United States (US) OEM Insulation Market (2025-2031) Outlook | Industry, Revenue, Share, Size, Companies, Trends, Analysis, Value, Growth & Forecast

| Product Code: ETC4514162 | Publication Date: Jul 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Shubham Deep | No. of Pages: 85 | No. of Figures: 45 | No. of Tables: 25 |

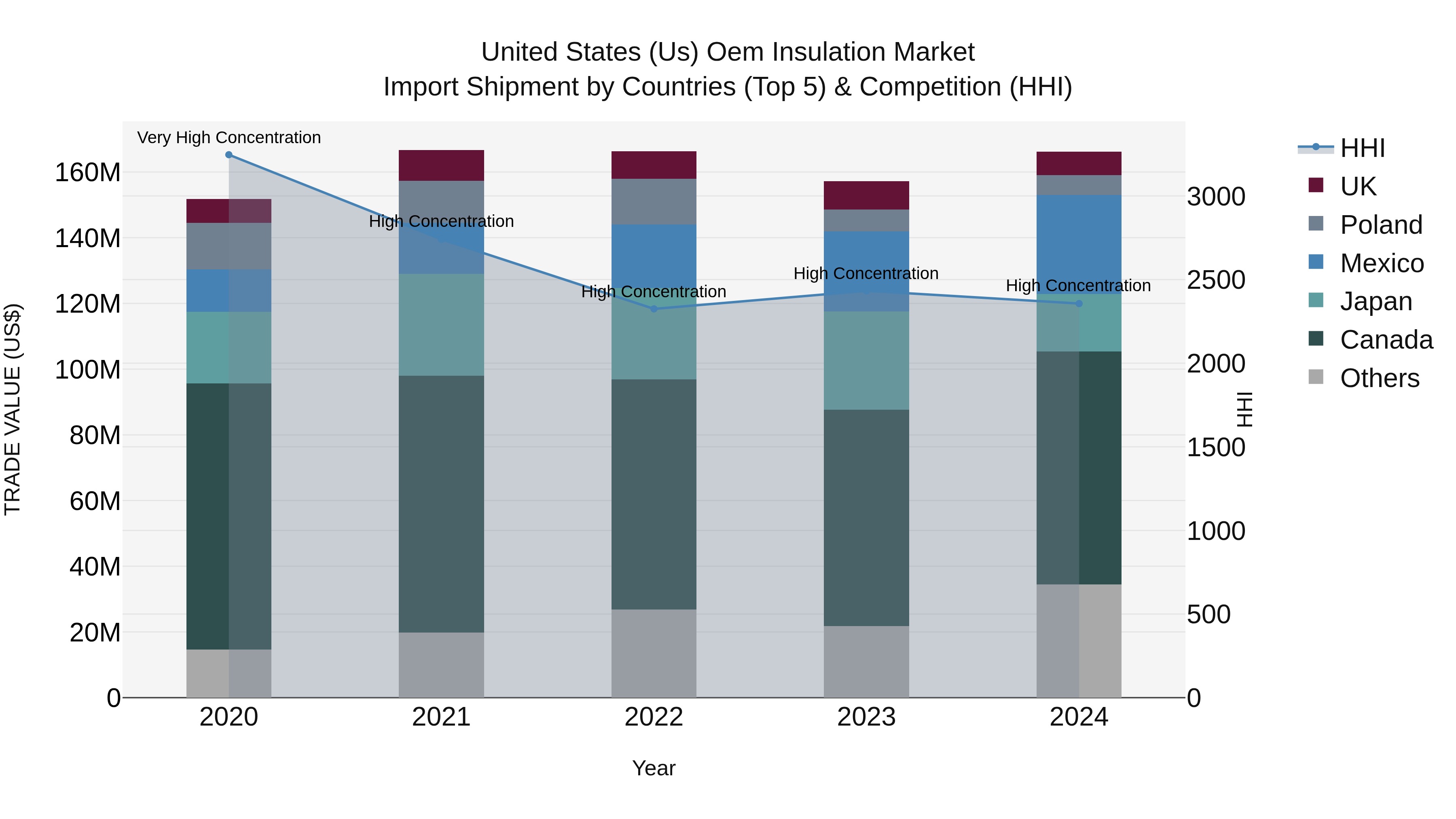

United States (US) Oem Insulation Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, United States saw a steady increase in OEM insulation import shipments, with top exporting countries being Canada, Mexico, Japan, China, and the UK. The Herfindahl-Hirschman Index (HHI) indicated high concentration in the market. The compound annual growth rate (CAGR) from 2020 to 2024 stood at 2.29%, showing a consistent upward trend. Furthermore, the impressive growth rate of 5.78% from 2023 to 2024 suggests a promising outlook for the OEM insulation import market in the US.

United States (US) OEM Insulation Market Overview

The United States OEM insulation market is witnessing steady growth driven by increasing demand from various industries such as automotive, aerospace, and appliances. OEM insulation products are essential components in ensuring energy efficiency, thermal management, and noise reduction in manufacturing processes. Key players in the market are focusing on developing innovative insulation materials to meet the evolving needs of industries while also complying with stringent regulations related to environmental sustainability. Factors such as the emphasis on lightweight and high-performance materials, along with the growing awareness of energy conservation, are expected to drive the market further. The US OEM insulation market is characterized by intense competition, technological advancements, and strategic collaborations among key players to enhance their market presence and cater to diverse industry requirements.

United States (US) OEM Insulation Market Trends and Opportunities

The US OEM insulation market is witnessing a growing demand for high-performance insulation materials driven by increasing focus on energy efficiency and sustainability across industries. Manufacturers are increasingly adopting innovative solutions like aerogel insulation, vacuum insulation panels, and advanced foam materials to meet stringent regulations and achieve higher thermal efficiency. Additionally, the rise in construction activities, particularly in the residential and commercial sectors, presents significant opportunities for insulation providers. The market is also seeing a shift towards eco-friendly and recyclable insulation materials in line with the growing environmental awareness among consumers. Overall, the US OEM insulation market is poised for growth with opportunities for companies to differentiate themselves through technological advancements and sustainable practices.

United States (US) OEM Insulation Market Challenges

In the US OEM insulation market, some of the key challenges include intense competition among established players, price volatility of raw materials impacting profit margins, regulatory changes and evolving building codes affecting product specifications, and the need for continuous innovation to meet sustainability and energy efficiency demands. Additionally, the market faces challenges related to the fluctuating demand in the construction industry, which heavily influences the demand for insulation products. Companies in the OEM insulation sector must navigate these challenges by investing in research and development to create high-performance and cost-effective solutions, building strong relationships with suppliers to mitigate raw material price fluctuations, and staying abreast of regulatory changes to ensure compliance and market competitiveness.

United States (US) OEM Insulation Market Drivers

The United States OEM insulation market is primarily driven by factors such as stringent building codes and regulations promoting energy efficiency, increasing focus on sustainability and green building practices, growing awareness about the benefits of insulation in reducing energy consumption and costs, and the rise in construction activities across residential, commercial, and industrial sectors. Additionally, the expanding automotive and aerospace industries in the US are boosting the demand for insulation materials in original equipment manufacturing processes. Technological advancements leading to the development of innovative and high-performance insulation materials are also contributing to market growth. Overall, the increasing emphasis on energy efficiency and sustainability, coupled with the growth of end-use industries, are key drivers propelling the US OEM insulation market.

United States (US) OEM Insulation Market Government Policy

Government policies related to the US OEM Insulation Market primarily focus on energy efficiency and environmental sustainability. The Department of Energy (DOE) sets energy efficiency standards for insulation materials used in Original Equipment Manufacturer (OEM) applications to reduce energy consumption and greenhouse gas emissions. Additionally, tax incentives and rebates are offered to manufacturers and consumers who use energy-efficient insulation products. The Environmental Protection Agency (EPA) regulates the use of certain insulation materials to protect public health and the environment. The US government encourages research and development in innovative insulation technologies through grants and funding opportunities to support the growth of the OEM insulation market while promoting sustainability and reducing carbon footprint.

United States (US) OEM Insulation Market Future Outlook

The United States OEM insulation market is expected to witness steady growth in the coming years due to increasing demand from various industries such as automotive, aerospace, and electronics. Factors such as stringent energy efficiency regulations, rising focus on sustainability, and the need for thermal management solutions are driving the demand for OEM insulation products. Additionally, the construction sector`s recovery post-pandemic and the growth of the manufacturing industry are likely to further boost the market. Technological advancements in insulation materials, such as the development of lightweight and high-performance solutions, are anticipated to drive innovation and adoption in the market. Overall, the US OEM insulation market is poised for growth as industries seek solutions to enhance energy efficiency and meet regulatory standards.

Key Highlights of the Report:

- United States (US) OEM Insulation Market Outlook

- Market Size of United States (US) OEM Insulation Market, 2024

- Forecast of United States (US) OEM Insulation Market, 2031

- Historical Data and Forecast of United States (US) OEM Insulation Revenues & Volume for the Period 2021 - 2031

- United States (US) OEM Insulation Market Trend Evolution

- United States (US) OEM Insulation Market Drivers and Challenges

- United States (US) OEM Insulation Price Trends

- United States (US) OEM Insulation Porter's Five Forces

- United States (US) OEM Insulation Industry Life Cycle

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Material Type for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Mineral Wool for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Polyurethane Foam for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Flexible Elastomeric Foam for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Other Insulations for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By End Use for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Building & Construction for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Industrial for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Transportation for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) OEM Insulation Market Revenues & Volume By Consumer for the Period 2021 - 2031

- United States (US) OEM Insulation Import Export Trade Statistics

- Market Opportunity Assessment By Material Type

- Market Opportunity Assessment By End Use

- United States (US) OEM Insulation Top Companies Market Share

- United States (US) OEM Insulation Competitive Benchmarking By Technical and Operational Parameters

- United States (US) OEM Insulation Company Profiles

- United States (US) OEM Insulation Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) OEM Insulation Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) OEM Insulation Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) OEM Insulation Market - Industry Life Cycle |

3.4 United States (US) OEM Insulation Market - Porter's Five Forces |

3.5 United States (US) OEM Insulation Market Revenues & Volume Share, By Material Type, 2021 & 2031F |

3.6 United States (US) OEM Insulation Market Revenues & Volume Share, By End Use, 2021 & 2031F |

4 United States (US) OEM Insulation Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for energy-efficient buildings and regulations promoting sustainable construction practices |

4.2.2 Growing awareness about the benefits of insulation in reducing energy consumption and lowering utility bills |

4.2.3 Rising focus on improving indoor air quality and thermal comfort in buildings |

4.3 Market Restraints |

4.3.1 Fluctuating raw material prices impacting production costs of insulation materials |

4.3.2 Intense competition among market players leading to pricing pressures |

4.3.3 Slowdown in the construction industry affecting demand for insulation products |

5 United States (US) OEM Insulation Market Trends |

6 United States (US) OEM Insulation Market, By Types |

6.1 United States (US) OEM Insulation Market, By Material Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) OEM Insulation Market Revenues & Volume, By Material Type, 2021 - 2031F |

6.1.3 United States (US) OEM Insulation Market Revenues & Volume, By Mineral Wool, 2021 - 2031F |

6.1.4 United States (US) OEM Insulation Market Revenues & Volume, By Polyurethane Foam, 2021 - 2031F |

6.1.5 United States (US) OEM Insulation Market Revenues & Volume, By Flexible Elastomeric Foam, 2021 - 2031F |

6.1.6 United States (US) OEM Insulation Market Revenues & Volume, By Other Insulations, 2021 - 2031F |

6.2 United States (US) OEM Insulation Market, By End Use |

6.2.1 Overview and Analysis |

6.2.2 United States (US) OEM Insulation Market Revenues & Volume, By Building & Construction, 2021 - 2031F |

6.2.3 United States (US) OEM Insulation Market Revenues & Volume, By Industrial, 2021 - 2031F |

6.2.4 United States (US) OEM Insulation Market Revenues & Volume, By Transportation, 2021 - 2031F |

6.2.5 United States (US) OEM Insulation Market Revenues & Volume, By Consumer, 2021 - 2031F |

7 United States (US) OEM Insulation Market Import-Export Trade Statistics |

7.1 United States (US) OEM Insulation Market Export to Major Countries |

7.2 United States (US) OEM Insulation Market Imports from Major Countries |

8 United States (US) OEM Insulation Market Key Performance Indicators |

8.1 Energy savings achieved through insulation installations |

8.2 Number of green building certifications attained by projects using OEM insulation |

8.3 Adoption rate of advanced insulation technologies in the construction sector |

9 United States (US) OEM Insulation Market - Opportunity Assessment |

9.1 United States (US) OEM Insulation Market Opportunity Assessment, By Material Type, 2021 & 2031F |

9.2 United States (US) OEM Insulation Market Opportunity Assessment, By End Use, 2021 & 2031F |

10 United States (US) OEM Insulation Market - Competitive Landscape |

10.1 United States (US) OEM Insulation Market Revenue Share, By Companies, 2024 |

10.2 United States (US) OEM Insulation Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero