Malaysia Motorcycle Market (2025-2029) | Forecast, Analysis, Growth, Industry, Companies, Share, Outlook, Size, Trends, Revenue & Value

Market Forecast By Type (Adventure, Cruiser, Mopeds, Sports, Standard, Touring), By Engine Capacity (151-300 CC, 301-500 CC, 501-800 CC, 801-1000 CC, 1001-1600 CC, Above 1600 CC) And Competitive Landscape

| Product Code: ETC040087 | Publication Date: Jun 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

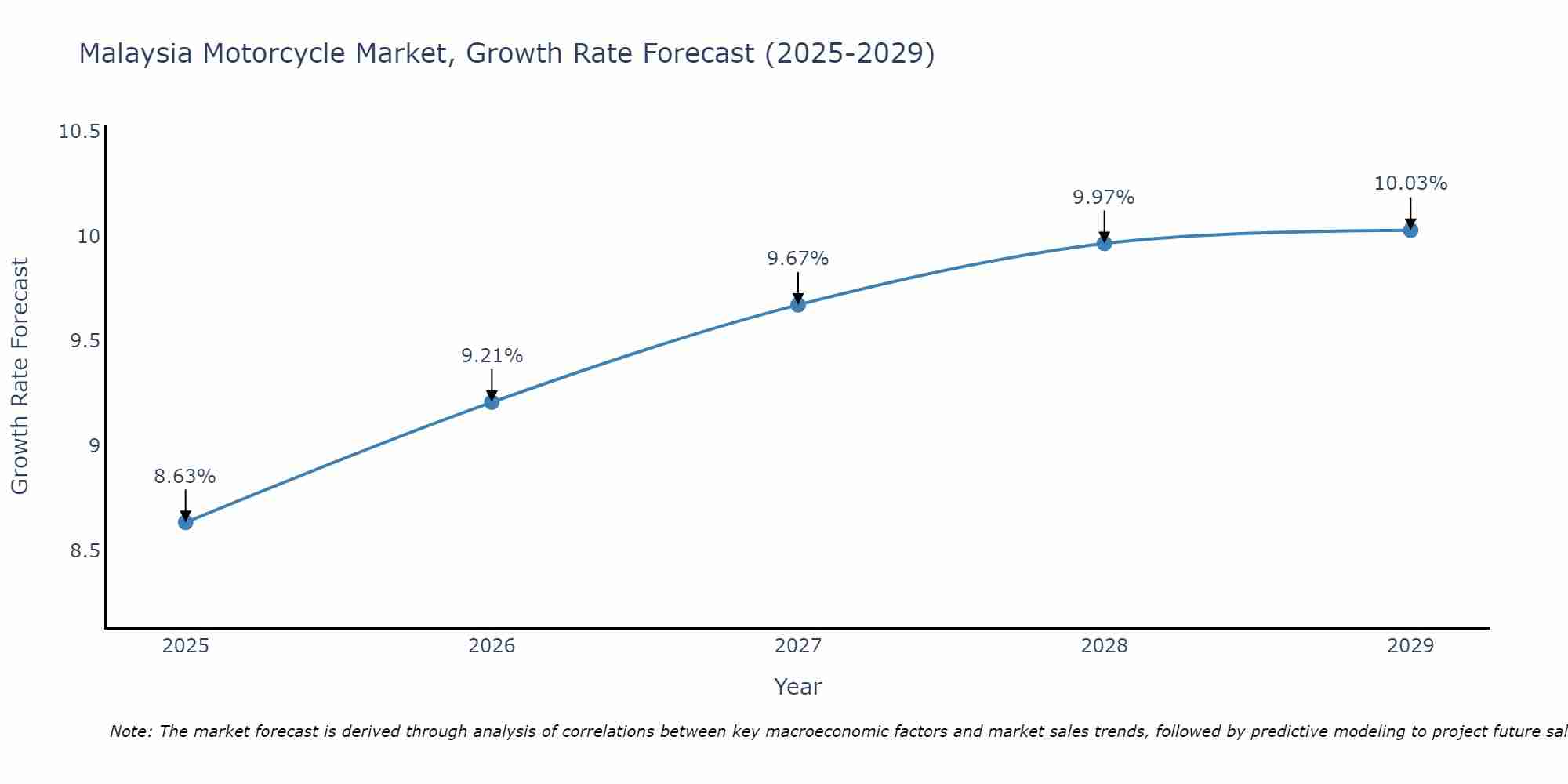

Malaysia Motorcycle Market Size Growth Rate

The Malaysia Motorcycle Market is poised for steady growth rate improvements from 2025 to 2029. The growth rate starts at 8.63% in 2025 and reaches 10.03% by 2029.

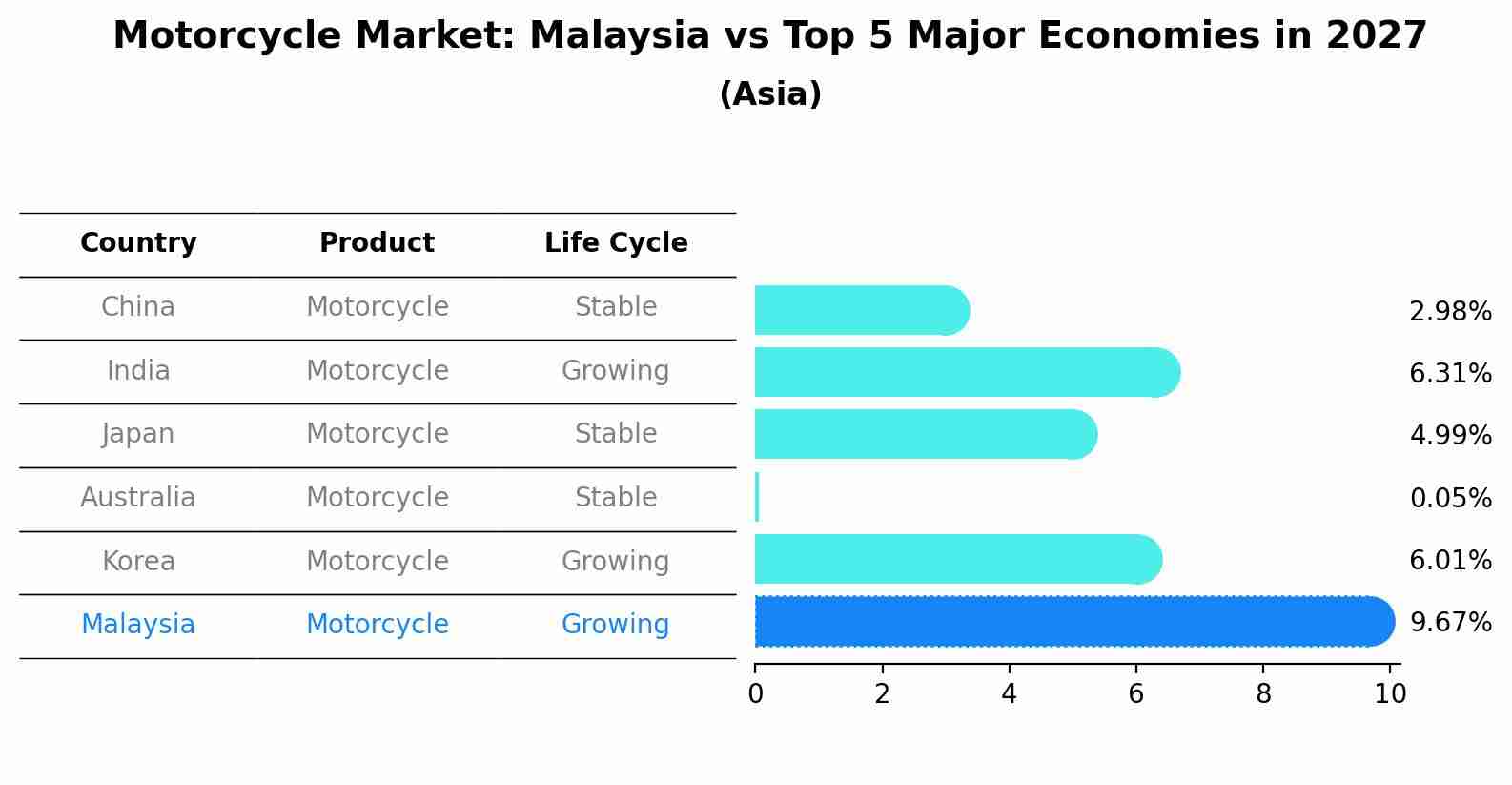

Motorcycle Market: Malaysia vs Top 5 Major Economies in 2027 (Asia)

Malaysia's Motorcycle market is anticipated to experience a growing growth rate of 9.67% by 2027, reflecting trends observed in the largest economy China, followed by India, Japan, Australia and South Korea.

Malaysia Motorcycle Market Highlights

| Report Name | Malaysia Motorcycle Market Highlights |

| Forecast Period | 2025-2029 |

| CAGR | 10.03% |

| Growing Sector | Automotive and Transportation |

Topics Covered in the Malaysia Motorcycle Market Report

The Malaysia Motorcycle Market report thoroughly covers the market by Type and by Engine Capacity. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

Malaysia Motorcycle Market Synopsis

Malaysia Motorcycle Market is witnessing significant growth, driven by rapid urbanization, higher disposable income, and the increasing need for affordable mobility solutions. As a key segment of Malaysia automotive sector, motorcycles serve both urban commuters and rural residents. Moreover, the rising preference for electric motorcycles reflects growing environmental awareness and alignment with national sustainability goals. This transition supports cleaner transportation methods and helps the country reduce its carbon footprint in line with global eco-friendly practices.

The Malaysia Motorcycle Market is anticipated to grow at a CAGR of 10.03% during the forecast period 2025-2029. The Malaysia Motorcycle Market is significantly influenced by the country's ongoing urbanization and increasing demand for low-cost transportation options. Motorcycles serve as an economical and agile solution for daily commuting in traffic-dense cities, attracting a large portion of the working population. Malaysia Motorcycle Market Growth is also being accelerated by supportive government policies favouring electric mobility. Furthermore, the appeal of modern designs and efficient performance among younger buyers, along with rural transportation demand, enhances the sector's expansion prospects.

Malaysia Motorcycle Market Challenges

Although the Malaysia Motorcycle Market holds strong growth prospects, it contends with several obstacles. The elevated cost of electric motorcycles and insufficient charging infrastructure are major barriers to green mobility adoption. Road safety remains a pressing concern due to the frequency of motorcycle accidents. The industry also Struggles with volatile input costs and supply chain inconsistencies, affecting production and pricing strategies. In addition, economic instability and evolving regulatory frameworks could further disrupt market momentum.

Malaysia Motorcycle Market Trends

The Malaysia Motorcycle Industry is experiencing notable changes due to rising interest in eco-friendly and fuel-efficient vehicles. Consumers are increasingly opting for electric motorcycles, influenced by environmental awareness. Technological features such as digital dashboards, advanced braking, and improved fuel performance contribute to rising consumer interest. Rising accessibility through easy financing options and the expansion of digital retail channels is broadening motorcycle ownership. These elements play a key role in accelerating market growth while supporting the country transition to eco-friendly and tech-enabled transportation options.

Investment Opportunities in the Malaysia Motorcycle Market

Investment prospects in the Malaysia Motorcycle Market are expanding due to infrastructural improvements like motorcycle lanes and parking spaces, which support the industry ecosystem. The flourishing tourism sector creates new revenue streams through rental services. Moreover, increasing interest in electric motorcycles spurred by environmental goals and fiscal incentives adds to the market appeal. These trends create a favourable environment for capital investment across product, service, and innovation-led domains within the market.

Leading Players in the Malaysia Motorcycle Market

The Malaysia Motorcycle Market is intensely competitive, dominated by major brands like Honda, Yamaha, SYM, and Kawasaki. These manufacturers frequently release updated models with advanced features. Meanwhile, local brands are steadily capturing market share by offering reliable, budget-friendly options that appeal to value-conscious consumers across both urban and rural regions.

Government Regulations in the Malaysia Motorcycle Market

Government policies and regulations play a critical role in shaping the Malaysia Motorcycle Market. Key initiatives include incentives for the adoption of electric vehicles, enforcement of strict emissions standards, and the implementation of mandatory safety protocols. These initiatives have a direct impact on prevailing market trends and shape how manufacturers develop their strategies. At the same time, authorities are actively supporting the growth of green technologies and related infrastructure to drive the adoption of cleaner transport options, reinforcing the motorcycle industry's role in national environmental policy.

Future Insights of the Malaysia Motorcycle Market

The future of the Malaysia Motorcycle Market appears promising, underpinned by rising demand, tech integration, and green transport initiatives. With electric and hybrid vehicles gaining traction due to policy support and eco-conscious consumers—the market is entering a new growth phase. Continued urbanization will reinforce motorcycles as a key transport mode. In response, manufacturers are expected to prioritize innovation, localization of production, and digital transformation strategies to meet emerging mobility demands and maintain their market share.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

Standard to Dominate the Market-By Type

According to Ritika Kalra, Senior Research Analyst, 6Wresearch, Standard motorcycles dominate the Vietnam Motorcycle Market due to their affordability, ease of handling, and suitability for daily commuting. These bikes appeal to a broad consumer base, including students, office-goers, and small business owners. Their balanced design and low maintenance make them ideal for Vietnam’s urban and semi-urban infrastructure.

151–300 CC to Dominate the Market-By Engine Capacity

Motorcycles with engine capacities between 151–300 CC hold the largest market share in Vietnam. This segment offers a strong balance between performance, fuel efficiency, and price, making it a popular choice among young riders and budget-conscious consumers. These bikes are well-suited for both city use and occasional long-distance travel.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Malaysia Motorcycle Market Outlook

- Market Size of Malaysia Motorcycle Market, 2024

- Forecast of Malaysia Motorcycle Market, 2029

- Historical Data and Forecast of Malaysia Motorcycle Revenues & Volume for the Period 2019-2029

- Malaysia Motorcycle Market Trend Evolution

- Malaysia Motorcycle Market Drivers and Challenges

- Malaysia Motorcycle Price Trends

- Malaysia Motorcycle Porter's Five Forces

- Malaysia Motorcycle Industry Life Cycle

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Type for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Adventure for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Cruiser for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Mopeds for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Sports for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Standard for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Touring for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Engine Capacity for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By 151-300 CC for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By 301-500 CC for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By 501-800 CC for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By 801-1000 CC for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By 1001-1600 CC for the Period 2019-2029

- Historical Data and Forecast of Malaysia Motorcycle Market Revenues & Volume By Above 1600 CC for the Period 2019-2029

- Malaysia Motorcycle Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Engine Capacity

- Malaysia Motorcycle Top Companies Market Share

- Malaysia Motorcycle Competitive Benchmarking By Technical and Operational Parameters

- Malaysia Motorcycle Company Profiles

- Malaysia Motorcycle Key Strategic Recommendations

Market Segmentation

The Market report covers a detailed analysis of the following market segments:

By Type

- Adventure

- Cruiser

- Mopeds

- Sports

- Standard

- Touring

By Engine Capacity

- 151–300 CC

- 301–500 CC

- 501–800 CC

- 801–1000 CC

- 1001–1600 CC

- Above 1600 CC

Malaysia Motorcycle Market (2025-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Malaysia Motorcycle Market Overview |

| 3.1 Malaysia Country Macro Economic Indicators |

| 3.2 Malaysia Motorcycle Market Revenues & Volume, 2019 & 2029F |

| 3.3 Malaysia Motorcycle Market - Industry Life Cycle |

| 3.4 Malaysia Motorcycle Market - Porter's Five Forces |

| 3.5 Malaysia Motorcycle Market Revenues & Volume Share, By Type, 2019 & 2029F |

| 3.6 Malaysia Motorcycle Market Revenues & Volume Share, By Engine Capacity, 2019 & 2029F |

| 4 Malaysia Motorcycle Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Malaysia Motorcycle Market Trends |

| 6 Malaysia Motorcycle Market, By Types |

| 6.1 Malaysia Motorcycle Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Malaysia Motorcycle Market Revenues & Volume, By Type, 2019 & 2029F |

| 6.1.3 Malaysia Motorcycle Market Revenues & Volume, By Adventure, 2019 - 2029F |

| 6.1.4 Malaysia Motorcycle Market Revenues & Volume, By Cruiser, 2019 - 2029F |

| 6.1.5 Malaysia Motorcycle Market Revenues & Volume, By Mopeds, 2019 - 2029F |

| 6.1.6 Malaysia Motorcycle Market Revenues & Volume, By Sports, 2019 - 2029F |

| 6.1.7 Malaysia Motorcycle Market Revenues & Volume, By Standard, 2019 - 2029F |

| 6.1.8 Malaysia Motorcycle Market Revenues & Volume, By Touring, 2019 - 2029F |

| 6.2 Malaysia Motorcycle Market, By Engine Capacity |

| 6.2.1 Overview and Analysis |

| 6.2.2 Malaysia Motorcycle Market Revenues & Volume, By 151-300 CC, 2019 - 2029F |

| 6.2.3 Malaysia Motorcycle Market Revenues & Volume, By 301-500 CC, 2019 - 2029F |

| 6.2.4 Malaysia Motorcycle Market Revenues & Volume, By 501-800 CC, 2019 - 2029F |

| 6.2.5 Malaysia Motorcycle Market Revenues & Volume, By 801-1000 CC, 2019 - 2029F |

| 6.2.6 Malaysia Motorcycle Market Revenues & Volume, By 1001-1600 CC, 2019 - 2029F |

| 6.2.7 Malaysia Motorcycle Market Revenues & Volume, By Above 1600 CC, 2019 - 2029F |

| 7 Malaysia Motorcycle Market Import-Export Trade Statistics |

| 7.1 Malaysia Motorcycle Market Export to Major Countries |

| 7.2 Malaysia Motorcycle Market Imports from Major Countries |

| 8 Malaysia Motorcycle Market Key Performance Indicators |

| 9 Malaysia Motorcycle Market - Opportunity Assessment |

| 9.1 Malaysia Motorcycle Market Opportunity Assessment, By Type, 2019 - 2029F |

| 9.2 Malaysia Motorcycle Market Opportunity Assessment, By Engine Capacity, 2019 - 2029F |

| 10 Malaysia Motorcycle Market - Competitive Landscape |

| 10.1 Malaysia Motorcycle Market Revenue Share, By Companies, 2024 |

| 10.2 Malaysia Motorcycle Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero