United States (US) Industrial Automation Oil & Gas Market (2025-2031) Outlook | Size, Companies, Forecast, Revenue, Share, Industry, Growth, Trends, Analysis & Value

| Product Code: ETC4584062 | Publication Date: Jul 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Vasudha | No. of Pages: 85 | No. of Figures: 45 | No. of Tables: 25 |

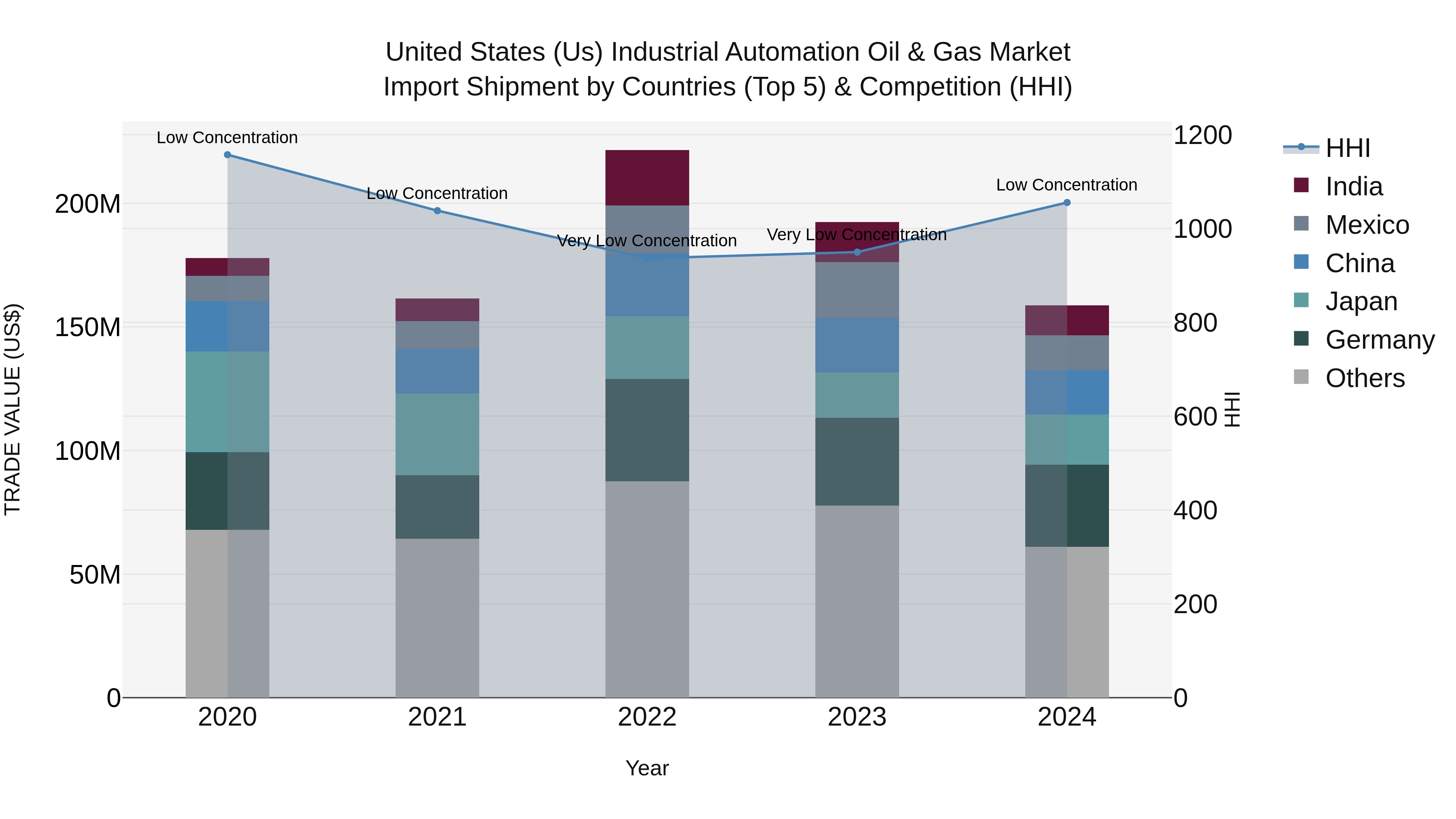

United States (US) IndUStrial Automation Oil & Gas Market Top 5 Importing Countries and Market Competition (HHI) Analysis

The United States continues to rely heavily on imports for industrial automation oil & gas equipment, with top suppliers including Germany, Japan, China, Canada, and Mexico. Despite a negative Compound Annual Growth Rate (CAGR) of -2.8% from 2020 to 2024 and a steep decline in growth rate of -17.5% from 2023 to 2024, the market concentration, as measured by the Herfindahl-Hirschman Index (HHI), remains low. This suggests a diverse and competitive landscape among the key exporting countries, providing the US with a range of options for sourcing essential automation equipment.

United States (US) Industrial Automation Oil & Gas Market Synopsis

The United States Industrial Automation Oil & Gas Market is a dynamic sector driven by technological advancements and increasing demand for efficient operations in the oil and gas industry. The market encompasses a wide range of automation solutions including distributed control systems, programmable logic controllers, supervisory control and data acquisition systems, and industrial robots. Key factors influencing market growth include the need for improved safety standards, cost reduction, and operational efficiency. The adoption of advanced technologies such as IoT, AI, and cloud computing is reshaping the industry by enabling remote monitoring, predictive maintenance, and real-time data analytics. Major players in the US Industrial Automation Oil & Gas Market include Siemens AG, ABB Ltd, Emerson Electric Co., and Schneider Electric SE, among others, who are continuously innovating to meet the evolving needs of the industry.

United States (US) Industrial Automation Oil & Gas Market Trends

The US Industrial Automation Oil & Gas Market is experiencing a shift towards digitalization and automation to increase operational efficiency and safety. Key trends include the adoption of advanced technologies such as Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and machine learning for predictive maintenance and asset optimization. There is a growing focus on cybersecurity solutions to protect critical infrastructure from cyberattacks. Opportunities lie in the integration of automation technologies to streamline processes, reduce downtime, and improve overall productivity in the oil and gas sector. Additionally, the increasing demand for energy and the need for cost reduction are driving companies to invest in innovative automation solutions. Collaborations between automation providers and oil & gas companies are crucial to capitalize on these trends and opportunities for sustainable growth.

United States (US) Industrial Automation Oil & Gas Market Challenges

In the US Industrial Automation Oil & Gas Market, challenges include the need for increased efficiency and cost-effectiveness due to the volatile nature of oil prices, stringent regulatory requirements, and the complexity of integrating new technologies with existing infrastructure. Furthermore, cybersecurity threats pose a significant risk to critical infrastructure in this sector, requiring robust protective measures to safeguard sensitive data and operations. Additionally, the industry faces workforce challenges with an aging workforce and a shortage of skilled workers with expertise in automation technologies. Adapting to rapidly evolving technologies, maintaining operational continuity, and ensuring safety and compliance are critical challenges that companies in the US Industrial Automation Oil & Gas Market need to address to stay competitive and sustainable in the long term.

United States (US) Industrial Automation Oil & Gas Market Investment Opportunities

The United States Industrial Automation Oil & Gas Market is primarily driven by the increasing demand for energy and the need for operational efficiency and cost savings in the oil and gas industry. The adoption of advanced technologies such as Internet of Things (IoT), artificial intelligence, and robotics in industrial automation is also fueling market growth. Additionally, the focus on enhancing safety and reducing environmental impact through automation solutions is a key driver in the industry. The trend towards digital transformation and the integration of automation systems with data analytics and cloud computing are further propelling the market forward. Overall, the drive for increased productivity, reduced downtime, and improved asset performance in the oil and gas sector is pushing companies to invest in industrial automation solutions.

United States (US) Industrial Automation Oil & Gas Market Government Polices

The US government has implemented various policies related to the Industrial Automation Oil & Gas Market to promote safety, efficiency, and innovation in the sector. These policies include regulations by the Environmental Protection Agency (EPA) to reduce emissions and promote environmental sustainability, as well as guidelines by the Occupational Safety and Health Administration (OSHA) to ensure worker safety in oil and gas operations. Additionally, the government has supported research and development initiatives to encourage technological advancements in industrial automation for the oil and gas industry. These policies aim to balance the economic benefits of the sector with environmental and safety considerations, driving growth and competitiveness in the US Industrial Automation Oil & Gas Market.

United States (US) Industrial Automation Oil & Gas Market Future Outlook

The future outlook for the US Industrial Automation Oil & Gas Market is expected to be positive, driven by increasing investments in technology and automation to improve operational efficiency, safety, and productivity in the oil and gas industry. With the growing focus on digital transformation and Industry 4.0 initiatives, companies are likely to adopt advanced automation solutions such as robotics, AI, IoT, and cloud computing to streamline processes and reduce costs. The integration of automation technologies in oil and gas operations will also help in meeting sustainability goals and regulatory requirements. Overall, the market is anticipated to witness steady growth as companies continue to prioritize automation to enhance their competitive advantage and adapt to the evolving industry landscape.

Key Highlights of the Report:

- United States (US) Industrial Automation Oil & Gas Market Outlook

- Market Size of United States (US) Industrial Automation Oil & Gas Market, 2024

- Forecast of United States (US) Industrial Automation Oil & Gas Market, 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Revenues & Volume for the Period 2021 - 2031

- United States (US) Industrial Automation Oil & Gas Market Trend Evolution

- United States (US) Industrial Automation Oil & Gas Market Drivers and Challenges

- United States (US) Industrial Automation Oil & Gas Price Trends

- United States (US) Industrial Automation Oil & Gas Porter's Five Forces

- United States (US) Industrial Automation Oil & Gas Industry Life Cycle

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By Component for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By Control Valves for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By HMI for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By Process Analyzers for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By Intelligent Pigging for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By Vibration Monitoring for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By Solutions for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By SCADA for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By PLC for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By DCS for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By MES for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Industrial Automation Oil & Gas Market Revenues & Volume By PAM for the Period 2021 - 2031

- United States (US) Industrial Automation Oil & Gas Import Export Trade Statistics

- Market Opportunity Assessment By Component

- Market Opportunity Assessment By Solutions

- United States (US) Industrial Automation Oil & Gas Top Companies Market Share

- United States (US) Industrial Automation Oil & Gas Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Industrial Automation Oil & Gas Company Profiles

- United States (US) Industrial Automation Oil & Gas Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Industrial Automation Oil & Gas Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Industrial Automation Oil & Gas Market - Industry Life Cycle |

3.4 United States (US) Industrial Automation Oil & Gas Market - Porter's Five Forces |

3.5 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume Share, By Component, 2021 & 2031F |

3.6 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume Share, By Solutions, 2021 & 2031F |

4 United States (US) Industrial Automation Oil & Gas Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for energy efficiency and cost reduction in oil gas operations |

4.2.2 Technological advancements in industrial automation solutions |

4.2.3 Growing adoption of Industrial Internet of Things (IIoT) in the oil gas industry |

4.3 Market Restraints |

4.3.1 High initial investment costs associated with implementing automation solutions |

4.3.2 Concerns regarding cybersecurity and data privacy in automation systems |

4.3.3 Slow adoption rate due to resistance to change in traditional oil gas operations |

5 United States (US) Industrial Automation Oil & Gas Market Trends |

6 United States (US) Industrial Automation Oil & Gas Market, By Types |

6.1 United States (US) Industrial Automation Oil & Gas Market, By Component |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By Component, 2021 - 2031F |

6.1.3 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By Control Valves, 2021 - 2031F |

6.1.4 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By HMI, 2021 - 2031F |

6.1.5 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By Process Analyzers, 2021 - 2031F |

6.1.6 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By Intelligent Pigging, 2021 - 2031F |

6.1.7 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By Vibration Monitoring, 2021 - 2031F |

6.2 United States (US) Industrial Automation Oil & Gas Market, By Solutions |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By SCADA, 2021 - 2031F |

6.2.3 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By PLC, 2021 - 2031F |

6.2.4 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By DCS, 2021 - 2031F |

6.2.5 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By MES, 2021 - 2031F |

6.2.6 United States (US) Industrial Automation Oil & Gas Market Revenues & Volume, By PAM, 2021 - 2031F |

7 United States (US) Industrial Automation Oil & Gas Market Import-Export Trade Statistics |

7.1 United States (US) Industrial Automation Oil & Gas Market Export to Major Countries |

7.2 United States (US) Industrial Automation Oil & Gas Market Imports from Major Countries |

8 United States (US) Industrial Automation Oil & Gas Market Key Performance Indicators |

8.1 Percentage increase in operational efficiency achieved through automation |

8.2 Reduction in downtime and maintenance costs in oil gas facilities |

8.3 Improvement in safety and compliance standards due to automation integration |

9 United States (US) Industrial Automation Oil & Gas Market - Opportunity Assessment |

9.1 United States (US) Industrial Automation Oil & Gas Market Opportunity Assessment, By Component, 2021 & 2031F |

9.2 United States (US) Industrial Automation Oil & Gas Market Opportunity Assessment, By Solutions, 2021 & 2031F |

10 United States (US) Industrial Automation Oil & Gas Market - Competitive Landscape |

10.1 United States (US) Industrial Automation Oil & Gas Market Revenue Share, By Companies, 2024 |

10.2 United States (US) Industrial Automation Oil & Gas Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero