India Liquefied Petroleum Gas Market (2025-2031) Outlook | Forecast, Trends, Value, Share, Revenue, Industry, Growth, Companies, Size & Analysis

| Product Code: ETC125333 | Publication Date: Aug 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

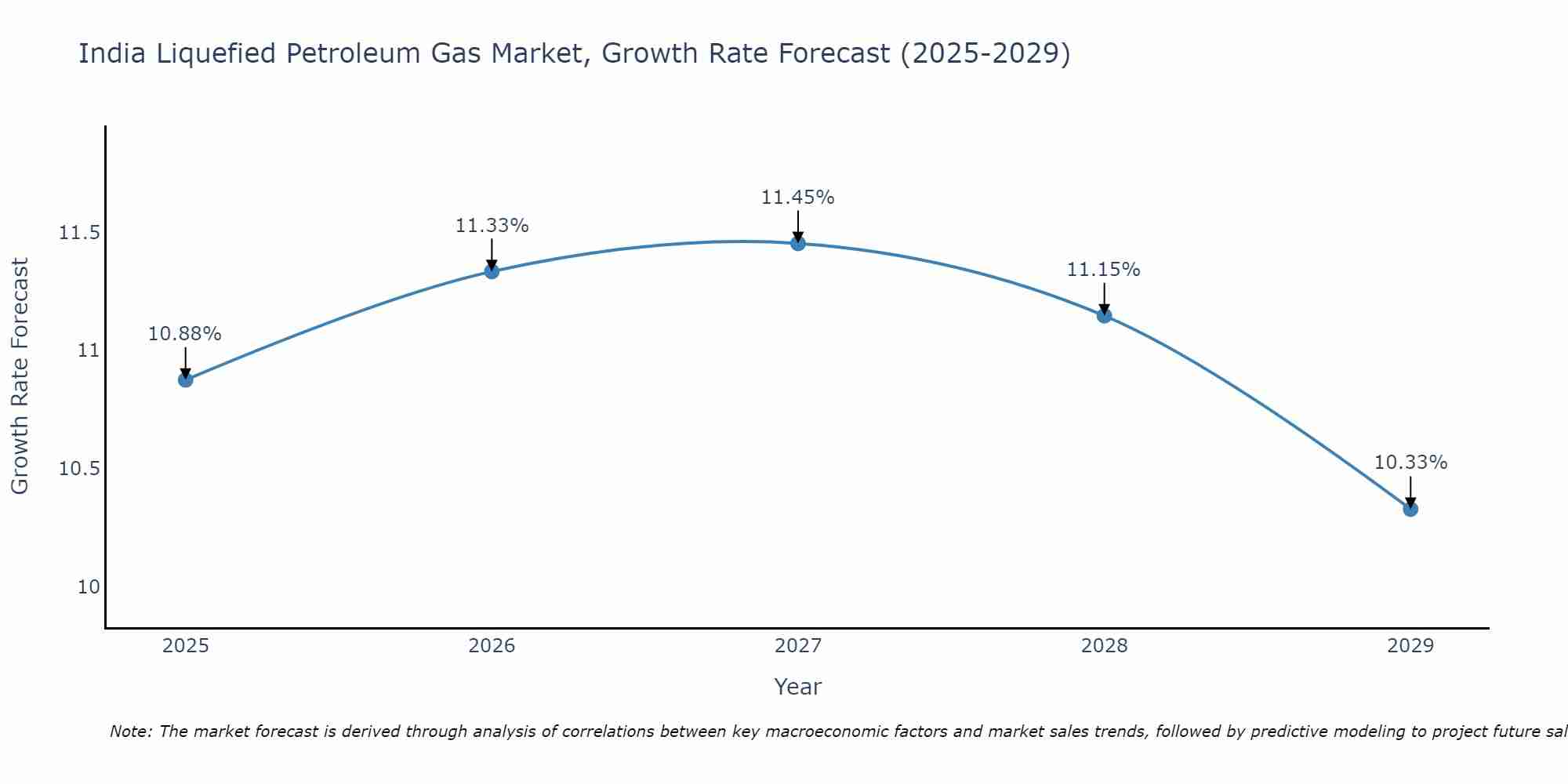

India Liquefied Petroleum Gas Market Size Growth Rate

The India Liquefied Petroleum Gas Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 11.45% in 2027, following an initial rate of 10.88%, before easing to 10.33% at the end of the period.

India Liquefied Petroleum Gas Market Synopsis

IndiaLiquefied Petroleum Gas (LPG) market is expected to grow at a steady pace.The increasing awareness about health and environmental impact of other conventional fuels such as firewood, kerosene and diesel has led to an increase in LPG consumption, which is driving growth for IndiaLPG gas market. In addition to this, government initiatives such as Ujjwala Yojana has further accelerated demand for cooking gas cylinders in rural areas of the country. Moreover, the rising population coupled with rapid urbanization and growing per capita income will propel the demand for clean energy sources such as LPG gas in India over the coming years. This will result in increased opportunities for domestic players involved in manufacturing or distributing LPG products across India.

Market Drivers

The major drivers that are contributing towards growth of India Liquefied Petroleum Gas (LPG) market include increasing awareness about health and environmental impact of other conventional fuels ilke firewood, kerosene and diesel; Government initiative like Ujjwala Yojana; Rising population coupled with rapid urbanization; Growing per capita income etc,. These factors are expected to drive demand for clean energy sources such as LPG gas over the next few years leading to higher revenue opportunities across India liquefied petroleum gas industry.

Challenges of the Market

The main challenges faced by players operating within India Liquefied Petroleum Gas (LGP)industry includes supply chain disruptions due lack of infrastructure support , fluctuating crude oil prices ; competition from alternate fuel sources etc., These issues may act as deterrents when it comes to expansion plans adopted by companies operating within this sector.

Key Players in the Market

Some of key players involved in manufacturing or distributioning LPF gases across India include IOCL-India Oil Corporation Limited , Bharat Petroleum Corporation Ltd(BPCL), Hindustan Petroleum Corporation Ltd(HPCL), GAIL -Gas Authority Of india Ltd , Essar Oil LTD , Shell india Pvt ltd., Reliance Industries limited etc

Key Highlights of the Report:

- India Liquefied Petroleum Gas Market Outlook

- Market Size of India Liquefied Petroleum Gas Market, 2024

- Forecast of India Liquefied Petroleum Gas Market, 2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Revenues & Volume for the Period 2021-2031

- India Liquefied Petroleum Gas Market Trend Evolution

- India Liquefied Petroleum Gas Market Drivers and Challenges

- India Liquefied Petroleum Gas Price Trends

- India Liquefied Petroleum Gas Porter's Five Forces

- India Liquefied Petroleum Gas Industry Life Cycle

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Source for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Refinery for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Associated Gas for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Non-associated Gas for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Residential/Commercial for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Chemical for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Industrial for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Autogas for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Refinery for the Period 2021-2031

- Historical Data and Forecast of India Liquefied Petroleum Gas Market Revenues & Volume By Others for the Period 2021-2031

- India Liquefied Petroleum Gas Import Export Trade Statistics

- Market Opportunity Assessment By Source

- Market Opportunity Assessment By Application

- India Liquefied Petroleum Gas Top Companies Market Share

- India Liquefied Petroleum Gas Competitive Benchmarking By Technical and Operational Parameters

- India Liquefied Petroleum Gas Company Profiles

- India Liquefied Petroleum Gas Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

India Liquefied Petroleum Gas |

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Liquefied Petroleum Gas Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Liquefied Petroleum Gas Market Revenues & Volume, 2021 & 2031F |

3.3 India Liquefied Petroleum Gas Market - Industry Life Cycle |

3.4 India Liquefied Petroleum Gas Market - Porter's Five Forces |

3.5 India Liquefied Petroleum Gas Market Revenues & Volume Share, By Source, 2021 & 2031F |

3.6 India Liquefied Petroleum Gas Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 India Liquefied Petroleum Gas Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 India Liquefied Petroleum Gas Market Trends |

6 India Liquefied Petroleum Gas Market, By Types |

6.1 India Liquefied Petroleum Gas Market, By Source |

6.1.1 Overview and Analysis |

6.1.2 India Liquefied Petroleum Gas Market Revenues & Volume, By Source, 2018 - 2031F |

6.1.3 India Liquefied Petroleum Gas Market Revenues & Volume, By Refinery, 2018 - 2031F |

6.1.4 India Liquefied Petroleum Gas Market Revenues & Volume, By Associated Gas, 2018 - 2031F |

6.1.5 India Liquefied Petroleum Gas Market Revenues & Volume, By Non-associated Gas, 2018 - 2031F |

6.2 India Liquefied Petroleum Gas Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 India Liquefied Petroleum Gas Market Revenues & Volume, By Residential/Commercial, 2018 - 2031F |

6.2.3 India Liquefied Petroleum Gas Market Revenues & Volume, By Chemical, 2018 - 2031F |

6.2.4 India Liquefied Petroleum Gas Market Revenues & Volume, By Industrial, 2018 - 2031F |

6.2.5 India Liquefied Petroleum Gas Market Revenues & Volume, By Autogas, 2018 - 2031F |

6.2.6 India Liquefied Petroleum Gas Market Revenues & Volume, By Refinery, 2018 - 2031F |

6.2.7 India Liquefied Petroleum Gas Market Revenues & Volume, By Others, 2018 - 2031F |

7 India Liquefied Petroleum Gas Market Import-Export Trade Statistics |

7.1 India Liquefied Petroleum Gas Market Export to Major Countries |

7.2 India Liquefied Petroleum Gas Market Imports from Major Countries |

8 India Liquefied Petroleum Gas Market Key Performance Indicators |

9 India Liquefied Petroleum Gas Market - Opportunity Assessment |

9.1 India Liquefied Petroleum Gas Market Opportunity Assessment, By Source, 2021 & 2031F |

9.2 India Liquefied Petroleum Gas Market Opportunity Assessment, By Application, 2021 & 2031F |

10 India Liquefied Petroleum Gas Market - Competitive Landscape |

10.1 India Liquefied Petroleum Gas Market Revenue Share, By Companies, 2024 |

10.2 India Liquefied Petroleum Gas Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero