United States (US) Entrance Matting Market Outlook | Value, Trends, Forecast, Size, Share, Industry, Companies, Analysis, COVID-19 IMPACT, Revenue & Growth

| Product Code: ETC291361 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Vasudha | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

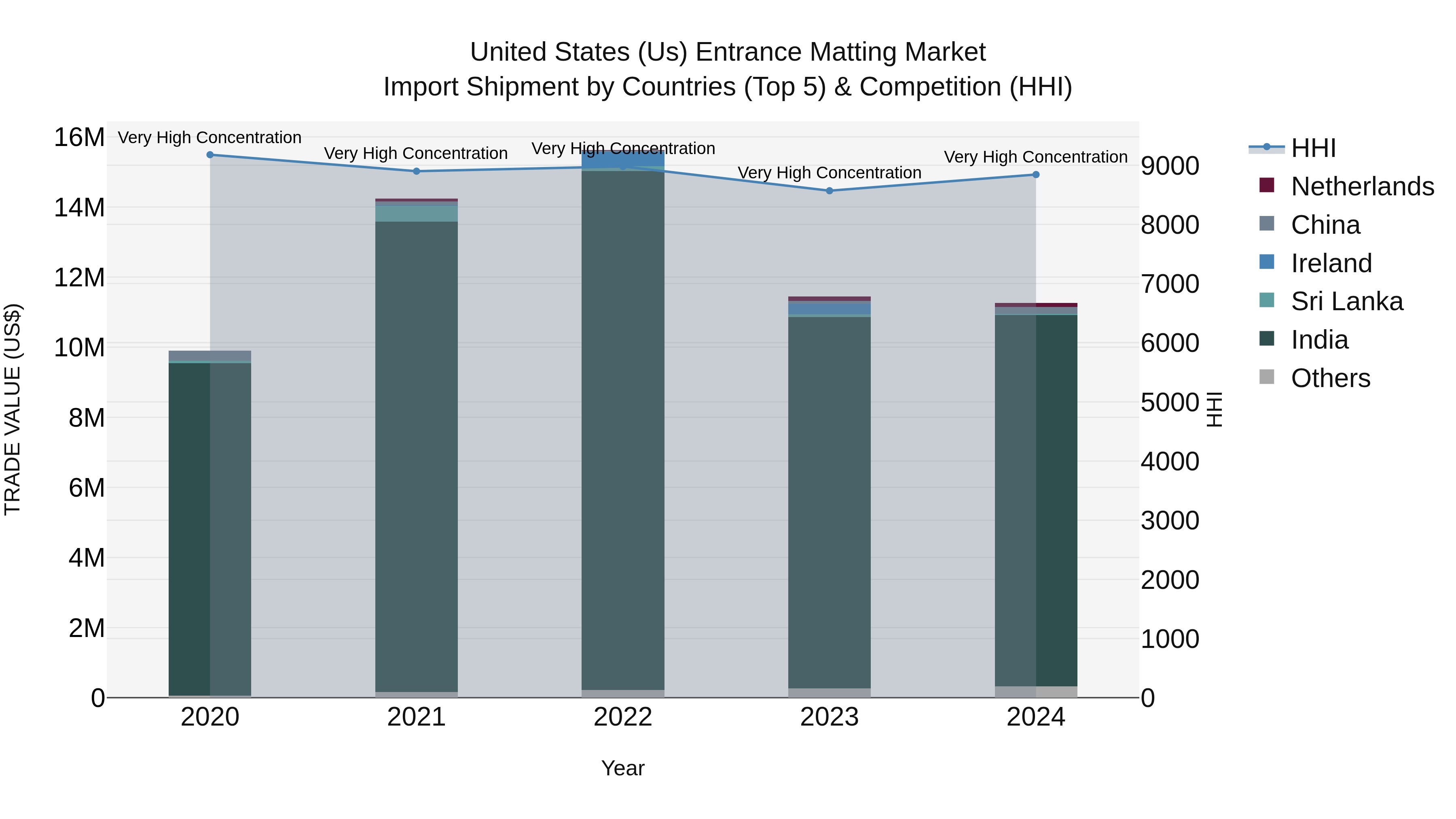

United States (US) Entrance Matting Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, the United States continued to be a key importer of entrance matting, with top exporting countries including India, China, Turkey, Netherlands, and Vietnam. Despite high concentration with a high Herfindahl-Hirschman Index (HHI), the industry maintained a steady compound annual growth rate (CAGR) of 3.28% from 2020 to 2024. However, there was a slight decline in growth rate from 2023 to 2024 at -1.6%, indicating a potential shift in market dynamics that importers and stakeholders should monitor closely.

USA Export Potential Assessment For Entrance Matting Market (Values in USD Thousand)

United States (US) Entrance Matting Market Overview

The United States Entrance Matting Market is a growing industry driven by factors such as increasing awareness about safety and hygiene, stringent regulations for workplace safety, and the rising focus on enhancing aesthetics in commercial and residential spaces. The market offers a wide range of entrance matting solutions, including rubber, carpet, vinyl, and aluminum mats, catering to various end-user industries such as retail, hospitality, healthcare, and education. With the growing emphasis on sustainability and eco-friendly products, manufacturers are introducing innovative and sustainable entrance matting options to meet consumer demands. The market is also witnessing a shift towards customized and branded entrance matting solutions to create a unique and impactful first impression. Overall, the US Entrance Matting Market is poised for steady growth, driven by evolving consumer preferences and the increasing importance of safety and cleanliness in public spaces.

United States (US) Entrance Matting Market Trends

Currently, the US Entrance Matting Market is experiencing a growing demand for sustainable and eco-friendly matting solutions due to increasing awareness about environmental impact. There is a shift towards innovative entrance matting technologies that offer superior durability, moisture absorption, and dirt trapping capabilities. Anti-slip and anti-fatigue properties are also becoming increasingly important features in entrance matting products, especially in high-traffic commercial settings. Additionally, customization options, such as logo mats and personalized designs, are gaining popularity as businesses seek to enhance their branding and create a unique entrance experience. With the ongoing emphasis on cleanliness and safety, entrance matting solutions that provide easy cleaning and maintenance are expected to continue driving the market growth in the US.

United States (US) Entrance Matting Market Challenges

In the US Entrance Matting Market, some of the key challenges faced include increasing competition from both domestic and international manufacturers, fluctuating raw material costs impacting profit margins, and a growing demand for sustainable and environmentally friendly products. Another challenge is the need for continuous innovation to meet changing customer preferences and technological advancements. Additionally, the market faces regulatory challenges related to compliance with safety and quality standards, which can increase production costs. Furthermore, the COVID-19 pandemic has disrupted supply chains and led to uncertainties in the market landscape, impacting both production and sales. Overall, companies operating in the US Entrance Matting Market need to navigate these challenges effectively to stay competitive and sustain growth in the industry.

United States (US) Entrance Matting Market Investment Opportunities

The US Entrance Matting Market presents promising investment opportunities due to factors such as the growing emphasis on safety and cleanliness in commercial and residential spaces. With the increasing awareness of the importance of maintaining a clean and safe environment, there is a rising demand for high-quality entrance matting solutions that can effectively trap dirt and moisture. Investing in innovative entrance matting technologies, eco-friendly materials, and customizable design options can cater to the evolving needs of businesses and consumers. Furthermore, with the construction industry booming and the hospitality sector looking to enhance customer experiences, there is a significant market potential for entrance matting products that offer durability, functionality, and aesthetic appeal. Overall, the US Entrance Matting Market offers opportunities for investors to capitalize on the demand for solutions that improve indoor air quality, reduce maintenance costs, and enhance the overall safety of spaces.

United States (US) Entrance Matting Market Government Policy

Government policies related to the US Entrance Matting Market primarily focus on safety and accessibility regulations. The Americans with Disabilities Act (ADA) requires that entrance mats in public buildings comply with specific guidelines to ensure they are slip-resistant and do not present a tripping hazard. Additionally, the Occupational Safety and Health Administration (OSHA) mandates that entrance mats in workplaces meet certain standards to prevent slips, trips, and falls, which can result in costly injuries and liabilities for businesses. These regulations influence the design, material, and placement of entrance mats in various settings to promote safety and accessibility for all individuals entering a building. Compliance with these government policies is essential for businesses to avoid fines and legal consequences while also prioritizing the well-being of employees and visitors.

United States (US) Entrance Matting Market Future Outlook

The United States Entrance Matting Market is expected to witness steady growth in the coming years due to factors such as increased awareness about safety and cleanliness, growing emphasis on sustainable building practices, and the rise in commercial construction activities. The market is likely to be driven by the demand for high-performance entrance matting solutions that offer enhanced durability, aesthetics, and functionality. Furthermore, the ongoing trend of smart buildings and the integration of advanced technologies in entrance matting products are anticipated to propel market growth. With an increasing focus on maintaining hygiene standards and ensuring safe indoor environments, the US Entrance Matting Market is poised for expansion, offering opportunities for manufacturers to innovate and cater to evolving customer needs.

Key Highlights of the Report:

- United States (US) Entrance Matting Market Outlook

- Market Size of United States (US) Entrance Matting Market, 2021

- Forecast of United States (US) Entrance Matting Market, 2031

- Historical Data and Forecast of United States (US) Entrance Matting Revenues & Volume for the Period 2018 - 2031

- United States (US) Entrance Matting Market Trend Evolution

- United States (US) Entrance Matting Market Drivers and Challenges

- United States (US) Entrance Matting Price Trends

- United States (US) Entrance Matting Porter's Five Forces

- United States (US) Entrance Matting Industry Life Cycle

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Type for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Walk-off for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Anti-fatigue for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Logo for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Specialty for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Material for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Nylon for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Coir for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Rubber for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Vinyl for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Others for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Jute for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Cotton for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Velvet for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Utility for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Indoor for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Entrance Matting Market Revenues & Volume By Outdoor for the Period 2018 - 2031

- United States (US) Entrance Matting Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Material

- Market Opportunity Assessment By Utility

- United States (US) Entrance Matting Top Companies Market Share

- United States (US) Entrance Matting Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Entrance Matting Company Profiles

- United States (US) Entrance Matting Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Entrance Matting Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Entrance Matting Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Entrance Matting Market - Industry Life Cycle |

3.4 United States (US) Entrance Matting Market - Porter's Five Forces |

3.5 United States (US) Entrance Matting Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 United States (US) Entrance Matting Market Revenues & Volume Share, By Material, 2021 & 2031F |

3.7 United States (US) Entrance Matting Market Revenues & Volume Share, By Utility, 2021 & 2031F |

4 United States (US) Entrance Matting Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing focus on workplace safety and cleanliness |

4.2.2 Growth in commercial and industrial construction activities |

4.2.3 Rising demand for high-quality and durable entrance matting solutions |

4.3 Market Restraints |

4.3.1 High initial cost of premium entrance matting products |

4.3.2 Limited awareness about the benefits of using entrance matting systems |

4.3.3 Competition from alternative flooring solutions |

5 United States (US) Entrance Matting Market Trends |

6 United States (US) Entrance Matting Market, By Types |

6.1 United States (US) Entrance Matting Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Entrance Matting Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 United States (US) Entrance Matting Market Revenues & Volume, By Walk-off, 2021-2031F |

6.1.4 United States (US) Entrance Matting Market Revenues & Volume, By Anti-fatigue, 2021-2031F |

6.1.5 United States (US) Entrance Matting Market Revenues & Volume, By Logo, 2021-2031F |

6.1.6 United States (US) Entrance Matting Market Revenues & Volume, By Specialty, 2021-2031F |

6.2 United States (US) Entrance Matting Market, By Material |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Entrance Matting Market Revenues & Volume, By Nylon, 2021-2031F |

6.2.3 United States (US) Entrance Matting Market Revenues & Volume, By Coir, 2021-2031F |

6.2.4 United States (US) Entrance Matting Market Revenues & Volume, By Rubber, 2021-2031F |

6.2.5 United States (US) Entrance Matting Market Revenues & Volume, By Vinyl, 2021-2031F |

6.2.6 United States (US) Entrance Matting Market Revenues & Volume, By Others, 2021-2031F |

6.2.7 United States (US) Entrance Matting Market Revenues & Volume, By Jute, 2021-2031F |

6.2.8 United States (US) Entrance Matting Market Revenues & Volume, By Velvet, 2021-2031F |

6.2.9 United States (US) Entrance Matting Market Revenues & Volume, By Velvet, 2021-2031F |

6.3 United States (US) Entrance Matting Market, By Utility |

6.3.1 Overview and Analysis |

6.3.2 United States (US) Entrance Matting Market Revenues & Volume, By Indoor, 2021-2031F |

6.3.3 United States (US) Entrance Matting Market Revenues & Volume, By Outdoor, 2021-2031F |

7 United States (US) Entrance Matting Market Import-Export Trade Statistics |

7.1 United States (US) Entrance Matting Market Export to Major Countries |

7.2 United States (US) Entrance Matting Market Imports from Major Countries |

8 United States (US) Entrance Matting Market Key Performance Indicators |

8.1 Number of commercial and industrial construction projects using entrance matting solutions |

8.2 Percentage of businesses implementing workplace safety measures including entrance matting |

8.3 Rate of adoption of innovative entrance matting technologies |

9 United States (US) Entrance Matting Market - Opportunity Assessment |

9.1 United States (US) Entrance Matting Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 United States (US) Entrance Matting Market Opportunity Assessment, By Material, 2021 & 2031F |

9.3 United States (US) Entrance Matting Market Opportunity Assessment, By Utility, 2021 & 2031F |

10 United States (US) Entrance Matting Market - Competitive Landscape |

10.1 United States (US) Entrance Matting Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Entrance Matting Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero