Singapore Sodium Phosphate Market (2025-2031) Outlook | Forecast, Analysis, Trends, Value, Share, Size, Growth, Companies, Revenue, Industry

| Product Code: ETC192579 | Publication Date: May 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 60 | No. of Figures: 40 | No. of Tables: 7 |

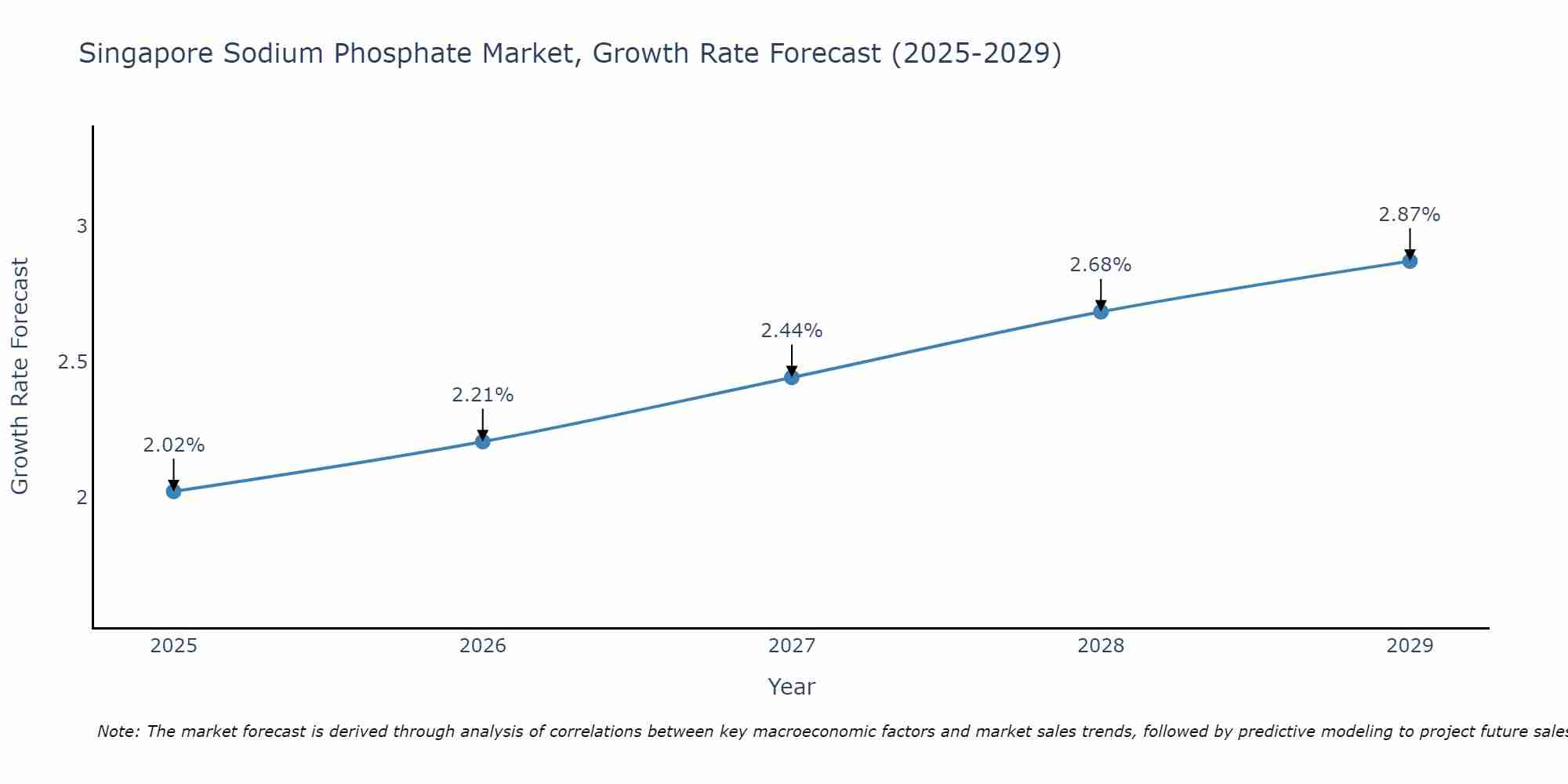

Singapore Sodium Phosphate Market Size Growth Rate

The Singapore Sodium Phosphate Market is poised for steady growth rate improvements from 2025 to 2029. The growth rate starts at 2.02% in 2025 and reaches 2.87% by 2029.

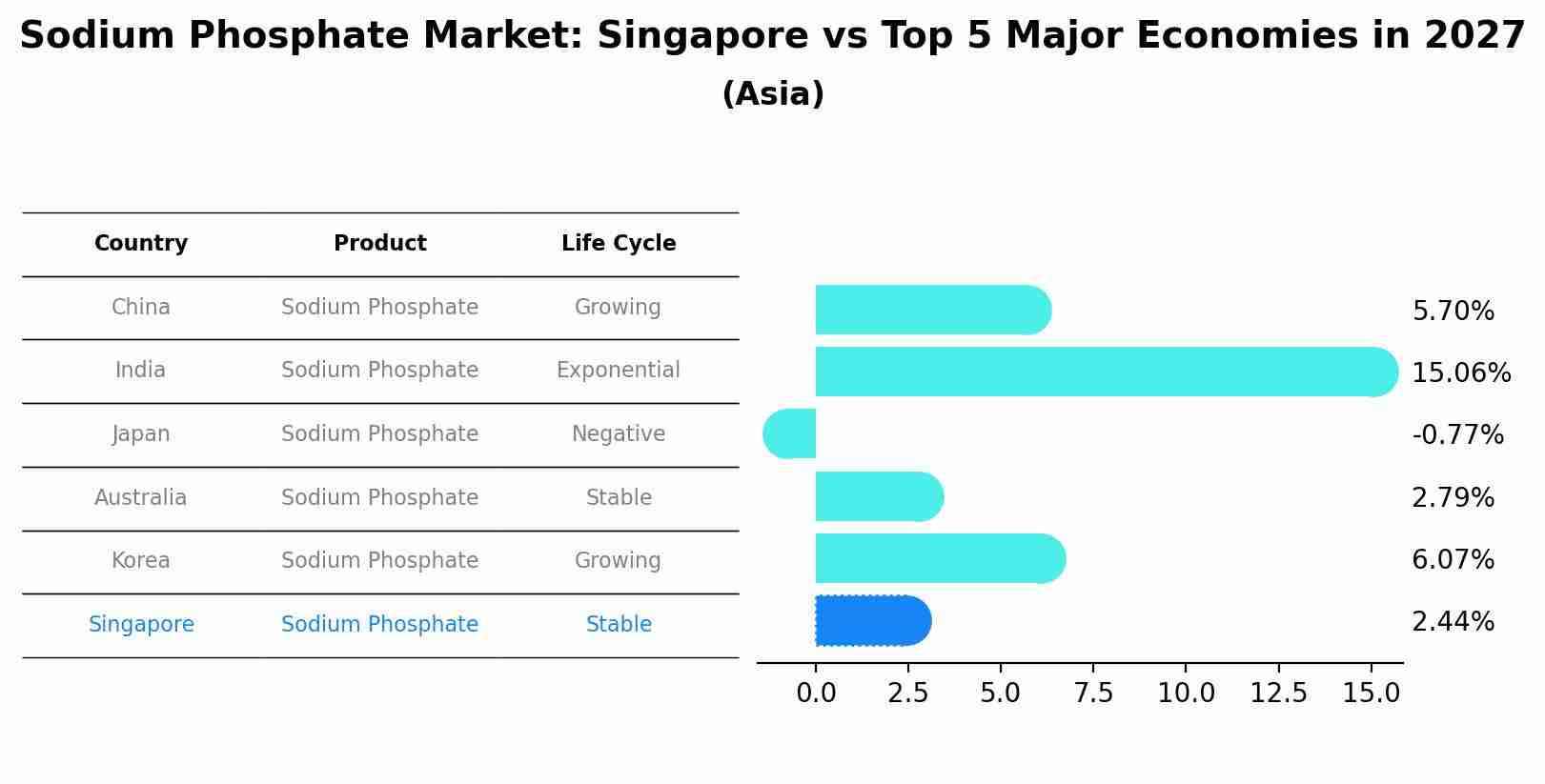

Sodium Phosphate Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Sodium Phosphate market in Singapore is projected to expand at a stable growth rate of 2.44% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Singapore Sodium Phosphate Market Synopsis

The Singapore sodium phosphate market is poised for growth due to its widespread applications in food processing, pharmaceuticals, and detergents. Sodium phosphate salts are essential additives in the food industry, serving as emulsifiers, stabilizers, and acidity regulators. With Singapore thriving food processing industry and the increasing demand for processed foods, the market for sodium phosphate is expected to expand. Additionally, sodium phosphate compounds are used in various medical and pharmaceutical applications, such as buffering agents and laxatives, further contributing to market growth. However, manufacturers should pay attention to regulatory requirements related to the use of sodium phosphate in food products, as changes in regulations can impact the market.

Drivers of the Market

The Singapore sodium phosphate market is poised for growth, primarily due to its applications in food processing, pharmaceuticals, and water treatment. Sodium phosphate compounds are used as food additives, buffering agents in pharmaceuticals, and water softeners. As Singapore food and pharmaceutical industries expand, the demand for sodium phosphate is expected to rise. Moreover, stringent water quality regulations are driving the adoption of water treatment chemicals, including sodium phosphate, to mitigate water hardness and other issues. Sustainable and safe usage practices are becoming critical in this market, with a focus on minimizing environmental impacts.

Challenges of the Market

The sodium phosphate market in Singapore is driven by its use in food processing, pharmaceuticals, and water treatment. Challenges include the need for consistent quality and purity standards to meet regulatory requirements. Sustainability concerns related to phosphate pollution and resource depletion may also affect market dynamics, leading to the development of eco-friendly alternatives.

COVID-19 Impact on the Market

The Singapore sodium phosphate market, predominantly used in food and pharmaceutical industries, was not immune to the impacts of COVID-19. During the initial phases of the pandemic, panic buying and disruptions in supply chains led to fluctuations in the sodium phosphate market. The food industry, in particular, saw erratic demand patterns as restaurants closed, and consumer preferences shifted. However, as the situation evolved, the market adapted to the changing consumer behavior, and demand stabilized. With the growing emphasis on health and nutrition, the demand for sodium phosphate in the food and pharmaceutical sectors is expected to recover and potentially witness long-term growth.

Key Players in the Market

The Singapore sodium phosphate market is expected to witness steady growth in the coming years. Sodium phosphate is widely used in the food and beverage industry as a food additive and in the pharmaceutical sector for various applications. Prominent players in the Singapore sodium phosphate market include Tata Chemicals, Merck Group, and Innophos Holdings Inc.

Key Highlights of the Report:

- Singapore Sodium Phosphate Market Outlook

- Market Size of Singapore Sodium Phosphate Market, 2024

- Forecast of Singapore Sodium Phosphate Market, 2031

- Historical Data and Forecast of Singapore Sodium Phosphate Revenues & Volume for the Period 2021-2031

- Singapore Sodium Phosphate Market Trend Evolution

- Singapore Sodium Phosphate Market Drivers and Challenges

- Singapore Sodium Phosphate Price Trends

- Singapore Sodium Phosphate Porter's Five Forces

- Singapore Sodium Phosphate Industry Life Cycle

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Online Retailing for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Offline Retailing for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Leavening & Emulsifying Agent for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Processed Food Stabilizing for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By pH Balance & Saline Laxatives for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Other for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By End-Use for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Food & Beverage Industry for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Medical & Pharmaceutical for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Personal Care & Water Treatment for the Period 2021-2031

- Historical Data and Forecast of Singapore Sodium Phosphate Market Revenues & Volume By Others for the Period 2021-2031

- Singapore Sodium Phosphate Import Export Trade Statistics

- Market Opportunity Assessment By Distribution Channel

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End-Use

- Singapore Sodium Phosphate Top Companies Market Share

- Singapore Sodium Phosphate Competitive Benchmarking By Technical and Operational Parameters

- Singapore Sodium Phosphate Company Profiles

- Singapore Sodium Phosphate Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Singapore Sodium Phosphate Market Overview |

3.1 Singapore Country Macro Economic Indicators |

3.2 Singapore Sodium Phosphate Market Revenues & Volume, 2021 & 2031F |

3.3 Singapore Sodium Phosphate Market - Industry Life Cycle |

3.4 Singapore Sodium Phosphate Market - Porter's Five Forces |

3.5 Singapore Sodium Phosphate Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

3.6 Singapore Sodium Phosphate Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.7 Singapore Sodium Phosphate Market Revenues & Volume Share, By End-Use, 2021 & 2031F |

4 Singapore Sodium Phosphate Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for sodium phosphate in food processing and pharmaceutical industries |

4.2.2 Growing awareness about the benefits of using sodium phosphate in water treatment and cleaning applications |

4.2.3 Favorable government regulations supporting the use of sodium phosphate in various industrial sectors |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials used in the production of sodium phosphate |

4.3.2 Environmental concerns related to the disposal of sodium phosphate waste |

4.3.3 Competition from alternative chemicals and substitutes in the market |

5 Singapore Sodium Phosphate Market Trends |

6 Singapore Sodium Phosphate Market, By Types |

6.1 Singapore Sodium Phosphate Market, By Distribution Channel |

6.1.1 Overview and Analysis |

6.1.2 Singapore Sodium Phosphate Market Revenues & Volume, By Distribution Channel, 2021-2031F |

6.1.3 Singapore Sodium Phosphate Market Revenues & Volume, By Online Retailing, 2021-2031F |

6.1.4 Singapore Sodium Phosphate Market Revenues & Volume, By Offline Retailing, 2021-2031F |

6.2 Singapore Sodium Phosphate Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Singapore Sodium Phosphate Market Revenues & Volume, By Leavening & Emulsifying Agent, 2021-2031F |

6.2.3 Singapore Sodium Phosphate Market Revenues & Volume, By Processed Food Stabilizing, 2021-2031F |

6.2.4 Singapore Sodium Phosphate Market Revenues & Volume, By pH Balance & Saline Laxatives, 2021-2031F |

6.2.5 Singapore Sodium Phosphate Market Revenues & Volume, By Other, 2021-2031F |

6.3 Singapore Sodium Phosphate Market, By End-Use |

6.3.1 Overview and Analysis |

6.3.2 Singapore Sodium Phosphate Market Revenues & Volume, By Food & Beverage Industry, 2021-2031F |

6.3.3 Singapore Sodium Phosphate Market Revenues & Volume, By Medical & Pharmaceutical, 2021-2031F |

6.3.4 Singapore Sodium Phosphate Market Revenues & Volume, By Personal Care & Water Treatment, 2021-2031F |

6.3.5 Singapore Sodium Phosphate Market Revenues & Volume, By Others, 2021-2031F |

7 Singapore Sodium Phosphate Market Import-Export Trade Statistics |

7.1 Singapore Sodium Phosphate Market Export to Major Countries |

7.2 Singapore Sodium Phosphate Market Imports from Major Countries |

8 Singapore Sodium Phosphate Market Key Performance Indicators |

8.1 Number of new product launches incorporating sodium phosphate |

8.2 Percentage of companies adopting sustainable practices in sodium phosphate production |

8.3 Growth in research and development investments in sodium phosphate applications |

8.4 Rate of adoption of sodium phosphate in emerging industries |

8.5 Number of regulatory approvals for sodium phosphate use in different sectors |

9 Singapore Sodium Phosphate Market - Opportunity Assessment |

9.1 Singapore Sodium Phosphate Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

9.2 Singapore Sodium Phosphate Market Opportunity Assessment, By Application, 2021 & 2031F |

9.3 Singapore Sodium Phosphate Market Opportunity Assessment, By End-Use, 2021 & 2031F |

10 Singapore Sodium Phosphate Market - Competitive Landscape |

10.1 Singapore Sodium Phosphate Market Revenue Share, By Companies, 2024 |

10.2 Singapore Sodium Phosphate Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero