United States (US) Spreads Market Outlook | Analysis, Companies, Growth, COVID-19 IMPACT, Size, Value, Trends, Industry, Forecast, Revenue & Share

| Product Code: ETC218701 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Dhaval Chaurasia | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

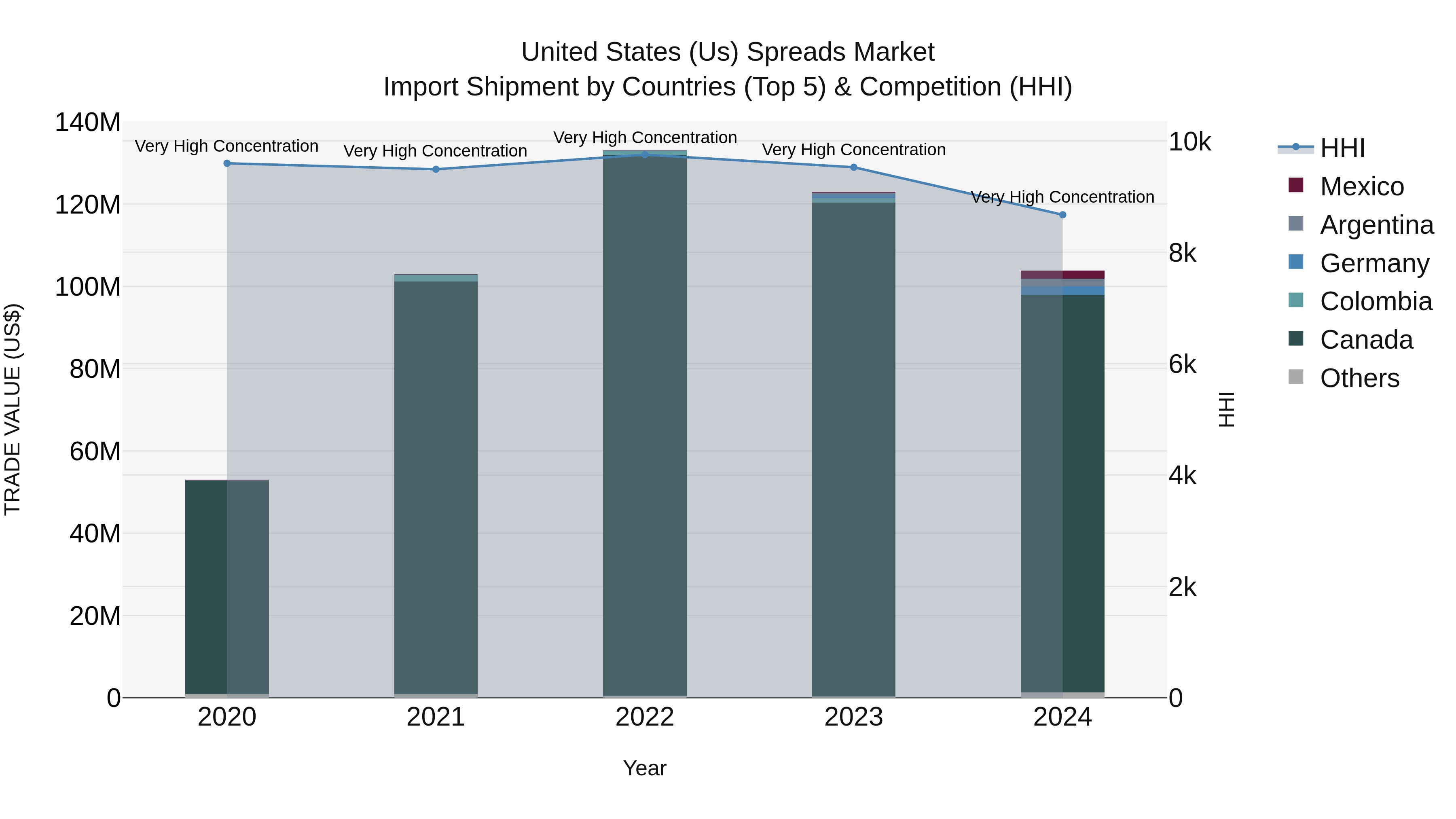

United States (US) Spreads Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, the United States saw a significant influx of spreads imports from key countries like Canada, Germany, Mexico, Argentina, and Indonesia. Despite high concentration with a high Herfindahl-Hirschman Index (HHI), the market exhibited strong growth with a notable compound annual growth rate (CAGR) of 18.34% from 2020 to 2024. However, there was a slight decline in growth rate from 2023 to 2024 at -15.54%, signaling potential shifts in the market dynamics. The diverse range of countries exporting spreads to the US highlights the global nature of this industry.

United States (US) Spreads Market Overview

The United States spreads market is a diverse and dynamic sector encompassing a wide variety of products such as jams, jellies, nut butters, honey, and cheese spreads. Key players in the market include major brands like Smucker`s, Jif, and Kraft, as well as smaller niche players offering unique flavors and organic options. The market is driven by consumer demand for convenient and versatile food products that can be used for breakfast, snacking, and cooking. Health and wellness trends have also influenced the market, leading to a rise in demand for natural, organic, and low-sugar spreads. With the growing popularity of online shopping and e-commerce platforms, manufacturers are increasingly focusing on digital marketing and direct-to-consumer sales channels to reach a wider audience and drive sales growth in this competitive market.

United States (US) Spreads Market Trends

The US spreads market is witnessing several key trends. One significant trend is the increasing demand for natural and organic spreads, driven by consumers` growing preference for healthier and more sustainable food options. This has led to a rise in product offerings that are free from artificial ingredients, preservatives, and added sugars. Another trend is the expansion of flavor varieties, with companies introducing unique and exotic flavor combinations to cater to evolving consumer tastes. Additionally, there is a growing interest in plant-based spreads, reflecting the rising popularity of vegetarian and vegan diets. The market is also seeing a focus on convenient and on-the-go packaging formats to meet the needs of busy consumers. Overall, these trends indicate a shift towards more diverse, healthier, and environmentally conscious options in the US spreads market.

United States (US) Spreads Market Challenges

The US spreads market faces several challenges, including increasing health consciousness among consumers leading to a shift away from traditional spreads high in sugar and fat. There is also growing competition from alternative spreads such as nut butters and plant-based options, as well as private label brands offering more affordable choices. Additionally, rising raw material costs, supply chain disruptions, and changing consumer preferences for natural and organic ingredients pose challenges for manufacturers in the spreads market. Meeting sustainability demands, navigating regulatory requirements, and adapting to changing consumption patterns driven by factors like convenience and flavor innovation are also key challenges faced by players in the US spreads market. Overall, companies in this industry must continuously innovate and differentiate their products to stay competitive in a dynamic and evolving market landscape.

United States (US) Spreads Market Investment Opportunities

In the US Spreads Market, there are various investment opportunities for investors looking to capitalize on the price differentials between related financial instruments. One of the key opportunities is trading in interest rate spreads, where investors can take advantage of the differences in interest rates between different maturities or types of fixed income securities. Another opportunity lies in trading commodity spreads, such as the price differential between different grades of oil or agricultural products. Additionally, investors can participate in equity spreads trading, which involves taking positions in pairs of related stocks or indices to profit from the relative price movements. Overall, the US Spreads Market offers a diverse range of investment opportunities for those looking to leverage pricing differentials in various asset classes.

United States (US) Spreads Market Government Policy

The United States Spreads Market is regulated by various government policies aimed at ensuring fair competition and protecting consumers. The Commodity Futures Trading Commission (CFTC) plays a key role in overseeing the trading of spreads, particularly in the futures markets, to prevent market manipulation and maintain market integrity. Additionally, the Securities and Exchange Commission (SEC) regulates certain types of spreads trading to safeguard investors and maintain orderly markets. The Federal Trade Commission (FTC) enforces antitrust laws to prevent anti-competitive behavior in the spreads market. Overall, these government policies work together to promote transparency, stability, and efficiency in the US Spreads Market, ultimately benefiting both market participants and consumers.

United States (US) Spreads Market Future Outlook

The future outlook for the United States spreads market appears optimistic, driven by factors such as increasing consumer demand for convenience foods, growing health consciousness leading to a shift towards natural and organic spreads, and innovative product offerings by market players. The market is expected to witness steady growth, supported by the rising trend of snacking on-the-go and a preference for versatile and flavorful spreads. Manufacturers are likely to focus on product innovation, clean label ingredients, and sustainable practices to cater to evolving consumer preferences. Additionally, the increasing availability of online retail channels and a focus on personalized nutrition could further boost market growth. Overall, the US spreads market is poised for expansion and diversification in the coming years.

Key Highlights of the Report:

- United States (US) Spreads Market Outlook

- Market Size of United States (US) Spreads Market, 2021

- Forecast of United States (US) Spreads Market, 2031

- Historical Data and Forecast of United States (US) Spreads Revenues & Volume for the Period 2018 - 2031

- United States (US) Spreads Market Trend Evolution

- United States (US) Spreads Market Drivers and Challenges

- United States (US) Spreads Price Trends

- United States (US) Spreads Porter's Five Forces

- United States (US) Spreads Industry Life Cycle

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Product Type for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Jam for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Chocolate spreads for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Peanut Butter for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Syrup for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Others for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Distribution Channel for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Convenience Stores for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Supermarkets and Hypermarkets for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Online Stores for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Spreads Market Revenues & Volume By Others for the Period 2018 - 2031

- United States (US) Spreads Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Distribution Channel

- United States (US) Spreads Top Companies Market Share

- United States (US) Spreads Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Spreads Company Profiles

- United States (US) Spreads Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Spreads Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Spreads Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Spreads Market - Industry Life Cycle |

3.4 United States (US) Spreads Market - Porter's Five Forces |

3.5 United States (US) Spreads Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

3.6 United States (US) Spreads Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

4 United States (US) Spreads Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Growing consumer awareness about health benefits of natural spreads over conventional ones |

4.2.2 Increasing demand for convenience and ready-to-eat food products |

4.2.3 Rising trend of home cooking and baking activities |

4.3 Market Restraints |

4.3.1 Fluctuating prices of key ingredients such as nuts and fruits |

4.3.2 Intense competition from substitute products like jams and preserves |

4.3.3 Regulatory challenges related to labeling and health claims |

5 United States (US) Spreads Market Trends |

6 United States (US) Spreads Market, By Types |

6.1 United States (US) Spreads Market, By Product Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Spreads Market Revenues & Volume, By Product Type, 2021-2031F |

6.1.3 United States (US) Spreads Market Revenues & Volume, By Jam, 2021-2031F |

6.1.4 United States (US) Spreads Market Revenues & Volume, By Chocolate spreads, 2021-2031F |

6.1.5 United States (US) Spreads Market Revenues & Volume, By Peanut Butter, 2021-2031F |

6.1.6 United States (US) Spreads Market Revenues & Volume, By Syrup, 2021-2031F |

6.1.7 United States (US) Spreads Market Revenues & Volume, By Others, 2021-2031F |

6.2 United States (US) Spreads Market, By Distribution Channel |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Spreads Market Revenues & Volume, By Convenience Stores, 2021-2031F |

6.2.3 United States (US) Spreads Market Revenues & Volume, By Supermarkets and Hypermarkets, 2021-2031F |

6.2.4 United States (US) Spreads Market Revenues & Volume, By Online Stores, 2021-2031F |

6.2.5 United States (US) Spreads Market Revenues & Volume, By Others, 2021-2031F |

7 United States (US) Spreads Market Import-Export Trade Statistics |

7.1 United States (US) Spreads Market Export to Major Countries |

7.2 United States (US) Spreads Market Imports from Major Countries |

8 United States (US) Spreads Market Key Performance Indicators |

8.1 Percentage of households using natural spreads as a substitute for conventional spreads |

8.2 Number of new product launches in the spreads market |

8.3 Online engagement metrics such as social media mentions and website traffic |

8.4 Consumer satisfaction scores for taste, texture, and packaging of spreads |

9 United States (US) Spreads Market - Opportunity Assessment |

9.1 United States (US) Spreads Market Opportunity Assessment, By Product Type, 2021 & 2031F |

9.2 United States (US) Spreads Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

10 United States (US) Spreads Market - Competitive Landscape |

10.1 United States (US) Spreads Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Spreads Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero