Netherlands Electric Vehicle Market (2025-2031) | Value, Share, Analysis, Industry, Companies, Trends, Size, Growth, Outlook, Revenue & Forecast

Market Forecast By Propulsion (BEV, PHEV, FCEV), By Vehicle Drive Type (FWD, RWD, AWD), By Vehicle Top Speed (<125 Mph, >125 Mph) And Competitive Landscape

| Product Code: ETC001630 | Publication Date: Dec 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

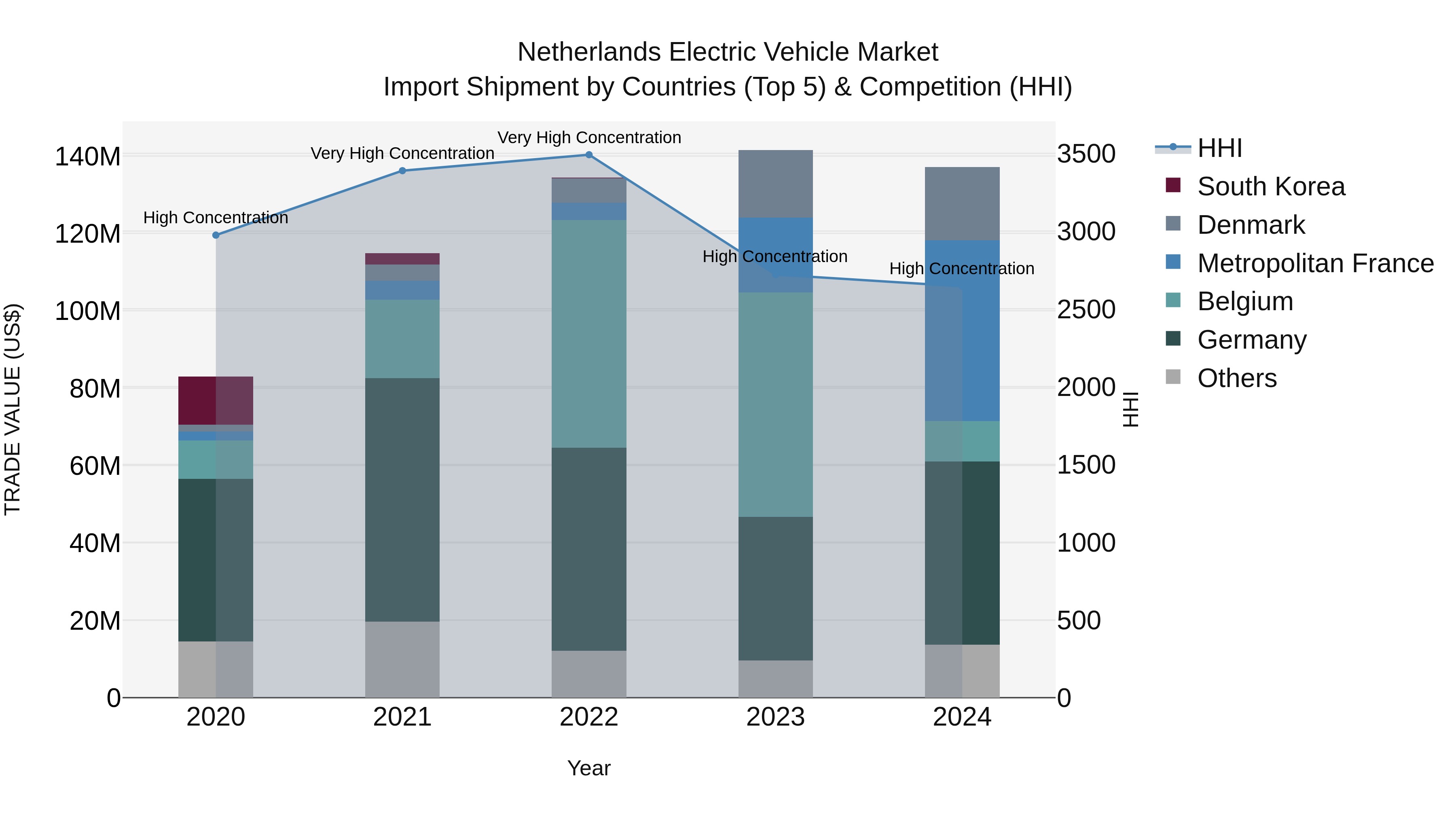

Netherlands Electric Vehicle Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, the Netherlands saw a significant influx of electric vehicle import shipments, with top exporters including Germany, Metropolitan France, Denmark, Belgium, and Sweden. Despite a slight decline in growth rate from 2023 to 2024, the compound annual growth rate (CAGR) from 2020-24 remained robust at 13.36%. The Herfindahl-Hirschman Index (HHI) indicated high market concentration in 2024, suggesting a competitive landscape dominated by key players in the electric vehicle import market. The continued interest and investments in electric vehicles underscore a promising future for sustainable transportation in the Netherlands.

Netherlands Electric Vehicle Market Growth Rate

According to 6Wresearch internal database and industry insights, The Netherlands Electric Vehicle Market is projected to grow at a compound annual growth rate (CAGR) of 21.9% during the forecast period (2025–2031).

Netherlands Electric Vehicle Market Highlights

| Report Name | Netherlands Electric Vehicle Market |

| Forecast Period | 2025-2031 |

| CAGR | 21.9% |

| Growing Sector | Passenger Vehicles & Public Transport |

Topics Covered in the Netherlands Electric Vehicle Market Report

The Netherlands Electric Vehicle Market report thoroughly covers the market by propulsion (BEV, PHEV, FCEV), vehicle drive type (FWD, RWD, AWD), and vehicle top speed (<125 mph, >125 mph). The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

Netherlands Electric Vehicle Market Synopsis

Netherlands Electric Vehicle Market is anticipated to attain major growth due to the country’s potent sustainability agenda, constructive tax policies, and worldwide charging infrastructure development. EVs are highly spreading in both passenger and public transport fleets specifically which consists of battery electric vehicles (BEV), plug-in hybrid vehicles (PHEV), and fuel-cell electric vehicles (FCEV). The government’s is majorly accelerating EV deployment in the Netherlands through concentrating on decreasing reliability on fossil fuels, coupled with consumer choice for eco-friendly transport and Europe-wide emission standards.

Evaluation of Growth Drivers in the Netherlands Electric Vehicle Market

Below mentioned are some prominent drivers and their influence on the market dynamics:

| Driver | Primary Segments Affected | Why it matters (evidence) |

| Zero-Emission Mandates | BEV; Passenger Vehicles, Public Transport | National targets for banning new ICE vehicle sales by 2030 profiler BEV deployment in both private and public segments. |

| Tax Incentives & Subsidies | BEV/PHEV; Residential & Commercial Users | Budget-friendliness of EVs is improving through favourable purchase subsidies, decreased registration tax, and less road taxes. |

| Expanding Charging Infrastructure | BEV; <125 mph & >125 mph | Range anxiety and encourage daily commutes is removing via dense charging chains across urban centres and highways. |

| Corporate Fleet Electrification | BEV/PHEV; Commercial Fleets | To align with ESG and emission compliance goals dutch logistics and ride-hailing companies are increasingly electrifying fleets. |

| EU Emission Regulations | All propulsion types; Passenger & Industrial Vehicles | Strict European Union regulations on CO₂ emissions reinforce quick deployment of low-emission vehicles. |

The Netherlands Electric Vehicle Market size is predicted to grow at the CAGR of 21.9% during the forecast period of 2025–2031. The market growth is strongly accelerated by the country’s leadership in renewable energy transition and proactive EV deployment strategies, making it one of the most appealing EV markets in Europe. Netherlands is shifting toward electrification of transport is making use of it developed infrastructure, innovation system and consumer knowledge.

Evaluation of Restraints in the Netherlands Electric Vehicle Market

Below mentioned are some major restraints and their influence to the market dynamics:

| Restraint | Primary Segments Affected | What this means (evidence) |

| High Purchase Costs | BEV/FCEV; Passenger Cars | Initial EV prices persist to increase than ICE vehicles, lowering mass deployment in lower-income groups in spite of subsidies. |

| Grid Load Challenges | BEV/PHEV; Residential Charging | Increasing EV adoption puts stress on local electricity grids, needing upgrades and smart load administration. |

| Limited Hydrogen Infrastructure | FCEV; Public Transport & Heavy Vehicles | FCEV adoption is insufficient due to scarce refuelling stations, delaying its large-scale deployment. |

| Battery Supply Dependency | All propulsion types | Heavy dependency on imported lithium-ion batteries makes supply threats and increases attainment prices. |

| Parking & Charging Limitations in Urban Areas | BEV; <125 mph | Dense city populations face constraints in installing private chargers, impacting EV adoption in apartments and rentals. |

Netherlands Electric Vehicle Market Challenges

Despite government support, the Netherlands Electric Vehicle Market encounter challenges consisting of increasing upfront EV costs, insufficient hydrogen fuelling infrastructure, and strain on the national electricity grid due to increasing charging demand. Insufficient charging access for residents of high-density housing also obstructs deployment, while reliability on global battery supply chains makes the sector vulnerable to disruptions.

Netherlands Electric Vehicle Market Trends

Several prominent trends reshaping the market growth include:

- Vehicle-to-Grid (V2G) Technology: To even out local electricity grids increasing deployment of EVs as energy storage systems.

- Smart Charging Systems: Increasing requirement for IoT-enabled chargers with remote monitoring, payment, and scheduling features.

- Rise of Shared E-Mobility: Decreasing emissions with increasing use of EVs in car-sharing and ride-hailing platforms.

- Hydrogen Mobility Initiatives: Early pilot programs for FCEVs in buses and trucks To expand clean transport solutions.

Investment Opportunities in the Netherlands Electric Vehicle Industry

Some prominent investment opportunities in the market include:

- EV Battery Recycling Facilities – To decrease reliability on imported materials and encourage sustainability launch recycling plants.

- Charging-as-a-Service (CaaS) – Give bundled charging infrastructure and service solutions for residential, commercial, and highway chains.

- Corporate Fleet Solutions – Provide tailored EV leasing and charging packages for logistics and ride-hailing companies.

- Hydrogen Mobility Pilots – To harness the potential of FCEVs in logistics and public transport allocate money in hydrogen refuelling stations.

Top 5 Leading Players in the Netherlands Electric Vehicle Market

Some leading players operating in the Netherlands Electric Vehicle Market consist of:

1. Tesla Inc.

| Company Name | Tesla Inc. |

| Established Year | 2003 |

| Headquarters | Austin, Texas, USA |

| Official Website | Click Here |

Tesla dominates the market with a solid presence of its BEV lineup and supercharging infrastructure across the Netherlands.

2. BYD Auto Co., Ltd.

| Company Name | BYD Auto Co., Ltd. |

| Established Year | 1995 |

| Headquarters | Shenzhen, China |

| Official Website | Click Here |

BYD imparts a major role in electrifying Dutch public transport and private markets by providing electric buses and passenger EVs.

3. Volkswagen AG

| Company Name | Volkswagen AG |

| Established Year | 1937 |

| Headquarters | Wolfsburg, Germany |

| Official Website | Click Here |

Volkswagen is a leading provider of BEVs and PHEVs in the Netherlands, providing economical models under its ID series.

4. Stellantis N.V.

| Company Name | Stellantis N.V. |

| Established Year | 2021 |

| Headquarters | Amsterdam, Netherlands |

| Official Website | Click Here |

Stellantis utilises its headquarters in the Netherlands to provide BEVs and PHEVs across brands like Peugeot, Opel, and Fiat.

5. Hyundai Motor Company

| Company Name | Hyundai Motor Company |

| Established Year | 1967 |

| Headquarters | Seoul, South Korea |

| Official Website | Click Here |

Hyundai has launched itself as a famous EV brand in the Netherlands with models such as the Kona Electric and Ioniq 5, integrating efficiency and budget-friendliness.

Government Regulations Introduced in the Netherlands Electric Vehicle Market

According to Netherland’s government data, numerous initiatives have been established to propel EV deployment. For instance, the government provides purchase subsidies for electric cars under the SEPP program, reduced vehicle registration taxes, and lower road taxes for EVs. The Netherlands also directed that all new company cars should be emission-free by 2026. Additionally, municipalities have been incentivized to extend public charging stations, while national policies meet with the EU Green Deal which has the objective of for carbon neutrality by 2050.

Future Insights of the Netherlands Electric Vehicle Market

The Netherlands Electric Vehicle Market Growth is anticipated to increase majorly in the upcoming years. This growth is encouraged by government-led zero-emission targets, solid charging infrastructure coverage, and increased consumer knowledge about sustainability. The extension of EV leasing programs, allocation of money in hydrogen transport, and innovations in vehicle-to-grid technologies will further solidify the Netherlands as one of Europe’s leaders in EV deployment.

Market Segmentation Analysis

BEV to Dominate the Market– By Propulsion

According to Shubhamdeep, Senior Research Analyst at 6Wresearch, the Battery Electric Vehicle (BEV) segment dominates the market. This dominance is accelerated by the government’s zero-emission policies, consumer incentives, and the availability of a broad variety of BEV models appropriate for urban and intercity travel.

FWD to Dominate the Market– By Vehicle Drive Type

The Front-Wheel Drive (FWD) category holds the largest Netherlands Electric Vehicle Market Share, as most mass-market EVs in the Netherlands are crafted with FWD layouts.

<125 mph to Dominate the Market– By Vehicle Top Speed

The Below 125 mph category leads the Netherlands Electric Vehicle Industry. Most consumer EVs are improved for efficiency and everyday commuting rather than high-speed performance, meeting with the country’s dense urban structure and short-distance travel needs.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Netherlands Electric Vehicle Market Outlook

- Market Size of Netherlands Electric Vehicle Market, 2024

- Forecast of Netherlands Electric Vehicle Market, 2031

- Historical Data and Forecast of Netherlands Electric Vehicle Revenues & Volume for the Period 2021-2031

- Netherlands Electric Vehicle Market Trend Evolution

- Netherlands Electric Vehicle Market Drivers and Challenges

- Netherlands Electric Vehicle Price Trends

- Netherlands Electric Vehicle Porter's Five Forces

- Netherlands Electric Vehicle Industry Life Cycle

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By Propulsion for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By BEV for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By PHEV for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By FCEV for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By Vehicle Drive Type for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By FWD for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By RWD for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By AWD for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By Vehicle Top Speed for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By <125 mph for the Period 2021-2031

- Historical Data and Forecast of Netherlands Electric Vehicle Market Revenues & Volume By >125 mph for the Period 2021-2031

- Netherlands Electric Vehicle Import Export Trade Statistics

- Market Opportunity Assessment By Propulsion

- Market Opportunity Assessment By Vehicle Drive Type

- Market Opportunity Assessment By Vehicle Top Speed

- Netherlands Electric Vehicle Top Companies Market Share

- Netherlands Electric Vehicle Competitive Benchmarking By Technical and Operational Parameters

- Netherlands Electric Vehicle Company Profiles

- Netherlands Electric Vehicle Key Strategic Recommendations

Markets Covered

TheNetherlands Electric Vehicle Marketreport provides a detailed analysis of the following market segments:

By Propulsion

- BEV

- PHEV

- FCEV

By Vehicle Drive Type

- FWD

- RWD

- AWD

By Vehicle Top Speed

- <125 Mph

- >125 Mph

Netherlands Electric Vehicle Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Netherlands Electric Vehicle Market Overview |

| 3.1 Netherlands Country Macro Economic Indicators |

| 3.2 Netherlands Electric Vehicle Market Revenues & Volume, 2021&2031F |

| 3.3 Netherlands Electric Vehicle Market - Industry Life Cycle |

| 3.4 Netherlands Electric Vehicle Market - Porter's Five Forces |

| 3.5 Netherlands Electric Vehicle Market Revenues & Volume Share, By Propulsion, 2021&2031F |

| 3.6 Netherlands Electric Vehicle Market Revenues & Volume Share, By Vehicle Drive Type, 2021&2031F |

| 3.7 Netherlands Electric Vehicle Market Revenues & Volume Share, By Vehicle Top Speed, 2021&2031F |

| 4 Netherlands Electric Vehicle Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Government incentives and subsidies for electric vehicles |

| 4.2.2 Increasing awareness and concern for environmental issues |

| 4.2.3 Advancements in technology leading to improved electric vehicle performance |

| 4.3 Market Restraints |

| 4.3.1 High initial cost of electric vehicles compared to traditional vehicles |

| 4.3.2 Limited charging infrastructure |

| 4.3.3 Range anxiety among consumers due to limited battery range |

| 5 Netherlands Electric Vehicle Market Trends |

| 6 Netherlands Electric Vehicle Market, By Types |

| 6.1 Netherlands Electric Vehicle Market, By Propulsion |

| 6.1.1 Overview and Analysis |

| 6.1.2 Netherlands Electric Vehicle Market Revenues & Volume, By Propulsion, 2021-2031F |

| 6.1.3 Netherlands Electric Vehicle Market Revenues & Volume, By BEV, 2021-2031F |

| 6.1.4 Netherlands Electric Vehicle Market Revenues & Volume, By PHEV, 2021-2031F |

| 6.1.5 Netherlands Electric Vehicle Market Revenues & Volume, By FCEV, 2021-2031F |

| 6.2 Netherlands Electric Vehicle Market, By Vehicle Drive Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Netherlands Electric Vehicle Market Revenues & Volume, By FWD, 2021-2031F |

| 6.2.3 Netherlands Electric Vehicle Market Revenues & Volume, By RWD, 2021-2031F |

| 6.2.4 Netherlands Electric Vehicle Market Revenues & Volume, By AWD, 2021-2031F |

| 6.3 Netherlands Electric Vehicle Market, By Vehicle Top Speed |

| 6.3.1 Overview and Analysis |

| 6.3.2 Netherlands Electric Vehicle Market Revenues & Volume, By <125 mph, 2021-2031F |

| 6.3.3 Netherlands Electric Vehicle Market Revenues & Volume, By >125 mph, 2021-2031F |

| 7 Netherlands Electric Vehicle Market Import-Export Trade Statistics |

| 7.1 Netherlands Electric Vehicle Market Export to Major Countries |

| 7.2 Netherlands Electric Vehicle Market Imports from Major Countries |

| 8 Netherlands Electric Vehicle Market Key Performance Indicators |

| 8.1 Number of public charging stations in the Netherlands |

| 8.2 Adoption rate of electric vehicles in urban areas |

| 8.3 Percentage of renewable energy sources used in charging electric vehicles |

| 9 Netherlands Electric Vehicle Market - Opportunity Assessment |

| 9.1 Netherlands Electric Vehicle Market Opportunity Assessment, By Propulsion, 2021&2031F |

| 9.2 Netherlands Electric Vehicle Market Opportunity Assessment, By Vehicle Drive Type, 2021&2031F |

| 9.3 Netherlands Electric Vehicle Market Opportunity Assessment, By Vehicle Top Speed, 2021&2031F |

| 10 Netherlands Electric Vehicle Market - Competitive Landscape |

| 10.1 Netherlands Electric Vehicle Market Revenue Share, By Companies, 2024 |

| 10.2 Netherlands Electric Vehicle Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Vehicle Types(Two-Wheeler, Passenger Vehicle, Bus, Trucks), By Regions(Northern Region, Eastern Region, Western Region, Southern Region) And Competitive Landscape.

| Product Code: ETC001630 | Publication Date: Mar 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Netherlands Electric Vehicle Market Synopsis

Netherlands electric vehicle market is driven by growing government initiatives to create awareness regarding electric vehicles along with the growing number of on-road passenger car fleet sizes in the country. Moreover, the Morocco government is also providing subsidies for the purchase of electric vehicles resulting in a further increase in the demand for electric vehicles in the country. Further, the number of charging stations in the country is also growing to help the end-users to charge their vehicles' batteries easily which is one of the major factors, which would fuel the growth of the Netherlands electric vehicle market.

According to 6Wresearch, the Netherlands Electric Vehicle Market size is projected to grow during 2020-2026. The government has planned various policies and investments for public convenience in the transport sector such as buying only zero-emission buses in the future, ensuring that all buses that are anticipated to run on either renewable fuels or energy, which would lead to a surge in demand for electric vehicles, especially buses and trucks segment during the forecast period.

In the Netherlands, Amsterdam is expected to dominate the Netherlands electric vehicle market share during the forecast period due to incentives and supporting charging networks. Amsterdam is offering free charging and reserved parking space for battery electric vehicles. Moreover, the manufacturers are working to improve the technology by reducing the time taken to charge the vehicle and making the electric vehicle more efficient.

The Netherlands electric vehicle market report thoroughly covers the market by vehicle types and regions including northern, southern, eastern, and western regions. The Netherlands electric vehicle market outlook provides an unbiased and detailed analysis of the ongoing Netherlands electric vehicle market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

The Netherlands electric vehicle market is projected to witness progressive growth in the foreseeable future on the back of the potential growth of the automotive industry. Additionally, rising fleet facilities and using low-cost biofuel vehicles than conventional energy vehicles as less production of fossil fuel with high demand causes price crisis would be the key component for generating profitable opportunities in the market. Further, the maximum distance coverage facility provided by electric vehicles along with less consumption of biofuel energy is anticipated to increase the adoption of electric vehicles in the coming timeframe and would instigate the significant growth of the Netherlands electric vehicle market in the coming years.

Netherland electric vehicle market is expected to gain traction in the upcoming six years on the back of the increasing concern toward environmental degradation. Further, Plugin hybrid electric vehicle is estimated to be prominent for the market growth coupled with widespread charging infrastructure and are more likely to set up which indicates the sales of electric vehicles would multiply at the fastest pace in the country. Thereby it is expected to leave a positive impact on the growth of the Netherlands electric vehicle market in the upcoming six years.

Major Companies operating in the Netherlands electric vehicle market are Mitsubishi Motors Corporation, Tesla Inc., BMW AG., The Volvo Group., Unu GmbH. Zero Motorcycles Incorporation.

Key Highlights of the Report:

- Netherlands Electric Vehicle Market Overview

- Netherlands Electric Vehicle Market Outlook

- Netherlands Electric Vehicle Market Forecast

- Netherlands Electric Vehicle Market Size and Netherlands Electric Vehicle Market Forecast, Until 2026.

- Historical Data of Netherlands Electric Vehicle Market Revenues for the Period 2016-2019

- Market Size & Forecast of Netherlands Electric Vehicle Market Revenues until 2026

- Historical Data of Netherlands Electric Vehicle Market Revenues, By Vehicle Types, for the Period 2016-2019

- Market Size & Forecast of Netherlands Electric Vehicle Market Revenues, By Vehicle Types, until 2026

- Historical Data of Netherlands Electric Vehicle Market Revenues, By Regions, for the Period 2016-2019

- Market Size & Forecast of Netherlands Electric Vehicle Market Revenues, By Regions, until 2026

- Netherlands Electric Vehicle Market Drivers and Restraints

- Netherlands Electric Vehicle Market Trends and Industry Life Cycle

- Netherlands Electric Vehicle Market Porter’s Five Force Analysis

- Netherlands Electric Vehicle Market Opportunity Assessment

- Netherlands Electric Vehicle Market Share, By Players

- Netherlands Electric Vehicle Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Netherlands Electric Vehicle Market report provides a detailed analysis of the following market segments:

By Vehicle Types

- Two-Wheeler

- Passenger Vehicle

- Bus

- Trucks

By Regions

- Northern Region

- Southern Region

- Eastern Region

- Western Region

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero