Israel Metallized Film Market (2025-2031) | Companies, Share, Forecast, Analysis, Segmentation, Industry, Growth, Size, Revenue, Outlook, Value & Trends

| Product Code: ETC4651191 | Publication Date: Nov 2023 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Shubham Padhi | No. of Pages: 60 | No. of Figures: 30 | No. of Tables: 5 |

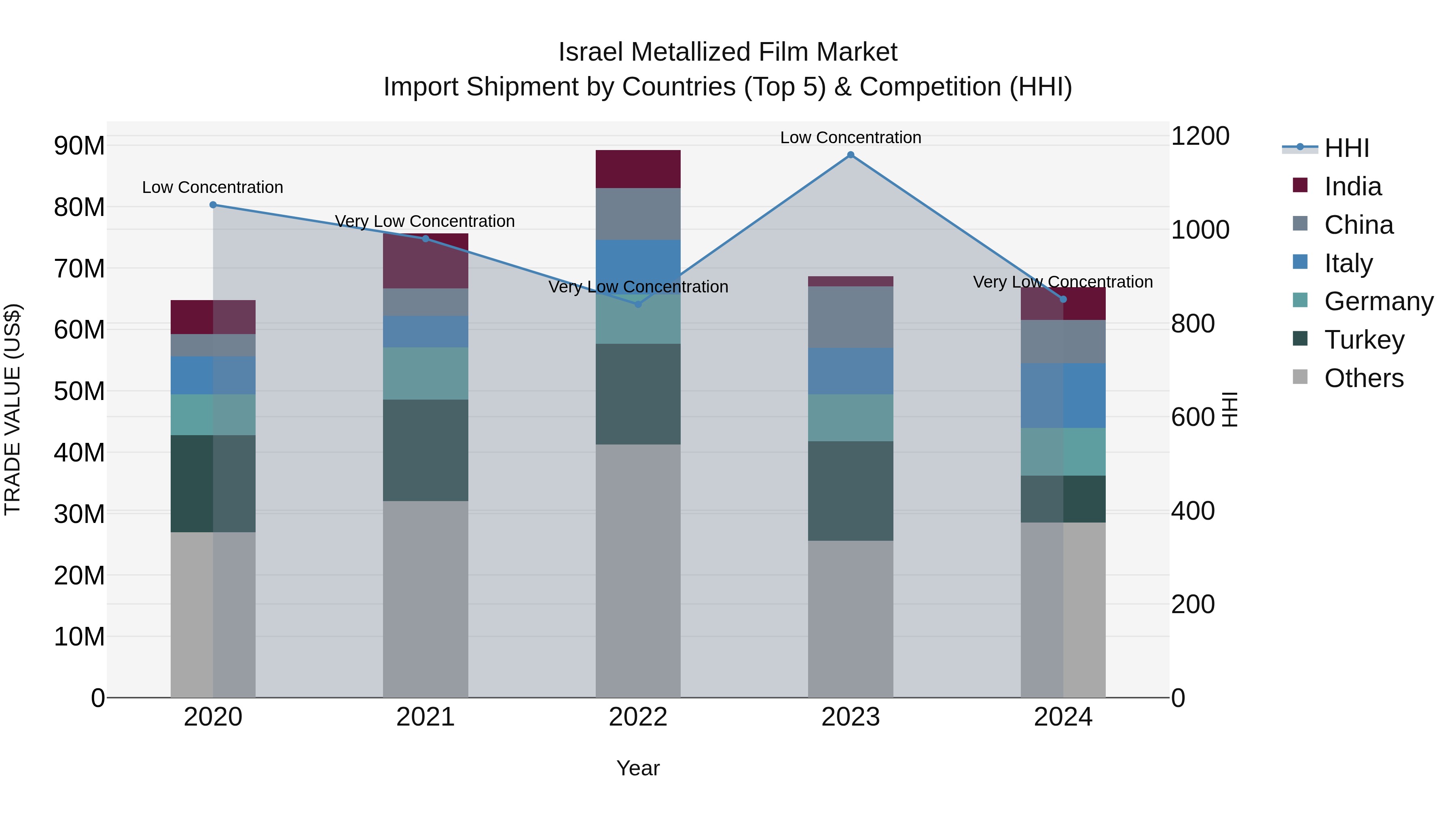

Israel Metallized Film Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, Israel`s metallized film import market continued to see a diverse range of suppliers, with Italy, Germany, Turkey, China, and India leading the pack. The market displayed very low concentration levels, indicating a competitive landscape. Despite a slight decline in growth rate from 2023 to 2024, the compound annual growth rate (CAGR) over the past four years remained positive at 0.81%. This suggests a steady but moderate expansion in the market, driven by a variety of international suppliers catering to Israel`s demand for metallized film products.

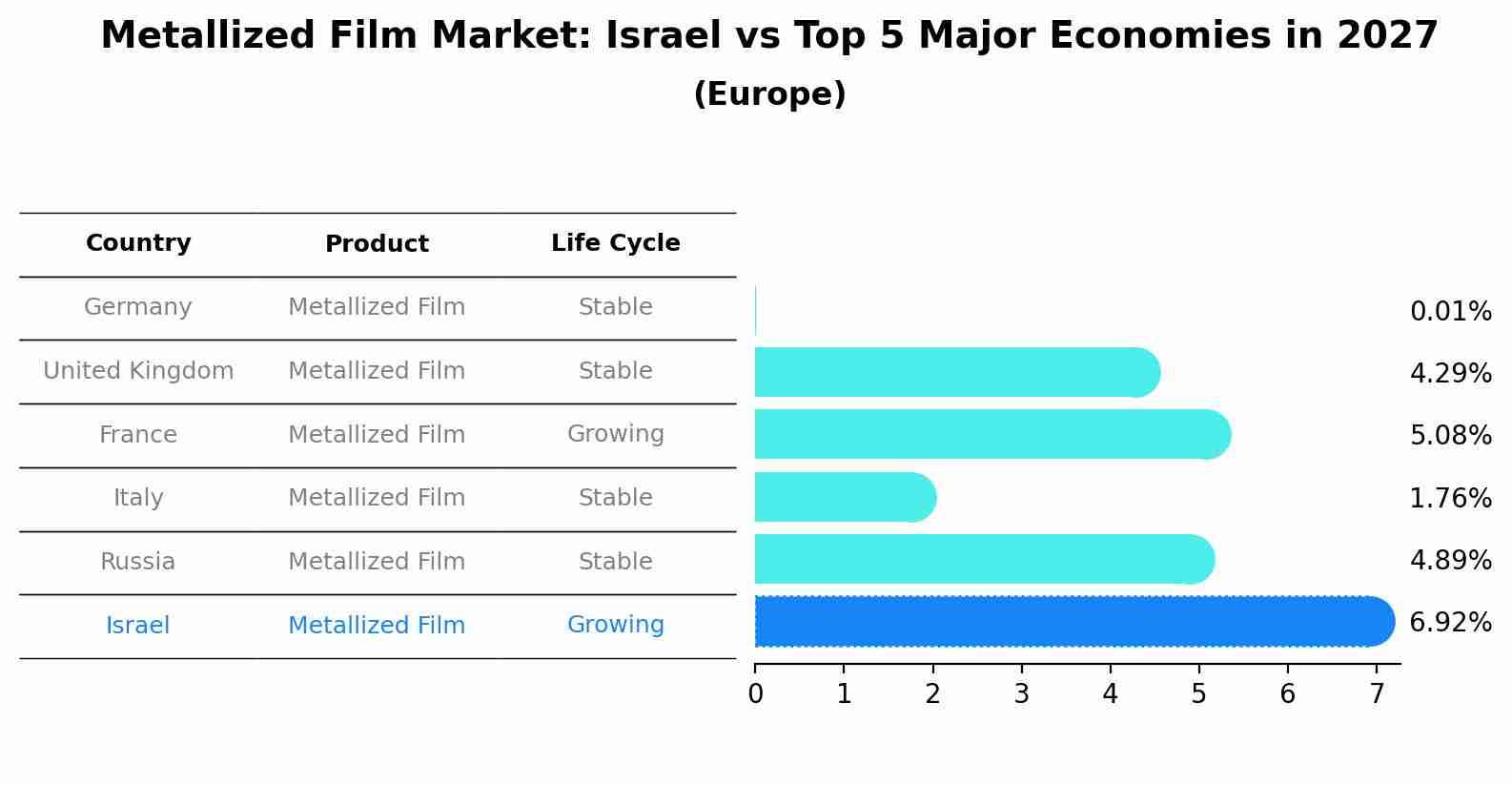

Metallized Film Market: Israel vs Top 5 Major Economies in 2027 (Europe)

By 2027, the Metallized Film market in Israel is anticipated to reach a growth rate of 6.92%, as part of an increasingly competitive Europe region, where Germany remains at the forefront, supported by United Kingdom, France, Italy and Russia, driving innovations and market adoption across sectors.

Israel Metallized Film Market Synopsis

The metallized film market in Israel includes manufacturers and converters of metallized plastic films coated with a thin layer of metal such as aluminum, used for packaging, labeling, and insulation applications. Metallized films offer barrier properties, heat resistance, and decorative effects, making them suitable for flexible packaging, food wrapping, and decorative laminates in diverse industries.

Drivers of the market

The Israel metallized film market is propelled by its applications in packaging, insulation, and decorative films industries. Metallized films, comprising a thin layer of metal deposited onto a polymer substrate, offer barrier properties, heat insulation, and decorative effects, making them versatile materials for various applications. In packaging, metallized films are used for flexible packaging, pouches, and labels to extend shelf life and preserve product freshness. Similarly, in insulation, metallized films provide thermal insulation and radiant barrier properties, improving energy efficiency in buildings and appliances. Moreover, advancements in metallization techniques and the development of new polymer-metal combinations drive innovation and market expansion in Israel.

Challenges of the market

The Israel Metallized Film market faces challenges attributed to material innovation, production scalability, and market competitiveness. Metallized films offer advantages such as barrier properties, heat resistance, and decorative effects, making them attractive for packaging, insulation, and labeling applications. However, challenges related to material purity, coating uniformity, and market differentiation pose hurdles to market expansion, requiring investments in R&D, process optimization, and market development to unlock the full potential of metallized films in diverse industries.

Government Policy of the market

In Israel, government policies concerning metallized films prioritize environmental sustainability and product safety. Regulatory frameworks govern the production, import, and use of metallized films, emphasizing compliance with quality standards and regulations related to packaging materials. The government also supports research and development initiatives aimed at improving the recyclability and biodegradability of metallized films, as well as reducing their environmental footprint throughout their lifecycle.

Key Highlights of the Report:

- Israel Metallized Film Market Outlook

- Market Size of Israel Metallized Film Market, 2024

- Forecast of Israel Metallized Film Market, 2031

- Historical Data and Forecast of Israel Metallized Film Revenues & Volume for the Period 2021-2031

- Israel Metallized Film Market Trend Evolution

- Israel Metallized Film Market Drivers and Challenges

- Israel Metallized Film Price Trends

- Israel Metallized Film Porter`s Five Forces

- Israel Metallized Film Industry Life Cycle

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Metal Types for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Aluminium for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Material Types for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Polypropylene (PP) for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Polyethylene Terephthalate (PET) for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By End-users for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Packaging for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Decorative for the Period 2021-2031

- Historical Data and Forecast of Israel Metallized Film Market Revenues & Volume By Others for the Period 2021-2031

- Israel Metallized Film Import Export Trade Statistics

- Market Opportunity Assessment By Metal Types

- Market Opportunity Assessment By Material Types

- Market Opportunity Assessment By End-users

- Israel Metallized Film Top Companies Market Share

- Israel Metallized Film Competitive Benchmarking By Technical and Operational Parameters

- Israel Metallized Film Company Profiles

- Israel Metallized Film Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Israel Metallized Film Market Overview |

3.1 Israel Country Macro Economic Indicators |

3.2 Israel Metallized Film Market Revenues & Volume, 2021 & 2031F |

3.3 Israel Metallized Film Market - Industry Life Cycle |

3.4 Israel Metallized Film Market - Porter's Five Forces |

3.5 Israel Metallized Film Market Revenues & Volume Share, By Metal Types, 2021 & 2031F |

3.6 Israel Metallized Film Market Revenues & Volume Share, By Material Types, 2021 & 2031F |

3.7 Israel Metallized Film Market Revenues & Volume Share, By End-users, 2021 & 2031F |

4 Israel Metallized Film Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Growing demand for sustainable packaging solutions due to environmental concerns |

4.2.2 Increasing use of metallized films in the food and beverage industry for packaging and labeling purposes |

4.2.3 Technological advancements leading to improved performance and cost-effectiveness of metallized films |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials impacting production costs |

4.3.2 Stringent regulations related to environmental impact and recycling of metallized films |

4.3.3 Competition from alternative packaging materials such as biodegradable films |

5 Israel Metallized Film Market Trends |

6 Israel Metallized Film Market Segmentations |

6.1 Israel Metallized Film Market, By Metal Types |

6.1.1 Overview and Analysis |

6.1.2 Israel Metallized Film Market Revenues & Volume, By Aluminium, 2021-2031F |

6.1.3 Israel Metallized Film Market Revenues & Volume, By Others, 2021-2031F |

6.2 Israel Metallized Film Market, By Material Types |

6.2.1 Overview and Analysis |

6.2.2 Israel Metallized Film Market Revenues & Volume, By Polypropylene (PP), 2021-2031F |

6.2.3 Israel Metallized Film Market Revenues & Volume, By Polyethylene Terephthalate (PET), 2021-2031F |

6.3 Israel Metallized Film Market, By End-users |

6.3.1 Overview and Analysis |

6.3.2 Israel Metallized Film Market Revenues & Volume, By Packaging, 2021-2031F |

6.3.3 Israel Metallized Film Market Revenues & Volume, By Decorative, 2021-2031F |

6.3.4 Israel Metallized Film Market Revenues & Volume, By Others, 2021-2031F |

7 Israel Metallized Film Market Import-Export Trade Statistics |

7.1 Israel Metallized Film Market Export to Major Countries |

7.2 Israel Metallized Film Market Imports from Major Countries |

8 Israel Metallized Film Market Key Performance Indicators |

8.1 Adoption rate of metallized films in new industries or applications |

8.2 Investment in research and development for enhancing the properties of metallized films |

8.3 Percentage of recycled metallized films in the market |

9 Israel Metallized Film Market - Opportunity Assessment |

9.1 Israel Metallized Film Market Opportunity Assessment, By Metal Types, 2021 & 2031F |

9.2 Israel Metallized Film Market Opportunity Assessment, By Material Types, 2021 & 2031F |

9.3 Israel Metallized Film Market Opportunity Assessment, By End-users, 2021 & 2031F |

10 Israel Metallized Film Market - Competitive Landscape |

10.1 Israel Metallized Film Market Revenue Share, By Companies, 2024 |

10.2 Israel Metallized Film Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations | 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero