India Ethylene Glycol Market (2026-2032) | Analysis, Size, Revenue, Growth, industry, Forecast, Trends, Value, Outlook

Market Forecast By Product Types (Monoethylene Glycol, Diethylene Glycol, Triethylene Glycol), By Applications (Automotive Industry, Textile Industry, Paint Industry, PET Industry) And Competitive Landscape

| Product Code: ETC001743 | Publication Date: Mar 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

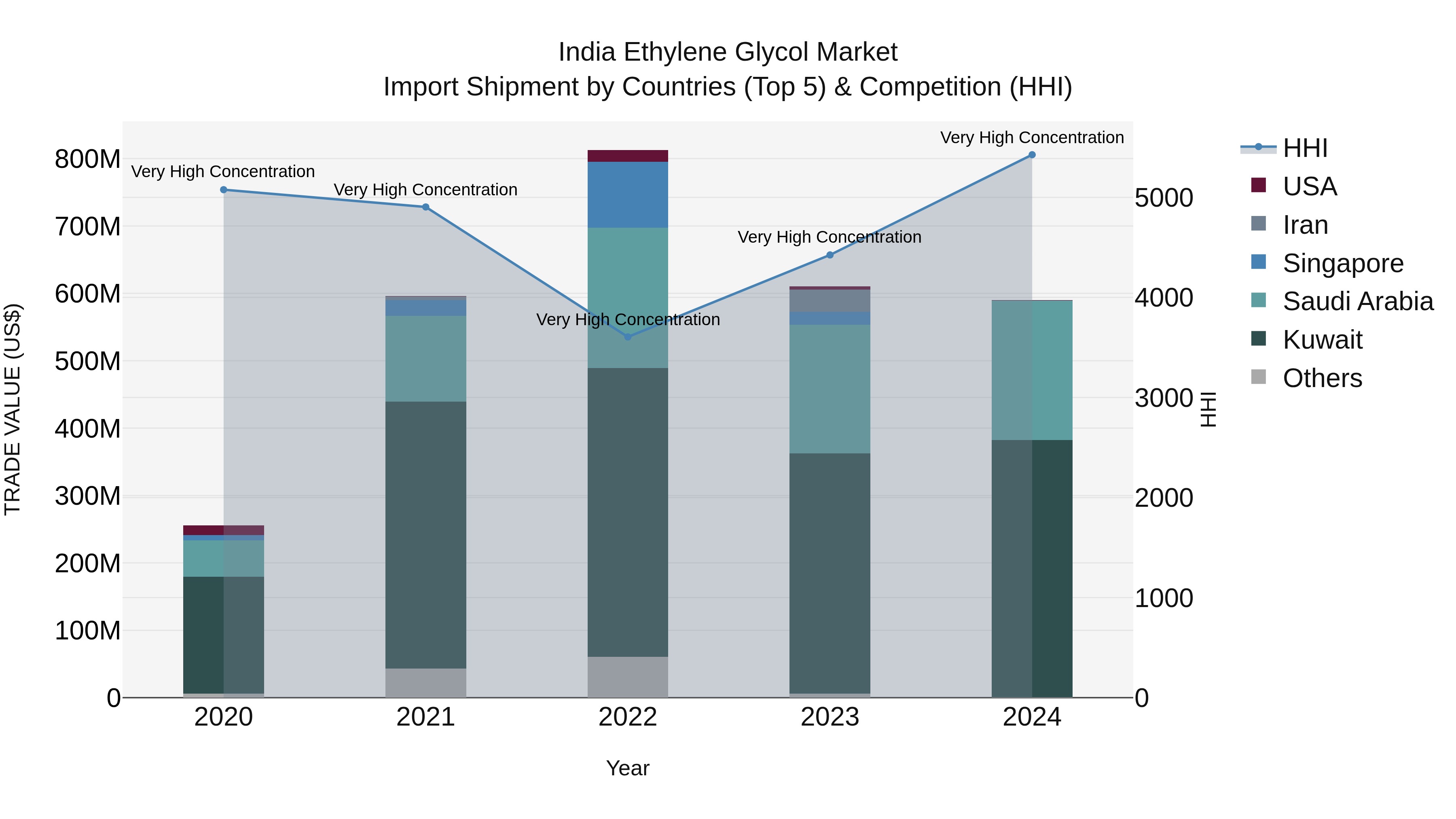

India Ethylene Glycol Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s ethylene glycol import market in 2024 saw significant contributions from top exporters Kuwait, Saudi Arabia, UAE, China, and India, indicating a diverse supply chain. Despite a slight decline in growth rate from 2023 to 2024, the compound annual growth rate (CAGR) for the period 2020-2024 remained impressive at 23.22%. The high Herfindahl-Hirschman Index (HHI) suggests a concentrated market, highlighting the dominance of key players. Monitoring these trends can provide valuable insights for stakeholders navigating the dynamic ethylene glycol import landscape in India.

India Ethylene Glycol Market Highlights

| Report Name | India Ethylene Glycol Market |

| Forecast period | 2026-2032 |

| CAGR | 4.5% |

| Growing Sector | Textile industry |

India Ethylene Glycol Market Synopsis

India ethylene glycol market witnessed a boom in recent years on account of growing demand from the industrial sector, the country has emerged as the second main consumption hub with its built-up second-largest downstream polyester capacities. Owing to varied applications across industries such as the automobile industry, textile industry, and paint industry the demand for mono ethylene glycol (MEG) has fuelled at a faster rate as compared to the overall market. The increase in the demand for decomposable MEG and the fluctuating price of crude oil could dampen the growth prospects of the ethylene glycol market in India.

According to 6Wresearch internal database and industry insights, the India Ethylene Glycol Market is expected to grow at a CAGR of 4.5% during the forecast period (2026-2032). Polyethene glycol helps in increasing the shelf life as well as stability of dental products, owing to which the demand for polyethene glycol is expected to increase in the medical and healthcare sector over the forecast period. Additionally, the Government of India has come up with initiatives to lift anti-dumping duty on polyester, which would support MSME industries to produce more domestically and in turn would further create abundant opportunities for the ethylene glycol market in India.

By Application, Polyethylene Terephthalate, or PET, is the largest consumer of MEG, accounting for a significant share in the domestic market. The textile and pesticide industries are other major consumers of MEG in the country and they are expected to witness strong growth in the coming years. Further, MEG is also used in applications that require chemical intermediates for resins, solvent couplers, freezing point depressors, solvents, humectants, and chemical intermediates.

The India ethylene glycol market report thoroughly covers the market by product types, and applications. India ethylene glycol market outlook report provides an unbiased and detailed analysis of the ongoing India ethylene glycol market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India ethylene glycol market is expected to witness potential growth in the upcoming six years on the back of the rising textile industry across the country. Further, increased manufacturing for polyester fiber with respect to the rising demand for home essential products such as carpets and pillows and leather dye facilities across the globe has led to the enhancement of government efforts in rising export trade process intended to encourage foreign direct investment which is leading to the massive expansion of the textile sector and is expected to be a potential driver for the extensive growth of India ethylene glycol market in the coming years.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2022 to 2025.

- Base Year: 2025

- Forecast Data until 2032.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Ethylene Glycol Market Overview

- India Ethylene Glycol Market Outlook

- India Ethylene Glycol Market Forecast

- Historical Data of India Ethylene Glycol Market Revenues and Volume for the Period 2022-2032

- India Ethylene Glycol Market Size & Ethylene Glycol Market Forecast of Revenues and Volume, Until 2022-2032

- Historical Data of India Ethylene Glycol Market Revenues and Volume, By Product Types, for the Period 2022-2032

- Market Size & Forecast of India Ethylene Glycol Market Revenues Volume, By Product Types, Until 2022-2032

- Historical Data of India Ethylene Glycol Market Revenues and Volume, By Applications, for the Period 2022-2032

- Market Size & Forecast of India Ethylene Glycol Market Revenues and Volume, By Applications, Until 2022-2032

- Market Drivers and Restraints

- India Ethylene Glycol Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis and Market Opportunity Assessment

- India Ethylene Glycol Market Share, By Players

- India Ethylene Glycol Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The India Ethylene Glycol Market report provides a detailed analysis of the following market segments:

By Product Types

- Monoethylene Glycol

- Diethylene Glycol

- Triethylene glycol

By Applications

- Automotive Industry

- Textile Industry

- Paint Industry

- PET Industry

- Others (Paper & Pulp, Food & Beverages, Optic Fibres, etc.)

India Ethylene Glycol Market (2026-2032): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Ethylene Glycol Market Overview |

| 3.1. India Ethylene Glycol Market Revenues and Volume, 2022-2032F |

| 3.2. India Ethylene Glycol Market Revenue and Volume Share, By Product Types, 2022 & 2032F |

| 3.3. India Ethylene Glycol Market Revenue and Volume Share, By Applications, 2022 & 2032F |

| 3.4. India Ethylene Glycol Market - Industry Life Cycle |

| 3.5. India Ethylene Glycol Market - Porter’s Five Forces |

| 4. India Ethylene Glycol Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Growing demand from end-use industries such as textiles, automotive, and packaging |

| 4.2.2 Increasing population and urbanization leading to higher consumption of consumer goods |

| 4.2.3 Government initiatives to promote domestic manufacturing and boost industrial production |

| 4.3. Market Restraints |

| 4.3.1 Volatility in raw material prices affecting the production cost of ethylene glycol |

| 4.3.2 Environmental concerns and regulations regarding the use and disposal of ethylene glycol |

| 4.3.3 Competition from alternative products such as bio-based glycols impacting market growth |

| 5. India Ethylene Glycol Market Trends |

| 6. India Ethylene Glycol Market Overview, By Product Types |

| 6.1. India Monoethylene Glycol Market Revenues and Volume, 2022-2032F |

| 6.2. India Diethylene Glycol Market Revenues and Volume, 2022-2032F |

| 6.3. India Triethylene Glycol Market Revenues and Volume, 2022-2032F |

| 7. India Ethylene Glycol Market Overview, By Applications |

| 7.1. India Ethylene Glycol Market Revenues and Volume, By Automobile Industry, 2022-2032F |

| 7.2. India Ethylene Glycol Market Revenues and Volume, By Textile Industry, 2022-2032F |

| 7.3. India Ethylene Glycol Market Revenues and Volume, By Paint Industry, 2022-2032F |

| 7.4. India Ethylene Glycol Market Revenues and Volume, By PET Industry, 2022-2032F |

| 7.5. India Ethylene Glycol Market Revenues and Volume, By Others, 2022-2032F |

| 8. India Ethylene Glycol Market Key Performance Indicators |

| 9. India Ethylene Glycol Market Opportunity Assessment |

| 9.1. India Ethylene Glycol Market Opportunity Assessment, By Product Types, 2022-2032F |

| 9.2. India Ethylene Glycol Market Opportunity Assessment, By Applications, 2022-2032F |

| 10. India Ethylene Glycol Market Competitive Landscape |

| 10.1. India Ethylene Glycol Market Competitive Benchmarking, By Operating & Technical Parameters |

| 10.2. India Ethylene Glycol Market Revenue Share, By Companies, 2022-2032F |

| 11. Company Profiles |

| 11.1. Indian Oil Corporation Ltd |

| 11.2. Haldia Petrochemicals Ltd. |

| 11.3. Reliance Industries Ltd. |

| 11.4. GAIL ( India ) Ltd. |

| 11.5. DCW Ltd. |

| 11.6. HPCL |

| 11.7. ONGC Petro Additions Limited |

| 11.8. L.G. Polymers India Pvt Ltd. |

| 11.9. Supreme Petrochem Ltd. |

| 11.10. INEOS Styrolution India Ltd. |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero