Colombia Cards Market (2025-2031) Outlook | Growth, Size, Value, Industry, Revenue, Companies, Share, Analysis, Trends & Forecast

| Product Code: ETC259144 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Vasudha | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

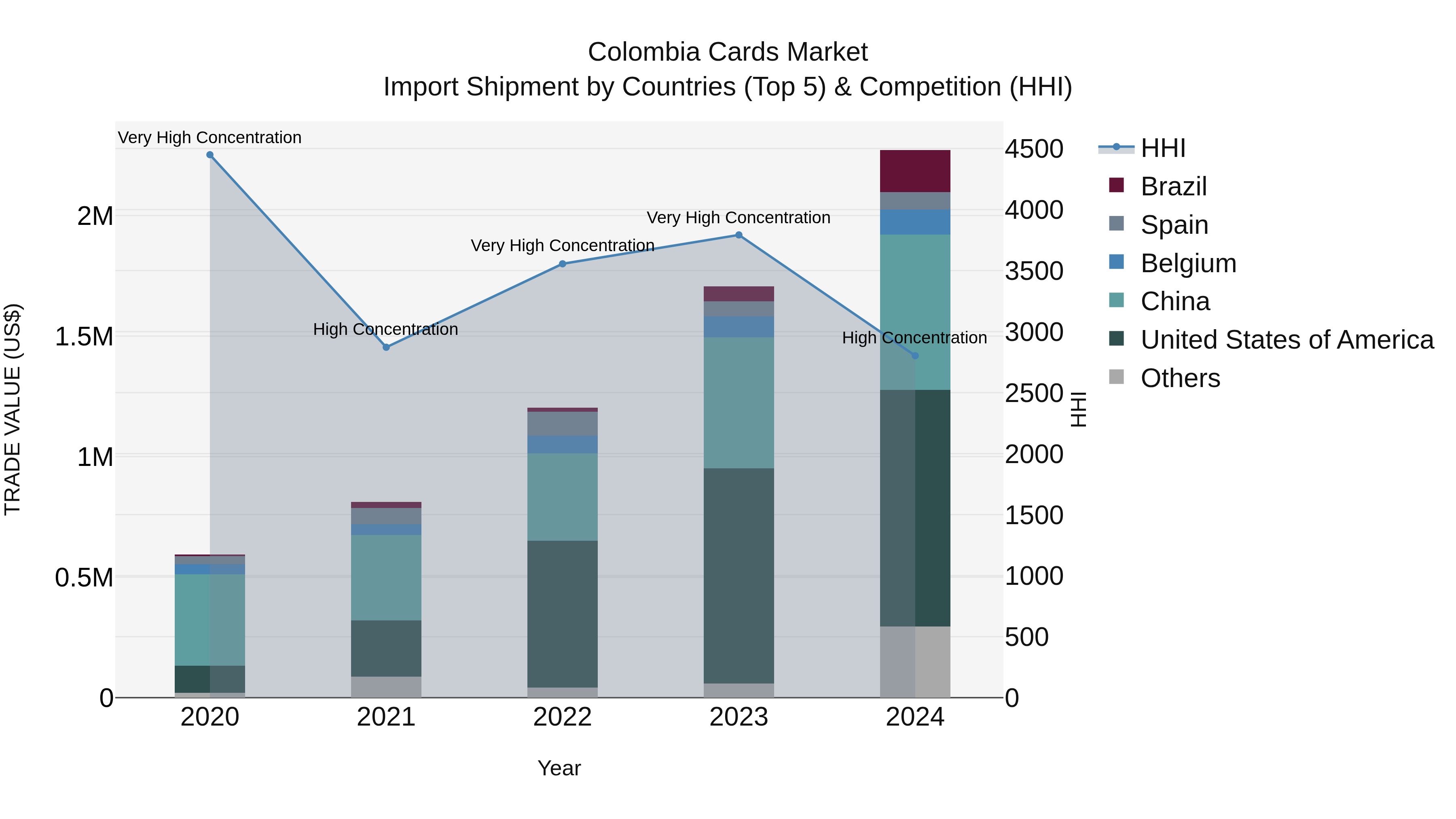

Colombia Cards Market: Top 5 Importing Countries and Market Competition (HHI) Analysis

Colombia card import market continued to thrive in 2024, with the United States, China, Brazil, India, and Belgium as the top exporters. The industry experienced a high concentration level, with the Herfindahl-Hirschman Index (HHI) indicating a shift from very high to high concentration. The impressive compound annual growth rate (CAGR) of 39.88% from 2020 to 2024 demonstrates the market`s robust expansion. Additionally, the growth rate of 33.08% from 2023 to 2024 highlights the sector`s accelerating momentum and attractiveness to international suppliers.

Colombia Cards Market Overview

The Colombia Cards Market is experiencing steady growth due to increasing consumer preference for electronic payments over cash transactions. Debit and credit cards are widely used for everyday purchases, online shopping, and bill payments. The market is competitive with major players offering a variety of card products with rewards and benefits to attract customers. The adoption of contactless payment technology is also on the rise, further driving market expansion. Regulatory changes and initiatives to promote financial inclusion are expected to drive further growth in the Colombia Cards Market, with a focus on expanding access to financial services for underserved populations. Overall, the market presents opportunities for innovation and partnerships to cater to evolving consumer needs and preferences.

Colombia Cards Market Trends

The Colombia Cards Market is experiencing several key trends, including a shift towards digital payments and contactless transactions, driven by the increasing adoption of smartphones and internet connectivity. Consumers are seeking convenience and security, leading to a rise in the use of mobile wallets and online payment platforms. Additionally, there is a growing demand for personalized rewards and loyalty programs, as well as an emphasis on sustainability and eco-friendly card options. Financial institutions are focusing on enhancing cybersecurity measures to protect cardholder data and prevent fraud. Overall, the market is evolving towards a more interconnected and tech-savvy landscape, with a strong emphasis on customer experience and innovation in payment solutions.

Colombia Cards Market Challenges

In the Colombia Cards Market, some key challenges include intense competition among card issuers, regulatory changes impacting fees and interest rates, and a relatively low level of financial inclusion in the population. The market is dominated by a few major players, leading to pricing pressures and the need for innovative offerings to attract and retain customers. Regulatory changes can impact the profitability of card issuers and require them to adapt quickly to new requirements. Additionally, a significant portion of the Colombian population remains unbanked or underbanked, limiting the overall growth potential of the market. Addressing these challenges requires a strategic approach that balances competition, regulatory compliance, and efforts to expand financial access to underserved segments of the population.

Colombia Cards Market Investment Opportunities

The Colombia Cards Market presents various investment opportunities, with growth driven by factors such as increasing internet and smartphone penetration, expanding middle-class population, and government initiatives promoting financial inclusion. Opportunities exist in credit card issuers leveraging data analytics for targeted marketing and risk management, fintech companies offering innovative payment solutions, and companies providing secure and convenient payment processing services. Additionally, there is potential for growth in prepaid cards targeting unbanked segments, loyalty programs enhancing customer retention, and contactless payment technologies. Investors can benefit from the market`s growth potential and evolving consumer preferences by strategically investing in companies poised to capitalize on the shifting dynamics of the Colombia Cards Market.

Colombia Cards Market Government Policy

In Colombia, the government has implemented several policies to regulate the Cards Market. The Superintendencia Financiera de Colombia oversees the sector and ensures compliance with regulations. One key regulation is the requirement for financial institutions to obtain licenses to issue cards and operate in the market. The government also mandates the protection of consumer data and enforces strict security measures to prevent fraud and identity theft. Additionally, there are regulations in place to promote financial inclusion, such as limiting fees and charges on certain types of cards to make them more accessible to all segments of the population. Overall, the government`s policies aim to foster a competitive and secure Cards Market while protecting the interests of consumers.

Colombia Cards Market Future Outlook

The Colombia Cards Market is expected to experience steady growth in the coming years, driven by factors such as increasing consumer adoption of digital payment methods, rising disposable incomes, and the government`s initiatives to promote financial inclusion. The market is likely to witness a shift towards contactless payments and mobile wallets, as well as a rise in demand for personalized and reward-based card offerings. Additionally, the ongoing advancements in technology and the growing e-commerce sector are anticipated to further fuel the growth of the cards market in Colombia. However, regulatory developments, cybersecurity concerns, and competition from alternative payment methods are some of the key challenges that may impact the market`s future growth trajectory. Overall, the Colombia Cards Market is poised for expansion, with opportunities for innovation and strategic partnerships to drive market players` success.

Key Highlights of the Report:

- Colombia Cards Market Outlook

- Market Size of Colombia Cards Market, 2024

- Forecast of Colombia Cards Market, 2031

- Historical Data and Forecast of Colombia Cards Revenues & Volume for the Period 2021 - 2031

- Colombia Cards Market Trend Evolution

- Colombia Cards Market Drivers and Challenges

- Colombia Cards Price Trends

- Colombia Cards Porter's Five Forces

- Colombia Cards Industry Life Cycle

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By General Purpose for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Private Label for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Usage for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By General Purpose Re-Loadable Card for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Government Benefit/Disbursement Card for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Payroll Card for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By End-User for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Retail Establishments for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Corporate Institutions for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Government for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Financial Institutions for the Period 2021 - 2031

- Historical Data and Forecast of Colombia Cards Market Revenues & Volume By Others for the Period 2021 - 2031

- Colombia Cards Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Usage

- Market Opportunity Assessment By End-User

- Colombia Cards Top Companies Market Share

- Colombia Cards Competitive Benchmarking By Technical and Operational Parameters

- Colombia Cards Company Profiles

- Colombia Cards Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Colombia Cards Market Overview |

3.1 Colombia Country Macro Economic Indicators |

3.2 Colombia Cards Market Revenues & Volume, 2021 & 2031F |

3.3 Colombia Cards Market - Industry Life Cycle |

3.4 Colombia Cards Market - Porter's Five Forces |

3.5 Colombia Cards Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Colombia Cards Market Revenues & Volume Share, By Usage, 2021 & 2031F |

3.7 Colombia Cards Market Revenues & Volume Share, By End-User, 2021 & 2031F |

4 Colombia Cards Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing adoption of digital payment methods in Colombia |

4.2.2 Growing population of financially inclusive individuals |

4.2.3 Government initiatives to promote cashless transactions |

4.3 Market Restraints |

4.3.1 High levels of informal economy leading to cash transactions |

4.3.2 Limited merchant acceptance of card payments in certain regions |

4.3.3 Concerns regarding data security and fraud risks associated with card transactions |

5 Colombia Cards Market Trends |

6 Colombia Cards Market, By Types |

6.1 Colombia Cards Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Colombia Cards Market Revenues & Volume, By Type, 2021 - 2031F |

6.1.3 Colombia Cards Market Revenues & Volume, By General Purpose, 2021 - 2031F |

6.1.4 Colombia Cards Market Revenues & Volume, By Private Label, 2021 - 2031F |

6.2 Colombia Cards Market, By Usage |

6.2.1 Overview and Analysis |

6.2.2 Colombia Cards Market Revenues & Volume, By General Purpose Re-Loadable Card, 2021 - 2031F |

6.2.3 Colombia Cards Market Revenues & Volume, By Government Benefit/Disbursement Card, 2021 - 2031F |

6.2.4 Colombia Cards Market Revenues & Volume, By Payroll Card, 2021 - 2031F |

6.2.5 Colombia Cards Market Revenues & Volume, By Others, 2021 - 2031F |

6.3 Colombia Cards Market, By End-User |

6.3.1 Overview and Analysis |

6.3.2 Colombia Cards Market Revenues & Volume, By Retail Establishments, 2021 - 2031F |

6.3.3 Colombia Cards Market Revenues & Volume, By Corporate Institutions, 2021 - 2031F |

6.3.4 Colombia Cards Market Revenues & Volume, By Government, 2021 - 2031F |

6.3.5 Colombia Cards Market Revenues & Volume, By Financial Institutions, 2021 - 2031F |

6.3.6 Colombia Cards Market Revenues & Volume, By Others, 2021 - 2031F |

7 Colombia Cards Market Import-Export Trade Statistics |

7.1 Colombia Cards Market Export to Major Countries |

7.2 Colombia Cards Market Imports from Major Countries |

8 Colombia Cards Market Key Performance Indicators |

8.1 Number of new merchant sign-ups for card acceptance |

8.2 Percentage increase in digital transactions over cash transactions |

8.3 Adoption rate of contactless payment technology in the market |

9 Colombia Cards Market - Opportunity Assessment |

9.1 Colombia Cards Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Colombia Cards Market Opportunity Assessment, By Usage, 2021 & 2031F |

9.3 Colombia Cards Market Opportunity Assessment, By End-User, 2021 & 2031F |

10 Colombia Cards Market - Competitive Landscape |

10.1 Colombia Cards Market Revenue Share, By Companies, 2024 |

10.2 Colombia Cards Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero