United States (US) Bearings Market (2026-2032) | Industry, Analysis, Share, Revenue, Growth, Value, Size, Trends, Outlook & Segmentation

Market Forecast By Product (Ball Bearings, Roller Bearings), By Application (Automotive, Agriculture, Electrical, Mining & Construction, Railway & Aerospace, Automotive Aftermarket, Others), And Competitive Landscape

| Product Code: ETC283861 | Publication Date: Aug 2022 | Updated Date: Dec 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

United States Bearings Market | Country-Wise Share and Competition Analysis

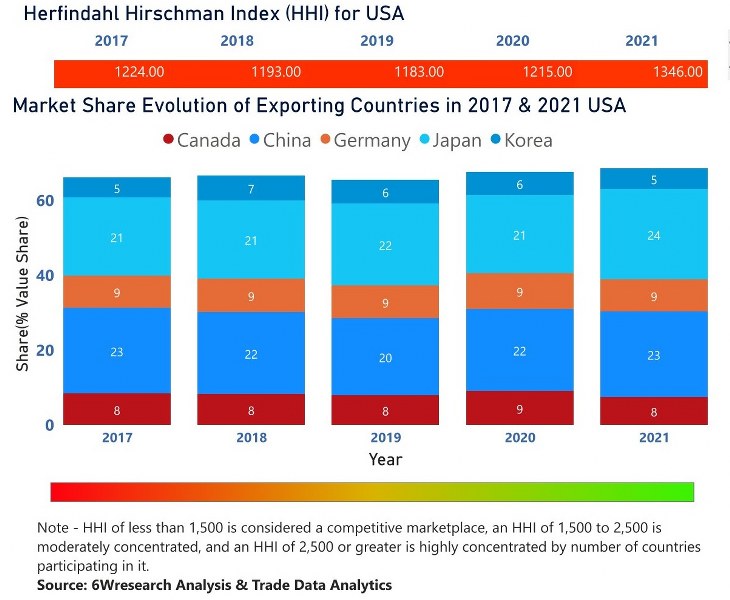

In the year 2021, Germany was the largest exporter in terms of value, followed by Israel. It has registered a decline of -12.01% over the previous year. While Israel registered a decline of -10.27% as compared to the previous year. In the year 2017, Israel was the largest exporter followed by Italy. In terms of Herfindahl Index, which measures the competitiveness of countries exporting, the USA has a Herfindahl index of 1599 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1259 which signifies high competitiveness in the market.

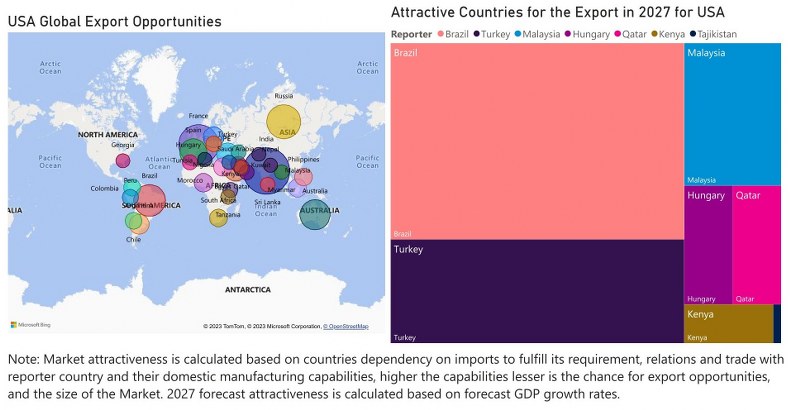

United States Bearings Market - Export Market Opportunities

United States (US) Bearings Market Highlights

| Report Name | United States (US) Bearings Market |

| Forecast period | 2026-2032 |

| CAGR | 6.5% |

| Growing Sector | Automotive |

Topics Covered in United States (US) Bearings Market Report

The United States (US) Bearings Market report thoroughly covers the market by product and application. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United States (US) Bearings Market Synopsis

The United States (US) Bearings Market is estimated to upsurge in the years to come and the sector has accomplished major success since the time of its establishment. Factors that are driving this industry are rising demand for automotive applications, aerospace, and manufacturing industries, and rising advancements in technology.

According to 6Wresearch, the United States (US) Bearings Market is projected to grow at a compound annual growth rate (CAGR) of 6.5% during the forecast period (2026–2032). The market has been experiencing growth and it will continue to experience major growth in the future. One of the key drivers for this market is the increasing demand for automotive applications, particularly hybrid and electric vehicles. This trend has given rise to the requirement for high-quality bearings which can offer efficiency and better performance. Another market driver is industrial automation, where advanced machinery needs precision bearings in order to run effortlessly. The use of robotics in the manufacturing processes also drives the demand for smart bearing technology with higher durability and load capacities. These factors are fueling the United States Bearings Market Growth. There is an increasing trend towards technologies that are energy-efficient, which need components such as bearings that minimize friction losses. Renewable energy sources’ adoption like solar panels and wind turbines has expanded the development of new kinds of bearings that are designed to enhance their performance while decreasing maintenance costs. Rising competition from low-cost bearing manufacturers in developing nations is the key challenge facing the market. Companies from other nations offer lower-price products which makes it challenging for US-based manufacturers to maintain their profitability and share.

United States (US) Bearings Market: Key Players

Some of the players that are stimulating the growth of the market are:

- Timken Company

- SKF Group

- Schaeffler AG

- NTN Corporation

- NSK Ltd.

- JTEKT Corporation

- RBC Bearings Incorporated

- THK CO., LTD.

These players have established themselves as leaders in the market by offering innovative services and solutions that help meet customer requirements.

Market by Product

According to Sumit, Senior Research Analyst, 6Wresearch, the roller bearings segment will propel in the years to come as this segment has been dominating the market for many years. The demand for roller bearings will rise more in the near future.

Market by Application

In terms of application, the Bearings Market in the United States is divided into Automotive, Agriculture, Electrical, Mining & Construction, Railway & Aerospace, Automotive Aftermarket, and Others. The automotive sector is projected to dominate the sector.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2022 to 2025.

- Base Year: 2025

- Forecast Data until 2032.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United States (US) Bearings Market Outlook

- Market Size of United States (US) Bearings Market, 2025

- Forecast of United States (US) Bearings Market, 2032

- Historical Data and Forecast of United States (US) Bearings Revenues & Volume for the Period 2022-2032

- United States (US) Bearings Market Trend Evolution

- United States (US) Bearings Market Drivers and Challenges

- United States (US) Bearings Price Trends

- United States (US) Bearings Porter's Five Forces

- United States (US) Bearings Industry Life Cycle

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Product for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Ball Bearings for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Roller Bearings for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Application for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Automotive for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Agriculture for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Electrical for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Mining & Construction for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Railway & Aerospace for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Automotive Aftermarket for the Period 2022-2032

- Historical Data and Forecast of United States (US) Bearings Market Revenues & Volume By Others for the Period 2022-2032

- United States (US) Bearings Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Application

- United States (US) Bearings Top Companies Market Share

- United States (US) Bearings Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Bearings Company Profiles

- United States (US) Bearings Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Product

- Ball Bearings

- Roller Bearings

By Application

- Automotive

- Agriculture

- Electrical

- Mining & Construction

- Railway & Aerospace

- Automotive Aftermarket

- Others

United States (US) Bearings Market (2026-2032): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 United States (US) Bearings Market Overview |

| 3.1 United States (US) Bearings Market Revenues & Volume, 2022-2032F |

| 3.2 United States (US) Bearings Market - Industry Life Cycle |

| 3.3 United States (US) Bearings Market - Porter's Five Forces |

| 3.4 United States (US) Bearings Market Revenues & Volume Share, By Product, 2022 & 2032F |

| 3.5 United States (US) Bearings Market Revenues & Volume Share, By Application, 2022 & 2032F |

| 4 United States (US) Bearings Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand from industries such as automotive, aerospace, and construction |

| 4.2.2 Technological advancements leading to the development of high-performance bearings |

| 4.2.3 Growing emphasis on energy efficiency and sustainability, driving the adoption of specialized bearings |

| 4.3 Market Restraints |

| 4.3.1 Fluctuations in raw material prices affecting manufacturing costs |

| 4.3.2 Intense competition from low-cost bearing manufacturers in emerging markets |

| 4.3.3 Impact of economic downturns on industrial production and capital expenditure |

| 5 United States (US) Bearings Market Trends |

| 6 United States (US) Bearings Market Segmentation |

| 6.1 United States (US) Bearings Market, By Product |

| 6.1.1 Overview and Analysis |

| 6.1.2 United States (US) Bearings Market Revenues & Volume, By Product, 2022-2032F |

| 6.1.3 United States (US) Bearings Market Revenues & Volume, By Ball Bearings, 2022-2032F |

| 6.1.4 United States (US) Bearings Market Revenues & Volume, By Roller Bearings, 2022-2032F |

| 6.2 United States (US) Bearings Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 United States (US) Bearings Market Revenues & Volume, By Automotive, 2022-2032F |

| 6.2.3 United States (US) Bearings Market Revenues & Volume, By Agriculture, 2022-2032F |

| 6.2.4 United States (US) Bearings Market Revenues & Volume, By Electrical, 2022-2032F |

| 6.2.5 United States (US) Bearings Market Revenues & Volume, By Mining & Construction, 2022-2032F |

| 6.2.6 United States (US) Bearings Market Revenues & Volume, By Railway & Aerospace, 2022-2032F |

| 6.2.7 United States (US) Bearings Market Revenues & Volume, By Automotive Aftermarket, 2022-2032F |

| 7 United States (US) Bearings Market Import-Export Trade Statistics |

| 7.1 United States (US) Bearings Market Export to Major Countries |

| 7.2 United States (US) Bearings Market Imports from Major Countries |

| 8 United States (US) Bearings Market Key Performance Indicators |

| 8.1 Number of patents filed for bearing technologies |

| 8.2 Adoption rate of smart bearings with condition monitoring capabilities |

| 8.3 Percentage of industrial machinery using high-performance bearings |

| 9 United States (US) Bearings Market - Opportunity Assessment |

| 9.1 United States (US) Bearings Market Opportunity Assessment, By Product, 2022 & 2032F |

| 9.2 United States (US) Bearings Market Opportunity Assessment, By Application, 2022 & 2032F |

| 10 United States (US) Bearings Market - Competitive Landscape |

| 10.1 United States (US) Bearings Market Revenue Share, By Companies, 2025 |

| 10.2 United States (US) Bearings Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero