Niger Orthopedic Contract Manufacturing Market (2025-2031) | Segmentation, Analysis, Share, Forecast, Growth, Trends, Industry, Size & Revenue, Outlook, Competitive Landscape, Value, Companies

| Product Code: ETC8609750 | Publication Date: Sep 2024 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Vasudha | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

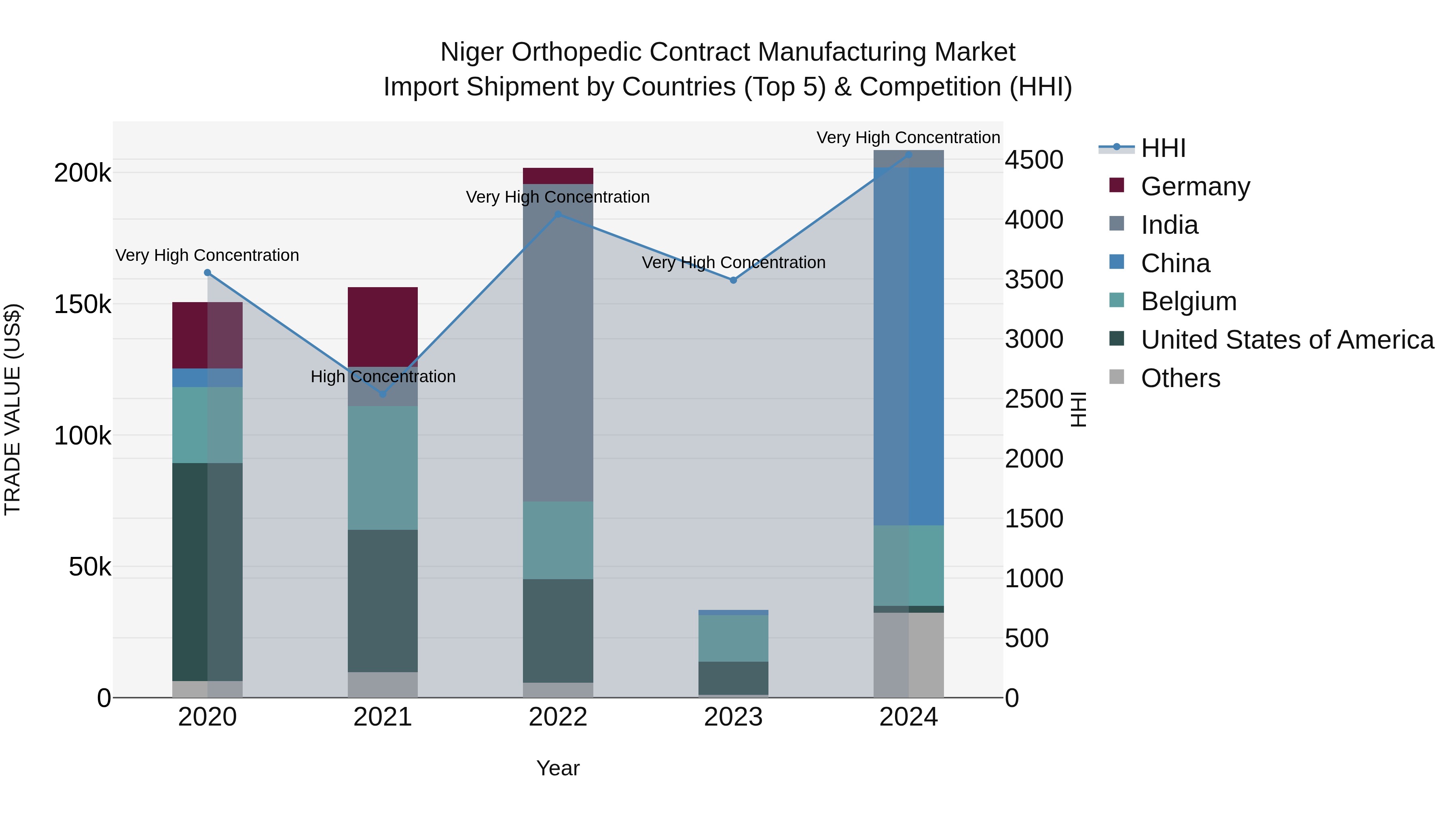

Niger Orthopedic Contract Manufacturing Market: Top 5 Importing Countries and Market Competition (HHI) Analysis

The orthopedic contract manufacturing import shipments to Niger in 2024 continued to show a high level of concentration, with top exporting countries being China, Switzerland, Belgium, India, and the United States of America. The industry exhibited a strong Compound Annual Growth Rate (CAGR) of 8.48% from 2020 to 2024, with a remarkable growth rate of 524.71% from 2023 to 2024. This data suggests a robust and rapidly expanding market for orthopedic contract manufacturing imports in Niger, indicating promising opportunities for both suppliers and stakeholders in the sector.

Niger Orthopedic Contract Manufacturing Market Overview

The Niger Orthopedic Contract Manufacturing Market is a growing sector within the country`s healthcare industry, driven by the increasing demand for orthopedic devices and implants. The market is primarily fueled by the rising incidence of orthopedic disorders and injuries, coupled with the expanding geriatric population. Key players in the market include both domestic and international orthopedic contract manufacturers who provide a wide range of services such as design, prototyping, manufacturing, packaging, and sterilization of orthopedic implants and devices. The market is characterized by a high level of competition, with companies focusing on technological advancements and product innovation to gain a competitive edge. Additionally, regulatory reforms and quality standards play a crucial role in shaping the market landscape, emphasizing the need for compliance and quality assurance in orthopedic contract manufacturing processes.

Niger Orthopedic Contract Manufacturing Market Trends and Opportunities

The Niger Orthopedic Contract Manufacturing Market is experiencing growth due to the increasing demand for orthopedic implants and devices. The market is witnessing a trend towards outsourcing manufacturing processes to specialized contract manufacturers to reduce costs and improve efficiency. This shift allows orthopedic companies to focus on research and development, while leveraging the expertise of contract manufacturers for production. Opportunities in the market include the adoption of advanced technologies such as 3D printing for custom implants, expanding product portfolios to meet the diverse needs of patients, and strategic partnerships with contract manufacturers to enhance production capabilities. Overall, the Niger Orthopedic Contract Manufacturing Market presents promising prospects for companies looking to capitalize on the growing demand for orthopedic devices in the region.

Niger Orthopedic Contract Manufacturing Market Challenges

In the Niger Orthopedic Contract Manufacturing Market, challenges include limited access to advanced technology and machinery, which may hinder the ability of local manufacturers to produce high-quality orthopedic devices and implants. Additionally, the lack of skilled workforce and specialized training in orthopedic manufacturing techniques can pose a challenge in meeting international quality standards. Infrastructure constraints, such as unreliable power supply and inadequate transportation networks, can also impact the timely delivery of products to customers. Moreover, regulatory hurdles and bureaucratic processes may create barriers to market entry and expansion for both domestic and foreign companies looking to operate within the Niger orthopedic contract manufacturing sector. Overall, addressing these challenges will be crucial in stimulating growth and competitiveness in the market.

Niger Orthopedic Contract Manufacturing Market Drivers

The drivers propelling the Niger Orthopedic Contract Manufacturing Market include the increasing prevalence of orthopedic conditions and injuries, leading to a rising demand for orthopedic implants and devices. Technological advancements in orthopedic manufacturing processes, such as 3D printing and computer-assisted design, are also driving market growth by enabling the production of customized and complex implants. Moreover, the growing geriatric population in Niger, coupled with improving healthcare infrastructure and rising disposable incomes, is further fueling the demand for orthopedic contract manufacturing services. Additionally, the trend towards outsourcing manufacturing operations to specialized contract manufacturers for cost-efficiency and expertise is expected to contribute to the market expansion in Niger.

Niger Orthopedic Contract Manufacturing Market Government Policies

The government policies related to the Niger Orthopedic Contract Manufacturing Market focus on promoting local manufacturing capacity and ensuring quality standards. The government has implemented regulations that encourage partnership between international orthopedic companies and local manufacturers to boost the domestic industry. Additionally, there are initiatives in place to provide financial support and incentives to local manufacturers in order to enhance their competitiveness. Quality control measures are also enforced to ensure that products meet international standards and adhere to regulatory requirements. Overall, the government is actively working to stimulate growth and innovation in the Niger Orthopedic Contract Manufacturing Market through supportive policies and regulatory frameworks.

Niger Orthopedic Contract Manufacturing Market Future Outlook

The Niger Orthopedic Contract Manufacturing Market is expected to experience steady growth in the coming years, driven by factors such as increasing demand for orthopedic devices, advancements in technology, and a growing aging population. The market is likely to witness a rise in outsourcing activities by orthopedic device manufacturers to specialized contract manufacturing companies in Niger, who can offer cost-effective solutions and expertise in producing high-quality orthopedic implants and instruments. Additionally, the trend towards personalized and customized orthopedic solutions is expected to further boost the market, as contract manufacturers can provide tailored products to meet individual patient needs. Overall, the Niger Orthopedic Contract Manufacturing Market is poised for expansion and innovation, presenting opportunities for both local and international players in the orthopedic industry.

Key Highlights of the Report:

- Niger Orthopedic Contract Manufacturing Market Outlook

- Market Size of Niger Orthopedic Contract Manufacturing Market, 2024

- Forecast of Niger Orthopedic Contract Manufacturing Market, 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Revenues & Volume for the Period 2021- 2031

- Niger Orthopedic Contract Manufacturing Market Trend Evolution

- Niger Orthopedic Contract Manufacturing Market Drivers and Challenges

- Niger Orthopedic Contract Manufacturing Price Trends

- Niger Orthopedic Contract Manufacturing Porter's Five Forces

- Niger Orthopedic Contract Manufacturing Industry Life Cycle

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Type for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Implants for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Instruments for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Cases for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Trays for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Services for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Forging/Casting for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Hip Machining & Finishing for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Knee Machining & Finishing for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Spine & Trauma for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Instrument Machining & Finishing for the Period 2021- 2031

- Historical Data and Forecast of Niger Orthopedic Contract Manufacturing Market Revenues & Volume By Others for the Period 2021- 2031

- Niger Orthopedic Contract Manufacturing Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Services

- Niger Orthopedic Contract Manufacturing Top Companies Market Share

- Niger Orthopedic Contract Manufacturing Competitive Benchmarking By Technical and Operational Parameters

- Niger Orthopedic Contract Manufacturing Company Profiles

- Niger Orthopedic Contract Manufacturing Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Niger Orthopedic Contract Manufacturing Market Overview |

3.1 Niger Country Macro Economic Indicators |

3.2 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, 2021 & 2031F |

3.3 Niger Orthopedic Contract Manufacturing Market - Industry Life Cycle |

3.4 Niger Orthopedic Contract Manufacturing Market - Porter's Five Forces |

3.5 Niger Orthopedic Contract Manufacturing Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Niger Orthopedic Contract Manufacturing Market Revenues & Volume Share, By Services, 2021 & 2031F |

4 Niger Orthopedic Contract Manufacturing Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for orthopedic devices due to a rise in orthopedic surgeries and procedures in Niger. |

4.2.2 Growing awareness about advanced orthopedic technologies and the benefits of outsourcing manufacturing services. |

4.2.3 Favorable government policies and initiatives promoting the development of the healthcare sector in Niger. |

4.3 Market Restraints |

4.3.1 Limited infrastructure and resources for advanced manufacturing processes in the orthopedic sector in Niger. |

4.3.2 Lack of skilled workforce and expertise in orthopedic device manufacturing. |

4.3.3 Challenges related to regulatory compliance and quality standards in contract manufacturing of orthopedic devices in Niger. |

5 Niger Orthopedic Contract Manufacturing Market Trends |

6 Niger Orthopedic Contract Manufacturing Market, By Types |

6.1 Niger Orthopedic Contract Manufacturing Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Type, 2021- 2031F |

6.1.3 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Implants, 2021- 2031F |

6.1.4 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Instruments, 2021- 2031F |

6.1.5 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Cases, 2021- 2031F |

6.1.6 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Trays, 2021- 2031F |

6.2 Niger Orthopedic Contract Manufacturing Market, By Services |

6.2.1 Overview and Analysis |

6.2.2 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Forging/Casting, 2021- 2031F |

6.2.3 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Hip Machining & Finishing, 2021- 2031F |

6.2.4 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Knee Machining & Finishing, 2021- 2031F |

6.2.5 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Spine & Trauma, 2021- 2031F |

6.2.6 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Instrument Machining & Finishing, 2021- 2031F |

6.2.7 Niger Orthopedic Contract Manufacturing Market Revenues & Volume, By Others, 2021- 2031F |

7 Niger Orthopedic Contract Manufacturing Market Import-Export Trade Statistics |

7.1 Niger Orthopedic Contract Manufacturing Market Export to Major Countries |

7.2 Niger Orthopedic Contract Manufacturing Market Imports from Major Countries |

8 Niger Orthopedic Contract Manufacturing Market Key Performance Indicators |

8.1 Percentage increase in the number of orthopedic surgeries in Niger. |

8.2 Adoption rate of advanced orthopedic technologies in the market. |

8.3 Percentage growth in the number of orthopedic contract manufacturing partnerships. |

8.4 Compliance rate with international quality standards in orthopedic manufacturing processes. |

8.5 Rate of innovation and introduction of new orthopedic products in the market. |

9 Niger Orthopedic Contract Manufacturing Market - Opportunity Assessment |

9.1 Niger Orthopedic Contract Manufacturing Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Niger Orthopedic Contract Manufacturing Market Opportunity Assessment, By Services, 2021 & 2031F |

10 Niger Orthopedic Contract Manufacturing Market - Competitive Landscape |

10.1 Niger Orthopedic Contract Manufacturing Market Revenue Share, By Companies, 2024 |

10.2 Niger Orthopedic Contract Manufacturing Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero