Indonesia Glycerine Market (2025-2031) Outlook | Forecast, Value, Industry, Share, Trends, Growth, Companies, Size, Revenue & Analysis

| Product Code: ETC326728 | Publication Date: Aug 2022 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

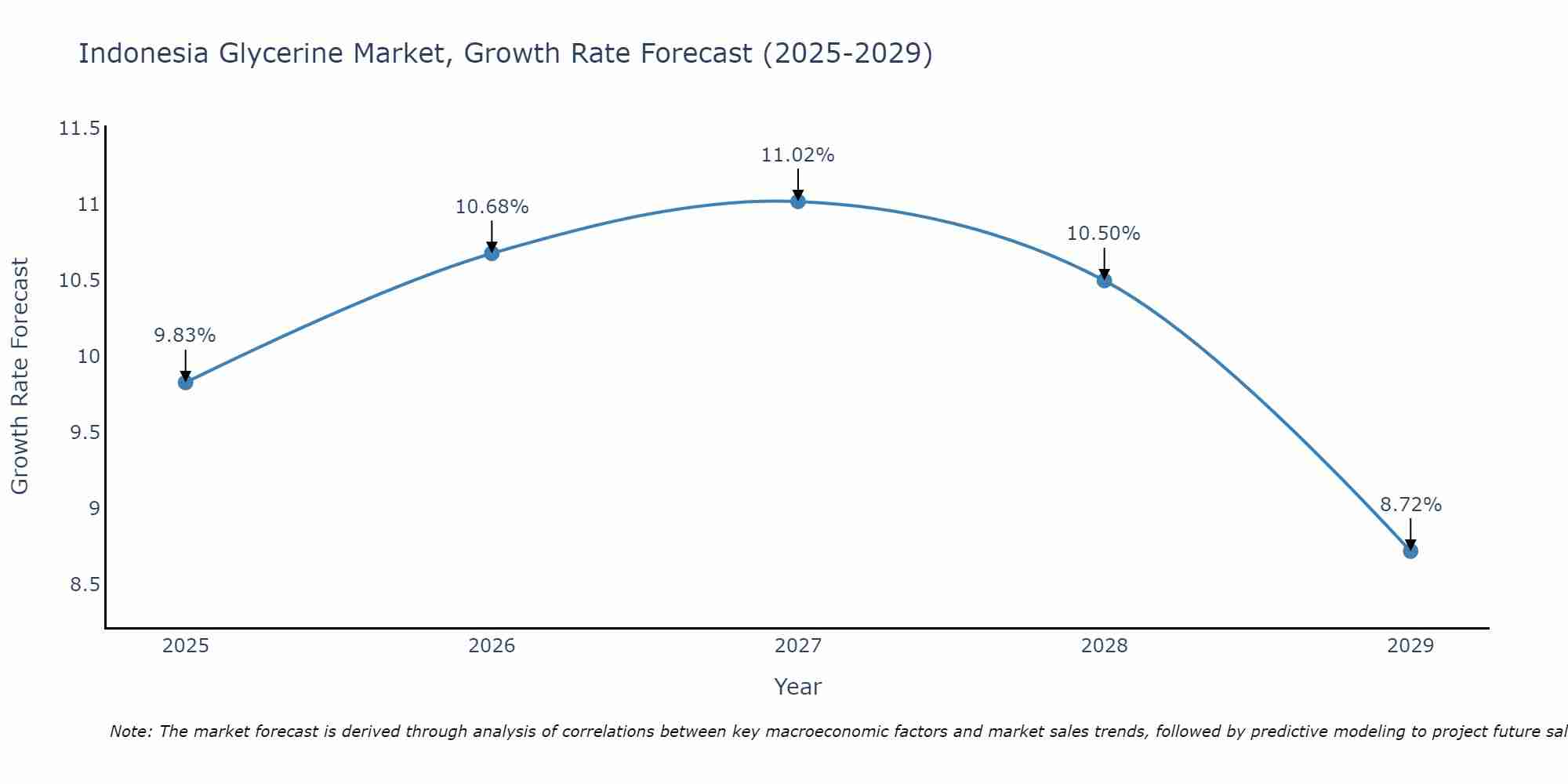

Indonesia Glycerine Market Size Growth Rate

The Indonesia Glycerine Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 9.83% in 2025, climbs to a high of 11.02% in 2027, and moderates to 8.72% by 2029.

Glycerine Market: Indonesia vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Glycerine market in Indonesia is anticipated to reach a growth rate of 11.02%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Indonesia Glycerine Market Synopsis

The glycerine market in Indonesia has witnessed steady growth over the past few years owing to its increased use as an ingredient in various industries including personal care products (soaps & shampoos), food items (confectionery), pharmaceuticals etc. As per latest estimates in 2018, glycerin production volume stood at around 11 thousand metric tons that year with an approximate value of US$26 million. Furthermore, it is projected that this sector will witness further increase with rising demands from numerous sectors over the coming years.

Drivers of the Market

The Indonesia Glycerine market is anticipated to expand due to its diverse applications in industries such as pharmaceuticals, personal care products, and food and beverages. Glycerine`s moisturizing properties drive its use in skincare and cosmetic products. Additionally, its role in the production of medicines, sweeteners, and humectants contributes to sustained market demand.

Challenges of the Market

Challenges might encompass fluctuating feedstock prices, evolving applications beyond traditional sectors, maintaining product purity standards, and addressing environmental concerns related to production processes.

COVID-19 Impact on the Market

The advent of the COVID-19 pandemic had a substantial impact on various industries, including the glycerine market in Indonesia. The imposition of lockdowns, travel restrictions, and changing consumer behavior disrupted supply chains and led to shifts in demand patterns. The personal care sector, a significant consumer of glycerine for its moisturizing and emollient properties, experienced a period of uncertainty as consumer preferences leaned towards essential products. Similarly, the pharmaceutical industry`s demand for glycerine remained relatively stable due to its role in drug formulations.

Key Players in the Market

Key players may encompass glycerine manufacturers, oleochemical companies, and suppliers like Cargill, Wilmar International, and IOI Oleochemicals, who are involved in glycerine production and its various applications.

Key Highlights of the Report:

- Indonesia Glycerine Market Outlook

- Market Size of Indonesia Glycerine Market, 2024

- Forecast of Indonesia Glycerine Market, 2031

- Historical Data and Forecast of Indonesia Glycerine Revenues & Volume for the Period 2021-2031

- Indonesia Glycerine Market Trend Evolution

- Indonesia Glycerine Market Drivers and Challenges

- Indonesia Glycerine Price Trends

- Indonesia Glycerine Porter's Five Forces

- Indonesia Glycerine Industry Life Cycle

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Grade for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By USP Grade for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Technical Grade for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Personal Care for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Food & Beverages for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Pharmaceuticals for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Polyether Polyols for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Chemical Intermediate for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Tobacco for the Period 2021-2031

- Historical Data and Forecast of Indonesia Glycerine Market Revenues & Volume By Others for the Period 2021-2031

- Indonesia Glycerine Import Export Trade Statistics

- Market Opportunity Assessment By Grade

- Market Opportunity Assessment By Application

- Indonesia Glycerine Top Companies Market Share

- Indonesia Glycerine Competitive Benchmarking By Technical and Operational Parameters

- Indonesia Glycerine Company Profiles

- Indonesia Glycerine Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- France Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Portugal Occupational Health & Safety Services Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Netherlands Occupational Health and Safety Services Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Belgium and Luxembourg Facility Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Russia Women Intimate Apparel Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Africa Chocolate Market (2025-2031) | Size, Share, Trends, Growth, Revenue, Analysis, Forecast, industry & Outlook

- Global Hydroxychloroquine And Chloroquine Market (2025-2031) | Industry, Trends, Size, Outlook, Growth, Value, Companies, Revenue, Analysis, Share, Forecast

- Saudi Arabia Plant Maintenance Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero