook 2031F |

| 38. Thailand Surfactants Market Opportunity Assessment, By Type, Volume Outlook 2031F |

| 39. Thailand Surfactants Market Opportunity Assessment, By End-Use Industry, Revenue Outlook 2031F |

| 40. Thailand Surfactants Market Opportunity Assessment, By End-Use Industry, Volume Outlook 2031F |

| 41. Thailand Surfactants Market Opportunity Assessment, By Source, Revenue Outlook 2031F |

| 42. Thailand Surfactants Market Opportunity Assessment, By Source, Volume Outlook 2031F |

| 43. Thailand Surfactants Market Revenue Ranking, By Companies, CY2024 |

| 44. Market Positioning in the Thailand Surfactants Market by Key Players |

| List of tables |

| 1. Thailand Key Macro Figures, 2024, 2025E & 2030F |

| 2. Thailand Residential Sector Projects, 2024-2026F |

| 3. Thailand Luxury Resort and Hotel Supply, 2027F-2028F |

| 4. Thailand Value of BOI Approved Investment Across Various Industries (FDI), Q1 2023 & Q1 2024, (in $ Billion) |

| 5. Thailand Surfactants Market Revenues, By Type, 2021-2031F ($ Million) |

| 6. Thailand Surfactants Market Volume, By Type, 2021-2031F (1000 Tonnes) |

| 7. Thailand Surfactants Market Revenues, By End-Use Industry, 2021-2031F ($ Million) |

| 8. Thailand Surfactants Market Volume, By End-Use Industry, 2021-2031F (in Tonnes) |

| 9. Thailand Surfactants Market Revenues, By Source, 2021-2031F ($ Million) |

| 10. Thailand Surfactants Market Volume, By Source, 2021-2031F (in Tonnes) |

| 11. Thailand High-End Beauty Market Forecast 2024E & 2028F |

| 12. Thailand Surfactants Market Critical Supply Chain Challenges |

| 13. Thailand Surfactants Market Sustainability Readiness Assessment |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero