France Gelling Agents Market (2025-2031) | Value, Size & Revenue, Forecast, Segmentation, Analysis, Outlook, Share, Growth, Trends, Industry, Competitive Landscape, Companies

| Product Code: ETC7219817 | Publication Date: Sep 2024 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Bhawna Singh | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

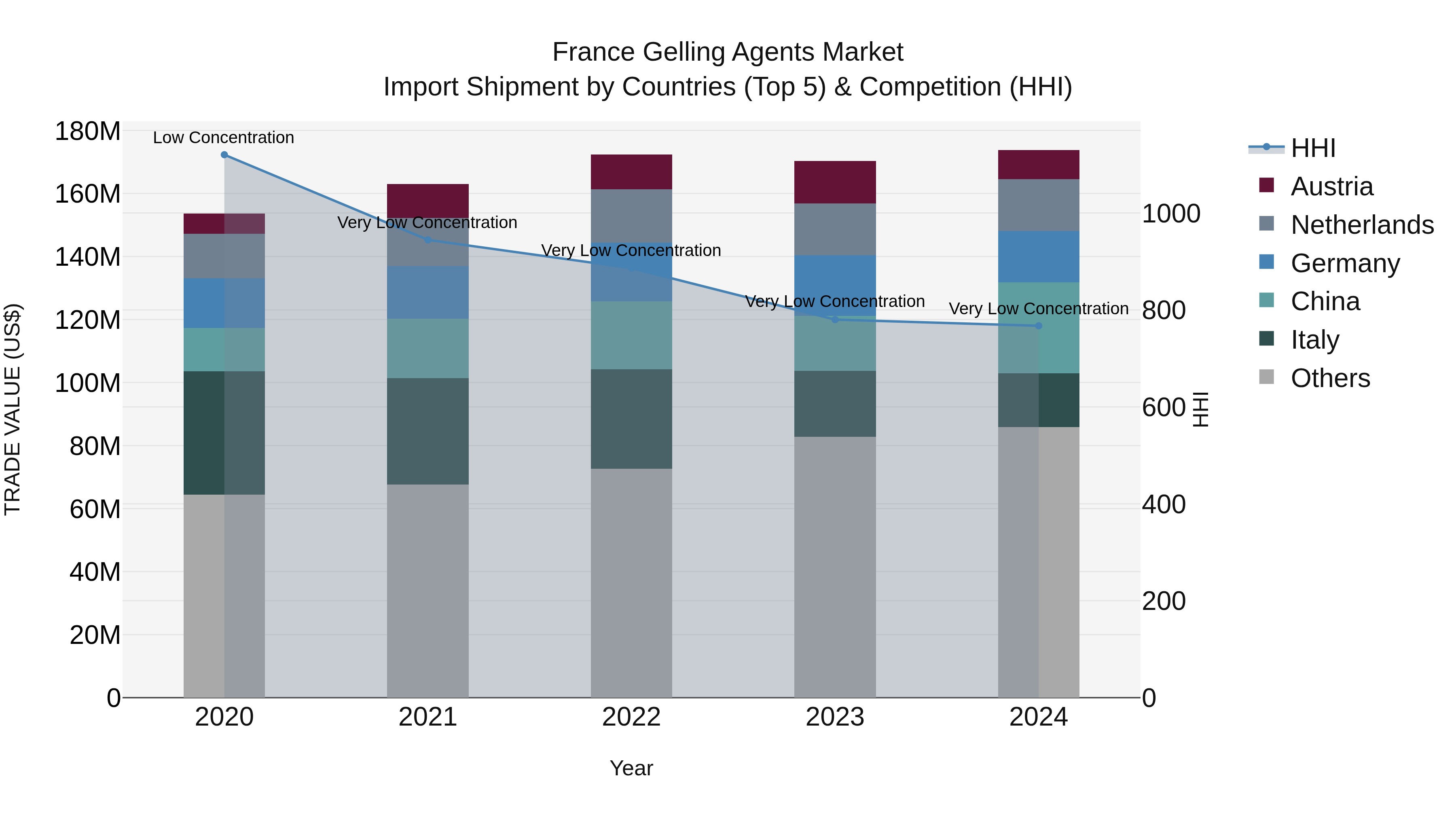

France Gelling Agents Market Top 5 Importing Countries and Market Competition (HHI) Analysis

France continues to rely on imports of gelling agents, with top suppliers including China, Italy, Netherlands, Germany, and Belgium. The market shows low concentration, as indicated by the Herfindahl-Hirschman Index (HHI). The compound annual growth rate (CAGR) from 2020 to 2024 stands at 3.13%, with a growth rate of 2.05% in 2024. This steady growth reflects the ongoing demand for gelling agents in various industries in France, highlighting opportunities for both domestic and international suppliers to capitalize on this market trend.

France Gelling Agents Market Synopsis

The France gelling agents market is witnessing steady growth driven by the rising demand for convenience food products and the increasing adoption of gelling agents in various industries such as food and beverage, pharmaceuticals, and personal care. Key players in the market are focusing on product innovation and development to cater to the evolving consumer preferences for clean label and natural ingredients. Gelatin, pectin, agar-agar, and carrageenan are among the widely used gelling agents in the French market. The food industry holds a significant share in the market, with gelling agents being used in a wide range of products including jams, confectionery, dairy products, and meat products. With the growing trend of vegan and plant-based products, there is also a rising demand for alternative gelling agents derived from plant sources such as seaweed and fruit pectin.

France Gelling Agents Market Trends

The France Gelling Agents Market is experiencing growth due to the increasing demand for natural and clean label ingredients in the food and beverage industry. Consumers are seeking healthier and more sustainable products, driving the market for gelling agents derived from plant-based sources such as pectin, agar-agar, and carrageenan. There is also a growing trend towards vegan and vegetarian diets, further boosting the demand for gelling agents that cater to these dietary preferences. Manufacturers in France have opportunities to innovate and develop new gelling agents formulations that meet these market demands and offer functional benefits such as improved texture, stability, and mouthfeel in various food and beverage applications. Collaboration with research institutions and investments in research and development can help companies capitalize on these trends and strengthen their market position in France.

France Gelling Agents Market Challenges

The France Gelling Agents Market faces several challenges, including increasing regulatory scrutiny and requirements for clean label and natural ingredients. Consumer demand for healthier and more transparent food products is driving the need for gelling agents derived from natural sources, which can be more expensive and difficult to source consistently. Additionally, the market is highly competitive, with a wide range of gelling agents available, making it challenging for companies to differentiate their products. Supply chain disruptions and fluctuations in raw material prices also pose challenges for manufacturers in maintaining stable production and pricing. Overall, companies operating in the France Gelling Agents Market need to navigate these challenges by investing in research and development, ensuring supply chain resilience, and adapting to changing consumer preferences.

France Gelling Agents Market Investment Opportunities

The France Gelling Agents Market is primarily driven by the growing demand for convenience foods and processed products, as gelling agents are essential ingredients in these food items to provide texture, stability, and consistency. Additionally, the increasing consumer preference for clean label and natural ingredients in food products is fueling the demand for gelling agents derived from natural sources such as seaweed, pectin, and agar. The food industry`s focus on product innovation and development of new textures and taste profiles is also driving the market growth, leading to a higher usage of gelling agents in various food applications like bakery, confectionery, dairy, and beverages. Furthermore, the rising awareness about the functional benefits of gelling agents, such as fat reduction and improved shelf-life, is contributing to their adoption in the food industry.

France Gelling Agents Market Government Polices

In France, the gelling agents market is regulated by various government policies to ensure product safety and quality. The European Union`s food additive regulations, specifically Regulation (EC) No 1333/2008, set out the rules for the use of gelling agents in food products. The French government also enforces labeling requirements under Regulation (EU) No 1169/2011 to provide consumers with clear information about the presence of gelling agents in food items. Additionally, the French National Agency for Food, Environmental and Occupational Health & Safety (ANSES) conducts risk assessments and monitors the use of gelling agents to safeguard public health. Overall, these policies aim to maintain high standards of quality, safety, and transparency in the France gelling agents market.

France Gelling Agents Market Future Outlook

The France Gelling Agents Market is expected to witness steady growth in the coming years, driven by increasing demand from various industries such as food and beverage, pharmaceuticals, and personal care. The growing trend towards clean label products and the rising popularity of convenience foods are key factors contributing to the market`s growth. Additionally, the emphasis on product innovation and development of new gelling agents with improved functionalities and applications is anticipated to further boost market expansion. As consumer preferences continue to evolve towards healthier and more natural products, manufacturers in the gelling agents market are likely to focus on offering clean label solutions to meet these demands. Overall, the future outlook for the France Gelling Agents Market appears optimistic with opportunities for growth and innovation.

Key Highlights of the Report:

- France Gelling Agents Market Outlook

- Market Size of France Gelling Agents Market, 2024

- Forecast of France Gelling Agents Market, 2031

- Historical Data and Forecast of France Gelling Agents Revenues & Volume for the Period 2021- 2031

- France Gelling Agents Market Trend Evolution

- France Gelling Agents Market Drivers and Challenges

- France Gelling Agents Price Trends

- France Gelling Agents Porter's Five Forces

- France Gelling Agents Industry Life Cycle

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Nature for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Conventional for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Organic for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Type for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Natural Gelling Agents for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Artificial Gelling Agents for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Function for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Stabilizer for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Thickener for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Texturizer for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Emulsifier for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Form for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Whole for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Diced/Cut for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Roasted for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Granular for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Application for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Food and Beverage for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Cosmetics and Personal Care for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Pharmaceuticals for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Other Applications for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Product type for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Agar-Agar for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Gellan Gum for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Curdlan for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Xanthan Gum for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Karaya Gum for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Gelatin for the Period 2021- 2031

- Historical Data and Forecast of France Gelling Agents Market Revenues & Volume By Pectin for the Period 2021- 2031

- France Gelling Agents Import Export Trade Statistics

- Market Opportunity Assessment By Nature

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Function

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Product type

- France Gelling Agents Top Companies Market Share

- France Gelling Agents Competitive Benchmarking By Technical and Operational Parameters

- France Gelling Agents Company Profiles

- France Gelling Agents Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 France Gelling Agents Market Overview |

3.1 France Country Macro Economic Indicators |

3.2 France Gelling Agents Market Revenues & Volume, 2021 & 2031F |

3.3 France Gelling Agents Market - Industry Life Cycle |

3.4 France Gelling Agents Market - Porter's Five Forces |

3.5 France Gelling Agents Market Revenues & Volume Share, By Nature, 2021 & 2031F |

3.6 France Gelling Agents Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.7 France Gelling Agents Market Revenues & Volume Share, By Function, 2021 & 2031F |

3.8 France Gelling Agents Market Revenues & Volume Share, By Form, 2021 & 2031F |

3.9 France Gelling Agents Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.10 France Gelling Agents Market Revenues & Volume Share, By Product type, 2021 & 2031F |

4 France Gelling Agents Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for natural and clean label ingredients in food and beverage industry |

4.2.2 Growing awareness about the health benefits of using gelling agents in food products |

4.2.3 Rising trend of vegan and vegetarian diets leading to higher demand for plant-based gelling agents |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials such as seaweed, agar, and carrageenan |

4.3.2 Stringent regulations and standards governing the use of gelling agents in food products |

4.3.3 Limited availability of certain specialty gelling agents in the market |

5 France Gelling Agents Market Trends |

6 France Gelling Agents Market, By Types |

6.1 France Gelling Agents Market, By Nature |

6.1.1 Overview and Analysis |

6.1.2 France Gelling Agents Market Revenues & Volume, By Nature, 2021- 2031F |

6.1.3 France Gelling Agents Market Revenues & Volume, By Conventional, 2021- 2031F |

6.1.4 France Gelling Agents Market Revenues & Volume, By Organic, 2021- 2031F |

6.2 France Gelling Agents Market, By Type |

6.2.1 Overview and Analysis |

6.2.2 France Gelling Agents Market Revenues & Volume, By Natural Gelling Agents, 2021- 2031F |

6.2.3 France Gelling Agents Market Revenues & Volume, By Artificial Gelling Agents, 2021- 2031F |

6.3 France Gelling Agents Market, By Function |

6.3.1 Overview and Analysis |

6.3.2 France Gelling Agents Market Revenues & Volume, By Stabilizer, 2021- 2031F |

6.3.3 France Gelling Agents Market Revenues & Volume, By Thickener, 2021- 2031F |

6.3.4 France Gelling Agents Market Revenues & Volume, By Texturizer, 2021- 2031F |

6.3.5 France Gelling Agents Market Revenues & Volume, By Emulsifier, 2021- 2031F |

6.4 France Gelling Agents Market, By Form |

6.4.1 Overview and Analysis |

6.4.2 France Gelling Agents Market Revenues & Volume, By Whole, 2021- 2031F |

6.4.3 France Gelling Agents Market Revenues & Volume, By Diced/Cut, 2021- 2031F |

6.4.4 France Gelling Agents Market Revenues & Volume, By Roasted, 2021- 2031F |

6.4.5 France Gelling Agents Market Revenues & Volume, By Granular, 2021- 2031F |

6.5 France Gelling Agents Market, By Application |

6.5.1 Overview and Analysis |

6.5.2 France Gelling Agents Market Revenues & Volume, By Food and Beverage, 2021- 2031F |

6.5.3 France Gelling Agents Market Revenues & Volume, By Cosmetics and Personal Care, 2021- 2031F |

6.5.4 France Gelling Agents Market Revenues & Volume, By Pharmaceuticals, 2021- 2031F |

6.5.5 France Gelling Agents Market Revenues & Volume, By Other Applications, 2021- 2031F |

6.6 France Gelling Agents Market, By Product type |

6.6.1 Overview and Analysis |

6.6.2 France Gelling Agents Market Revenues & Volume, By Agar-Agar, 2021- 2031F |

6.6.3 France Gelling Agents Market Revenues & Volume, By Gellan Gum, 2021- 2031F |

6.6.4 France Gelling Agents Market Revenues & Volume, By Curdlan, 2021- 2031F |

6.6.5 France Gelling Agents Market Revenues & Volume, By Xanthan Gum, 2021- 2031F |

6.6.6 France Gelling Agents Market Revenues & Volume, By Karaya Gum, 2021- 2031F |

6.6.7 France Gelling Agents Market Revenues & Volume, By Gelatin, 2021- 2031F |

7 France Gelling Agents Market Import-Export Trade Statistics |

7.1 France Gelling Agents Market Export to Major Countries |

7.2 France Gelling Agents Market Imports from Major Countries |

8 France Gelling Agents Market Key Performance Indicators |

8.1 Consumer perception and acceptance of gelling agents in food products |

8.2 Innovation and development of new gelling agents with improved functionality |

8.3 Adoption rate of gelling agents in various food and beverage applications |

9 France Gelling Agents Market - Opportunity Assessment |

9.1 France Gelling Agents Market Opportunity Assessment, By Nature, 2021 & 2031F |

9.2 France Gelling Agents Market Opportunity Assessment, By Type, 2021 & 2031F |

9.3 France Gelling Agents Market Opportunity Assessment, By Function, 2021 & 2031F |

9.4 France Gelling Agents Market Opportunity Assessment, By Form, 2021 & 2031F |

9.5 France Gelling Agents Market Opportunity Assessment, By Application, 2021 & 2031F |

9.6 France Gelling Agents Market Opportunity Assessment, By Product type, 2021 & 2031F |

10 France Gelling Agents Market - Competitive Landscape |

10.1 France Gelling Agents Market Revenue Share, By Companies, 2024 |

10.2 France Gelling Agents Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero