Russia Electric Motor Market (2025-2031) | Size, Analysis, Revenue, Trends, Growth, Forecast, Value, Segmentation, Industry & Outlook

Market Forecast By Motor Type (Alternate Current (AC) Motor, Direct Current (DC) Motor, Hermetic Motor), By Output Power, By Voltage Range (9 V & Below, 10-20 V, 21-60 V, 60 V & Above), By Application (Industrial machinery, Motor vehicles, Heating, ventilating, and cooling (HVAC) equipment, Aerospace & Transportation, Household appliances, Other), By Speed (RPM) (Low-Speed Electric Motors (Less Than 1,000 RPM), Medium-Speed Electric Motors (1,001-25,000 RPM), High-Speed Electric Motors (25,001-75,000 RPM), Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)) And Competitive Landscape

| Product Code: ETC041093 | Publication Date: Jan 2021 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Russia Electric Motor Market | Country-Wise Share and Competition Analysis

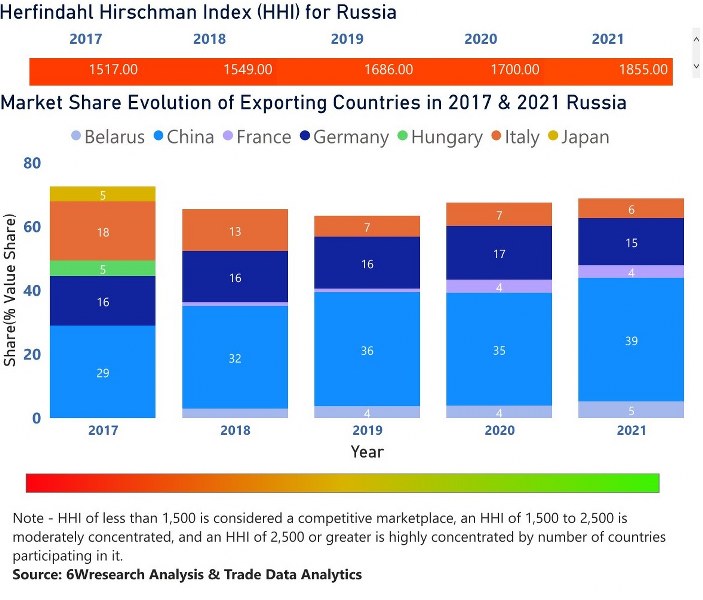

In the year 2021, China was the largest exporter in terms of value, followed by Germany. It has registered a growth of 16.5% over the previous year. While Germany registered a decline of -7.18% as compared to the previous year. In the year 2017 China was the largest exporter followed by Italy. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Russia has the Herfindahl index of 1517 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1855 which signifies moderately concentrated in the market.

![Russia Electric Motor Market | Country-Wise Share and Competition Analysis]() Russia Electric Motor Market - Export Market Opportunities

Russia Electric Motor Market - Export Market Opportunities![Russia Electric Motor Market - Export Market Opportunities]()

Russia Electric Motor Market Growth Rate

According to industry insights and secondary research databases, the Russia Electric Motor Market is projected to grow at a compound annual growth rate (CAGR) of 6.5% during the forecast period 2025-2031.

Russia Electric Motor Market Highlights

| Report Name | Russia Electric Motor Market |

| Forecast Period | 2025–2031 |

| CAGR | 6.5% |

| Growing Sector | Oil & Gas and Manufacturing |

Topics Covered in the Russia Electric Motor Market Report

The Russia Electric Motor Market report thoroughly covers the market by motor type, by output power, by voltage, by range, by application, and by speed (RPM). The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

Russia Electric Motor Market Synopsis

Russia Electric Motor Market is moving forward throughout the years as the country continues to modernize its industrial base, strengthen its oil & gas processing infrastructure, and expand its transport and aerospace segments. Apart from this, railway systems are modernized, manufacturing modernization, and renewable integration are noticed in selective regions such as Kaliningrad and Tatarstan are driving market adoption.

Evaluation of Growth Drivers in the Russia Electric Motor Market

Below mentioned some growth drivers and their impact on market dynamics:

Russia Electric Motor Market size is predicted to rise exponentially at a CAGR of 6.5% during the forecast period 2025-2031. The demand of electric motors in Russia, is strengthened by the industrialization in heavy sectors and ongoing infrastructure development. Further, electrification of public transportation and localization of motor servicing and assembly plants are together contributing in the ecosystem of market. There is urban development noticed in Moscow, St. Petersburg, and Novosibirsk further pushes demand across HVAC, motor vehicles, and consumer appliances. Furthermore, government-backed industrial localization programs are fostering demand for high-efficiency and locally assembled motors.

Evaluation of Restraints in the Russia Electric Motor Market

Below mentioned are some major restraints and their influence on market dynamics:

| Restraints | Primary Segments Affected | What this Means |

| Dependence on Imported Components | All Segments | Although Russia assembles motors, advanced components (bearings, drives) are often imported, raising supply risks. |

| Cost Pressure in SMEs | Household appliances, Industrial machinery | Many SMEs continue using IE2 motors to minimize costs, slowing IE3/IE4 adoption. |

| Slow Technology Adoption | Industrial machinery | Some traditional industries delays are adopting digital monitoring and IoT-based motor control systems. |

| Harsh Climatic Conditions | Utilities, Transportation | There are performance issues in Arctic and Siberian environments requiring extra durability and insulation. |

| Economic Sanctions & Policy Risks | All Segments | Limited access to Western technology increases the reliance on domestic R&D and Asian suppliers. |

Russia Electric Motor Market Challenges

Like every market, Russia Electric Motor Market Growth is also affected by the presence of challenges such as the limited adoption of premium-efficiency IE4 motors across SMEs, there is heavy reliance on imported control systems, and the shortage of advanced automation specialists. Also, the extreme cold weather in regions such as Yakutia demands additional design modifications and higher costs for protective enclosures. Furthermore, fluctuating exchange rates and global trade restrictions impact structures of costs and availability of critical motor components.

Russia Electric Motor Market Trends

Some major trends contributing in the market are:

- Adoption of IE3 & IE4 Motors: Government is driving the market with energy efficiency standards and industries are gradually upgrading to high-efficiency motors.

- Electrification of Rail & Metro Systems: Metro lines and railway modernization are expanding that pushes demand for medium- and high-voltage traction motors.

- Smart Monitoring & IoT Integration: Manufacturing plants and oil refineries increasingly deploy IoT-based control systems for predictive maintenance.

- Cold-Climate Resistant Motors: The demand for motors designed for sub-zero performance is rising in Arctic and Siberian oilfields and utilities.

- Local Assembly & Substitution Drive: Russian OEMs are expanding domestic assembly of motors to reduce reliance on imports and shorten supply cycles.

Investment Opportunities in the Russia Electric Motor Industry

Here are some investment opportunities in the Russia Electric Motor Industry:

- Premium-Efficiency Motors: Regulatory enforcement and industrial efficiency targets fuel demand for IE3/IE4 motors.

- Rail & Metro Electrification Projects: Investments are increased in urban metro lines and electrified freight corridors require high-output AC motors.

- Oil & Gas Pumping Stations: There is continuous upgrades in Siberia and Ural regions sustain long-term demand for high-voltage pumping motors.

- Aerospace Applications: The demand of lightweight, high-performance motors are needed for avionics, drones, and propulsion systems.

- Localized Service & Training Centres: Advanced training hubs and servicing workshops are established which helps reduce downtime and reliance on imports.

Top 5 Leading Players in the Russia Electric Motor Market

Here are some top companies listed:

1. ABB

| Company Name | ABB |

| Established Year | 1988 |

| Headquarters | Zurich, Switzerland |

| Offical Website | Click Here |

This company has a significant presence in Russia, offering high-efficiency motors, drives, and automation systems used in oil & gas, metallurgy, and water utilities.

2. Siemens

| Company Name | Siemens |

| Established Year | 1847 |

| Headquarters | Munich, Germany |

| Offical Website | Click Here |

This company supplies a wide range of medium-voltage motors and servo drives supporting railway electrification, industrial automation, and energy projects.

3. Nidec Corporation

| Company Name | Nidec Corporation |

| Established Year | 1973 |

| Headquarters | Kyoto, Japan |

| Offical Website | Click Here |

This company provides precision motors and high-performance drive systems widely used in Russian automotive and aerospace industries.

4. Ruselprom

| Company Name | Ruselprom |

| Established Year | 1992 |

| Headquarters | Moscow, Russia |

| Offical Website | Click Here |

This is a leading domestic motor manufacturer supplying AC and DC motors, generators, and drives tailored for Russia’s oil, gas, and metallurgical sectors.

5. WEG

| Company Name | WEG |

| Established Year | 1961 |

| Headquarters | Jaragua do Sul, Brazil |

| Offical Website | Click Here |

This company offers robust motor and drive solutions adapted for cold climates of Russia, serving industries from mining to oil refineries and renewable projects.

Government Regulations Introduced in the Russia Electric Motor Market

According to Russian Government Data, governments have enforced some regulations on the Russia Electric Motor Market include higher efficiency norms under its Energy Efficiency Program and Industry Modernization Strategy. Apart from this, some ambitious targets are set for reducing carbon emissions, which aligns with the adoption of energy-efficient motor technologies. These policies are pushing industries to upgrade to motors that meet or exceed new energy standards. Energy Ministry guidelines encourage use of IE3 motors in manufacturing and transport systems. Large-scale infrastructure and utility projects financed by state-owned enterprises mandate high-efficiency AC motors. Further, regional initiatives in Tatarstan and Ural industrial hubs incentivize domestic assembly and substitution of imported motor components.

Future Insights of the Russia Electric Motor Market

The future of Russia Electric Motor Market is expected for steady growth. In the coming years, the market is likely to see major growth with rapidly industrial modernization, railway electrification, and energy efficiency mandates. This is high probability that oil & gas sector continued to be remain a dominant consumer, while aerospace, defence, and smart manufacturing will emerge as growth drivers. Local R&D in cold-climate motor technologies and expansion of local assembly facilities are anticipated to reduce import reliance.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

60 V & Above Motors to Dominate the Market – By Voltage Range

According to Vasu, Senior Research Analyst, 6Wresearch, high-voltage motors are set to dominate the market as these are broadly used in oil & gas, utilities, and transportation. Also, lower-voltage motors remain important for consumer appliances, but industrial reliability needs sustain demand for high-voltage categories.

Alternate Current (AC) Motors to Dominate the Market – By Motor Type

AC motors are expected to hold the largest Russia Electric Motor Market Share due to their durability, cost-effectiveness, and wide application across oil refineries, railways, and heavy manufacturing. Due to their compatibility with variable frequency drives (VFDs), these are especially suited for automation in aerospace and industrial plants.

1-100 kW Motors to Dominate the Market – By Output Power

Motors in the 1-100 kW category will capture the largest market share, being widely used in pumping stations, rolling mills, and HVAC systems. Smaller units (<1 kW) remain in household appliances, while motors above 100 kW are concentrated in metallurgy and oil processing units.

Industrial Machinery to Dominate the Market – By Application

Industrial machinery is set to lead market share in Russia, driven by metallurgy, oil refining, and aerospace manufacturing. While HVAC and motor vehicles contribute significantly, industrial processing plants provide the strongest and most consistent demand.

Medium-Speed Motors to Dominate the Market – By Speed (RPM)

Medium-speed motors are more preferred among consumers as they are mostly used in compressors, pumps, and industrial machinery. (1,001-25,000 RPM) this speed motors balance between durability and efficiency makes them the ideal choice in both manufacturing and oil & gas projects.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Russia Electric Motor Outlook

- Market Size of Russia Electric Motor Market, 2024

- Forecast of Russia Electric Motor Market, 2031

- Historical Data and Forecast of Russia Electric Motor Revenues & Volume for the Period 2021-2031F

- Russia Electric Motor Market Trend Evolution

- Russia Electric Motor Market Drivers and Challenges

- Russia Electric Motor Price Trends

- Russia Electric Motor Porter's Five Forces

- Russia Electric Motor Market Industry Life Cycle

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Motor Type for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Alternate Current (AC) Motor for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Direct Current (DC) Motor for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Hermetic Motor for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Voltage Range for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By 9 V & Below for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By 10-20 V for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By 21-60 V for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By 60 V & Above for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Application for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Industrial Machinery for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Motor Vehicles for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Heating for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Ventilating & Cooling Equipment for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Aerospace and Transportation for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Household Appliances for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Others for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Speed for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By (Low-Speed Electric Motors (Less Than 1,000 RPM) for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Medium-Speed Electric Motors (1,001-25,000 RPM) for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By High-Speed Electric Motors (25,001-75,000 RPM) for the Period 2021-2031F

- Historical Data and Forecast of Russia Electric Motor Market Revenues & Volume By Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM) for the Period 2021-2031F

- Russia Electric Motor Market Import Export Trade Statistics

- Market Opportunity Assessment By Motor Type

- Market Opportunity Assessment By Voltage Range

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Speed

- Russia Electric Motor Top Companies Market Share

- Russia Electric Motor Competitive Benchmarking By Technical and Operational Parameters

- Russia Electric Motor Market Company Profiles

- Russia Electric Motor Market Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Motor Type

- Alternate Current (AC) Motor

- Direct Current (DC) Motor

- Hermetic Motor

By Voltage Range

- 9 V & Below

- 10-20 V

- 21-60 V

- 60 V & Above

By Application

- Industrial Machinery

- Motor Vehicles

- Heating

- Ventilating, And Cooling (HVAC) Equipment

- Aerospace & Transportation

- Household Appliances

- Other

By Speed (RPM)

- Low-Speed Electric Motors (Less Than 1,000 RPM)

- Medium-Speed Electric Motors (1,001-25,000 RPM)

- High-Speed Electric Motors (25,001-75,000 RPM)

- Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)

Russia Electric Motor Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Russia Electric Motor Market Overview |

| 3.1 Russia Electric Motor Market Revenues & Volume, 2021 - 2031F |

| 3.2 Russia Electric Motor Market - Industry Life Cycle |

| 3.3 Russia Electric Motor Market - Porter's Five Forces |

| 3.4 Russia Electric Motor Market Revenues & Volume Share, By Motor Type, 2021 & 2031F |

| 3.5 Russia Electric Motor Market Revenues & Volume Share, By Output Power, 2021 & 2031F |

| 3.6 Russia Electric Motor Market Revenues & Volume Share, By Voltage Range, 2021 & 2031F |

| 3.7 Russia Electric Motor Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 3.8 Russia Electric Motor Market Revenues & Volume Share, By Speed (RPM), 2021 & 2031F |

| 4 Russia Electric Motor Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing adoption of electric vehicles and hybrid vehicles in Russia |

| 4.2.2 Government initiatives promoting energy efficiency and sustainability |

| 4.2.3 Growing industrial automation and robotics sector in Russia |

| 4.3 Market Restraints |

| 4.3.1 High initial investment cost associated with electric motors |

| 4.3.2 Lack of widespread charging infrastructure for electric vehicles in Russia |

| 5 Russia Electric Motor Market Trends |

| 6 Russia Electric Motor Market Segmentation |

| 6.1 Russia Electric Motor Market, By Motor Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Russia Electric Motor Market Revenues & Volume, By Motor Type, 2021 - 2031F |

| 6.1.3 Russia Electric Motor Market Revenues & Volume, By Alternate Current (AC) Motor, 2021 - 2031F |

| 6.1.4 Russia Electric Motor Market Revenues & Volume, By Direct Current (DC) Motor, 2021 - 2031F |

| 6.1.5 Russia Electric Motor Market Revenues & Volume, By Hermetic Motor, 2021 - 2031F |

| 6.2 Russia Electric Motor Market, By Output Power |

| 6.2.1 Overview and Analysis |

| 6.3 Russia Electric Motor Market, By Voltage Range |

| 6.3.1 Overview and Analysis |

| 6.3.2 Russia Electric Motor Market Revenues & Volume, By 9 V & Below, 2021 - 2031F |

| 6.3.3 Russia Electric Motor Market Revenues & Volume, By 10-20 V, 2021 - 2031F |

| 6.3.4 Russia Electric Motor Market Revenues & Volume, By 21-60 V, 2021 - 2031F |

| 6.3.5 Russia Electric Motor Market Revenues & Volume, By 60 V & Above, 2021 - 2031F |

| 6.4 Russia Electric Motor Market, By Application |

| 6.4.1 Overview and Analysis |

| 6.4.2 Russia Electric Motor Market Revenues & Volume, By Industrial machinery, 2021 - 2031F |

| 6.4.3 Russia Electric Motor Market Revenues & Volume, By Motor vehicles, 2021 - 2031F |

| 6.4.4 Russia Electric Motor Market Revenues & Volume, By Heating, ventilating, and cooling (HVAC) equipment, 2021 - 2031F |

| 6.4.5 Russia Electric Motor Market Revenues & Volume, By Aerospace & transportation, 2021 - 2031F |

| 6.4.6 Russia Electric Motor Market Revenues & Volume, By Household appliances, 2021 - 2031F |

| 6.4.7 Russia Electric Motor Market Revenues & Volume, By Other, 2021 - 2031F |

| 6.5 Russia Electric Motor Market, By Speed (RPM) |

| 6.5.1 Overview and Analysis |

| 6.5.2 Russia Electric Motor Market Revenues & Volume, By Low-Speed Electric Motors (Less Than 1,000 RPM), 2021 - 2031F |

| 6.5.3 Russia Electric Motor Market Revenues & Volume, By Medium-Speed Electric Motors (1,001-25,000 RPM), 2021 - 2031F |

| 6.5.4 Russia Electric Motor Market Revenues & Volume, By High-Speed Electric Motors (25,001-75,000 RPM), 2021 - 2031F |

| 6.5.5 Russia Electric Motor Market Revenues & Volume, By Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM), 2021 - 2031F |

| 7 Russia Electric Motor Market Import-Export Trade Statistics |

| 7.1 Russia Electric Motor Market Export to Major Countries |

| 7.2 Russia Electric Motor Market Imports from Major Countries |

| 8 Russia Electric Motor Market Key Performance Indicators |

| 8.1 Average energy efficiency improvement in electric motors used in industries |

| 8.2 Number of electric vehicle charging stations installed across Russia |

| 8.3 Percentage increase in the use of electric motors in key industries such as manufacturing and transportation |

| 9 Russia Electric Motor Market - Opportunity Assessment |

| 9.1 Russia Electric Motor Market Opportunity Assessment, By Motor Type, 2021 & 2031F |

| 9.2 Russia Electric Motor Market Opportunity Assessment, By Output Power, 2021 & 2031F |

| 9.3 Russia Electric Motor Market Opportunity Assessment, By Voltage Range, 2021 & 2031F |

| 9.4 Russia Electric Motor Market Opportunity Assessment, By Application, 2021 & 2031F |

| 9.5 Russia Electric Motor Market Opportunity Assessment, By Speed (RPM), 2021 & 2031F |

| 10 Russia Electric Motor Market - Competitive Landscape |

| 10.1 Russia Electric Motor Market Revenue Share, By Companies, 2024 |

| 10.2 Russia Electric Motor Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero