United States (US) Fats and Oils Market | COVID-19 IMPACT, Industry, Trends, Value, Size, Companies, Analysis, Outlook, Revenue, Share, Growth & Forecast

| Product Code: ETC170780 | Publication Date: Jan 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Shubham Padhi | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

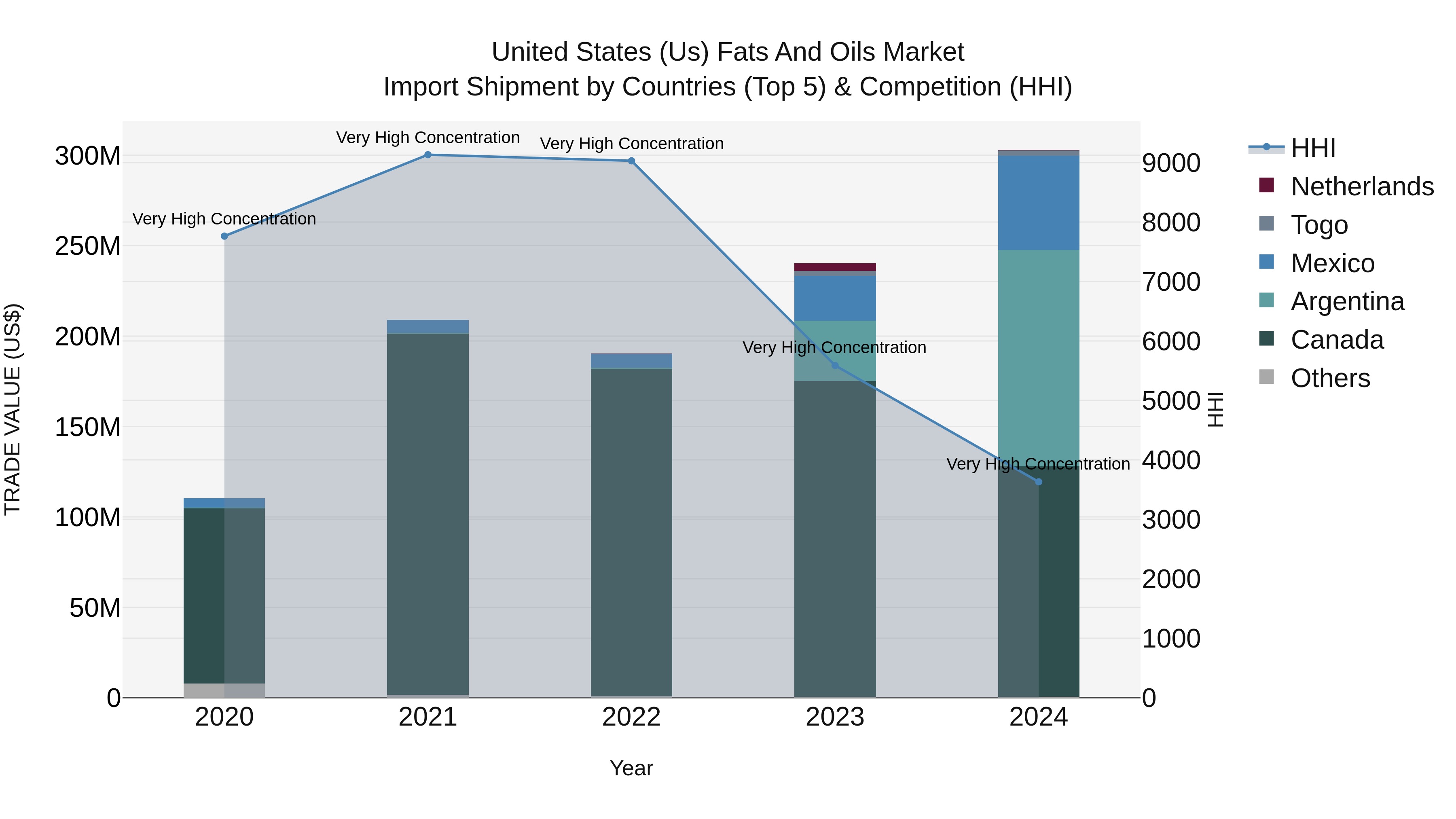

United States (US) Fats and Oils Market Top 5 Importing Countries and Market Competition (HHI) Analysis

The United States continued to see significant growth in fats and oils import shipments in 2024, with Canada, Argentina, Mexico, Togo, and South Korea emerging as top exporters to the country. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market, while the impressive Compound Annual Growth Rate (CAGR) of 28.72% from 2020 to 2024 underscores the strong demand for these products. The notable growth rate of 25.99% from 2023 to 2024 suggests sustained momentum in the fats and oils import market, positioning the US as a key player in this sector.

USA Export Potential Assessment For Fats And Oils Market (Values in USD Thousand)

United States (US) Fats and Oils Market Overview

The United States fats and oils market is a highly dynamic and competitive industry characterized by a wide range of products including vegetable oils, animal fats, and specialty fats. Key factors driving market growth include changing consumer dietary preferences, the rise of health-conscious consumption patterns, and increasing demand for plant-based oils. The market is dominated by prominent players such as Cargill, ADM, Bunge, and Wilmar International. The industry is also influenced by factors such as fluctuating raw material prices, regulatory trends related to health and sustainability, and evolving food processing technologies. Overall, the US fats and oils market is expected to continue experiencing steady growth driven by innovation, product diversification, and shifting consumer preferences towards healthier and sustainable options.

United States (US) Fats and Oils Market Trends

The fats and oils market in the United States is witnessing several key trends. One prominent trend is the rising demand for plant-based oils such as olive oil, avocado oil, and coconut oil, driven by increasing awareness of their health benefits and sustainability credentials. Consumers are also increasingly seeking out functional oils like omega-3 rich oils and oils with high antioxidant properties. In addition, there is a growing interest in specialty oils for culinary experimentation and unique flavor profiles. Another significant trend is the focus on clean label and non-GMO oils, with consumers paying more attention to the sourcing and production processes of fats and oils. Overall, the US fats and oils market is evolving to meet consumer preferences for healthier, more diverse, and sustainably sourced products.

United States (US) Fats and Oils Market Challenges

The United States fats and oils market faces several challenges, including fluctuating commodity prices, regulatory changes impacting production and labeling requirements, and increasing consumer demand for healthier alternatives. The market is also influenced by factors such as weather conditions affecting crop yields, international trade policies impacting imports and exports, and the growing sustainability concerns related to palm oil production. Additionally, competition from alternative sources of fats and oils, such as plant-based options, adds complexity to the market landscape. Companies operating in this sector must navigate these challenges to stay competitive and meet evolving consumer preferences for transparency, sustainability, and health-conscious products.

United States (US) Fats and Oils Market Investment Opportunities

Investment opportunities in the US Fats and Oils Market include the growing demand for healthy and organic oils, such as avocado oil and coconut oil, driven by increasing health consciousness among consumers. Additionally, the trend towards plant-based diets and alternatives to traditional cooking oils presents opportunities for investment in innovative product development. Investing in sustainable sourcing practices and production methods can also be lucrative, as consumers are becoming more environmentally conscious. With the expanding use of fats and oils in various industries beyond food, such as cosmetics and biofuels, there is potential for diversified investments in this market. Overall, the US Fats and Oils Market offers opportunities for growth and innovation for investors looking to capitalize on changing consumer preferences and market trends.

United States (US) Fats and Oils Market Government Policy

Government policies related to the US Fats and Oils Market primarily focus on ensuring food safety, labeling requirements, and promoting healthy dietary choices. The Food and Drug Administration (FDA) regulates the production and labeling of fats and oils to ensure accurate information for consumers, including requirements for trans fat content labeling. Additionally, the US Department of Agriculture (USDA) provides dietary guidelines that recommend limiting saturated fats and trans fats consumption while promoting the use of healthier oils like olive oil and canola oil. The government also supports initiatives to increase domestic production of fats and oils to reduce reliance on imports and enhance food security. Overall, these policies aim to protect consumer health, promote transparency in labeling, and encourage the consumption of healthier fats and oils in the US market.

United States (US) Fats and Oils Market Future Outlook

The United States fats and oils market is expected to witness steady growth in the coming years, driven by factors such as increasing consumer demand for healthier cooking oils, rising awareness about the benefits of plant-based oils, and the growing use of fats and oils in various food applications. The market is also likely to be influenced by trends such as the rise of clean label products, the introduction of innovative oil blends, and the expansion of the organic and non-GMO product categories. Additionally, the shift towards sustainable sourcing practices and the emphasis on transparency in the supply chain are expected to shape the future landscape of the fats and oils market in the US, presenting opportunities for market players to differentiate themselves and capture a larger share of the market.

Key Highlights of the Report:

- United States (US) Fats and Oils Market Outlook

- Market Size of United States (US) Fats and Oils Market, 2021

- Forecast of United States (US) Fats and Oils Market, 2031

- Historical Data and Forecast of United States (US) Fats and Oils Revenues & Volume for the Period 2018 - 2031

- United States (US) Fats and Oils Market Trend Evolution

- United States (US) Fats and Oils Market Drivers and Challenges

- United States (US) Fats and Oils Price Trends

- United States (US) Fats and Oils Porter's Five Forces

- United States (US) Fats and Oils Industry Life Cycle

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Type for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Oil Type for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Fat Type for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Application for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Food Applications for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Industrial Applications for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Source for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Vegetable for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Animal for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Sales Channel for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Direct Sales for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Supermarkets and Hypermarkets for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Retail Stores for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Online Stores for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Fats and Oils Market Revenues & Volume By Others for the Period 2018 - 2031

- United States (US) Fats and Oils Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Source

- Market Opportunity Assessment By Sales Channel

- United States (US) Fats and Oils Top Companies Market Share

- United States (US) Fats and Oils Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Fats and Oils Company Profiles

- United States (US) Fats and Oils Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Fats and Oils Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Fats and Oils Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Fats and Oils Market - Industry Life Cycle |

3.4 United States (US) Fats and Oils Market - Porter's Five Forces |

3.5 United States (US) Fats and Oils Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 United States (US) Fats and Oils Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.7 United States (US) Fats and Oils Market Revenues & Volume Share, By Source, 2021 & 2031F |

3.8 United States (US) Fats and Oils Market Revenues & Volume Share, By Sales Channel, 2021 & 2031F |

4 United States (US) Fats and Oils Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing consumer awareness towards health and wellness leading to higher demand for healthier fats and oils |

4.2.2 Growth in food processing industry creating demand for fats and oils as ingredients |

4.2.3 Rising popularity of plant-based and organic fats and oils driving market growth |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials impacting production costs |

4.3.2 Stringent regulations and standards affecting market entry and product development |

4.3.3 Health concerns related to consumption of certain types of fats and oils leading to consumer skepticism |

5 United States (US) Fats and Oils Market Trends |

6 United States (US) Fats and Oils Market, By Types |

6.1 United States (US) Fats and Oils Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Fats and Oils Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 United States (US) Fats and Oils Market Revenues & Volume, By Oil Type, 2021-2031F |

6.1.4 United States (US) Fats and Oils Market Revenues & Volume, By Fat Type, 2021-2031F |

6.2 United States (US) Fats and Oils Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Fats and Oils Market Revenues & Volume, By Food Applications, 2021-2031F |

6.2.3 United States (US) Fats and Oils Market Revenues & Volume, By Industrial Applications, 2021-2031F |

6.3 United States (US) Fats and Oils Market, By Source |

6.3.1 Overview and Analysis |

6.3.2 United States (US) Fats and Oils Market Revenues & Volume, By Vegetable, 2021-2031F |

6.3.3 United States (US) Fats and Oils Market Revenues & Volume, By Animal, 2021-2031F |

6.4 United States (US) Fats and Oils Market, By Sales Channel |

6.4.1 Overview and Analysis |

6.4.2 United States (US) Fats and Oils Market Revenues & Volume, By Direct Sales, 2021-2031F |

6.4.3 United States (US) Fats and Oils Market Revenues & Volume, By Supermarkets and Hypermarkets, 2021-2031F |

6.4.4 United States (US) Fats and Oils Market Revenues & Volume, By Retail Stores, 2021-2031F |

6.4.5 United States (US) Fats and Oils Market Revenues & Volume, By Online Stores, 2021-2031F |

6.4.6 United States (US) Fats and Oils Market Revenues & Volume, By Others, 2021-2031F |

7 United States (US) Fats and Oils Market Import-Export Trade Statistics |

7.1 United States (US) Fats and Oils Market Export to Major Countries |

7.2 United States (US) Fats and Oils Market Imports from Major Countries |

8 United States (US) Fats and Oils Market Key Performance Indicators |

8.1 Consumer demand for organic and plant-based fats and oils |

8.2 Adoption rate of healthier fats and oils in food processing industry |

8.3 Innovation in fats and oils product development as per changing consumer preferences |

9 United States (US) Fats and Oils Market - Opportunity Assessment |

9.1 United States (US) Fats and Oils Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 United States (US) Fats and Oils Market Opportunity Assessment, By Application, 2021 & 2031F |

9.3 United States (US) Fats and Oils Market Opportunity Assessment, By Source, 2021 & 2031F |

9.4 United States (US) Fats and Oils Market Opportunity Assessment, By Sales Channel, 2021 & 2031F |

10 United States (US) Fats and Oils Market - Competitive Landscape |

10.1 United States (US) Fats and Oils Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Fats and Oils Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero