India Copper Market (2025-2031) | Companies, Share, Value, Trends, Growth, Industry, Forecast, Size, Outlook, Revenue & Analysis

Market Forecast By Applications (Building & Construction, Electrical & Electronics, Industrial Machinery & Equipment, Transportation, Consumer & General Products), By Product Type (Rods and Wires, Plates and Strips, Tubes, Others) And Competitive Landscape

| Product Code: ETC008504 | Publication Date: Aug 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

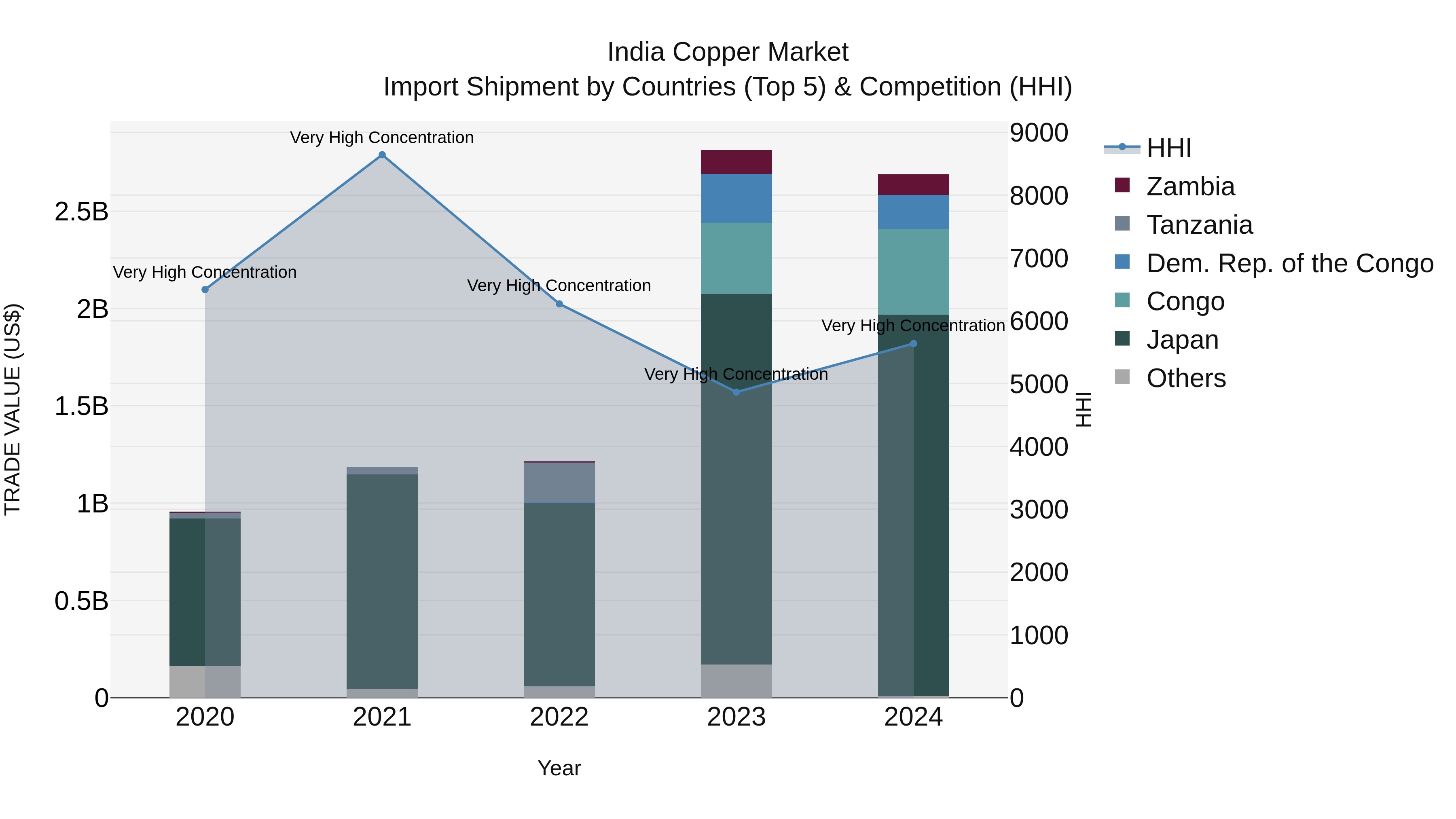

India Copper Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, India continued to see significant copper import shipments with top exporters being Japan, Congo, Dem. Rep. of the Congo, Zambia, and Austria. The market exhibited high concentration with a high Herfindahl-Hirschman Index (HHI). Despite a strong compound annual growth rate (CAGR) of 29.53% from 2020-24, there was a slight decline in the growth rate from 2023-24. This data suggests a robust demand for copper in India, with fluctuations in growth rates reflecting evolving market dynamics.

India Copper Market Highlights

| Report Name | India Copper Market |

| Forecast Period | 2025-2031 |

| CAGR | 6.2% |

| Growing Sector | Construction Sector |

Topics Covered India Copper Market Report

The India Copper Market Report thoroughly covers the market by applications and product type. The India Copper Market Outlook report provides an unbiased and detailed analysis of the ongoing India Copper Market trends, opportunities/high growth areas, and market drivers. This would help the stakeholders devise and align their market strategies according to the current and future market dynamics.

India Copper Market Synopsis

India copper market is poised for major growth in the coming years, driven by the construction, electrical, and renewable energy sectors. The industry faces challenges, such as the shortage of raw materials, key players, including Hindalco Industries Limited and Vedanta Limited, and government initiatives are geared towards overcoming these challenges.

According to 6Wresearch, the India Copper Market size is estimated to expand at a CAGR of 6.2% during 2025-2031. One of the key drivers of the India copper market is the growth of the construction industry. The demand for copper in the construction industry has increased significantly, owing to the rise in urbanization and the increased demand for housing projects. Besides this, the demand for copper wire and cables has also increased due to the growth of the electrical and electronics industry. Another significant driver of the India copper market is the increase in the renewable energy sector. Copper is an essential component in solar panels and wind turbines and, as the Indian government emphasizes renewable energy, the demand for copper is predicted to increase. These factors have been driving the India Copper Market growth.

Copper is a scarce metal, and its production is heavily dependent on imports. India imports around 95% of copper concentrates, and the high dependence on imports in turn restricts the growth of the industry. Furthermore, the fluctuating global prices of copper can also have a significant impact on the India copper market.

Copper Market in India: Leading Players

Several key players operate in the India copper market, including Hindalco Industries Limited, Vedanta Limited, Hindustan Copper Limited, and Birla Copper. Hindalco Industries Limited is one of the largest copper producers in India, and it has a production capacit. Vedanta Limited is another major player in the India copper market, with a production capacity of 400,000 tonnes per annum. These companies have been investing significantly in the expansion and modernization of their operations to meet the growing demand for copper.

India Copper Industry: Government Initiatives

The Government of India has taken several initiatives to support the growth of the copper industry. The government has implemented policies such as the National Mineral Policy, which aims to provide a conducive environment for the growth of the mining industry, including copper mining. Moreover, the government encourages private sector participation in the copper industry through policies like Foreign Direct Investment. Additionally, the government has undertaken several measures to promote renewable energy, which, as stated earlier, is a significant driver of the copper industry.

Future Insights of the Market

India Copper Market is poised for significant growth in the coming years. Increasing demand, favorable government policies, technological advancements, and global trends all indicate that the copper industry will continue to expand. Investors looking for opportunities in the Indian market should consider the copper industry as a potentially lucrative sector. The future looks bright for the India Copper Market, and those who position themselves well could stand to benefit.

Market Segmentation by Application

According to Prakhar, Senior Research Analyst, 6Wreserach, building and construction is the largest end-use application segments for copper in India. The growth in the building and construction sectors, especially in residential and commercial construction, is driving the growth of the copper market in India.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Copper Market Outlook

- Market Size of India Copper Market, 2031

- Forecast of India Copper Market, 2031

- Historical Data and Forecast of India Copper Revenues & Volume for the Period 2021 - 2031

- India Copper Market Trend Evolution

- India Copper Market Drivers and Challenges

- India Copper Price Trends

- India Copper Porter's Five Forces

- India Copper Industry Life Cycle

- Historical Data and Forecast of India Copper Market Revenues & Volume By Applications for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Building & Construction for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Electrical & Electronics for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Industrial Machinery & Equipment for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Transportation for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Consumer & General Products for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Rods and Wires for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Plates and Strips for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Tubes for the Period 2021 - 2031

- Historical Data and Forecast of India Copper Market Revenues & Volume By Others for the Period 2021 - 2031

- India Copper Import Export Trade Statistics

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Product Type

- India Copper Top Companies Market Share

- India Copper Competitive Benchmarking By Technical and Operational Parameters

- India Copper Company Profiles

- India Copper Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Applications

- Building & Construction

- Electrical & Electronics

- Industrial Machinery & Equipment

- Transportation

- Consumer & General Products

By Product Type

- Rods And Wires

- Plates And Strips

- Tubes

- Others

India Copper Market (2025-2031) :FAQ

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Copper Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Copper Market Revenues & Volume, 2021 & 2031F |

| 3.3 India Copper Market - Industry Life Cycle |

| 3.4 India Copper Market - Porter's Five Forces |

| 3.5 India Copper Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 3.6 India Copper Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 4 India Copper Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing infrastructure development projects in India leading to higher demand for copper. |

| 4.2.2 Growth in the electrical and electronics industry, where copper is a key component. |

| 4.2.3 Rising urbanization and industrialization boosting the consumption of copper in various applications. |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating copper prices in the global market impacting the profitability of copper producers in India. |

| 4.3.2 Environmental concerns and regulations related to copper mining and processing. |

| 4.3.3 Competition from alternative materials like aluminum affecting the demand for copper. |

| 5 India Copper Market Trends |

| 6 India Copper Market, By Types |

| 6.1 India Copper Market, By Applications |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Copper Market Revenues & Volume, By Applications, 2021 - 2031F |

| 6.1.3 India Copper Market Revenues & Volume, By Building & Construction, 2021 - 2031F |

| 6.1.4 India Copper Market Revenues & Volume, By Electrical & Electronics, 2021 - 2031F |

| 6.1.5 India Copper Market Revenues & Volume, By Industrial Machinery & Equipment, 2021 - 2031F |

| 6.1.6 India Copper Market Revenues & Volume, By Transportation, 2021 - 2031F |

| 6.1.7 India Copper Market Revenues & Volume, By Consumer & General Products, 2021 - 2031F |

| 6.2 India Copper Market, By Product Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Copper Market Revenues & Volume, By Rods and Wires, 2021 - 2031F |

| 6.2.3 India Copper Market Revenues & Volume, By Plates and Strips, 2021 - 2031F |

| 6.2.4 India Copper Market Revenues & Volume, By Tubes, 2021 - 2031F |

| 6.2.5 India Copper Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 India Copper Market Import-Export Trade Statistics |

| 7.1 India Copper Market Export to Major Countries |

| 7.2 India Copper Market Imports from Major Countries |

| 8 India Copper Market Key Performance Indicators |

| 8.1 Import and export volumes of copper in India. |

| 8.2 Capacity utilization rates of copper production facilities in India. |

| 8.3 Consumption trends of copper in key industries such as construction and automotive. |

| 9 India Copper Market - Opportunity Assessment |

| 9.1 India Copper Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 9.2 India Copper Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 10 India Copper Market - Competitive Landscape |

| 10.1 India Copper Market Revenue Share, By Companies, 2024 |

| 10.2 India Copper Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero