US Medical Imaging Equipment Market (2025-2031) | Growth, Companies, Revenue, Share, Industry, Value, Forecast, Analysis, Size, Trends & Outlook

Market Forecast By Product Type (Magnetic resonance imaging equipment, Compound tomography equipment, X-ray equipment, Ultrasound equipment, Molecular equipment), By Application (Cardiology, Neurology, Orthopedics, Gynecology, Oncology, Others), By End user (Hospitals, Specialty clinics, Diagnostic imaging centers, Others) And Competitive Landscape

| Product Code: ETC027201 | Publication Date: Oct 2020 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

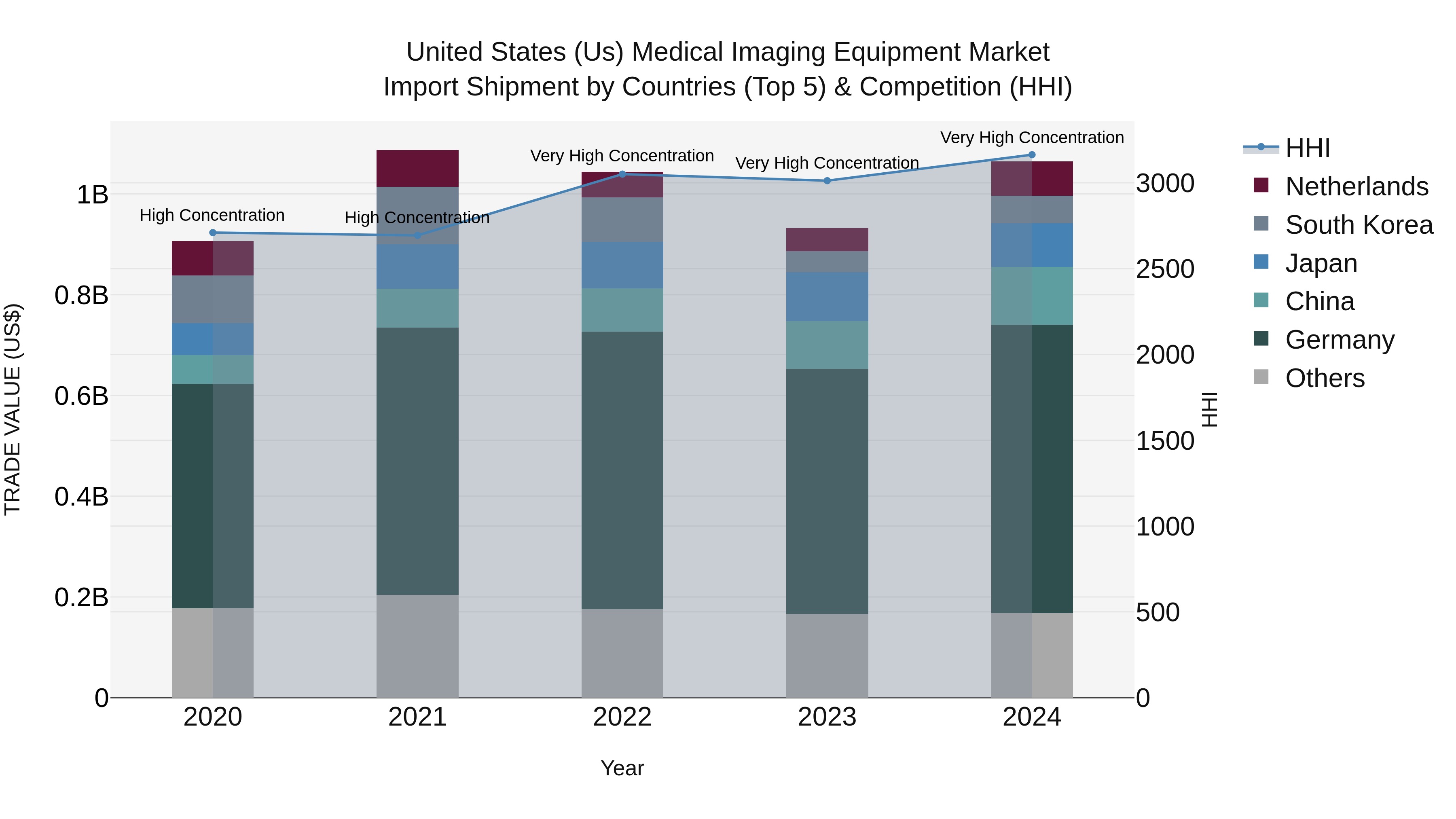

United States (US) Medical Imaging Equipment Market Top 5 Importing Countries and Market Competition (HHI) Analysis

The United States continues to be a key importer of medical imaging equipment, with top suppliers in 2024 including Germany, China, Japan, Netherlands, and South Korea. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market. A steady Compound Annual Growth Rate (CAGR) of 4.1% from 2020 to 2024 demonstrates consistent demand, while a notable growth rate of 14.2% from 2023 to 2024 suggests increasing interest in advanced imaging technologies. The sustained influx of medical imaging equipment from these leading countries highlights the importance of international trade in meeting the healthcare needs of the US market.

US Medical Imaging Equipment Market Highlights

| Report Name | US Medical Imaging Equipment Market |

| Forecast period | 2025-2031 |

| CAGR | 6.2% |

| Growing Sector | Healthcare |

Topics Covered in the US Medical Imaging Equipment Market Report

The US Medical Imaging Equipment market report thoroughly covers the market by product type, by application, by end user and competitive Landscape. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

US Medical Imaging Equipment Market Synopsis

The US medical imaging equipment market is witnessing a significant transformation, driven by advancements in technology and an increasing emphasis on patient-centered care. Innovations such as AI-enhanced imaging, portable devices, and cloud-based storage solutions are not only improving the accuracy and efficiency of diagnostic procedures but are also making complex imaging techniques more accessible to a wider patient population. This trend is anticipated to encourage early diagnostics and personalized treatment plans, ultimately contributing to better patient outcomes and a reduction in healthcare costs. Additionally, Several key trends are shaping the future of the US medical imaging equipment market. Firstly, the integration of artificial intelligence (AI) is streamlining the interpretation process, reducing errors and enabling faster decision-making in clinical settings. Secondly, the shift towards mobile and portable imaging equipment is enhancing the ability to deliver care in remote areas, thus democratizing access to advanced diagnostic tools. Additionally, the adoption of cloud-based solutions is facilitating the secure storage and sharing of medical images, enabling multidisciplinary teams to collaborate more effectively. These trends, coupled with ongoing research and investment in innovation, are poised to further revolutionize the field of medical imaging in the United States.

According to 6Wresearch, US Medical Imaging Equipment market size is projected to grow at a CAGR of 6.2% during 2025-2031. The growth of the US medical imaging equipment market is not only a product of technological advancements. Several key drivers play crucial roles in this expansion. Escalating healthcare demands from an aging population, coupled with a growing prevalence of chronic diseases such as cancer and cardiovascular disorders, necessitate advanced diagnostic solutions. Government and regulatory support also significantly bolster market growth, with initiatives aimed at enhancing healthcare infrastructure and promoting the adoption of digital health technologies.

Additionally, increased healthcare expenditure and investments in research and development by both public and private sectors fuel continuous innovation, ensuring the US remains at the forefront of medical imaging technology. These factors collectively contribute to the robust growth and dynamic evolution of the medical imaging equipment market in the United States.

Government Initiatives Introduced in the US Medical Imaging Equipment Market

Government initiatives have significantly propelled advancements in the medical imaging equipment market. The United States government, recognizing the pivotal role of medical imaging in early disease detection and treatment, has launched several programs to support research and development in this sector. For instance, the National Institutes of Health (NIH) offers grants for projects aiming to develop innovative imaging technologies that can lead to more accurate diagnoses and better patient outcomes. Furthermore, regulatory frameworks established by the Food and Drug Administration (FDA) ensure that new imaging devices meet stringent safety and efficacy standards before being introduced to the market. Consistently, these actions have boosted the US Medical Imaging Equipment Market Share. Additionally, these efforts not only emphasize the government's commitment to improving healthcare quality but also reassure patients and healthcare providers of the reliability and effectiveness of medical imaging technologies.

Key Players in the US Medical Imaging Equipment Market

Prominent companies playing a key role in the US medical imaging market include GE Healthcare, Siemens Healthineers, Philips Healthcare, and Canon Medical Systems. GE Healthcare is renowned for its innovative imaging technologies and comprehensive solutions that improve patient care. Siemens Healthineers leads with cutting-edge diagnostic imaging and laboratory diagnostics while Philips Healthcare is recognized for its advanced patient monitoring, healthcare informatics, and imaging systems. Canon Medical Systems, on the other hand, excels in delivering high-quality imaging systems that are both effective and efficient. In addition, the businesses’ grasp massive US Medical Imaging Equipment Market Revenues. Further, together, these industry titans contribute significantly to the advancements in medical imaging, driving technology forward and ensuring healthcare professionals have access to superior diagnostic tools.

Future Insights of the US Medical Imaging Equipment Market

Looking towards the future, the medical imaging sector is poised for significant transformations, driven by rapid technological advancements and increasing demand for precision medicine. Artificial Intelligence (AI) and Machine Learning (ML) are expected to play critical roles in enhancing image analysis, improving diagnostic accuracy, and reducing the time required for interpretation. Furthermore, the integration of imaging data with electronic health records (EHR) and the application of big data analytics will provide deeper insights into patient health, enabling personalized treatment plans and predictive healthcare. Advancements in portable and wearable imaging devices will also broaden the accessibility of diagnostic services, particularly in remote areas, thus democratizing healthcare and improving patient outcomes on a global scale. These innovations, coupled with ongoing research and development, underscore a future where medical imaging becomes even more integral to healthcare delivery, offering promising avenues for early detection, intervention, and improved patient care.

Market Analysis by Type

According to Ravi Bhandari, Research Head, 6Wresearch, within the medical imaging sector, several key types of equipment play pivotal roles in diagnosing and monitoring various health conditions. Magnetic Resonance Imaging (MRI) Equipment utilizes strong magnetic fields and radio waves to generate detailed images of organs and tissues within the body, offering insights that other imaging modalities might not provide. Compound Tomography (CT) Equipment, through its sophisticated imaging capabilities, allows for detailed cross-sectional views of the body, aiding in the detection and monitoring of diseases such as cancer. X-Ray Equipment, one of the most ubiquitous imaging tools, provides essential imaging for assessing bone fractures, dental evaluations, and detecting pneumonia. Lastly, Ultrasound Equipment employs sound waves to produce images of the inside of the body, widely used in obstetrics, cardiology, and to guide minimally invasive procedures. Each of these technologies underscores the diversity and complexity of modern medical imaging, contributing significantly to the advancements in healthcare diagnostics and treatment plans.

Market Analysis by Application

The applications of medical imaging extend across various medical specialties, each utilizing these powerful tools to enhance patient care and treatment outcomes. In Cardiology, imaging is pivotal in diagnosing heart diseases and monitoring heart conditions, enabling doctors to assess cardiac structure and function in remarkable detail. Neurology relies on imaging to visualize the brain and nervous system, aiding in the diagnosis of tumors, strokes, and neurodegenerative diseases. Orthopedics benefits from the precise imaging of bones, joints, and soft tissues, assisting in the detection of fractures, degenerative diseases, and guiding surgical planning. Gynecology uses imaging to monitor fetal development during pregnancy and diagnose reproductive system disorders. Lastly, in Oncology, medical imaging plays a crucial role in the detection, staging, and monitoring of cancer, guiding treatment decisions and evaluating response to therapy. These applications underscore the versatility and indispensability of medical imaging across the spectrum of healthcare.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- US Medical Imaging Equipment Market Outlook

- Market Size of US Medical Imaging Equipment Market, 2024

- Forecast of US Medical Imaging Equipment Market, 2031

- Historical Data and Forecast of US Medical Imaging Equipment Revenues & Volume for the Period 2021-2031

- US Medical Imaging Equipment Market Trend Evolution

- US Medical Imaging Equipment Market Drivers and Challenges

- US Medical Imaging Equipment Price Trends

- US Medical Imaging Equipment Porter's Five Forces

- US Medical Imaging Equipment Industry Life Cycle

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Magnetic resonance imaging equipment for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Compound tomography equipment for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By X-ray equipment for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Ultrasound equipment for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Molecular equipment for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Cardiology for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Neurology for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Orthopedics for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Gynecology for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Oncology for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By End user for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Hospitals for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Specialty clinics for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Diagnostic imaging centers for the Period 2021-2031

- Historical Data and Forecast of US Medical Imaging Equipment Market Revenues & Volume By Others for the Period 2021-2031

- US Medical Imaging Equipment Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End user

- US Medical Imaging Equipment Top Companies Market Share

- US Medical Imaging Equipment Competitive Benchmarking By Technical and Operational Parameters

- US Medical Imaging Equipment Company Profiles

- US Medical Imaging Equipment Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Magnetic resonance imaging equipment

- Compound tomography equipment

- X-ray equipment

- Ultrasound equipment

- Molecular equipment

By Application

- Cardiology

- Neurology

- Orthopedics

- Gynecology

- Oncology

- Others

By End user

- Hospitals

- Specialty clinics

- Diagnostic imaging centers

- Others

US Medical Imaging Equipment Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 US Medical Imaging Equipment Market Overview |

| 3.1 US Country Macro Economic Indicators |

| 3.2 US Medical Imaging Equipment Market Revenues & Volume, 2021 & 2031F |

| 3.3 US Medical Imaging Equipment Market - Industry Life Cycle |

| 3.4 US Medical Imaging Equipment Market - Porter's Five Forces |

| 3.5 US Medical Imaging Equipment Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 US Medical Imaging Equipment Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 3.7 US Medical Imaging Equipment Market Revenues & Volume Share, By End user, 2021 & 2031F |

| 4 US Medical Imaging Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Technological advancements in medical imaging equipment |

| 4.2.2 Increasing prevalence of chronic diseases driving the demand for diagnostic imaging |

| 4.2.3 Growing geriatric population leading to higher demand for medical imaging services |

| 4.3 Market Restraints |

| 4.3.1 High cost associated with medical imaging equipment |

| 4.3.2 Stringent regulatory requirements for approval and usage of imaging equipment |

| 4.3.3 Limited reimbursement policies impacting the adoption of advanced imaging technologies |

| 5 US Medical Imaging Equipment Market Trends |

| 6 US Medical Imaging Equipment Market, By Types |

| 6.1 US Medical Imaging Equipment Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 US Medical Imaging Equipment Market Revenues & Volume, By Product Type, 2021 - 2031F |

| 6.1.3 US Medical Imaging Equipment Market Revenues & Volume, By Magnetic resonance imaging equipment, 2021 - 2031F |

| 6.1.4 US Medical Imaging Equipment Market Revenues & Volume, By Compound tomography equipment, 2021 - 2031F |

| 6.1.5 US Medical Imaging Equipment Market Revenues & Volume, By X-ray equipment, 2021 - 2031F |

| 6.1.6 US Medical Imaging Equipment Market Revenues & Volume, By Ultrasound equipment, 2021 - 2031F |

| 6.1.7 US Medical Imaging Equipment Market Revenues & Volume, By Molecular equipment, 2021 - 2031F |

| 6.2 US Medical Imaging Equipment Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 US Medical Imaging Equipment Market Revenues & Volume, By Cardiology, 2021 - 2031F |

| 6.2.3 US Medical Imaging Equipment Market Revenues & Volume, By Neurology, 2021 - 2031F |

| 6.2.4 US Medical Imaging Equipment Market Revenues & Volume, By Orthopedics, 2021 - 2031F |

| 6.2.5 US Medical Imaging Equipment Market Revenues & Volume, By Gynecology, 2021 - 2031F |

| 6.2.6 US Medical Imaging Equipment Market Revenues & Volume, By Oncology, 2021 - 2031F |

| 6.2.7 US Medical Imaging Equipment Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3 US Medical Imaging Equipment Market, By End user |

| 6.3.1 Overview and Analysis |

| 6.3.2 US Medical Imaging Equipment Market Revenues & Volume, By Hospitals, 2021 - 2031F |

| 6.3.3 US Medical Imaging Equipment Market Revenues & Volume, By Specialty clinics, 2021 - 2031F |

| 6.3.4 US Medical Imaging Equipment Market Revenues & Volume, By Diagnostic imaging centers, 2021 - 2031F |

| 6.3.5 US Medical Imaging Equipment Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 US Medical Imaging Equipment Market Import-Export Trade Statistics |

| 7.1 US Medical Imaging Equipment Market Export to Major Countries |

| 7.2 US Medical Imaging Equipment Market Imports from Major Countries |

| 8 US Medical Imaging Equipment Market Key Performance Indicators |

| 8.1 Adoption rate of new medical imaging technologies in healthcare facilities |

| 8.2 Average waiting time for patients to undergo medical imaging procedures |

| 8.3 Number of partnerships and collaborations between medical imaging equipment manufacturers and healthcare providers |

| 9 US Medical Imaging Equipment Market - Opportunity Assessment |

| 9.1 US Medical Imaging Equipment Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 US Medical Imaging Equipment Market Opportunity Assessment, By Application, 2021 & 2031F |

| 9.3 US Medical Imaging Equipment Market Opportunity Assessment, By End user, 2021 & 2031F |

| 10 US Medical Imaging Equipment Market - Competitive Landscape |

| 10.1 US Medical Imaging Equipment Market Revenue Share, By Companies, 2024 |

| 10.2 US Medical Imaging Equipment Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero