Saudi Arabia Connector Market (2025-2031) Outlook | Growth, Companies, Share, Value, Trends, Size, Analysis, Industry, Revenue, Forecast

| Product Code: ETC288219 | Publication Date: Aug 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

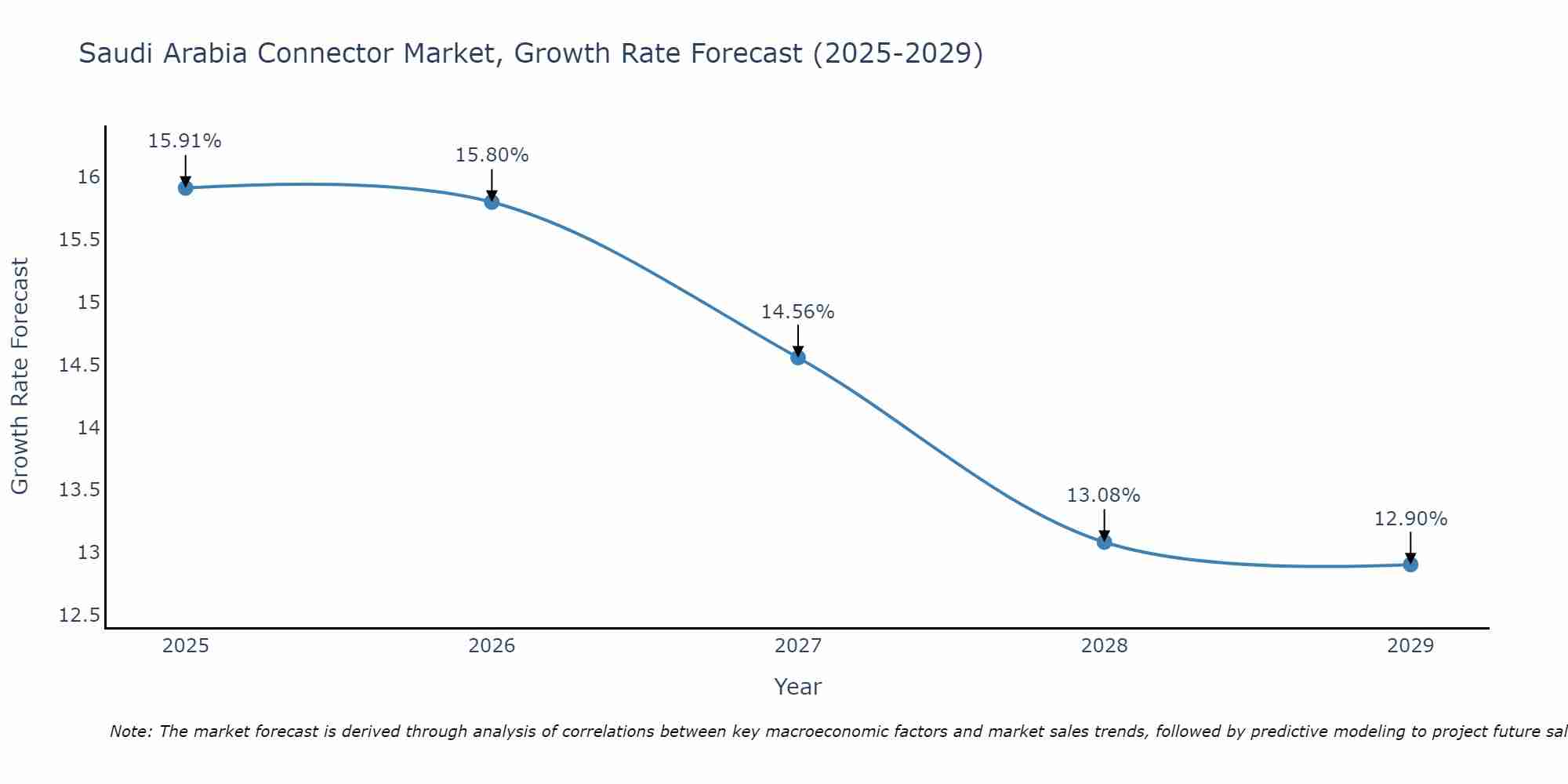

Saudi Arabia Connector Market Size Growth Rate

The Saudi Arabia Connector Market may undergo a gradual slowdown in growth rates between 2025 and 2029. Beginning strongly at 15.91% in 2025, growth softens to 12.90% in 2029.

Saudi Arabia Connector Market Synopsis

The connector market in Saudi Arabia holds significance across industries, as connectors play a critical role in establishing electrical and electronic connections. Sectors such as automotive, telecommunications, aerospace, and manufacturing rely on connectors for seamless data and power transmission. The market offers a diverse range of connectors, including wire-to-wire, wire-to-board, and board-to-board connectors, among others. With technological advancements such as the Internet of Things (IoT) driving demand for connected devices, the connector market is witnessing innovation in terms of miniaturization, durability, and compatibility with emerging technologies.

Drivers of the Market

The connector market in Saudi Arabia has witnessed growth driven by the widespread adoption of electronic devices, digitalization, and technological advancements across various industries. Sectors such as automotive, telecommunications, consumer electronics, and industrial automation have fueled the demand for connectors. The increasing integration of electronic components in modern systems, coupled with the need for reliable and high-performance connectivity solutions, has propelled the market forward. Moreover, the growing emphasis on renewable energy and smart infrastructure projects has further augmented the demand for connectors in the country.

Opportunities of the Market

Challenges of the Market

The connector market in Saudi Arabia encounters challenges related to market fragmentation and counterfeit products. There are numerous connector types available in the market, and the absence of standardized connectors can lead to compatibility issues and complexity for users. Additionally, counterfeit connectors pose a significant risk to both consumers and manufacturers, affecting the market`s trustworthiness.

COVID-19 Impact on the Market

The Saudi Arabia connector market faced disruptions during the COVID-19 pandemic, primarily due to supply chain interruptions and a slowdown in industrial activities. The pandemic impacted both the demand and supply sides of the market. On one hand, several industries scaled down operations or temporarily shut down, leading to reduced demand for connectors. On the other hand, restrictions on international trade affected the supply of connector components. Companies had to adapt to remote work and adopt digital solutions, increasing the demand for connectors in the IT and telecom sectors. As the economy gradually reopened and industries resumed operations, the connector market witnessed a recovery, driven by investments in infrastructure and technology.

Key Players in the Market

In the saudi arabia Connector market, major players include Jubaili Bros, Amiantit Fiber Glass Systems, and Amphenol Middle East FZE. These companies provide various types of connectors for electrical and industrial applications, serving diverse sectors in the Kingdom.

Key Highlights of the Report:

- Saudi Arabia Connector Market Outlook

- Market Size of Saudi Arabia Connector Market, 2024

- Forecast of Saudi Arabia Connector Market, 2031

- Historical Data and Forecast of Saudi Arabia Connector Revenues & Volume for the Period 2021-2031

- Saudi Arabia Connector Market Trend Evolution

- Saudi Arabia Connector Market Drivers and Challenges

- Saudi Arabia Connector Price Trends

- Saudi Arabia Connector Porter's Five Forces

- Saudi Arabia Connector Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By PCB Connectors for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By IO Connectors for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Circular Connectors for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Fiber Optic Connectors for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By RF Coaxial Connectors for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By End Use for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Telecom for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Transportation for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Automotive for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Industrial for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Computer & Peripherals for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Connector Market Revenues & Volume By Others for the Period 2021-2031

- Saudi Arabia Connector Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By End Use

- Saudi Arabia Connector Top Companies Market Share

- Saudi Arabia Connector Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Connector Company Profiles

- Saudi Arabia Connector Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Saudi Arabia Connector Market Overview |

3.1 Saudi Arabia Country Macro Economic Indicators |

3.2 Saudi Arabia Connector Market Revenues & Volume, 2021 & 2031F |

3.3 Saudi Arabia Connector Market - Industry Life Cycle |

3.4 Saudi Arabia Connector Market - Porter's Five Forces |

3.5 Saudi Arabia Connector Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 Saudi Arabia Connector Market Revenues & Volume Share, By End Use, 2021 & 2031F |

4 Saudi Arabia Connector Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Growing adoption of advanced technologies in various industries in Saudi Arabia, leading to increased demand for connectors. |

4.2.2 Increasing investments in infrastructure development projects by the government, driving the need for connectors in construction and transportation sectors. |

4.2.3 Rising emphasis on renewable energy sources and smart grid projects, creating opportunities for connectors in the energy sector. |

4.3 Market Restraints |

4.3.1 High initial costs associated with advanced connector technologies may hinder market growth. |

4.3.2 Economic fluctuations and uncertainties impacting the overall investment climate in Saudi Arabia, affecting the demand for connectors. |

4.3.3 Stringent regulations and standards governing the use of connectors in different industries, leading to compliance challenges. |

5 Saudi Arabia Connector Market Trends |

6 Saudi Arabia Connector Market, By Types |

6.1 Saudi Arabia Connector Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 Saudi Arabia Connector Market Revenues & Volume, By Product, 2021-2031F |

6.1.3 Saudi Arabia Connector Market Revenues & Volume, By PCB Connectors, 2021-2031F |

6.1.4 Saudi Arabia Connector Market Revenues & Volume, By IO Connectors, 2021-2031F |

6.1.5 Saudi Arabia Connector Market Revenues & Volume, By Circular Connectors, 2021-2031F |

6.1.6 Saudi Arabia Connector Market Revenues & Volume, By Fiber Optic Connectors, 2021-2031F |

6.1.7 Saudi Arabia Connector Market Revenues & Volume, By RF Coaxial Connectors, 2021-2031F |

6.1.8 Saudi Arabia Connector Market Revenues & Volume, By Others, 2021-2031F |

6.2 Saudi Arabia Connector Market, By End Use |

6.2.1 Overview and Analysis |

6.2.2 Saudi Arabia Connector Market Revenues & Volume, By Telecom, 2021-2031F |

6.2.3 Saudi Arabia Connector Market Revenues & Volume, By Transportation, 2021-2031F |

6.2.4 Saudi Arabia Connector Market Revenues & Volume, By Automotive, 2021-2031F |

6.2.5 Saudi Arabia Connector Market Revenues & Volume, By Industrial, 2021-2031F |

6.2.6 Saudi Arabia Connector Market Revenues & Volume, By Computer & Peripherals, 2021-2031F |

6.2.7 Saudi Arabia Connector Market Revenues & Volume, By Others, 2021-2031F |

7 Saudi Arabia Connector Market Import-Export Trade Statistics |

7.1 Saudi Arabia Connector Market Export to Major Countries |

7.2 Saudi Arabia Connector Market Imports from Major Countries |

8 Saudi Arabia Connector Market Key Performance Indicators |

8.1 Adoption rate of advanced connector technologies by key industries in Saudi Arabia. |

8.2 Number of infrastructure projects in the pipeline that require connectors. |

8.3 Percentage increase in renewable energy capacity and smart grid installations in Saudi Arabia. |

8.4 Customer satisfaction levels with connector quality and reliability. |

8.5 Rate of innovation in connector design and functionality to meet industry-specific requirements. |

9 Saudi Arabia Connector Market - Opportunity Assessment |

9.1 Saudi Arabia Connector Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 Saudi Arabia Connector Market Opportunity Assessment, By End Use, 2021 & 2031F |

10 Saudi Arabia Connector Market - Competitive Landscape |

10.1 Saudi Arabia Connector Market Revenue Share, By Companies, 2024 |

10.2 Saudi Arabia Connector Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero