Hungary Cosmetics Packaging Market (2020-2026) | Size, Growth, Trends, Forecast, Share, Outlook, Analysis, Revenue, Industry, Segmentation & COVID-19 IMPACT

Market Forecast By Material Types (Plastic, Glass, Metal, Paper), By Product Types (Plastic Bottles and Containers, Glass Bottles and Containers, Metal Containers, Folding Cartons, Caps and Closures, Droppers, Flexible Plastic Packaging, Others), By Cosmetic Types (Hair Care, Color Cosmetics, Skin Care, Men’s Grooming, Deodorants, Nail Care, Others) And Competitive Landscape

| Product Code: ETC006819 | Publication Date: Jun 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

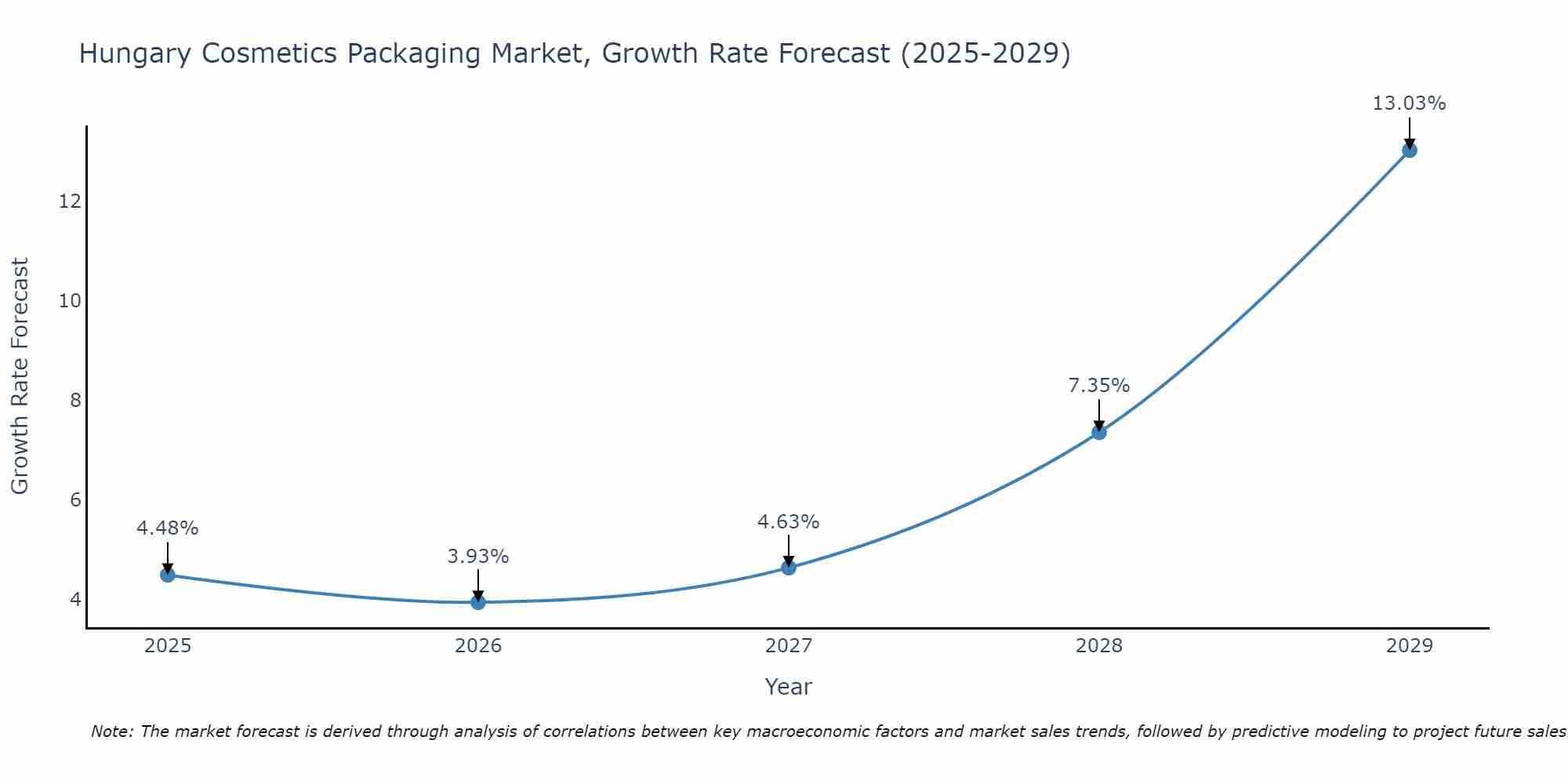

Hungary Cosmetics Packaging Market Size Growth Rate

The Hungary Cosmetics Packaging Market is projected to witness mixed growth rate patterns during 2025 to 2029. From 4.48% in 2025, the growth rate steadily ascends to 13.03% in 2029.

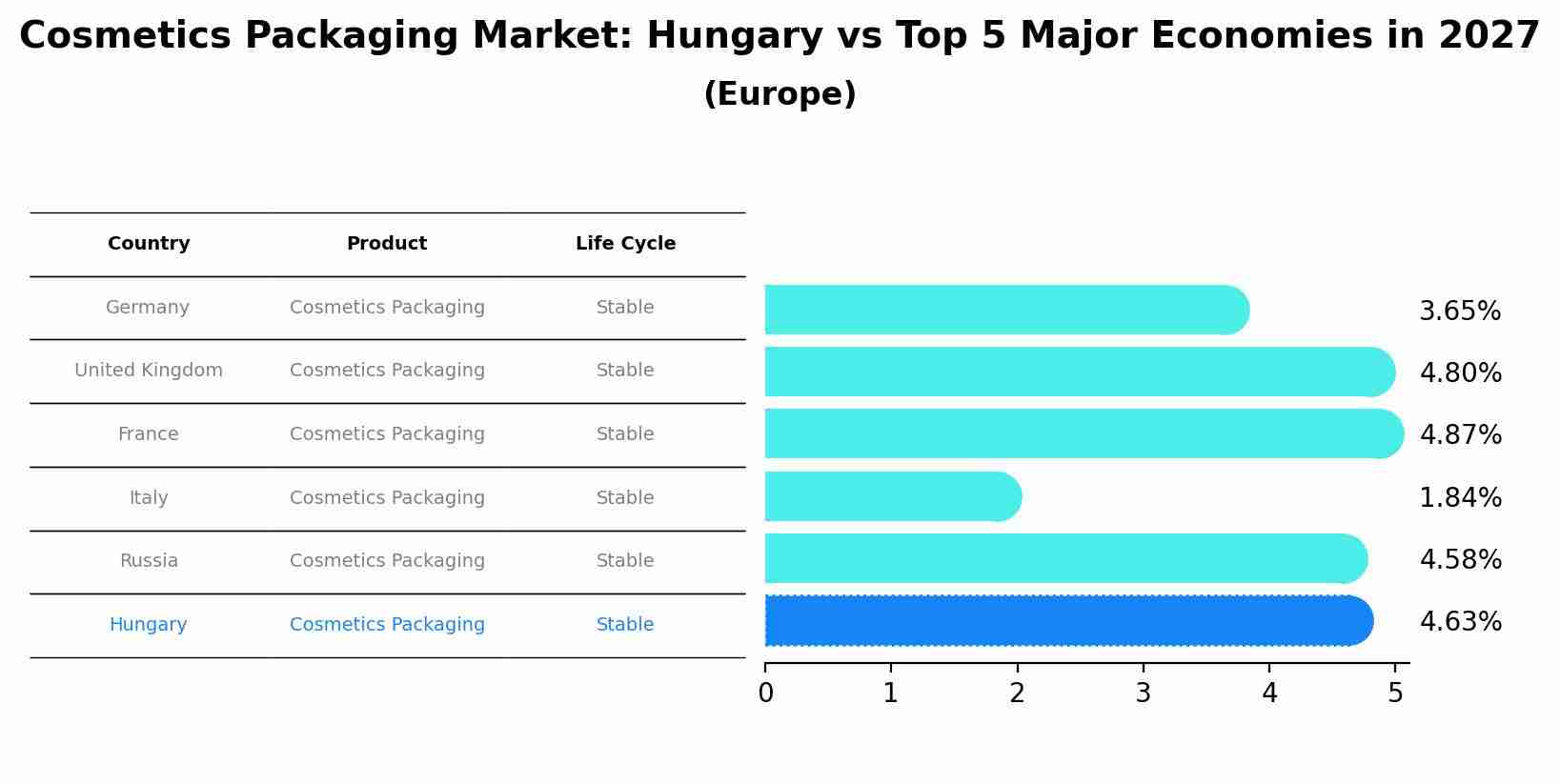

Cosmetics Packaging Market: Hungary vs Top 5 Major Economies in 2027 (Europe)

By 2027, Hungary's Cosmetics Packaging market is forecasted to achieve a stable growth rate of 4.63%, with Germany leading the Europe region, followed by United Kingdom, France, Italy and Russia.

Latest (2023) Developments in the Hungary Cosmetics Packaging Market

The Hungary Cosmetics Packaging Market has been evolving rapidly in recent years, and 2023 is set to bring even more exciting developments. One of the key trends that we can expect to see is a continued focus on sustainability. With consumers becoming increasingly concerned about the environmental impact of packaging materials, manufacturers are exploring new ways to create eco-friendly solutions.

Another trend that we can expect to see in 2023 is an increased emphasis on personalization. As consumer preferences become more diverse and individualized, brands are looking for innovative ways to tailor their products and packaging accordingly.

In addition, technological innovations will continue to play a significant role in shaping the cosmetics packaging industry in Hungary. We can anticipate further advancements in smart packaging technology, such as interactive labels or near-field communication (NFC) enabled packages that provide customers with unique product information or promotional offers.

There will be a growing shift towards minimalist designs that emphasize simplicity and elegance over flashy graphics or branding. This trend reflects a broader cultural movement towards minimalism across various industries and markets worldwide.

Hungary Cosmetics Packaging Market Synopsis

The Hungary Cosmetics Packaging Market has been experiencing steady growth over the past few years. This can be attributed to various factors, such as an increase in disposable income and a growing interest in personal grooming and beauty products. Additionally, the rise of e-commerce platforms has made it easier for consumers to access cosmetics from anywhere at any time.

One particular trend that is driving the market is the demand for sustainable packaging solutions. Consumers are becoming more environmentally conscious and are looking for brands that prioritize eco-friendly options. As a result, many companies have started incorporating biodegradable materials into their packaging designs.

Another factor contributing to market growth is product innovation. With increased competition, companies are investing in research and development to create unique packaging designs that stand out on shelves or online stores.

With favorable economic conditions and consumer trends towards sustainability and innovation, the Hungary Cosmetics Packaging Market looks set for continued success in the coming years.

COVID-19 Impact on the Hungary Cosmetics Packaging Market

The COVID-19 pandemic has had a significant impact on the Hungary cosmetics packaging market. With the lockdowns and restrictions in place, there has been a decline in demand for cosmetic products, which consequently led to a decrease in demand for cosmetics packaging.

Moreover, several cosmetic companies have shifted their focus towards manufacturing essential items like sanitizers and disinfectants due to the increased demand caused by the pandemic. This shift has further affected the cosmetics packaging industry as they are producing more sanitary packaging options.

On top of that, the supply chain disruptions have also impacted manufacturers' ability to produce and distribute their products efficiently. The lack of raw materials and transportation issues resulted in delayed production times and delivery schedules, which ultimately lead to an increase in manufacturing costs.

However, with vaccination programs being rolled out worldwide leading to decreased cases of COVID-19 infections across Hungary, it is expected that there will be an increase in demand for personal care products including cosmetics again soon. As such, this could positively impact the country's cosmetics packaging market moving forward.

Key Players in the Hungary Cosmetics Packaging Market

The Hungary cosmetics packaging market has shown a steady growth rate in recent years and is expected to continue its upward trajectory in the forecast period of 2020-2026. With increasing demand for sustainable and eco-friendly packaging solutions, companies are focusing on innovative and environmentally conscious designs.

The key players operating in the Hungary cosmetics packaging market include Albéa Group, Gerresheimer AG, Quadpack Industries SA, RPC M&H Plastics Ltd., Silgan Holdings Inc., AptarGroup Inc., HCP Packaging (Shanghai) Co. Ltd., Lumson SPA, Coverpla S.

These companies are constantly investing in research and development to introduce new products that meet consumer demands while also adhering to sustainability standards. As competition intensifies within the market, it will be interesting to see how these key players adapt their strategies to maintain their positions as leaders in this growing industry.

Key Highlights of the Report:

- Hungary Cosmetics Packaging Market Outlook

- Market Size of Hungary Cosmetics Packaging Market, 2019

- Forecast of Hungary Cosmetics Packaging Market, 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Revenues & Volume for the Period 2016 - 2026

- Hungary Cosmetics Packaging Market Trend Evolution

- Hungary Cosmetics Packaging Market Drivers and Challenges

- Hungary Cosmetics Packaging Price Trends

- Hungary Cosmetics Packaging Porter's Five Forces

- Hungary Cosmetics Packaging Industry Life Cycle

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Material Types for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Plastic for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Glass for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Metal for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Paper for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Product Types for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Plastic Bottles and Containers for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Glass Bottles and Containers for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Metal Containers for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Folding Cartons for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Caps and Closures for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Droppers for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Flexible Plastic Packaging for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Others for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Cosmetic Types for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Hair Care for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Color Cosmetics for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Skin Care for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Mens Grooming for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Deodorants for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Nail Care for the Period 2016 - 2026

- Historical Data and Forecast of Hungary Cosmetics Packaging Market Revenues & Volume By Others for the Period 2016 - 2026

- Hungary Cosmetics Packaging Import Export Trade Statistics

- Market Opportunity Assessment By Material Types

- Market Opportunity Assessment By Product Types

- Market Opportunity Assessment By Cosmetic Types

- Hungary Cosmetics Packaging Top Companies Market Share

- Hungary Cosmetics Packaging Competitive Benchmarking By Technical and Operational Parameters

- Hungary Cosmetics Packaging Company Profiles

- Hungary Cosmetics Packaging Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Hungary Cosmetics Packaging Market Overview |

| 3.1 Hungary Country Macro Economic Indicators |

| 3.2 Hungary Cosmetics Packaging Market Revenues & Volume, 2019 & 2026F |

| 3.3 Hungary Cosmetics Packaging Market - Industry Life Cycle |

| 3.4 Hungary Cosmetics Packaging Market - Porter's Five Forces |

| 3.5 Hungary Cosmetics Packaging Market Revenues & Volume Share, By Material Types, 2019 & 2026F |

| 3.6 Hungary Cosmetics Packaging Market Revenues & Volume Share, By Product Types, 2019 & 2026F |

| 3.7 Hungary Cosmetics Packaging Market Revenues & Volume Share, By Cosmetic Types, 2019 & 2026F |

| 4 Hungary Cosmetics Packaging Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Hungary Cosmetics Packaging Market Trends |

| 6 Hungary Cosmetics Packaging Market, By Types |

| 6.1 Hungary Cosmetics Packaging Market, By Material Types |

| 6.1.1 Overview and Analysis |

| 6.1.2 Hungary Cosmetics Packaging Market Revenues & Volume, By Material Types, 2016 - 2026F |

| 6.1.3 Hungary Cosmetics Packaging Market Revenues & Volume, By Plastic, 2016 - 2026F |

| 6.1.4 Hungary Cosmetics Packaging Market Revenues & Volume, By Glass, 2016 - 2026F |

| 6.1.5 Hungary Cosmetics Packaging Market Revenues & Volume, By Metal, 2016 - 2026F |

| 6.1.6 Hungary Cosmetics Packaging Market Revenues & Volume, By Paper, 2016 - 2026F |

| 6.2 Hungary Cosmetics Packaging Market, By Product Types |

| 6.2.1 Overview and Analysis |

| 6.2.2 Hungary Cosmetics Packaging Market Revenues & Volume, By Plastic Bottles and Containers, 2016 - 2026F |

| 6.2.3 Hungary Cosmetics Packaging Market Revenues & Volume, By Glass Bottles and Containers, 2016 - 2026F |

| 6.2.4 Hungary Cosmetics Packaging Market Revenues & Volume, By Metal Containers, 2016 - 2026F |

| 6.2.5 Hungary Cosmetics Packaging Market Revenues & Volume, By Folding Cartons, 2016 - 2026F |

| 6.2.6 Hungary Cosmetics Packaging Market Revenues & Volume, By Caps and Closures, 2016 - 2026F |

| 6.2.7 Hungary Cosmetics Packaging Market Revenues & Volume, By Droppers, 2016 - 2026F |

| 6.2.8 Hungary Cosmetics Packaging Market Revenues & Volume, By Others, 2016 - 2026F |

| 6.2.9 Hungary Cosmetics Packaging Market Revenues & Volume, By Others, 2016 - 2026F |

| 6.3 Hungary Cosmetics Packaging Market, By Cosmetic Types |

| 6.3.1 Overview and Analysis |

| 6.3.2 Hungary Cosmetics Packaging Market Revenues & Volume, By Hair Care, 2016 - 2026F |

| 6.3.3 Hungary Cosmetics Packaging Market Revenues & Volume, By Color Cosmetics, 2016 - 2026F |

| 6.3.4 Hungary Cosmetics Packaging Market Revenues & Volume, By Skin Care, 2016 - 2026F |

| 6.3.5 Hungary Cosmetics Packaging Market Revenues & Volume, By Men?s Grooming, 2016 - 2026F |

| 6.3.6 Hungary Cosmetics Packaging Market Revenues & Volume, By Deodorants, 2016 - 2026F |

| 6.3.7 Hungary Cosmetics Packaging Market Revenues & Volume, By Nail Care, 2016 - 2026F |

| 7 Hungary Cosmetics Packaging Market Import-Export Trade Statistics |

| 7.1 Hungary Cosmetics Packaging Market Export to Major Countries |

| 7.2 Hungary Cosmetics Packaging Market Imports from Major Countries |

| 8 Hungary Cosmetics Packaging Market Key Performance Indicators |

| 9 Hungary Cosmetics Packaging Market - Opportunity Assessment |

| 9.1 Hungary Cosmetics Packaging Market Opportunity Assessment, By Material Types, 2019 & 2026F |

| 9.2 Hungary Cosmetics Packaging Market Opportunity Assessment, By Product Types, 2019 & 2026F |

| 9.3 Hungary Cosmetics Packaging Market Opportunity Assessment, By Cosmetic Types, 2019 & 2026F |

| 10 Hungary Cosmetics Packaging Market - Competitive Landscape |

| 10.1 Hungary Cosmetics Packaging Market Revenue Share, By Companies, 2019 |

| 10.2 Hungary Cosmetics Packaging Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero