Vietnam Biosimilar Market (2023-2029) | Companies, Size, Analysis, Revenue, Industry, Forecast, Value, Trends, Share & Growth

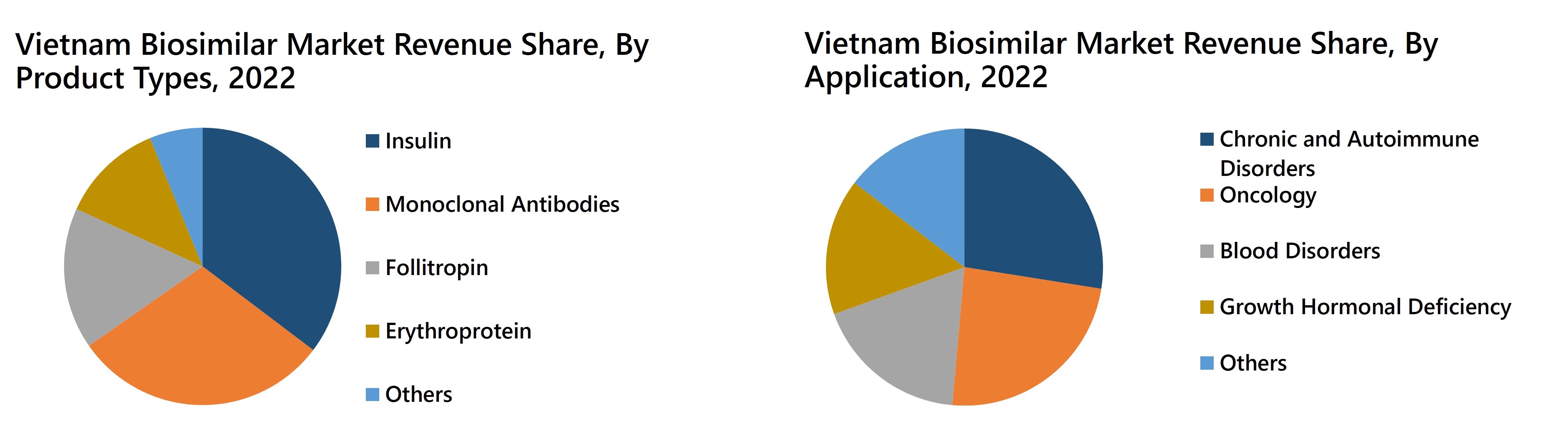

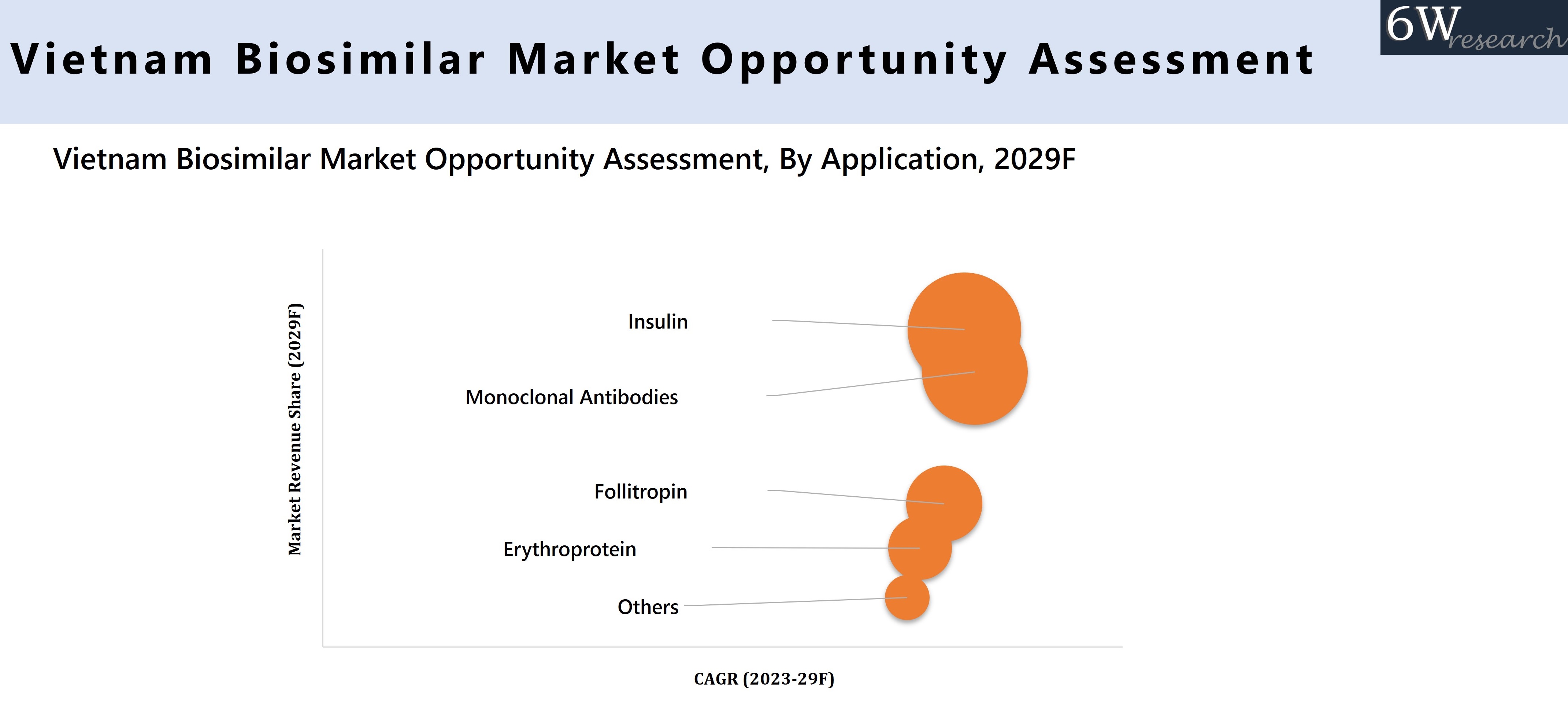

Market Forecast By Product Types (Insulin, Follitropin, Monoclonal Antibodies, Erythroprotein, Others),By Application (Oncology, Chronic and Autoimmune Disorders, Blood Disorders, Growth Hormonal Deficiency, Others), By Manufacturing (Outsourced, In-House)And Competitive Landscape

| Product Code: ETC069949 | Publication Date: Aug 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 63 | No. of Figures: 15 | No. of Tables: 1 |

Vietnam Biosimilar Market Size & Growth Rate

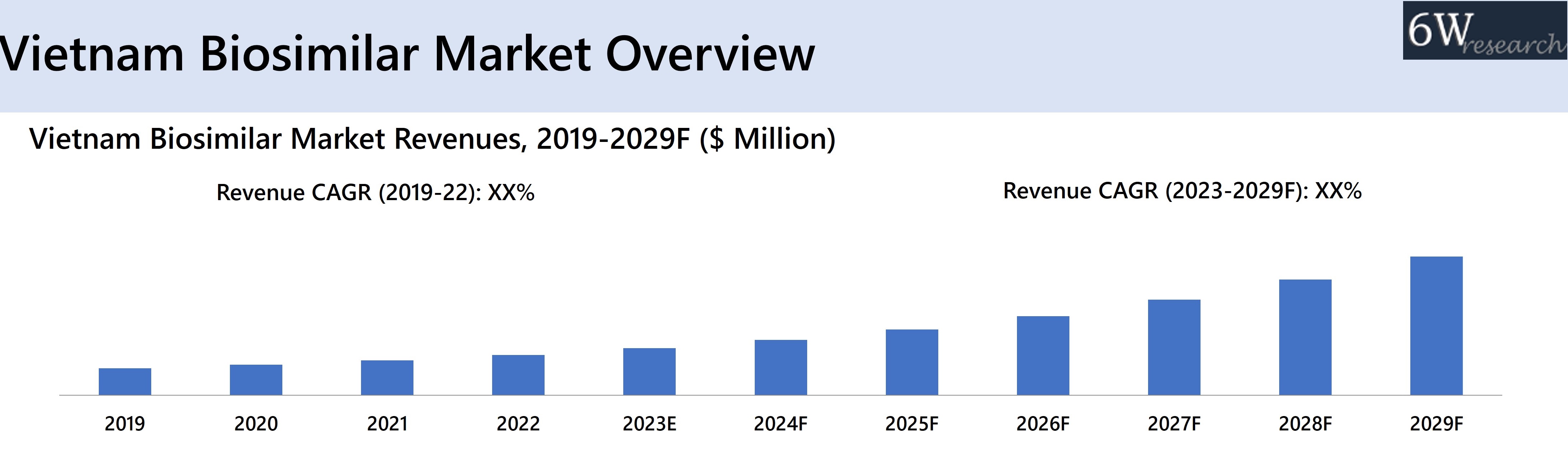

The Vietnam Biosimilar Market is projected to grow at a CAGR of 19.8% from 2023 to 2029, driven by rising government funding, increasing prevalence of chronic diseases among the aging population, and expanding pharmaceutical infrastructure, including a multi-billion-dollar pharmaceutical park project in Hai Duong province.

Vietnam Biosimilar Market Synopsis

Government funding is one of the major drivers for medicines and government tenders and reimbursement programs have led to penetration of biosimilars in the public healthcare system and contributed to the Vietnam Biosimilar Market growth. The European Medicines Agency (EMA) has approved nearly 30 biosimilar medicines globally and more than 300 biosimilars are under development in Asia along with its upcoming simplification in streamlining of the application evaluation process, provides ample opportunities for the biosimilar industry. Moreover, Hai Duong province has recently collaborated with Indian partner Sri Avantika Contractor and SMS Pharmaceuticals for the construction of a pharmaceutical park project worth US$10-12 billion. The pharmaceutical park project is expected to cover nearly 900 hectares of land area in Binh Giang and Thanh Mien districts and aims at the development of new domestic pharmaceutical products as well as improving the competitiveness with imported products which would further accelerate the growth of the biosimilar industry in the coming years.

According to 6Wresearch, Vietnam Biosimilar Market size is projected to grow at a CAGR of 19.8% during 2023-2029. Vietnam’s increasing elderly population is expected to account for 25% of the total population by 2050 an increase from 12% in 2019 with the majority of the aged population more likely to suffer cardiovascular ailments, chronic diseases such as cancer, diabetes, and gastrointestinal disorders. Moreover, biosimilars are cheaper than their counterparts and more accessible drugs for diagnosis and treatment of a variety of illnesses in the aged population, thereby increasing aged people would positively impact the biosimilar market. Moreover, pharmaceutical spending per capita of Vietnam is predicted to increase from $60 in 2021 to $92 in 2026, accounting for around 5% of the country’s income per capita, and would propel the growth of the biosimilars market in the forecast period. The rising overall cost of biosimilar medicines owing to a dispersed distribution network led to operational duplication, poor coordination, and higher logistical costs would act as a restraint and can hamper the growth of the biosimilar market in Vietnam.

According to 6Wresearch, Vietnam Biosimilar Market size is projected to grow at a CAGR of 19.8% during 2023-2029. Vietnam’s increasing elderly population is expected to account for 25% of the total population by 2050 an increase from 12% in 2019 with the majority of the aged population more likely to suffer cardiovascular ailments, chronic diseases such as cancer, diabetes, and gastrointestinal disorders. Moreover, biosimilars are cheaper than their counterparts and more accessible drugs for diagnosis and treatment of a variety of illnesses in the aged population, thereby increasing aged people would positively impact the biosimilar market. Moreover, pharmaceutical spending per capita of Vietnam is predicted to increase from $60 in 2021 to $92 in 2026, accounting for around 5% of the country’s income per capita, and would propel the growth of the biosimilars market in the forecast period. The rising overall cost of biosimilar medicines owing to a dispersed distribution network led to operational duplication, poor coordination, and higher logistical costs would act as a restraint and can hamper the growth of the biosimilar market in Vietnam.

![Vietnam Biosimilar Market Revenue Share]() Market by Product Types

Market by Product Types

Insulin dominated the Vietnam biosimilar industry owing to the increasing diabetic population and change of lifestyle with diabetic patients increasing by 43% from 3.5 million cases in 2019 to roughly 5 million cases in 2022 in the country. Moreover, patient’s preference for cost-effective treatment has contributed to the insulin biosimilar growth.

Market by Application

By application, chronic and autoimmune disorders garnered maximum revenue share in 2022 owing to the high prevalence of heart disease, and kidney diseases among the population. For instance, currently, 55% of diabetes patients have complications involving cardiovascular health, eyes, and the nervous system, or kidneys which would increase the demand for biosimilars for chronic and autoimmune disorders application.

Market by Manufacturing

Outsourced acquired the highest revenue share in the overall Vietnam biosimilar market, mainly due to the emerging market, the country has more dependency on imports. Further, Chinese and Indian sources account for nearly 85% of pharmaceutical materials which contributes to outsourced market revenues.

Key Attractiveness of the Report:

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Biosimilar Market Overview

- Vietnam Biosimilar Market Outlook

- Vietnam Biosimilar Market Forecast

- Vietnam Biosimilar Market Porter's Five Forces

- Vietnam Biosimilar Market Industry Life Cycle

- Historical Market Data and Forecast of Vietnam Biosimilar Revenues, By Product Types for the period 2019-2029F.

- Historical Market Data and Forecast of Vietnam Biosimilar Revenues, By Application for the period 2019-2029F.

- Historical Market Data and Forecast of Vietnam Biosimilar Revenues, By Manufacturing for the period 2019-2029F.

- Market Drivers and Restraints

- Market Opportunity Assessment

- Key Performance Indicators

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Covered:

By Product Types

- Insulin

- Follitropin

- Monoclonal Antibodies

- Erythroprotein

- Others

By Application

- Oncology

- Chronic and Autoimmune Disorders

- Blood Disorders

- Growth Hormonal Deficiency

- Others

By Manufacturing

- Outsourced

- In-House

Vietnam Biosimilar Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Vietnam Biosimilar Market Overview |

| 3.1. Vietnam Biosimilar Market Revenues (2023-2030F) |

| 3.2. Vietnam Biosimilar Market Industry Life Cycle |

| 3.3. Vietnam Biosimilar Market Porter’s Five Forces |

| 4. Vietnam Biosimilar Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing healthcare expenditure in Vietnam |

| 4.2.2 Rising prevalence of chronic diseases requiring biologic treatments |

| 4.2.3 Supportive government initiatives to promote biosimilar adoption |

| 4.3. Market Restraints |

| 4.3.1 Limited awareness and understanding of biosimilars among healthcare professionals and patients |

| 4.3.2 Stringent regulatory requirements for biosimilar approval and market entry |

| 5. Vietnam Biosimilar Market Trends & Evolution |

| 6. Vietnam Biosimilar Market Overview, By Product Types |

| 6.1. Vietnam Biosimilar Market Revenue Share and Revenues, By Product Types (2023-2030F) |

| 6.1.1 Vietnam Biosimilar Market Revenues, By Insulin (2023-2030F) |

| 6.1.2 Vietnam Biosimilar Market Revenues, By Follitropin (2023-2030F) |

| 6.1.3 Vietnam Biosimilar Market Revenues, By Monoclonal Antibodies (2023-2030F) |

| 6.1.4 Vietnam Biosimilar Market Revenues, By Erythroprotein (2023-2030F) |

| 6.1.5 Vietnam Biosimilar Market Revenues, By Others (2023-2030F) |

| 7. Vietnam Biosimilar Market Overview, By Application |

| 7.1. Vietnam Biosimilar Market Revenue Share and Revenues, By Application (2023-2030F) |

| 7.1.1 Vietnam Biosimilar Market Revenues, By Oncology (2023-2030F) |

| 7.1.2 Vietnam Biosimilar Market Revenues, By Chronic and Autoimmune Disorders (2023-2030F) |

| 7.1.3 Vietnam Biosimilar Market Revenues, By Blood Disorders (2023-2030F) |

| 7.1.4 Vietnam Biosimilar Market Revenues, By Growth Hormonal Deficiency (2023-2030F) |

| 7.1.5 Vietnam Biosimilar Market Revenues, By Others (2023-2030F) |

| 8. Vietnam Biosimilar Market Overview, By Manufacturing |

| 8.1. Vietnam Biosimilar Market Revenue Share and Revenues, By Manufacturing (2023-2030F) |

| 8.1.1 Vietnam Biosimilar Market Revenues, By Outsourced (2023-2030F) |

| 8.1.2 Vietnam Biosimilar Market Revenues, By In-House (2023-2030F) |

| 9. Vietnam Biosimilar Market Key Performance Indicators |

| 9.1 Number of biosimilar approvals by regulatory authorities in Vietnam |

| 9.2 Investment in research and development of biosimilars in the country |

| 9.3 Number of partnerships and collaborations between local and international biopharmaceutical companies for biosimilar development and distribution |

| 10. Vietnam Biosimilar Market Opportunity Assessment |

| 10.1 Vietnam Biosimilar Market Opportunity Assessment, By Product Types (2030F) |

| 10.2 Vietnam Biosimilar Market Opportunity Assessment, By Application (2030F) |

| 10.3 Vietnam Biosimilar Market Opportunity Assessment, By Manufacturing(2030F) |

| 11. Vietnam Biosimilar Market Competitive Landscape |

| 11.1 Vietnam Biosimilar Market Revenue Ranking, By Companies (2023) |

| 11.2 Vietnam Biosimilar Market Competitive Benchmarking, By Technical Parameter |

| 11.3 Vietnam Biosimilar Market Competitive Benchmarking, By Operating Parameter |

| 12. Company Profiles |

| 12.1 Medochemie Ltd Medochemie Ltd |

| 12.2 Sandoz International GmbHSandoz International GmbH |

| 12.3 Pfizer Inc. |

| 12.4 Biocon Biocon |

| 12.5 Shanghai Henlius Biotech, Inc. |

| 12.6 BIOCAD |

| 12.7 Nanogen Pharmaceutical Biotechnology JSC |

| 12.8 Celltrion Healthcare Co.,Ltd.Celltrion Healthcare Co.,Ltd. |

| 12.9 Dr. Reddy’s Laboratories Ltd |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Vietnam Biosimilar Market Revenues, 2023-2030F ($ Million) |

| 2. Vietnam % of Population aged 65 and above, 2020-2049F (%) |

| 3. Vietnam Cancer Patients, 2018-2020 |

| 4. Vietnam Pharmaceutical Spending Per captia,2023-206F ($) |

| 5. Out-of-pocket expenditure (% of current health expenditure),2023-2023E |

| 6. Vietnam Health Spending, 2023-2030F($ Billion) |

| 7. Vietnam Biosimilar Market Revenue Share, By Product Types, 2020 & 2030F |

| 8. Vietnam Biosimilar Market Revenue Share, By Application, 2020 & 2030F |

| 9. Vietnam Biosimilar Market Revenue Share, By Manufacturing, 2020 & 2030F |

| 10. Vietnam Pharmaceutical Market Growth Trends, 2020-2030F |

| 11. Vietnam Pharmaceutical Market, 2020-2030F ($ Billion) |

| 12. Vietnam Healthcare Market,2023-2030F($ Billion) |

| 13. Vietnam Public Healthcare Expenditure, 2023 (%) |

| 14. Vietnam Private Healthcare Expenditure, 2023 (%) |

| 15. Vietnam Biosimilar Market Revenue Ranking, By Companies, 2023 |

| List of Tables |

| 1. Vietnam Biosimilar Market Revenues, By Product Types, 2023-2030F ($ Million) |

| 2. Vietnam Biosimilar Market Revenues, By Product Types, 2023-2030F ($ Million) |

| 3. Vietnam Biosimilar Market Revenues, By Manufacturing, 2023-2030F ($ Million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero