Armenia Carboxymethyl Cellulose Market (2025-2031) | Outlook, Analysis, Companies, Share, Industry, Trends, Size, Segmentation, Growth, Revenue, Value & Forecast

| Product Code: ETC5254030 | Publication Date: Nov 2023 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Bhawna Singh | No. of Pages: 60 | No. of Figures: 30 | No. of Tables: 5 |

Armenia Carboxymethyl Cellulose Market: Import Trend Analysis

Armenia import trend for carboxymethyl cellulose experienced a significant decline from 2023 to 2024, with a growth rate of -74.72%. The compound annual growth rate (CAGR) for 2020-2024 stood at -38.59%. This sharp contraction in imports can be attributed to shifts in demand dynamics or changes in market conditions impacting trade flows.

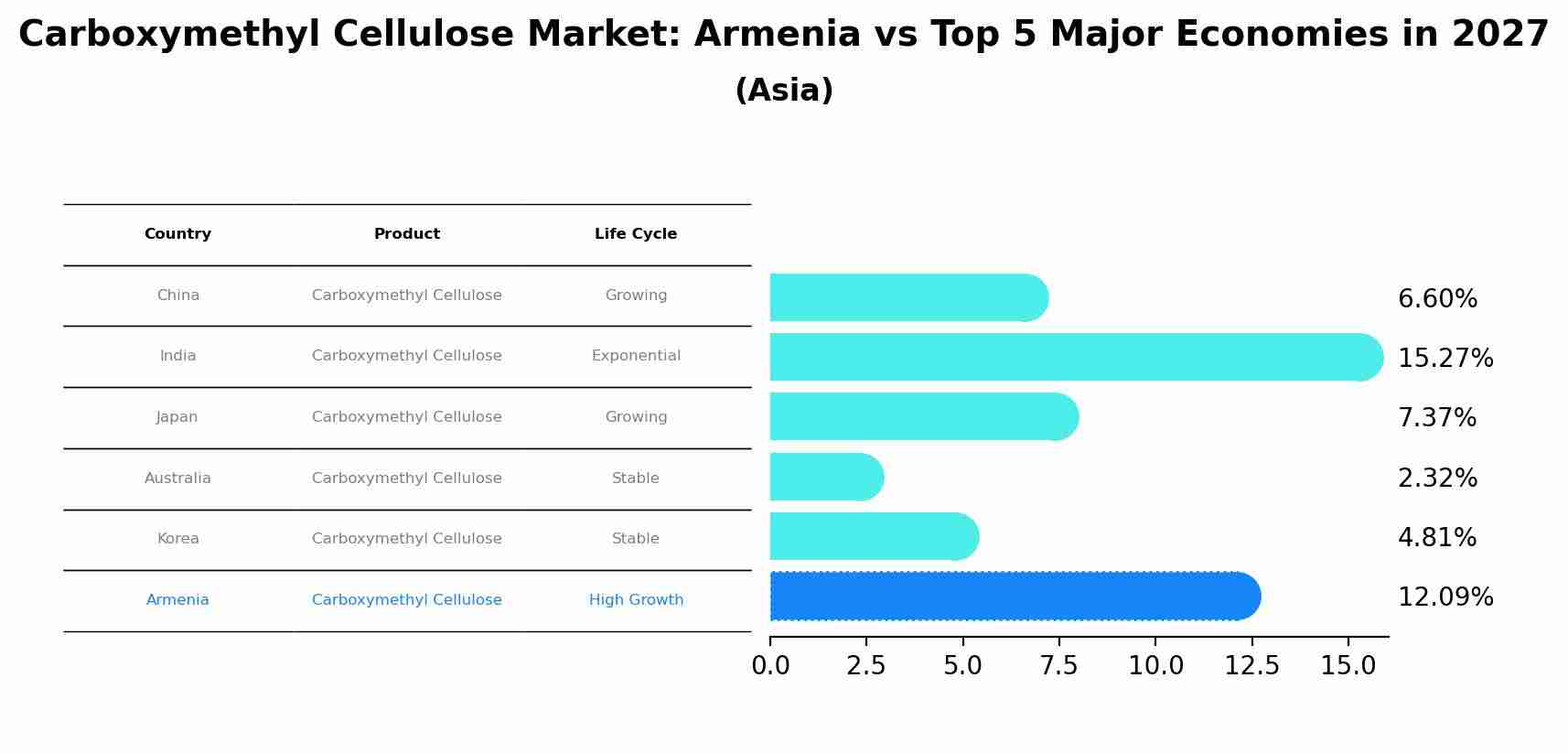

Carboxymethyl Cellulose Market: Armenia vs Top 5 Major Economies in 2027 (Asia)

The Carboxymethyl Cellulose market in Armenia is projected to grow at a high growth rate of 12.09% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Armenia Carboxymethyl Cellulose Market Overview

In Armenia, the carboxymethyl cellulose (CMC) market is growing, driven by its diverse applications in food and beverages, pharmaceuticals, cosmetics, and oil drilling. CMC is valued for its thickening, stabilizing, and emulsifying properties. The market benefits from government support for industrial development and increasing demand for processed and convenience foods. Local manufacturers are focusing on producing high-quality CMC to meet both domestic and international standards.

Drivers of the market

The Armenia Carboxymethyl Cellulose market is driven by its wide range of applications in various industries, including food and beverages, pharmaceuticals, and cosmetics. The demand for carboxymethyl cellulose as a thickening, stabilizing, and binding agent in these industries is a significant factor. Additionally, the growth of the processed food industry and the increasing demand for low-fat and gluten-free food products propel the market.

Challenges of the market

The carboxymethyl cellulose (CMC) market in Armenia is challenged by high production costs and the need for imported raw materials. Limited local production capacity and technological constraints hinder market growth. The market also faces competition from alternative thickening and stabilizing agents, which are often more cost-effective. Additionally, the lack of awareness and understanding of CMC`s applications in various industries limits its adoption. Import dependence and fluctuating international prices for raw materials add to the market`s volatility and financial challenges.

Government Policy of the market

The Armenian government supports the carboxymethyl cellulose (CMC) market through policies that encourage the development of the chemical and pharmaceutical industries. Grants and tax incentives are provided for research and development projects focused on producing high-quality CMC for various applications, including food, pharmaceuticals, and personal care products. Environmental regulations also promote the use of biodegradable and eco-friendly materials, driving demand for sustainable alternatives like CMC. These policies aim to enhance the competitiveness of Armenian manufacturers in the global market.

Key Highlights of the Report:

- Armenia Carboxymethyl Cellulose Market Outlook

- Market Size of Armenia Carboxymethyl Cellulose Market, 2024

- Forecast of Armenia Carboxymethyl Cellulose Market, 2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Revenues & Volume for the Period 2021-2031

- Armenia Carboxymethyl Cellulose Market Trend Evolution

- Armenia Carboxymethyl Cellulose Market Drivers and Challenges

- Armenia Carboxymethyl Cellulose Price Trends

- Armenia Carboxymethyl Cellulose Porter`s Five Forces

- Armenia Carboxymethyl Cellulose Industry Life Cycle

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Purity for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Above 95% for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By 80% - 95% for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Below 80% for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By End-user for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Food & beverage for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Pharmaceuticals for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Personal care for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Oil & gas for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Pulp & paper for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Detergents & laundry for the Period 2021-2031

- Historical Data and Forecast of Armenia Carboxymethyl Cellulose Market Revenues & Volume By Others for the Period 2021-2031

- Armenia Carboxymethyl Cellulose Import Export Trade Statistics

- Market Opportunity Assessment By Purity

- Market Opportunity Assessment By End-user

- Armenia Carboxymethyl Cellulose Top Companies Market Share

- Armenia Carboxymethyl Cellulose Competitive Benchmarking By Technical and Operational Parameters

- Armenia Carboxymethyl Cellulose Company Profiles

- Armenia Carboxymethyl Cellulose Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Armenia Carboxymethyl Cellulose Market Overview |

3.1 Armenia Country Macro Economic Indicators |

3.2 Armenia Carboxymethyl Cellulose Market Revenues & Volume, 2021 & 2031F |

3.3 Armenia Carboxymethyl Cellulose Market - Industry Life Cycle |

3.4 Armenia Carboxymethyl Cellulose Market - Porter's Five Forces |

3.5 Armenia Carboxymethyl Cellulose Market Revenues & Volume Share, By Purity, 2021 & 2031F |

3.6 Armenia Carboxymethyl Cellulose Market Revenues & Volume Share, By End-user, 2021 & 2031F |

4 Armenia Carboxymethyl Cellulose Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for carboxymethyl cellulose in food and beverage industry for its various applications such as thickening, stabilizing, and emulsifying properties. |

4.2.2 Growing awareness about the benefits of carboxymethyl cellulose in pharmaceutical and cosmetics industries, driving its usage in these sectors. |

4.2.3 Rising adoption of carboxymethyl cellulose in oil and gas drilling fluids due to its ability to control fluid loss and viscosity. |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials used in the production of carboxymethyl cellulose leading to cost variations. |

4.3.2 Stringent regulations and quality standards governing the use of carboxymethyl cellulose in different industries. |

4.3.3 Competition from alternative products offering similar functionalities at lower costs. |

5 Armenia Carboxymethyl Cellulose Market Trends |

6 Armenia Carboxymethyl Cellulose Market Segmentations |

6.1 Armenia Carboxymethyl Cellulose Market, By Purity |

6.1.1 Overview and Analysis |

6.1.2 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By Above 95%, 2021-2031F |

6.1.3 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By 80% - 95%, 2021-2031F |

6.1.4 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By Below 80%, 2021-2031F |

6.2 Armenia Carboxymethyl Cellulose Market, By End-user |

6.2.1 Overview and Analysis |

6.2.2 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By Food & beverage, 2021-2031F |

6.2.3 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By Pharmaceuticals, 2021-2031F |

6.2.4 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By Personal care, 2021-2031F |

6.2.5 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By Oil & gas, 2021-2031F |

6.2.6 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By Pulp & paper, 2021-2031F |

6.2.7 Armenia Carboxymethyl Cellulose Market Revenues & Volume, By Detergents & laundry, 2021-2031F |

7 Armenia Carboxymethyl Cellulose Market Import-Export Trade Statistics |

7.1 Armenia Carboxymethyl Cellulose Market Export to Major Countries |

7.2 Armenia Carboxymethyl Cellulose Market Imports from Major Countries |

8 Armenia Carboxymethyl Cellulose Market Key Performance Indicators |

8.1 Research and development investment in innovative applications of carboxymethyl cellulose. |

8.2 Percentage of market share in key industries such as food and beverage, pharmaceuticals, and oil and gas. |

8.3 Number of new product launches and partnerships within the carboxymethyl cellulose market. |

9 Armenia Carboxymethyl Cellulose Market - Opportunity Assessment |

9.1 Armenia Carboxymethyl Cellulose Market Opportunity Assessment, By Purity, 2021 & 2031F |

9.2 Armenia Carboxymethyl Cellulose Market Opportunity Assessment, By End-user, 2021 & 2031F |

10 Armenia Carboxymethyl Cellulose Market - Competitive Landscape |

10.1 Armenia Carboxymethyl Cellulose Market Revenue Share, By Companies, 2024 |

10.2 Armenia Carboxymethyl Cellulose Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations | 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero