Nigeria LPG Tanker Market (2025-2031) | Outlook, Trends, Share, Forecast, Growth, Industry, Value, Analysis, Competitive Landscape, Size & Revenue, Segmentation, Companies

| Product Code: ETC8627808 | Publication Date: Sep 2024 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Vasudha | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

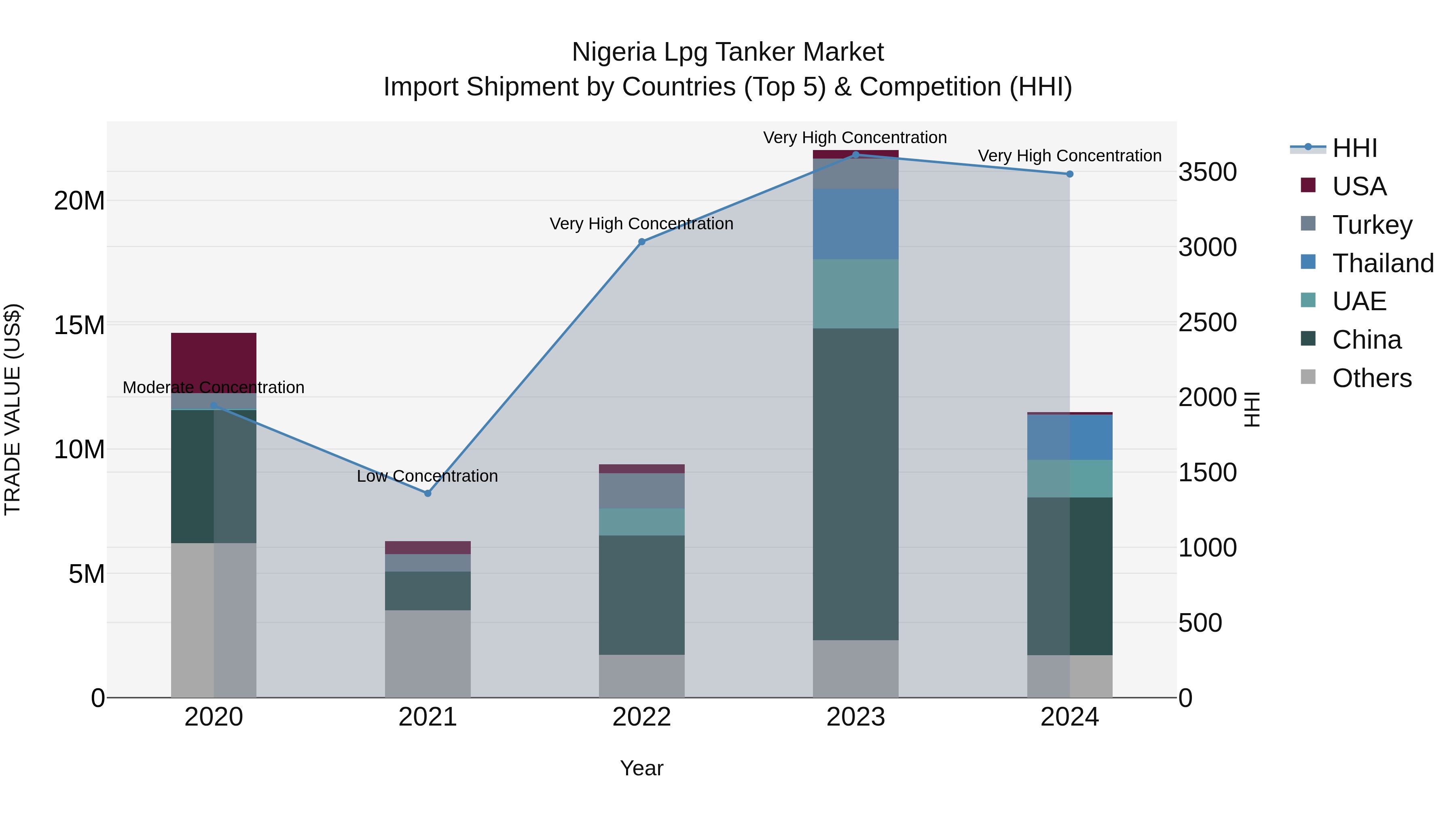

Nigeria Lpg Tanker Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, Nigeria continued to rely on LPG tanker imports, with top exporting countries being China, Thailand, UAE, Malaysia, and Germany. Despite a high concentration level indicated by the HHI, the market experienced a significant decline in both CAGR (-5.94%) and growth rate (-47.86%) from 2023 to 2024. This suggests a challenging landscape for LPG tanker imports in Nigeria, with potential implications for market dynamics and competition among key exporting nations.

Nigeria LPG Tanker Market Synopsis

The Nigeria LPG tanker market is experiencing steady growth driven by increasing government initiatives promoting the use of LPG as a cleaner and more efficient alternative to traditional fuels. With a rising demand for LPG for cooking, heating, and industrial purposes, the need for efficient transportation of LPG via tankers has also increased. Key players in the market include tanker manufacturers, logistics companies, and LPG suppliers. However, challenges such as inadequate infrastructure, safety concerns, and regulatory issues pose potential obstacles to market growth. Despite these challenges, the Nigeria LPG tanker market offers significant opportunities for investment and expansion, especially with the government`s focus on increasing LPG consumption and infrastructure development in the country.

Nigeria LPG Tanker Market Trends

The Nigeria LPG tanker market is witnessing a growing demand due to the increasing adoption of LPG as a cleaner alternative to traditional fuels. A key trend in the market is the shift towards larger and more efficient LPG tanker vessels to meet the rising transportation needs. This trend is driven by the government`s push for increased LPG usage and infrastructure development to support the sector. Additionally, there are opportunities for market players to invest in technology and innovation to enhance safety standards, optimize logistics operations, and reduce environmental impact. With the potential for further growth in domestic LPG consumption and export opportunities, the Nigeria LPG tanker market presents promising prospects for industry players looking to capitalize on the country`s evolving energy landscape.

Nigeria LPG Tanker Market Challenges

In the Nigeria LPG tanker market, some of the key challenges include inadequate infrastructure for storage and transportation, leading to inefficiencies and potential safety risks. Limited access to funding for fleet expansion and maintenance also hinders the growth of the market. Additionally, regulatory issues and compliance requirements pose challenges for tanker operators, impacting their operational flexibility and increasing costs. Market fragmentation and intense competition further add pressure on profit margins. Addressing these challenges will require investments in infrastructure development, improved access to financing, streamlined regulatory processes, and industry collaboration to promote sustainable growth in the Nigeria LPG tanker market.

Nigeria LPG Tanker Market Investment Opportunities

The Nigeria LPG tanker market is primarily driven by the increasing demand for LPG as a clean and efficient energy source for cooking, heating, and industrial applications. The government`s push towards promoting LPG usage as a cleaner alternative to traditional fuels like firewood and kerosene has resulted in a growing number of households and businesses switching to LPG. Additionally, the expansion of distribution networks, investments in infrastructure development, and the implementation of favorable policies to support the LPG industry have further boosted the demand for LPG tankers in Nigeria. With the rising awareness of environmental benefits and the convenience of using LPG, the market for LPG tankers is expected to continue growing in the coming years.

Nigeria LPG Tanker Market Government Polices

The Nigerian government has implemented various policies to regulate the LPG tanker market in the country. These include the Nigeria Liquefied Petroleum Gas Association (NLPGA) guidelines, which set standards for LPG transportation and storage to ensure safety and quality. The Department of Petroleum Resources (DPR) also oversees the licensing and regulation of LPG tanker operators to ensure compliance with safety and environmental standards. Additionally, the Nigerian National Petroleum Corporation (NNPC) has introduced initiatives to promote the use of LPG as a cleaner and more efficient source of energy, thereby increasing demand for LPG tankers. Overall, these policies aim to promote the growth of the LPG tanker market in Nigeria while ensuring safety, quality, and environmental sustainability.

Nigeria LPG Tanker Market Future Outlook

The future outlook for the Nigeria LPG tanker market appears promising, driven by factors such as increasing government initiatives to promote LPG usage as a cleaner alternative to traditional fuels, growing urbanization and industrialization, and rising consumer awareness about the benefits of LPG. The market is expected to witness steady growth in demand for LPG tankers as the country continues to invest in infrastructure development and expand its LPG distribution network. Additionally, the implementation of favorable policies and regulations to support the LPG sector is likely to further boost market growth. Overall, the Nigeria LPG tanker market is poised for expansion in the coming years, presenting opportunities for industry participants to capitalize on the growing demand for LPG transportation services.

Key Highlights of the Report:

- Nigeria LPG Tanker Market Outlook

- Market Size of Nigeria LPG Tanker Market, 2024

- Forecast of Nigeria LPG Tanker Market, 2031

- Historical Data and Forecast of Nigeria LPG Tanker Revenues & Volume for the Period 2021- 2031

- Nigeria LPG Tanker Market Trend Evolution

- Nigeria LPG Tanker Market Drivers and Challenges

- Nigeria LPG Tanker Price Trends

- Nigeria LPG Tanker Porter's Five Forces

- Nigeria LPG Tanker Industry Life Cycle

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Vessel Size for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Very Large Gas Carriers (VLGC) for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Large Gas Carriers (LGC) for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Medium Gas Carriers (MGC) for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Small Gas Carriers (SGC) for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Refrigeration & Pressurization for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Ethylene for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Full Refrigerated for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Semi Refrigerated for the Period 2021- 2031

- Historical Data and Forecast of Nigeria LPG Tanker Market Revenues & Volume By Full Pressurized for the Period 2021- 2031

- Nigeria LPG Tanker Import Export Trade Statistics

- Market Opportunity Assessment By Vessel Size

- Market Opportunity Assessment By Refrigeration & Pressurization

- Nigeria LPG Tanker Top Companies Market Share

- Nigeria LPG Tanker Competitive Benchmarking By Technical and Operational Parameters

- Nigeria LPG Tanker Company Profiles

- Nigeria LPG Tanker Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Nigeria LPG Tanker Market Overview |

3.1 Nigeria Country Macro Economic Indicators |

3.2 Nigeria LPG Tanker Market Revenues & Volume, 2021 & 2031F |

3.3 Nigeria LPG Tanker Market - Industry Life Cycle |

3.4 Nigeria LPG Tanker Market - Porter's Five Forces |

3.5 Nigeria LPG Tanker Market Revenues & Volume Share, By Vessel Size, 2021 & 2031F |

3.6 Nigeria LPG Tanker Market Revenues & Volume Share, By Refrigeration & Pressurization, 2021 & 2031F |

4 Nigeria LPG Tanker Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for LPG as a cleaner alternative to traditional fuels in Nigeria |

4.2.2 Government initiatives promoting the use of LPG for cooking and heating purposes |

4.2.3 Growth in industrial and commercial sectors driving the need for efficient LPG transportation |

4.3 Market Restraints |

4.3.1 Infrastructure challenges in Nigeria hindering the distribution and transportation of LPG |

4.3.2 Volatility in global oil and gas prices impacting the cost of LPG transportation |

4.3.3 Regulatory hurdles and compliance issues affecting the LPG tanker market in Nigeria |

5 Nigeria LPG Tanker Market Trends |

6 Nigeria LPG Tanker Market, By Types |

6.1 Nigeria LPG Tanker Market, By Vessel Size |

6.1.1 Overview and Analysis |

6.1.2 Nigeria LPG Tanker Market Revenues & Volume, By Vessel Size, 2021- 2031F |

6.1.3 Nigeria LPG Tanker Market Revenues & Volume, By Very Large Gas Carriers (VLGC), 2021- 2031F |

6.1.4 Nigeria LPG Tanker Market Revenues & Volume, By Large Gas Carriers (LGC), 2021- 2031F |

6.1.5 Nigeria LPG Tanker Market Revenues & Volume, By Medium Gas Carriers (MGC), 2021- 2031F |

6.1.6 Nigeria LPG Tanker Market Revenues & Volume, By Small Gas Carriers (SGC), 2021- 2031F |

6.2 Nigeria LPG Tanker Market, By Refrigeration & Pressurization |

6.2.1 Overview and Analysis |

6.2.2 Nigeria LPG Tanker Market Revenues & Volume, By Ethylene, 2021- 2031F |

6.2.3 Nigeria LPG Tanker Market Revenues & Volume, By Full Refrigerated, 2021- 2031F |

6.2.4 Nigeria LPG Tanker Market Revenues & Volume, By Semi Refrigerated, 2021- 2031F |

6.2.5 Nigeria LPG Tanker Market Revenues & Volume, By Full Pressurized, 2021- 2031F |

7 Nigeria LPG Tanker Market Import-Export Trade Statistics |

7.1 Nigeria LPG Tanker Market Export to Major Countries |

7.2 Nigeria LPG Tanker Market Imports from Major Countries |

8 Nigeria LPG Tanker Market Key Performance Indicators |

8.1 Percentage of households using LPG as a cooking fuel in Nigeria |

8.2 Number of new LPG distribution centers opened in key regions |

8.3 Average fleet utilization rate of LPG tankers in Nigeria |

9 Nigeria LPG Tanker Market - Opportunity Assessment |

9.1 Nigeria LPG Tanker Market Opportunity Assessment, By Vessel Size, 2021 & 2031F |

9.2 Nigeria LPG Tanker Market Opportunity Assessment, By Refrigeration & Pressurization, 2021 & 2031F |

10 Nigeria LPG Tanker Market - Competitive Landscape |

10.1 Nigeria LPG Tanker Market Revenue Share, By Companies, 2024 |

10.2 Nigeria LPG Tanker Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero