Saudi Arabia MVNO Market (2025-2031) | Outlook, Companies, Size, Industry, Forecast, Revenue, Growth, Value, Analysis, Share & Trends

Market Forecast By Operational Model (Reseller, Service Operator, Full MVNO), By Subscriber (Consumer, Enterprise), By Organization size (Small & Medium Enterprise, Large Enterprise), And Competitive Landscape

| Product Code: ETC4420540 | Publication Date: Jul 2023 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 64 | No. of Figures: 18 | No. of Tables: 4 |

Topics Covered in Saudi Arabia MVNO Market Report

Saudi Arabia MVNO Market Report thoroughly covers the market by operational model, subscriber and enterprise by organization size. Saudi Arabia MVNO Market Outlook report provides an unbiased and detailed analysis of the ongoing Saudi Arabia MVNO Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia MVNO Market Synopsis

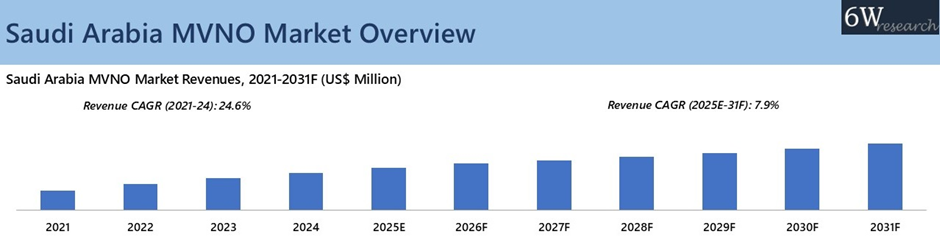

The Saudi Arabia MVNO market grew during 2021-2024, driven by Vision 2030’s emphasis on digital transformation, telecom liberalization, and competition enhancement. The Communications, Space & Technology Commission (CST) has played a central role by introducing new MVNO in 2021 and IoT-VNO frameworks in 2023, promoting fair wholesale access while encouraging private investment in digital infrastructure. Saudi Arabia ranks among the most digitally advanced nations globally, with internet penetration reaching to the population and mobile connections exceeding by 2025. Average mobile data usage surged per user per month in 2024, increasing the global average, reflecting the Kingdom’s mobile-first economy. 5G coverage has expanded to populated areas, and mobile subscriptions are projected to exceed by 2025, further boosting MVNO adoption.

According to 6Wresearch, the Saudi Arabia MVNO Market is projected to grow at a CAGR of 7.9% from 2025 to 2031. This market’s growth is underpinned by several key developments. In January 2025, STC secured a government infrastructure contract, expanding wholesale backhaul capacity for MVNOs. Meanwhile, Beyond ONE’s partnership with TIMWETECH in March 2025 introduced Direct Carrier Billing across Virgin Mobile Saudi Arabia and FRiENDi Oman, enabling users to purchase premium content via mobile wallets, an example of how fintech convergence has been transforming MVNO monetization models. Additionally, government initiatives such as the “National IT Development Program” and “Saudi Green Initiative” further align the MVNO sector with ESG and sustainability goals, encouraging investment in AI, IoT, and 5G-based service models.

Also, the telecom sector’s revenue grew from 2021 to 2024, projected to reach more by 2028, supported by strong profitability and a diversification of ICT services. Additionally, Saudi Arabia’s expanding media and entertainment industry, where video streaming occurs via mobile platforms, has been driving MVNO demand for high-data and content-bundled plans. Average daily social-media use stands more with social media identities, underscoring the high engagement potential for digital-centric MVNO offerings and driving the demand for MVNO’s in Saudi Arabia.

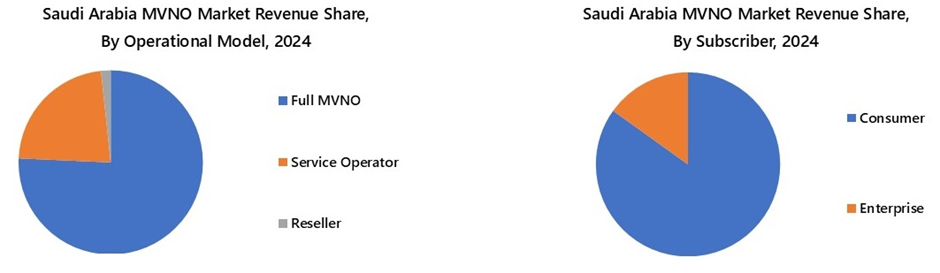

Market Segmentation By Operational Model

The full MVNO segment is expected to remain the largest in terms of revenue size and would have fastest growth by 2031 due to its ability to provide advanced, customizable services, including 5G and IoT solutions, that cater to both consumer and enterprise segments, ensuring long-term market dominance.

The service operator segment is expected to witness the fastest growth during 2025-2031 driven by the increasing demand for specialized, niche mobile services tailored to specific industries, such as IoT, M2M, and enterprise solutions. Service operators in the Kingdom are increasingly focusing on offering customized connectivity solutions, including private 5G networks and cloud-integrated mobile services, to meet the evolving needs of businesses.

Market Segmentation By Subscriber

The consumer segment would garner maximum revenue size due to the growing demand for flexible, affordable mobile plans, increasing smartphone penetration, and the expansion of digital-first MVNO offerings, including eSIM adoption. The rising mobile data consumption further driving consumer MVNO subscriptions.

Additionally, competitive pricing and value-added services such as unlimited data plans and bundled entertainment services would continue attracting a large user base. However, the enterprise segment would experience the fastest CAGR growth during 2025-2031 due to the rising adoption of IoT and M2M solutions, driven by smart city projects and industrial automation. Businesses would increasingly rely on MVNOs for tailored connectivity solutions, including private 5G networks and cloud-integrated mobile services.

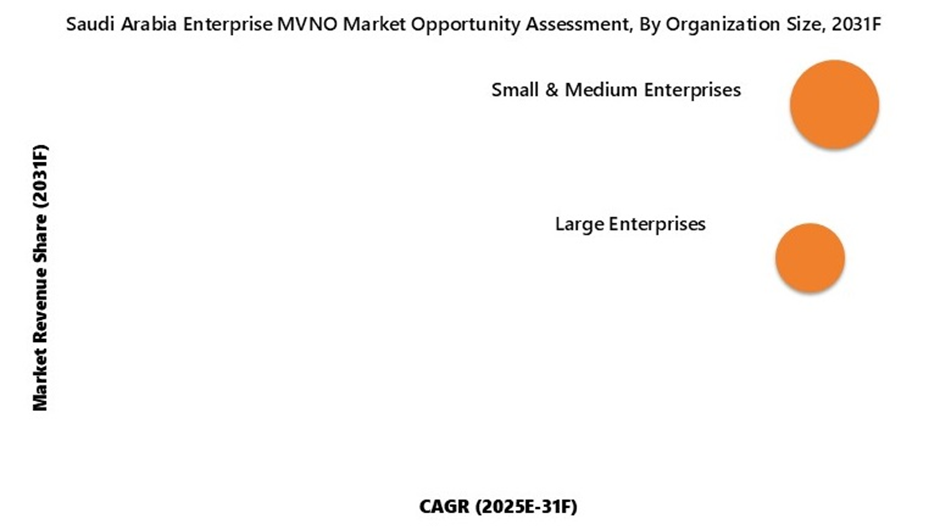

Market Segmentation By Organization Size

The small and medium enterprise (SME) segment is expected to capture the largest revenue size, driven by the increasing reliance on cost-effective, scalable mobile solutions. SMEs are increasingly adopting digital transformation strategies, including cloud-based services, mobile workforce management, and connectivity solutions. The rise in demand for flexible, customized mobile plans and the ability to scale as businesses grow would contribute significantly to their share of the MVNO market.

Additionally, the SME segment would also experience the fastest growth rate through 2025-2031 due to the rapid adoption of IoT and M2M solutions in sectors such as logistics, manufacturing, and retail. The growing focus on automation and smart technologies will increase the demand for specialized mobile services, making MVNOs an attractive option for SMEs looking to implement advanced mobile solutions at competitive prices.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia MVNO Market Overview

- Saudi Arabia MVNO Market Outlook

- Saudi Arabia MVNO Market Forecast

- Historical Data and Forecast of Saudi Arabia MVNO Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Market Revenues, By Operational Model, for the Period 2021-2031F

- Historical Data and Forecast of Market Revenues, By Subscriber, for the Period 2021-2031F

- Historical Data and Forecast of Market Revenues, Enterprise MVNO By Organization Size, for the Period 2021-2031F

- Saudi Arabia MVNO Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Saudi Arabia MVNO Market Trends & Evolution

- Market Opportunity Assessment

- Saudi Arabia MVNO Market Revenue Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Operational Model

- Reseller

- Service Operator

- Full MVNO

By Subscriber

- Consumer

- Enterprise

By Organization size

- Small & Medium Enterprise

- Large Enterprise

Saudi Arabia MVNO Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Global MVNO Market Overview |

| 3.1. Global MVNO Market Revenues, 2021 - 2031F |

| 4. Saudi Arabia MVNO Market Overview |

| 4.1. Saudi Arabia MVNO Market - Macroeconomic Indicators |

| 4.2. Saudi Arabia MVNO Market Revenues, 2021 - 2031F |

| 4.3. Saudi Arabia MVNO Market - Industry Life Cycle |

| 4.4. Saudi Arabia MVNO Market - Porter's Five Forces |

| 5. Saudi Arabia MVNO Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Saudi Arabia MVNO Market Trends and Evolution |

| 7. Saudi Arabia MVNO Market Overview, By Operational Model |

| 7.1 Saudi Arabia MVNO Market Revenue Share, By Operational Model, 2024 & 2031F |

| 7.1.1. Saudi Arabia MVNO Market Revenues, By Reseller, 2021-2031F |

| 7.1.2. Saudi Arabia MVNO Market Revenues, By Service Operator, 2021-2031F |

| 7.1.3. Saudi Arabia MVNO Market Revenues, By Full MVNO, 2021-2031F |

| 8. Saudi Arabia MVNO Market Overview, By Subscriber |

| 8.1 Saudi Arabia MVNO Market Revenue Share, By Subscriber, 2024 & 2031F |

| 8.1.1. Saudi Arabia MVNO Market Revenues, By Consumer, 2021-2031F |

| 8.1.2. Saudi Arabia MVNO Market Revenues, By Enterprise, 2021-2031F |

| 9. Saudi Arabia Enterprise MVNO Market Overview, By Organization Size |

| 9.1 Saudi Arabia Enterprise MVNO Market Revenue Share, By Organisation Size, 2024 & 2031F |

| 9.1.1. Saudi Arabia Enterprise MVNO Market Revenue Share, By Small & Medium Enterprise, 2021-2031F |

| 9.1.2. Saudi Arabia Enterprise MVNO Market Revenue Share, By Large Enterprise, 2021-2031F |

| 10. Saudi Arabia MVNO Market Key Performance Indicators |

| 11. Saudi Arabia MVNO Market Opportunity Assessment |

| 11.1. Saudi Arabia MVNO Market Opportunity Assessment, By Operational Model, 2031F |

| 11.2. Saudi Arabia MVNO Market Opportunity Assessment, By Subscriber, 2031F |

| 11.3. Saudi Arabia MVNO Market Opportunity Assessment, Enterprise MVNO By Organisation Size, 2031F |

| 12. Saudi Arabia MVNO Market Competitive Landscape |

| 12.1. Saudi Arabia MVNO Market Revenue Ranking, By Top 3 Companies, CY2024 |

| 12.2. Saudi Arabia MVNO Market Competitive Benchmarking, By Operating Parameters |

| 12.3. Saudi Arabia MVNO Market Competitive Benchmarking, By Technical Parameters |

| 13. Company Profiles |

| 13.1. Virgin Mobile Middle East and Africa |

| 13.2. Lebara Mobile Limited |

| 13.3. Yaqoot by Zain KSA |

| 13.4. Jawwy by STC |

| 13.5. Etihad Salam Telecom Company (Salam) |

| 13.6. Future Networks Communications Company |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Global MVNO Market Revenues, 2021-2031F ($ Million) |

| 2. Saudi Arabia Real GDP Growth, YOY Change, 2021-2026F & 2030F, (in %) |

| 3. Saudi Arabia General Government Gross Debt 2021-2026F, (% of GDP) |

| 4. Saudi Arabia MVNO Market Revenues, 2021-2031F ($ Million) |

| 5. Saudi Arabia Total Number of Cellular Mobile Connections (Excluding Cellular IOT Connections), 2023–2025 (In Million) |

| 6. Saudi Arabia Number of Individual Using the Internet, 2019–2025 (In Million) |

| 7. Saudi Arabia MVNO Market Revenue Share, By Operational Model, 2024 & 2031F |

| 8. Saudi Arabia MVNO Market Revenue Share, By Subscriber, 2024 & 2031F |

| 9. Saudi Arabia Enterprise MVNO Market Revenue Share, By Organization Size, 2024 & 2031F |

| 10. Saudi Arabia Telecom Sector Revenue, 2021-2025F (In $ Billion) |

| 11. Saudi Arabia YoY Growth Rate of Telecom Sector Revenue, 2021-2025F (In %) |

| 12. Saudi Arabia Telecom Sector Net Income and Net Margin, 2021-2025F (In $ Billion) |

| 13. Saudi Arabia Weekly Online Video Viewing by Internet Users, Aged 16+, As of 2024 |

| 14. Saudi Arabia Number of Subscribers of Major Streaming Platforms as on 2024 |

| 15. Saudi Arabia MVNO Market Opportunity Assessment, By Operational Model, 2031F |

| 16. Saudi Arabia MVNO Market Opportunity Assessment, By Subscriber, 2031F |

| 17. Saudi Arabia Enterprise MVNO Market Opportunity Assessment, By Organization Size, 2031F |

| 18. Saudi Arabia MVNO Market Revenue Ranking, By Top 3 Companies, CY2024 |

| List of Table |

| 1. Saudi Arabia Key Figures, 2024-2025E & 2030F |

| 2. Saudi Arabia MVNO Market Revenues, By Operational Model, 2021-2031F ($ Million) |

| 3. Saudi Arabia MVNO Market Revenues, By Subscriber, 2021-2031F ($ Million) |

| 4. Saudi Arabia Enterprise MVNO Market Revenues, By Organization Size, 2021-2031F ($ Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Iraq Insulation and Waterproofing Market (2026-2032) | Outlook, Drivers, Growth, Size, Share, Industry, Revenue, Trends, Demand, Competitive, Strategic Insights, Opportunities, Segments, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Value, Segmentation, Forecast, Restraints

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero