United States (US) Cassava Market | COVID-19 IMPACT, Share, Revenue, Value, Trends, Companies, Industry, Growth, Forecast, Analysis & Size

| Product Code: ETC176780 | Publication Date: Jan 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Shubham Padhi | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

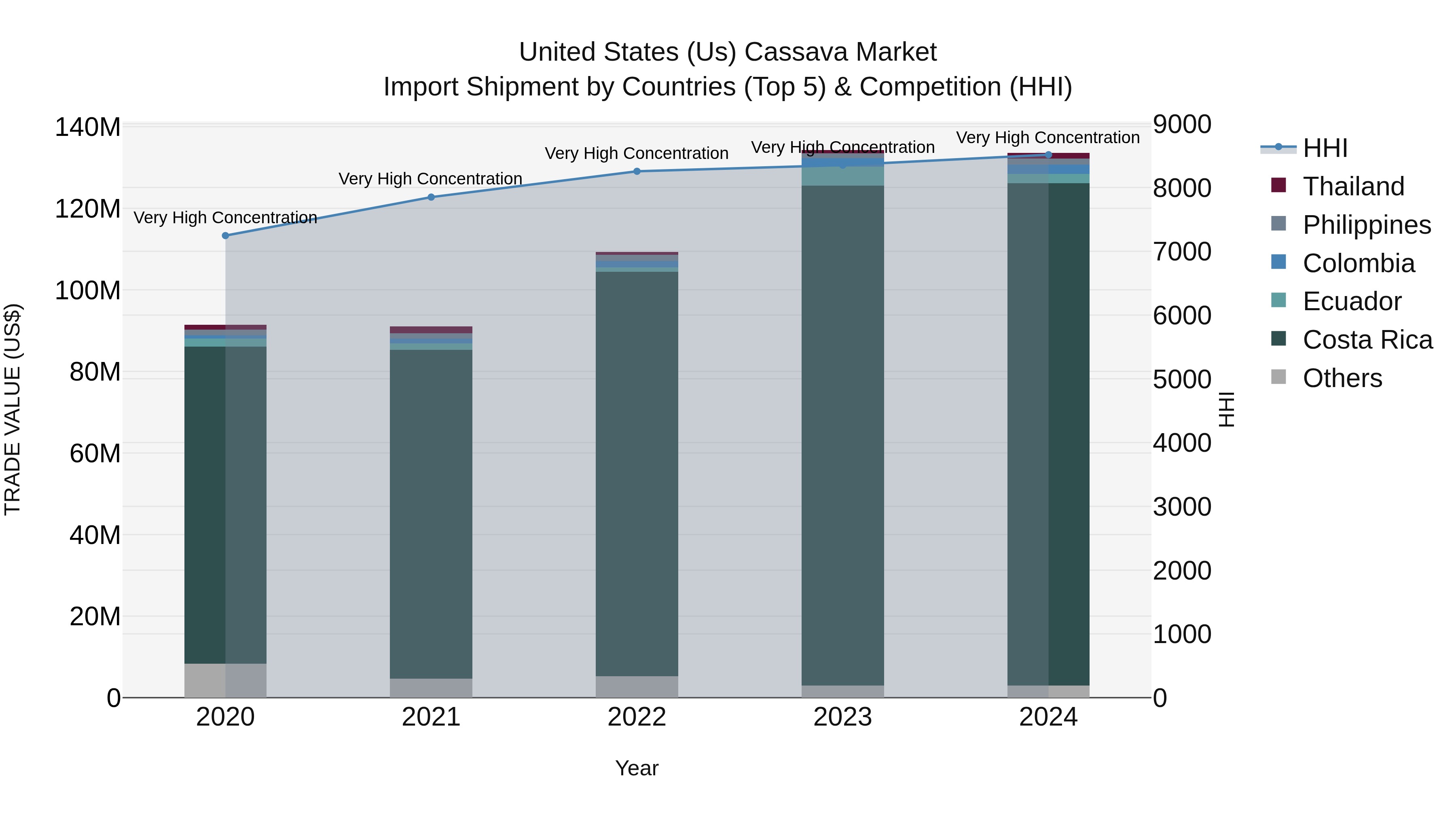

United States (US) Cassava Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, the United States continued to see significant cassava import shipments, with top exporters including Costa Rica, Ecuador, Colombia, Philippines, and Thailand. Despite a slight decrease in growth rate from 2023 to 2024, the compound annual growth rate (CAGR) for the period of 2020-2024 remained strong at 9.93%. The Herfindahl-Hirschman Index (HHI) indicated a high concentration of imports, suggesting a dominant market presence among the key exporting countries. This data highlights the ongoing importance of cassava imports for the US market and the competitive landscape among the top exporting nations.

USA Export Potential Assessment For Cassava Market (Values in USD Thousand)

United States (US) Cassava Market Overview

The United States cassava market is experiencing steady growth driven by increasing consumer demand for gluten-free and alternative flours. Cassava, also known as yuca, is a root vegetable popular in many cuisines and is being increasingly recognized for its versatility and nutritional benefits. The market is seeing an uptick in innovative cassava-based products such as cassava flour, chips, and snacks, catering to the growing health-conscious consumer base. Additionally, cassava`s resilience to drought and adaptability to various climates make it a sustainable crop choice for farmers. The US cassava market is also benefiting from the ethnic diversity in the country, with cassava being a staple in many Latin American, African, and Asian cuisines, driving demand among immigrant populations and mainstream consumers alike.

United States (US) Cassava Market Trends

In the United States, the Cassava Market is experiencing a growing demand due to the increasing popularity of gluten-free and healthier food options. Cassava, also known as yuca, is being incorporated into various food products as a gluten-free alternative to wheat flour. Additionally, the rise in multicultural cuisines and the growing awareness of the nutritional benefits of cassava are driving its consumption. The convenience and versatility of cassava products such as cassava chips, flour, and pearls are also contributing to the market`s growth. With consumers seeking out diverse and nutritious options, the US Cassava Market is expected to continue its upward trajectory in the coming years.

United States (US) Cassava Market Challenges

In the US Cassava Market, one of the key challenges faced is the lack of awareness and demand for cassava products among consumers. Cassava is not a commonly consumed crop in the US, leading to limited market penetration and lower consumer acceptance. Additionally, cassava faces competition from other more popular and established starch sources such as potatoes and corn. Another challenge is the limited domestic production of cassava in the US, which results in higher prices due to the need for imports. This adds to the overall cost and supply chain complexities for cassava-based products in the market. Overcoming these challenges would require targeted marketing efforts to increase consumer awareness, investment in domestic cassava cultivation, and strategic pricing strategies to enhance competitiveness in the market.

United States (US) Cassava Market Investment Opportunities

The United States Cassava Market presents promising investment opportunities due to factors such as increasing demand for gluten-free and alternative flour products, growing popularity of ethnic cuisines that use cassava as a staple ingredient, and the potential for cassava to be used in various industries such as animal feed, biofuels, and pharmaceuticals. Investors can consider opportunities in cassava farming and processing facilities, as well as research and development of innovative cassava-based products to cater to changing consumer preferences. Collaborating with local farmers and leveraging sustainable farming practices can also be a strategic approach to tap into this market. Overall, the US cassava market offers potential for growth and diversification in the food and agriculture sector.

United States (US) Cassava Market Government Policy

Government policies related to the US Cassava Market include regulations on import and export, crop insurance programs, and research funding. The US Department of Agriculture (USDA) plays a key role in monitoring and enforcing these policies to ensure the stability and growth of the cassava market. Import regulations focus on quality control and safety standards to protect consumers, while export policies may involve trade agreements and tariffs. Crop insurance programs provide financial protection to cassava farmers in cases of crop failure or low market prices. Additionally, government funding for research and development aims to improve cassava production efficiency, disease resistance, and overall market competitiveness. Overall, these policies aim to support the sustainable growth of the US cassava market and ensure food security for the population.

United States (US) Cassava Market Future Outlook

The future outlook for the United States Cassava Market appears promising due to the increasing consumer demand for gluten-free and alternative flour options. Cassava, known for its versatility and nutritional benefits, is gaining popularity in various food products such as gluten-free bread, snacks, and as a thickening agent in soups and sauces. The market is expected to witness steady growth driven by the rising awareness of health-conscious consumers and the expanding application of cassava in the food industry. Additionally, the growing immigrant population in the US, especially from countries where cassava is a staple food, is expected to further boost the demand for cassava-based products. Overall, the US Cassava Market is poised for expansion and innovation in the coming years.

Key Highlights of the Report:

- United States (US) Cassava Market Outlook

- Market Size of United States (US) Cassava Market, 2021

- Forecast of United States (US) Cassava Market, 2031

- Historical Data and Forecast of United States (US) Cassava Revenues & Volume for the Period 2018 - 2031

- United States (US) Cassava Market Trend Evolution

- United States (US) Cassava Market Drivers and Challenges

- United States (US) Cassava Price Trends

- United States (US) Cassava Porter's Five Forces

- United States (US) Cassava Industry Life Cycle

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Category for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Organic for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Conventional for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Form for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Solid for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Liquid for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Application for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Food & Beverages for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Animal Feed for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cassava Market Revenues & Volume By Others for the Period 2018 - 2031

- United States (US) Cassava Import Export Trade Statistics

- Market Opportunity Assessment By Category

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Application

- United States (US) Cassava Top Companies Market Share

- United States (US) Cassava Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Cassava Company Profiles

- United States (US) Cassava Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Cassava Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Cassava Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Cassava Market - Industry Life Cycle |

3.4 United States (US) Cassava Market - Porter's Five Forces |

3.5 United States (US) Cassava Market Revenues & Volume Share, By Category, 2021 & 2031F |

3.6 United States (US) Cassava Market Revenues & Volume Share, By Form, 2021 & 2031F |

3.7 United States (US) Cassava Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 United States (US) Cassava Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for gluten-free and healthier food options |

4.2.2 Growing awareness about the nutritional benefits of cassava |

4.2.3 Expansion of cassava cultivation due to its resilience to harsh climates and pests |

4.3 Market Restraints |

4.3.1 Price volatility of cassava due to fluctuating production levels |

4.3.2 Competition from other staple food crops like maize and wheat |

4.3.3 Limited technological advancements in cassava processing and value addition |

5 United States (US) Cassava Market Trends |

6 United States (US) Cassava Market, By Types |

6.1 United States (US) Cassava Market, By Category |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Cassava Market Revenues & Volume, By Category, 2021-2031F |

6.1.3 United States (US) Cassava Market Revenues & Volume, By Organic, 2021-2031F |

6.1.4 United States (US) Cassava Market Revenues & Volume, By Conventional, 2021-2031F |

6.2 United States (US) Cassava Market, By Form |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Cassava Market Revenues & Volume, By Solid, 2021-2031F |

6.2.3 United States (US) Cassava Market Revenues & Volume, By Liquid, 2021-2031F |

6.3 United States (US) Cassava Market, By Application |

6.3.1 Overview and Analysis |

6.3.2 United States (US) Cassava Market Revenues & Volume, By Food & Beverages , 2021-2031F |

6.3.3 United States (US) Cassava Market Revenues & Volume, By Animal Feed, 2021-2031F |

6.3.4 United States (US) Cassava Market Revenues & Volume, By Others, 2021-2031F |

7 United States (US) Cassava Market Import-Export Trade Statistics |

7.1 United States (US) Cassava Market Export to Major Countries |

7.2 United States (US) Cassava Market Imports from Major Countries |

8 United States (US) Cassava Market Key Performance Indicators |

8.1 Average yield per acre of cassava cultivation |

8.2 Adoption rate of improved cassava varieties |

8.3 Percentage of cassava processed into value-added products |

8.4 Consumer awareness and perception of cassava as a healthy food option |

8.5 Number of new cassava-based product launches in the market |

9 United States (US) Cassava Market - Opportunity Assessment |

9.1 United States (US) Cassava Market Opportunity Assessment, By Category, 2021 & 2031F |

9.2 United States (US) Cassava Market Opportunity Assessment, By Form, 2021 & 2031F |

9.3 United States (US) Cassava Market Opportunity Assessment, By Application, 2021 & 2031F |

10 United States (US) Cassava Market - Competitive Landscape |

10.1 United States (US) Cassava Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Cassava Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero