United Arab Emirates (UAE) Cranes Market (2026-2032) | Industry, Trends, Share, Size, Value, Analysis, Outlook, Companies, Revenue, Forecast & Growth

Market Forecast By Product Type (Mobile, Fixed, Marine), By End-User (Construction, Mining, Industrial, Oil & Gas, Others) And Competitive Landscape

| Product Code: ETC288700 | Publication Date: Aug 2022 | Updated Date: Dec 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

UAE Cranes Market | Country-Wise Share and Competition Analysis

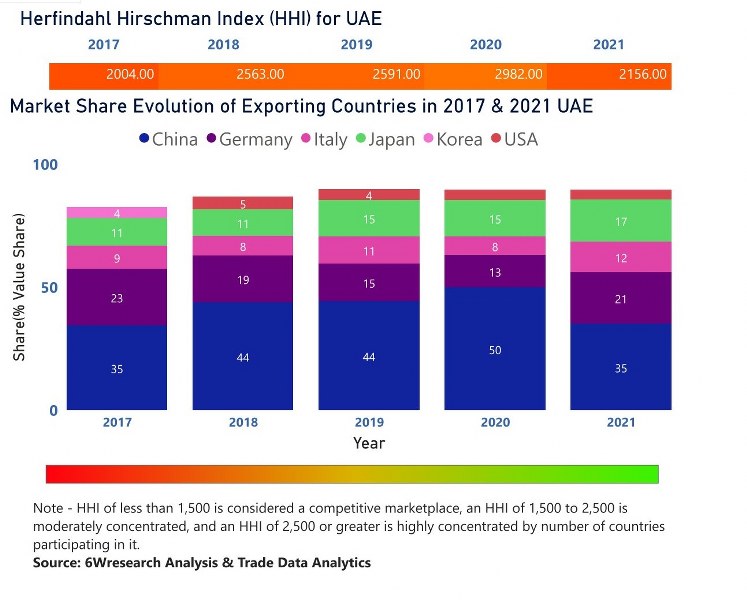

In the year 2021, China was the largest exporter in terms of value, followed by Germany. It has registered a decline of -55.47% over the previous year. While Germany registered a growth of 1.18% as compared to the previous year. In the year 2017, China was the largest exporter followed by Germany. In terms of Herfindahl Index, which measures the competitiveness of countries exporting, UAE has the Herfindahl index of 2004 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 2156 which signifies moderately concentrated in the market.

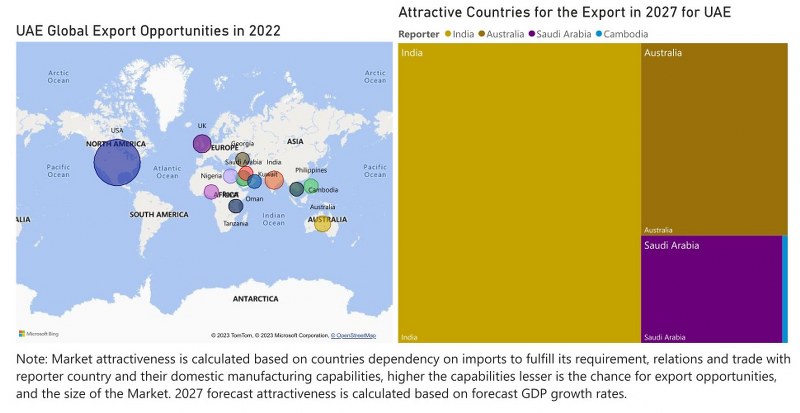

UAE Cranes Market - Export Market Opportunities

United Arab Emirates (UAE) Cranes Market Highlights

| Report Name | United Arab Emirates (UAE) Cranes Market |

| Forecast period | 2026-2032 |

| CAGR | 3% |

| Growing Sector | Construction |

Topics Covered in the United Arab Emirates (UAE) Cranes Market Report

The United Arab Emirates (UAE) Cranes Market report thoroughly covers the market by product type and end-user. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United Arab Emirates (UAE) Cranes Market Synopsis

The United Arab Emirates (UAE) Cranes Market is attaining significant growth and is projected to gain major success in the coming years. The nation is well-known for its faster urbanization as well as extensive infrastructure development, which has stimulated the demand for cranes in this nation.

According to 6Wresearch, United Arab Emirates (UAE) Cranes Market is projected to grow at a compound annual growth rate (CAGR) of 3% during the forecast period (2026–2032). The demand for cranes in UAE is growing since the country is known for faster urbanization and extensive development of infrastructure. Cranes have a very essential role to play in construction projects, for skyscrapers, commercial buildings, residential complexes, and infrastructure development like bridges, airports, and roads. The nation has witnessed construction activities in cities like Abu Dhabi, and Dubai and the nation has become a hub for real estate as well as tourism across the world with many iconic projects such as Burj Khalifa, Dubai Marina, and Palm Jumeirah. These projects need a wide range of cranes in order to handle construction tasks and heavy lifting. The Cranes Market in the United Arab Emirates is characterized by the presence of both international and local crane suppliers and manufacturers.

Key Players Operating in the Market

Both local and international players operate in this market and this is the key reason the market is thriving. Some major market players include Arabtec Construction, Al Jaber Group, Al Faris Group, Byrne Equipment Rental, Liebherr Group, Tadano Ltd, Manitowoc Company, Inc., Terex Corporation, Kato Works Co., Ltd., and Zoomlion Heavy Industry Science & Technology Co., Ltd. These players with their efforts and business strategies have been boosting the market growth. They come up with products that align with the needs of consumers which is expanding the United Arab Emirates Cranes Market Size.

Future of the Market

There is no denying that the future of this market is luminous. The market has experienced a major success and it will continue to experience more success in the near future. The nation is continuing to focus on its infrastructure development as part of its long-term vision. Bigger projects like the construction of new cities, investment in sustainable initiatives, development of transportation networks, and expansion of airports are anticipated to stimulate the demand for cranes in the future. Cranes have a very essential role to play in construction projects, for skyscrapers, commercial buildings, residential complexes, and infrastructure development like bridges, airports, and roads.

Market by Product Type

According to Saurav, Senior Research Analyst, 6Wresearch, the segment by product type which is projected to dominate the market in the future is the mobile crane. There will be a significant boost in demand for mobile cranes in the future.

Market by End-User

In terms of end-user, the United Arab Emirates (UAE) Cranes Industry is separated into Construction, Mining, Industrial, Oil & Gas, and Others, and the construction segment among all will boost in demand in the near future.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2022 to 2025.

- Base Year: 2025

- Forecast Data until 2032.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United Arab Emirates (UAE) Cranes Market Outlook

- Market Size of United Arab Emirates (UAE) Cranes Market, 2025

- Forecast of United Arab Emirates (UAE) Cranes Market, 2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Revenues & Volume for the Period 2022-2032

- United Arab Emirates (UAE) Cranes Market Trend Evolution

- United Arab Emirates (UAE) Cranes Market Drivers and Challenges

- United Arab Emirates (UAE) Cranes Price Trends

- United Arab Emirates (UAE) Cranes Porter's Five Forces

- United Arab Emirates (UAE) Cranes Industry Life Cycle

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Product Type for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Mobile for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Fixed for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Marine for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By End-User for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Construction for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Mining for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Industrial for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Oil & Gas for the Period 2022-2032

- Historical Data and Forecast of United Arab Emirates (UAE) Cranes Market Revenues & Volume By Others for the Period 2022-2032

- United Arab Emirates (UAE) Cranes Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-User

- United Arab Emirates (UAE) Cranes Top Companies Market Share

- United Arab Emirates (UAE) Cranes Competitive Benchmarking By Technical and Operational Parameters

- United Arab Emirates (UAE) Cranes Company Profiles

- United Arab Emirates (UAE) Cranes Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Mobile

- Fixed

- Marine

By End-User

- Construction

- Mining

- Industrial

- Oil & Gas

- Others

United Arab Emirates (UAE) Cranes Market (2026-2032): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 United Arab Emirates (UAE) Cranes Market Overview |

| 3.1 United Arab Emirates (UAE) Cranes Market Revenues & Volume, 2022-2032F |

| 3.2 United Arab Emirates (UAE) Cranes Market - Industry Life Cycle |

| 3.3 United Arab Emirates (UAE) Cranes Market - Porter's Five Forces |

| 3.4 United Arab Emirates (UAE) Cranes Market Revenues & Volume Share, By Product Type, 2022 & 2032F |

| 3.5 United Arab Emirates (UAE) Cranes Market Revenues & Volume Share, By End-User, 2022 & 2032F |

| 4 United Arab Emirates (UAE) Cranes Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growth in construction and infrastructure development projects in the UAE |

| 4.2.2 Increasing demand for specialized cranes for industries like oil gas, marine, and renewable energy |

| 4.2.3 Government initiatives and investments in mega projects like Expo 2020 and Vision 2021 |

| 4.3 Market Restraints |

| 4.3.1 Economic fluctuations impacting construction activities and investment in new projects |

| 4.3.2 Stringent regulations and compliance requirements for crane operations in the UAE |

| 4.3.3 Competition from alternative lifting technologies and solutions |

| 5 United Arab Emirates (UAE) Cranes Market Trends |

| 6 United Arab Emirates (UAE) Cranes Market Segmentation |

| 6.1 United Arab Emirates (UAE) Cranes Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Product Type, 2022-2032F |

| 6.1.3 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Mobile, 2022-2032F |

| 6.1.4 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Fixed, 2022-2032F |

| 6.1.5 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Marine, 2022-2032F |

| 6.2 United Arab Emirates (UAE) Cranes Market, By End-User |

| 6.2.1 Overview and Analysis |

| 6.2.2 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Construction, 2022-2032F |

| 6.2.3 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Mining, 2022-2032F |

| 6.2.4 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Industrial, 2022-2032F |

| 6.2.5 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Oil & Gas, 2022-2032F |

| 6.2.6 United Arab Emirates (UAE) Cranes Market Revenues & Volume, By Others, 2022-2032F |

| 7 United Arab Emirates (UAE) Cranes Market Import-Export Trade Statistics |

| 7.1 United Arab Emirates (UAE) Cranes Market Export to Major Countries |

| 7.2 United Arab Emirates (UAE) Cranes Market Imports from Major Countries |

| 8 United Arab Emirates (UAE) Cranes Market Key Performance Indicators |

| 8.1 Utilization rate of cranes in major construction projects |

| 8.2 Average age of crane fleets in the UAE |

| 8.3 Number of new crane orders from key industries in the region |

| 9 United Arab Emirates (UAE) Cranes Market - Opportunity Assessment |

| 9.1 United Arab Emirates (UAE) Cranes Market Opportunity Assessment, By Product Type, 2022 & 2032F |

| 9.2 United Arab Emirates (UAE) Cranes Market Opportunity Assessment, By End-User, 2022 & 2032F |

| 10 United Arab Emirates (UAE) Cranes Market - Competitive Landscape |

| 10.1 United Arab Emirates (UAE) Cranes Market Revenue Share, By Companies, 2025 |

| 10.2 United Arab Emirates (UAE) Cranes Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero