United States (US) AC Electric Motor Sales in Oil & Gas Market (2025-2031) Outlook | Value, Companies, Forecast, Revenue, Analysis, Share, Trends, Size, Growth & Industry

| Product Code: ETC4528622 | Publication Date: Jul 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Vasudha | No. of Pages: 85 | No. of Figures: 45 | No. of Tables: 25 |

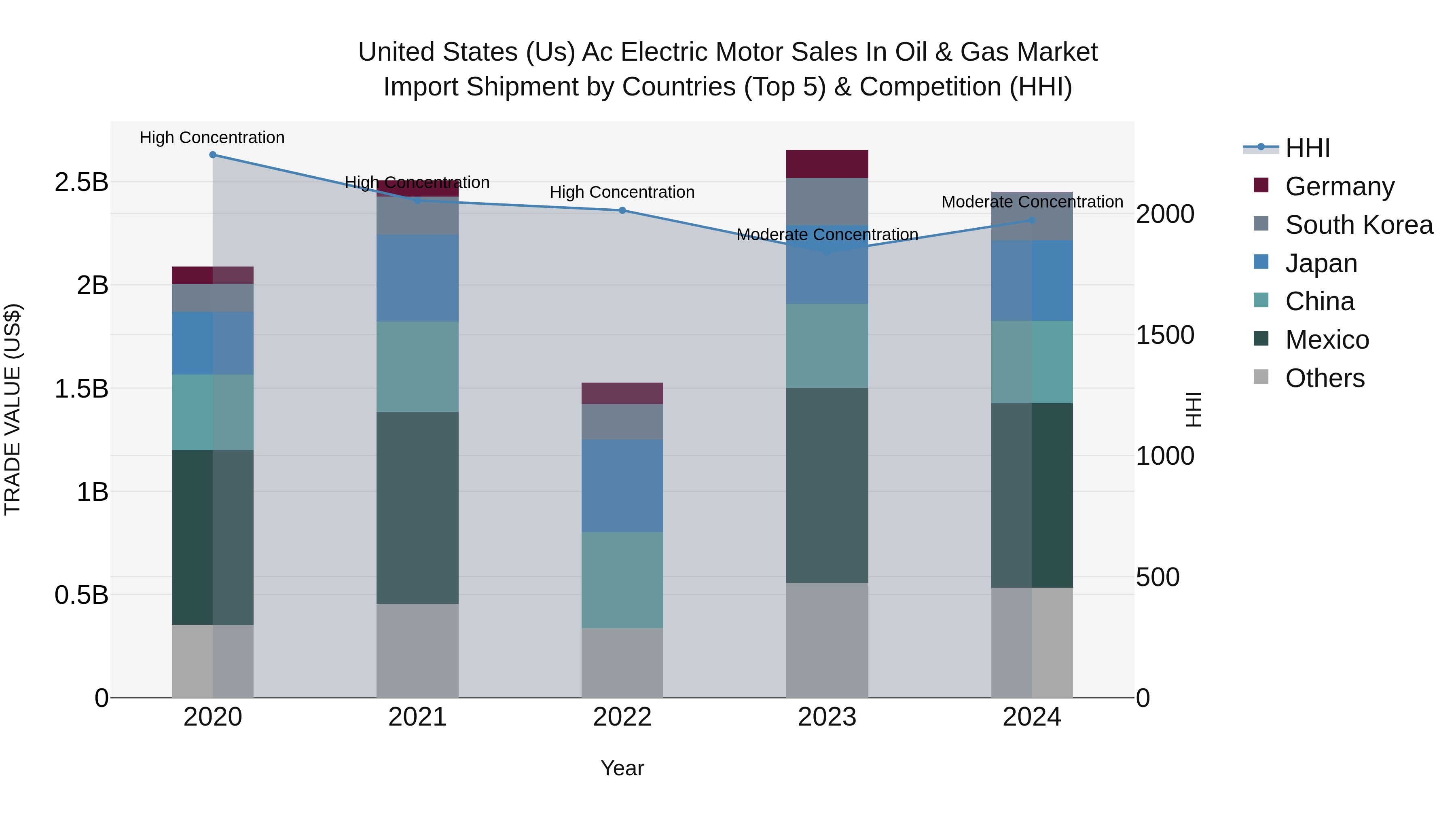

United States (US) Ac Electric Motor Sales in Oil & Gas Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, the United States saw a steady CAGR of 4.07% in AC electric motor sales within oil & gas import shipments. Despite a slight decline of -7.61% in growth rate from 2023 to 2024, the market remained relatively stable. Key exporting countries to the USA included Mexico, China, Japan, South Korea, and Vietnam, highlighting a diverse supply chain. With a moderate concentration level indicated by the HHI, the market for AC electric motors in the oil & gas sector continues to show resilience and potential for growth.

United States (US) AC Electric Motor Sales in Oil & Gas Market Synopsis

The United States AC Electric Motor Sales in the Oil & Gas market is experiencing steady growth due to the increasing demand for energy production and exploration activities in the region. The market is driven by factors such as technological advancements in motor efficiency, rising investments in shale gas and offshore drilling projects, and the need for equipment replacement and maintenance. Major players in the industry are focusing on developing energy-efficient motors to meet the stringent regulatory requirements and reduce operational costs for oil and gas companies. Additionally, the growing adoption of automation and digitalization in the industry is further propelling the demand for AC electric motors. Overall, the US AC Electric Motor Sales in the Oil & Gas market is poised for continued expansion in the coming years.

United States (US) AC Electric Motor Sales in Oil & Gas Market Trends

The US AC Electric Motor Sales in Oil & Gas Market is experiencing growth due to increasing investments in oil and gas exploration and production activities. Key trends include the adoption of high-efficiency motors to reduce energy consumption and operational costs, as well as the integration of advanced technologies such as IoT and data analytics for predictive maintenance. Opportunities exist for manufacturers to develop customized motor solutions that meet the specific requirements of oil and gas applications, such as high torque and variable speed capabilities. With a focus on sustainability and environmental regulations, there is also a growing demand for motors that are energy-efficient and environmentally friendly. Overall, the market presents opportunities for innovation and collaboration to meet the evolving needs of the oil and gas industry.

United States (US) AC Electric Motor Sales in Oil & Gas Market Challenges

In the US AC Electric Motor Sales in the Oil & Gas market, several challenges are prevalent. These include the fluctuations in oil prices that directly impact investment decisions and demand for new equipment, the increasing emphasis on energy efficiency and sustainability driving the need for more advanced and eco-friendly motor technologies, and the competitive landscape with numerous players offering similar products. Additionally, the volatility in the oil and gas industry due to geopolitical factors and regulatory changes poses a risk to sales forecasts and market growth. Moreover, the shift towards renewable energy sources may also impact the demand for traditional AC electric motors in the sector, necessitating companies to adapt their product offerings and strategies to stay competitive in a changing market environment.

United States (US) AC Electric Motor Sales in Oil & Gas Market Investment Opportunities

The United States AC electric motor sales in the oil & gas market are primarily driven by the increasing demand for energy-efficient and reliable motor systems within the industry. As the oil & gas sector focuses on optimizing operations and reducing energy consumption, the adoption of high-efficiency AC electric motors has become crucial. Additionally, stringent regulations regarding energy efficiency and environmental impact have led companies to invest in more sustainable motor solutions. The need for improved performance, enhanced productivity, and cost savings also contribute to the growth of AC electric motor sales in the oil & gas market. Technological advancements in motor design, such as variable frequency drives and smart motor systems, further propel the market by offering better control and monitoring capabilities.

United States (US) AC Electric Motor Sales in Oil & Gas Market Government Policie

In the United States, government policies related to AC electric motor sales in the oil & gas market primarily focus on energy efficiency, environmental regulations, and safety standards. The Department of Energy (DOE) sets minimum energy efficiency requirements for motors to promote the use of high-efficiency technologies in the oil & gas industry. Additionally, the Environmental Protection Agency (EPA) enforces emissions standards to reduce the environmental impact of motor operations. Safety regulations from agencies like the Occupational Safety and Health Administration (OSHA) ensure that motors are installed and operated safely in oil & gas facilities. Overall, these policies aim to drive the adoption of energy-efficient and environmentally friendly AC electric motors while maintaining a high level of safety in the oil & gas sector.

United States (US) AC Electric Motor Sales in Oil & Gas Market Future Outlook

The future outlook for AC electric motor sales in the US oil & gas market is expected to be positive, driven by the increasing adoption of electric motor-driven equipment for efficient operations and growing investments in oil and gas exploration and production activities. The demand for AC electric motors is likely to be fueled by the industry`s focus on reducing energy consumption, improving operational efficiency, and meeting stringent environmental regulations. Additionally, advancements in motor technology, such as the development of high-efficiency motors and smart motor systems, are anticipated to further drive the market growth. Overall, the US AC electric motor sales in the oil & gas market are poised for steady expansion in the coming years, supported by the industry`s ongoing efforts to enhance productivity and sustainability.

Key Highlights of the Report:

- United States (US) AC Electric Motor Sales in Oil & Gas Market Outlook

- Market Size of United States (US) AC Electric Motor Sales in Oil & Gas Market, 2024

- Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market, 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Revenues & Volume for the Period 2021 - 2031

- United States (US) AC Electric Motor Sales in Oil & Gas Market Trend Evolution

- United States (US) AC Electric Motor Sales in Oil & Gas Market Drivers and Challenges

- United States (US) AC Electric Motor Sales in Oil & Gas Price Trends

- United States (US) AC Electric Motor Sales in Oil & Gas Porter's Five Forces

- United States (US) AC Electric Motor Sales in Oil & Gas Industry Life Cycle

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By Induction & Synchronous for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By Voltage for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By < 1 KV for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By 1-6.6 kV for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By > 6.6 kV for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By Output Power (HP) for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By < 1 HP for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By > 1 HP for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By Output Power (kW) for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By 0.12-7.5 kW for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By 7.5-110 kW for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By 110-1000 kW for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume By > 1000 kW for the Period 2021 - 2031

- United States (US) AC Electric Motor Sales in Oil & Gas Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Voltage

- Market Opportunity Assessment By Output Power (HP)

- Market Opportunity Assessment By Output Power (kW)

- United States (US) AC Electric Motor Sales in Oil & Gas Top Companies Market Share

- United States (US) AC Electric Motor Sales in Oil & Gas Competitive Benchmarking By Technical and Operational Parameters

- United States (US) AC Electric Motor Sales in Oil & Gas Company Profiles

- United States (US) AC Electric Motor Sales in Oil & Gas Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) AC Electric Motor Sales in Oil & Gas Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) AC Electric Motor Sales in Oil & Gas Market - Industry Life Cycle |

3.4 United States (US) AC Electric Motor Sales in Oil & Gas Market - Porter's Five Forces |

3.5 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume Share, By Voltage, 2021 & 2031F |

3.7 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume Share, By Output Power (HP), 2021 & 2031F |

3.8 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume Share, By Output Power (kW), 2021 & 2031F |

4 United States (US) AC Electric Motor Sales in Oil & Gas Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing exploration and production activities in the US oil gas sector |

4.2.2 Growing focus on energy efficiency and sustainability in the industry |

4.2.3 Technological advancements leading to the adoption of more efficient AC electric motors in oil gas applications |

4.3 Market Restraints |

4.3.1 Volatility in oil prices affecting investment decisions in the sector |

4.3.2 Regulatory challenges and environmental concerns impacting the oil gas market |

4.3.3 Competition from alternative energy sources like renewables affecting demand for traditional oil gas equipment |

5 United States (US) AC Electric Motor Sales in Oil & Gas Market Trends |

6 United States (US) AC Electric Motor Sales in Oil & Gas Market, By Types |

6.1 United States (US) AC Electric Motor Sales in Oil & Gas Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By Type, 2021 - 2031F |

6.1.3 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By Induction & Synchronous, 2021 - 2031F |

6.2 United States (US) AC Electric Motor Sales in Oil & Gas Market, By Voltage |

6.2.1 Overview and Analysis |

6.2.2 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By < 1 KV, 2021 - 2031F |

6.2.3 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By 1-6.6 kV, 2021 - 2031F |

6.2.4 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By > 6.6 kV, 2021 - 2031F |

6.3 United States (US) AC Electric Motor Sales in Oil & Gas Market, By Output Power (HP) |

6.3.1 Overview and Analysis |

6.3.2 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By < 1 HP, 2021 - 2031F |

6.3.3 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By > 1 HP, 2021 - 2031F |

6.4 United States (US) AC Electric Motor Sales in Oil & Gas Market, By Output Power (kW) |

6.4.1 Overview and Analysis |

6.4.2 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By 0.12-7.5 kW, 2021 - 2031F |

6.4.3 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By 7.5-110 kW, 2021 - 2031F |

6.4.4 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By 110-1000 kW, 2021 - 2031F |

6.4.5 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenues & Volume, By > 1000 kW, 2021 - 2031F |

7 United States (US) AC Electric Motor Sales in Oil & Gas Market Import-Export Trade Statistics |

7.1 United States (US) AC Electric Motor Sales in Oil & Gas Market Export to Major Countries |

7.2 United States (US) AC Electric Motor Sales in Oil & Gas Market Imports from Major Countries |

8 United States (US) AC Electric Motor Sales in Oil & Gas Market Key Performance Indicators |

8.1 Energy efficiency improvements in AC electric motors used in oil gas operations |

8.2 Adoption rate of advanced AC electric motor technologies in the industry |

8.3 Maintenance cost reduction achieved through the use of AC electric motors in oil gas applications |

9 United States (US) AC Electric Motor Sales in Oil & Gas Market - Opportunity Assessment |

9.1 United States (US) AC Electric Motor Sales in Oil & Gas Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 United States (US) AC Electric Motor Sales in Oil & Gas Market Opportunity Assessment, By Voltage, 2021 & 2031F |

9.3 United States (US) AC Electric Motor Sales in Oil & Gas Market Opportunity Assessment, By Output Power (HP), 2021 & 2031F |

9.4 United States (US) AC Electric Motor Sales in Oil & Gas Market Opportunity Assessment, By Output Power (kW), 2021 & 2031F |

10 United States (US) AC Electric Motor Sales in Oil & Gas Market - Competitive Landscape |

10.1 United States (US) AC Electric Motor Sales in Oil & Gas Market Revenue Share, By Companies, 2024 |

10.2 United States (US) AC Electric Motor Sales in Oil & Gas Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero