India Electric Drives Market (2017-2023) | Value, Size, Industry, Forecast, Share, Trends, Revenue, Companies, Outlook, Analysis & Growth

Market Forecast by Types (AC Drives and DC Drives), By End-Users (Oil and Gas, Water & Waste Water Treatment, Chemicals & Petrochemicals, Power Generation, Mining, Food & Beverages, and Others), By Applications (Fans, Pumps, Compressors, Conveyors and Extruders), By Voltage (Low voltage and Medium-voltage) and Competitive Landscape

| Product Code: ETC000407 | Publication Date: Aug 2023 | Updated Date: Apr 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 111 | No. of Figures: 36 | No. of Tables: 9 | |

India Electric Drives Market Shipment Analysis

India Electric Drives Market registered a growth of 2.75% in value shipments in 2022 as compared to 2021 and an increase of 5.05% CAGR in 2022 over a period of 2017. In Electric Drives Market India is becoming less competitive as HHI index in 2022 was 3692 while in 2017 it was 3310. Herfindahl Index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means less numbers of players or countries exporting in the market. India has reportedly relied more on domestic production to meet its growing demand in Electric Drives Market.

India Electric Drives Market Competition 2023

India Export Potential Assessment For Electric Drives Market (Values in Thousand)

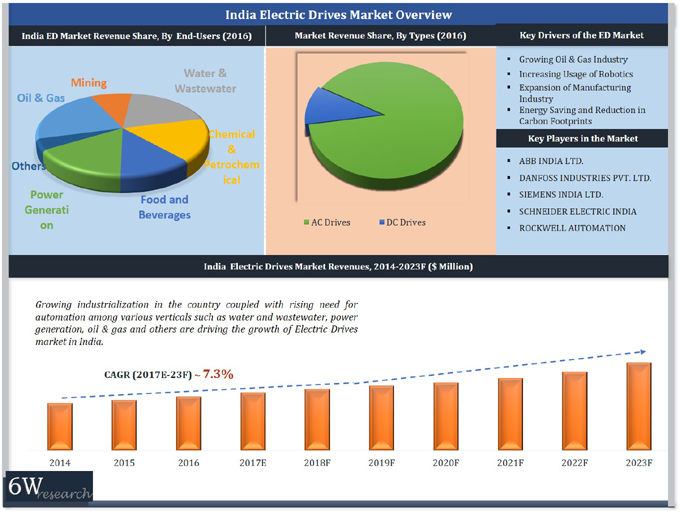

Increasing industrialization as well as the rising need for energy efficiency and industrial automation are driving the growth of the electric drives market in India. Different industry verticals including oil & gas, food & beverages, mining, cement, paper & pulp, and others are readily deploying electric drives to reduce carbon emission and energy conservation.

According to 6Wresearch, India electric drives market size is projected to grow at a CAGR of over 7% during 2017-23. AC drives captured the majority of the India electric drives market share in 2016 and would dominate the market over the coming years. Among various applications, fans and pumps were the major contributors to the overall market share. The energy-saving capacity and replacement ability of AC drives are the prime growth drivers for the AC segment. Additionally, advanced functionality, system reliability, and cost-effectiveness of AC drives are a few other contributors catalyzing its market growth. DC drives are expected to witness a continuous decline in India electric drives market forecast revenues over the coming years.

Among various end-users, oil & gas, water & wastewater treatment, power generation industries majorly installed electric drives to achieve operational efficiency and reduce their carbon footprints. During 2017-23, water and wastewater treatment is likely to exhibit the highest growth owing to increasing investments in the industry.

The India electric drives market report thoroughly covers the electric drives market by applications, end-users, voltage levels, and types of drives. The India electric drives market outlook report provides an unbiased and detailed analysis of the India electric drives market trends, opportunities/ high growth areas, market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

India electric drives market is anticipated to find its true potential underpinned by the rising growth of the product application across multiple sectors like agriculture, and oil & gas. Additionally, on the basis of the product type, Pumps are estimated to accelerate the high sales revenues owing to the rising growth of the industrial landscape in the country at the fastest pace, as a result, is widen the pumps use in the construction sector with the ongoing projects like Navi Mumbai International Airport and Megha business district for Mumbai have boosted the deployment of submersible pumps to pump out the excess water on construction site Simultaneously is estimated to instigate the growth of the electric drives market in the coming timeframe.

Key Highlights of the Report

• India Electric Drives Market Overview

• India Electric Drives Market Outlook

• Market Size & Forecast of Global Electric Drives Market until 2023

• India Electric Drives Market Size & India Electric Drives Market Forecast of revenues, until 2023

• Market Size & Forecast of India Electric Drives Market Revenues, By Types, until 2023

• Market Size & Forecast of India Electric Drives Market Revenues, By End Users, until 2023

• Market Size & Forecast of India Electric Drives Market Revenues, By Applications until 2023

• Market Size & Forecast of India Electric Drives Market Revenues, By Voltage, until 2023

• Market Drivers and Restraints

• Industry Life Cycle

• Value Chain Analysis

• Porter's Five Forces Analysis

• India Electric Drives Market Trends and Opportunities

• India Electric Drives Market Overview on Competitive Benchmarking

• India Electric Drives Market Share, by Players

• Company Profiles

• Key Strategic Pointers

Markets Covered

The India electric drives market report provides a detailed analysis of the following market segments:

• By Types

o AC Drives

o DC Drives

• By End-Users

o Oil and Gas

o Water and Waste Water Treatment

o Chemicals and Petrochemicals

o Power Generation

o Mining

o Food and Beverages

o Others

• By Applications

o Fans

o Pumps

o Compressors

o Conveyors

o Extruders

• By Voltage

o Low Voltage

o Medium Voltage

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Assumptions & Methodology

3 Global Electric Drives Market Overview

3.1 Global Electric Drives Market Revenues (2014-2023F)

3.2 Global Electric Drives Market Revenue Share, By Regions

4 India Electric Drives Market Overview

4.1 India Electric Drives Market Revenues (2014-2023F)

4.2 India Electric Drives Industry Life Cycle

4.3 India Electric Drives Market Opportunistic Matrix

4.4 India Electric Drives Market Value Chain Analysis

4.5 India Electric Drives Market Porter's Five Forces Model

4.6 India Electric Drives Market Revenue Share, By Types (2017 & 2023F)

4.7 India Electric Drives Market Revenue Share, By End Users (2017 & 2023F)

4.8 India Electric Drives Market Revenue Share, By Applications (2017 & 2023F)

4.9 India Electric Drives Market Revenue Share, By Voltage (2017 & 2023F)

5 Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.4 Market Restraints

5.4 Market Opportunity

6 India Electric Drives Market Trends

6.1 Internet of Things

6.2 Electric Vehicle Applications

6.3 Energy Efficient Drives

7 India Electric Drives Market Overview, By Types

7.1 India Electric Drives Market, By AC Drives (2014-2023F)

7.2 India Electric Drives Market, By DC Drives (2014-2023F)

8 India Electric Drives Market Overview, By End-Users

8.1 India Electric Drives Market, By oil & gas (2014-2023F)

8.2 India Electric Drives Market, By Water and Waste Water Treatment (2014-2023F)

8.3 India Electric Drives Market, By Chemicals and Petrochemicals (2014-2023F)

8.4 India Electric Drives Market, By Food and Beverages Industry (2014-2023F)

8.5 India Electric Drives Market, By Power Generation (2014-2023F)

8.6 India Electric Drives Market, By Mining (2014-2023F)

8.7 India Electric Drives Market, By Others (2014-2023F)

9 India Electric Drives Market Overview, By Applications

9.1 India Electric Drives Market, By Fans (2014-2023F)

9.2 India Electric Drives Market, By Pumps (2014-2023F)

9.3 India Electric Drives Market, By Compressors (2014-2023F)

9.4 India Electric Drives Market, By Extruders (2014-2023F)

9.5 India Electric Drives Market, By Conveyors (2014-2023F)

10 India Electric Drives Market Overview, By Voltage

10.1 India Electric Drives Market, By Low voltage (2014-2023F)

10.2 India Electric Drives Market, By Medium voltage (2014-2023F)

11 Competitive Landscape

11.1 India Electric Drives Market Players Revenue Share (2016)

11.2 Competitive Benchmarking, By Operating Parameters

12 Company Profiles

12.1 ABB India Ltd.

12.2 Danfoss Industries Pvt. Ltd.

12.3 Siemens India Ltd.

12.4 Schneider Electric India Pvt. Ltd.

12.5 Rockwell Automation India Pvt. Ltd.

12.6 Mitsubishi Eelctric India Pvt. Ltd.

12.7 Yaskawa India Pvt. Ltd.

12.8 Fuji Electric India Pvt. Ltd.

12.9 Hitachi India Pvt. Ltd.

12.10 Larsen & Toubro Ltd.

13 Recommendations

14 Disclaimer

List of Figures

1 Global Electric Drives Market Revenues, 2014-2023F ($ Billion)

2 Global Electric Drives Revenue Share, By Regions (2016)

3 India Electric Drives Market Revenues, 2014-2023F ($ Million)

4 India Electric Drives Industry Life Cycle (2016)

5 Value Chain Analysis of India Electric Drives Market

6 India Electric Drives Market Revenue Share, By Types (2016)

7 India Electric Drives Market Revenue Share, By Types (2023F)

8 India Electric Drives Market Revenue Share, By End Users (2016)

9 India Electric Drives Market Revenue Share, By End Users (2023F)

10 India Electric Drives Market Revenue Share, By Applications (2016)

11 India Electric Drives Market Revenue Share, By Applications (2023F)

12 India Electric Drives Market Revenue Share, By Voltage (2016)

13 India Electric Drives Market Revenue Share, By Voltage (2023F)

14 India Industrial Internet of Things Market Revenues, 2014-2022F ($ Billion)

15 India Internet of Things Industrial IoT Market Revenues, 2014-2022F ($ Billion)

16 India Electric Vehicles Market Volume, 2014-2023F (Thousands Units)

17 India Electric Drives Market Revenues, By AC Drives, 2014-2023F ($ Million)

18 India Electric Drives Market Revenues, By DC Drives, 2014-2023F ($ Million)

19 India Electric Drives Market Revenues, By Oil & Gas Industry, 2014-2023F ($ Million)

20 India Electric Drives Market Revenues, By Water & Wastewater Treatment, 2014-2023F ($ Million)

21 India Electric Drives Market Revenues, By Chemical and Petrochemical, 2014-2023F ($ Million)

22 Export Share of Chemicals in India (2016)

23 India Chemical Industry, 2013-2025 ($ Billion)

24 India Electric Drives Market Revenues, By Food and Beverages, 2014-2023F ($ Million)

25 India Electric Drives Market Revenues, By Power Generation, 2014-2023F ($ Million)

26 Installed Capacity of Different Sources of Power in India (2017E)

27 India Electric Drives Market Revenues, By Mining, 2014-2023F ($ Million)

28 India Electric Drives Market Revenues, By Others, 2014-2023F ($ Million)

29 India Electric Drives Market Revenues, By Fans, 2014-2023F ($ Million)

30 India Electric Drives Market Revenues, By Pumps, 2014-2023F ($ Million)

31 India Electric Drives Market Revenues, By Compressors, 2014-2023F ($ Million)

32 India Electric Drives Market Revenues, By Extruders, 2014-2023F ($ Million)

33 India Electric Drives Market Revenues, By Conveyors, 2014-2023F ($ Million)

34 India Electric Drives Market Revenues, By Low Voltage, 2014-2023F ($ Million)

35 India Electric Drives Market Revenues, By Medium Voltage, 2014-2023F ($ Million)

36 India Electric Vehicle Powertrain Systems Market Revenue Share, By Players (2016)

List of Tables

1 India Electrical Equipment Industry Segments

2 Estimated Yearly Shipments Of Multipurpose Industrial Robots In Different Regions

3 Key Ongoing Oil & Gas Projects in India ($ Billion)

4 IIoT Solution Providers in India

5 India Food Processing Sector, 2016, Production in Million Tonnes (MT)

6 Major Players in Power Sector, India

7 Typical AC Drive Pump Applications

8 Power Capacity of Electric Drives

9 India Electric Vehicle Powertrain Systems Market Revenues, By Players (2016)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Conductors Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Australia Fire Doors Market (2023-2029) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- UAE Online Gifting Market (2023-2029) | Size, industry, Revenue, Growth, Size, Share, Value, Outlook & COVID-19 IMPACT

- India Baby Product Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- India Multiprotocol Label Switching-Transport Profile Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- India Plant Protein Market (2023-2029) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- India Switches Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Indonesia System Integrator Market (2024-2030) | Companies, Analysis, Industry, Growth, Forecast, Size, Value, Share, Revenue & Trends

- India LV Switchgear Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Hungary Air Conditioner Market (2024-2030) | Size, Trends, Industry, Forecast, Share, Growth, Value, Revenue, Analysis, Outlook & COVID-19 IMPACT

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines