Australia & New Zealand Elevator & Escalator Market (2017-2023) | Outlook, Trends, Size, Growth, Forecast, Industry, Companies, Analysis, Share, Revenue & Value

Market Forecast by Segments (Elevator (Passenger, Home, and Cargo Elevator) and Escalator (Moving Stairs and Moving Walkways)), Services (New Installation, Maintenance, and Modernization), Verticals (Residential, Commercial and Industrial), Countries Covered (Australia and New Zealand) and Competitive Landscape

| Product Code: ETC000365 | Publication Date: Nov 2021 | Product Type: Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 129 | No. of Figures: 88 | No. of Tables: 9 |

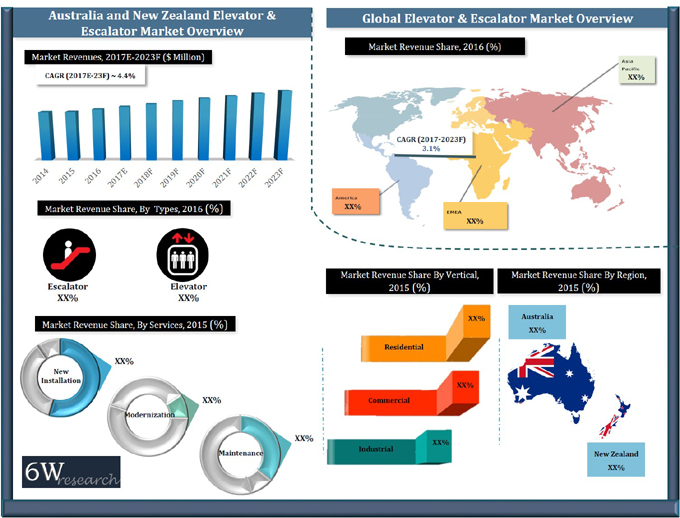

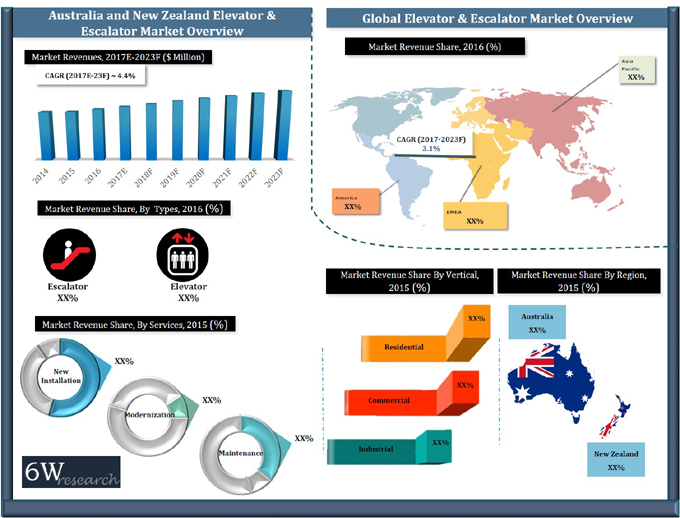

Projected growth in the construction market, upcoming new hotels & shopping malls coupled with growing government spending on infrastructural development projects, and increasing inflow of FDI in construction and retail sectors are some of the key factors that have resulted in the overall growth of Australia & New Zealand elevator & escalator market. Additionally, in the Australia & New Zealand elevator & escalator market, the elevator segment accounted for the majority of the market revenue owing to the high installation of elevators in retail and residential verticals. However, the escalator segment is projected to grow at a higher CAGR during 2017-23, primarily due to growth in airports, metros, and railway development projects in the region.

According to 6Wresearch, Australia & New Zealand elevator & escalator market size is expected to grow at a CAGR of 4.4% during 2017-23. In the last two years, the economic slowdown, the decline in export revenues, and government infrastructural development projects coupled with the depreciating currency in ANZ have affected the demand for elevators and escalators in the region. However, Increasing FDI and infrastructural development projects will increase the demand for Australia & New Zealand elevator & escalator market forecast revenues over the coming years. Amongst all verticals, the commercial vertical acquired the highest revenue share of the market pie in the region. Over the next six years, the residential vertical is forecast to grow at a higher CAGR from 2017 to 2023.

In the ANZ region, Australia held the majority of Australia & New Zealand elevator & escalator market share in terms of revenue, on the back of increasing infrastructure development activities, especially in commercial and residential verticals. However, over the next six years, the New Zealand elevator and escalator market are expected to witness a higher growth rate.

The Australia & New Zealand elevator & escalator market report thoroughly covers the market by elevator & escalator types, by verticals, by services, and by regions. The Australia & New Zealand elevator & escalator market outlook report provides an unbiased and detailed analysis of the Australia & New Zealand elevator & escalator market trends, opportunities/ high growth areas, market drivers, which would help stakeholders to device and align market strategies according to current and future market dynamics.

The elevator and escalator market in Australia and New Zealand is all set to pave new horizons as a result of rising advancements in the construction sector and rising interests of the construction sector towards integrated and well-equipped infrastructure. With the initiation of the product into the market, the application was limited to commercial construction owing to high costs of installation and less infrastructural knowledgeability. But, with the era of globalization and increase in the construction patterns, new private players have been registered to enter the market landscape in Australia and New Zealand. This led to massive investment in the construction sector. A boom in the construction sector has given a new light to the Australia and New Zealand elevator and escalator market. The era of urbanization has no doubt been proven evident in bringing in bountiful opportunities for the elevator and escalator technology products to make their presence a meaningful one in the market competitive landscape across the construction sector. A spur in the suburban migration in these countries for better livelihood and increased commercialization has led to increased construction of not only the corporate buildings but also for household living spaces. This has no doubt, bought new opportunities for the elevator and escalator market in New Zealand and Australia to shape its market landscape, and not only this, the market growth is expected to offer superior investment opportunities for the potential investors to mark a double-digit and promising future business growth in the next five to ten years.

Key Highlights of the Report:

• Australia & New Zealand Elevator & Escalator Market Overview

• Australia & New Zealand Elevator & Escalator Market Outlook

• Historical data of Global Elevator and Escalator Market for the Period 2014-2016.

• Market Size & Forecast of Global Elevator and Escalator Market until 2023.

• Australia & New Zealand Elevator & Escalator Market Size & Australia & New Zealand Elevator &

Escalator Market Forecast of Revenue & Volume, until 2023.

• Historical data of Australia Elevator and Escalator Market Revenue & Volume for the Period 2014-2016

• Historical data of New Zealand Elevator and Escalator Market Revenue & Volume for the Period 2014-2016

• Market Size & Forecast of New Zealand Elevator and Escalator Revenue & Volume Market until 2023.

• Historical data & Forecast of Australia Elevators Market Revenue & Volume for the Period 2014-2023.

• Historical data & Forecast of Australia Escalator Market Revenue & Volume for the Period 2014-2023.

• Historical data & Forecast of Australia Elevator and Escalator Market Revenue, By Region for the

Period 2014-2023.

• Historical data & Forecast of New Zealand Elevators Market Revenue & Volume for the Period 2014-2023.

• Historical data & Forecast of New Zealand Escalator Market Revenue & Volume for the Period 2014-2023.

• Historical data & Forecast of New Zealand Elevator and Escalator Market Revenue, By Region for the

Period 2014-2023

• Historical data of Australia & New Zealand Elevator & Escalator Market Revenue, by Verticals during, 2014-2016.

• Historical data of Australia & New Zealand Elevator & Escalator Market Revenue, by Services for the

Period 2014-2016.

• Australia & New Zealand Elevator & Escalator Market Trends and Developments

• Australia & New Zealand Elevator & Escalator Market Share by Players

• Australia & New Zealand Elevator & Escalator Market Overview on Competitive Landscape.

• Company profiles

Markets Covered

The Australia & New Zealand elevator & escalator market report provides a detailed analysis of the following market segments:

• By Segments

o Elevators

?Passenger Elevator

?Home Elevator

?Cargo Elevator

o Escalator

?Moving Stairs

? Moving Walkways

• By Services

o New Installation

o Maintenance

o Modernization

• By Verticals

o Residential

o Commercial

o Industrial

• By Countries

o Australia

o New Zealand

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3 Global Elevator and Escalator Market Overview

3.1 Global Elevator and Escalator Market Revenues

3.2 Global Elevator and Escalator Market Volume

3.3 Global Elevator and Escalator Market Revenue Share - By Regions

4 Australia & New Zealand Elevator & Escalator Market Overview

4.1 Australia & New Zealand Elevator and Escalator Market Revenues

5 Australia & New Zealand Elevator & Escalator Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.2.1 Burgeoning Construction Market

5.2.2 Growing Tourism Industry

5.2.3 Increasing Number of Skyscrapers

5.3 Market Restraints

5.3.1 High Cost

6 Australia & New Zealand Elevator & Escalator Market Trends

6.1 High-Speed Double Decker Elevators

6.2 Green Elevators and Escalators

6.3 Growing Acceptance of Smart Elevators

7 Australia Elevator and Escalator Market Overview

7.1 Australia Elevator and Escalator Market- Opportunity Matrix

7.2 Australia Elevator and Escalator Market Revenues

7.3 Australia Elevator and Escalator Market Volume

7.4 Australia Elevator and Escalator Market Revenue Share, By Services

7.5 Australia Elevator and Escalator Market Revenue Share, By Verticals

7.6 Australia Elevator and Escalator Market Revenue Share, By Regions

7.7 Australia Elevator Market Overview

7.7.1 Australia Elevator Market Revenue and Volume

7.7.2 Australia Elevator Market Revenue Share, By Types

7.8 Australia Escalator Market Overview

7.8.1 Australia Escalator Market Revenue and Volume

7.8.2 Australia Escalator Market Revenue Share, By Types

7.9 Australia Elevator and Escalator Services Market Overview

7.9.1 Australia Elevator and Escalator Service Market Revenues

7.10 Australia Elevator and Escalator Market Overview, By Verticals

7.10.1 Australia Residential Elevator and Escalator Market Revenues

7.10.2 Australia Commercial Elevator and Escalator Market Revenues

7.10.3 Australia Industrial Elevator and Escalator Market Revenues

7.11 Australia Elevator and Escalator Market Overview, By Regions

7.11.1 Australia Elevator and Escalator Market Revenues, By Regions

7.12 Australia Elevator and Escalator Market Competitive Landscape

7.12.1 Australia Elevator and Escalator Market Players Revenue Share

8 New Zealand Elevator and Escalator Market Overview

8.1 New Zealand Elevator and Escalator Market- Opportunity Matrix

8.2 New Zealand Elevator and Escalator Market Revenues

8.3 New Zealand Elevator and Escalator Market Volume

8.4 New Zealand Elevator and Escalator Market Revenue Share, By Services

8.5 New Zealand Elevator and Escalator Market Revenue Share, By Verticals

8.6 New Zealand Elevator and Escalator Market Revenue Share, By Regions

8.7 New Zealand Elevator Market Overview

8.7.1 New Zealand Elevator Market Revenue and Volume

8.7.2 New Zealand Elevator Market Revenue Share, By Types

8.8 New Zealand Escalator Market Overview

8.8.1 New Zealand Escalator Market Revenue and Volume

8.8.2 New Zealand Escalator Market Revenue Share, By Types

8.9 New Zealand Elevator and Escalator Services Market Overview

8.9.1 New Zealand Elevator and Escalator Service Market Revenues

8.10 New Zealand Elevator and Escalator Market Overview, By Verticals

8.10.1 New Zealand Residential Elevator and Escalator Market Revenues

8.10.2 New Zealand Commercial Elevator and Escalator Market Revenues

8.10.3 New Zealand Industrial Elevator and Escalator Market Revenues

8.11 New Zealand Elevator and Escalator Market Overview, By Regions

8.11.1 New Zealand North Island and South Island Elevator and Escalator Market Revenues

8.12 New Zealand Elevator and Escalator Market Competitive Landscape

8.12.1 New Zealand Elevator and Escalator Market Players Revenue Share

9 Company Profiles

9.1 Kone Corporation

9.2 Otis Elevator Co.

9.3 Schindler

9.4 ThyssenKrupp AG

10 Key Strategic Pointers

11 Disclaimer

List of Figures

Figure 1 Global Elevator and Escalator Market Revenues, 2014-2023F ($ Billion)

Figure 2 Global Elevator and Escalator Market Volume, 2014-2023F (Million Units)

Figure 3 Global Elevator and Escalator Market Revenue Share, By Regions (2016)

Figure 4 Australia & New Zealand Elevator and Escalator Market Revenues, 2014-2023F ($ Billion)

Figure 5 Australia & New Zealand Construction Market By, Sectors (2016)

Figure 6 Number of Tourist Arrivals in Australia, 2016 (Thousand Visitors)

Figure 7 Australia Elevator and Escalator Market Opportunity Matrix, By Verticals (2023F )

Figure 8 Australia Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 9 Australia Iron Ore Prices, Jan 2015-Nov 2016 ($ per Dry Metric Ton)

Figure 10 Australia Coal Prices, Jan 2015-Nov 2016 ($ per Metric Ton)

Figure 11 Australia Annual GDP Growth (%), 2012-2021F

Figure 12 Australia Construction Work Turnover Growth (2012-2017F)

Figure 13 Australia Construction Market, By Sectors (2015)

Figure 14 Australia GDP Contribution, By Industries (2014-2015)

Figure 15 Australia Elevator and Escalator Market Volume, 2014-2023F (Units)

Figure 16 Australia Elevator and Escalator Market Revenue Share, By Services (2016 & 2023F)

Figure 17 Australia Elevator and Escalator Market Revenue Share, By Verticals (2016 & 2023F)

Figure 18 Australia Elevator and Escalator Market Revenue Share, By Regions (2016 & 2023F)

Figure 19 Australia Elevator Market Revenues, 2014-2023F ($ Million)

Figure 20 Australia Elevator Market Volume, 2014-2023F (Units)

Figure 21 Australia Elevator Market Revenue Share, 2016 (Percentage)

Figure 22 Australia Elevator Market Revenue Share, By Types (2016 & 2023F)

Figure 23 Australia Passenger Elevator Market Revenues, 2014-2023F ($ Million)

Figure 24 Australia Home Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 25 Australia Cargo Elevator Market Revenues, 2014-2023F ($ Million)

Figure 26 Australia Escalator Market Revenues, 2014-2023F ($ Million)

Figure 27 Australia Escalator Market Volume, 2014-2023F (Units)

Figure 28 Australia Escalator Market Revenue Share, 2016 (Percentage)

Figure 29 Australia Escalator Market Revenue Share, By Types (2016 & 2023F)

Figure 30 Australia Moving Stairs Escalator Market Revenues, 2014-2023F ($ Million)

Figure 31 Australia Moving Walkways Escalator Market Revenues, 2014-2023F ($ Million)

Figure 32 Australia Elevator and Escalator New Installation Service Market Revenue Share, By Types (2016)

Figure 33 Australia Residential Elevator and Escalator Market Volume, 2014-2023F ( $ Million)

Figure 34 Australia Residential Sector Value of Construction Work Done, 3Q 2014-2Q 2017E ($ Million)

Figure 35 Australia Commercial Elevator and Escalator Market Volume, 2014-2023F ( $ Million)

Figure 36 Australia Hospitality Sector Value of Construction Work Done, 3Q 2014-2Q 2017E ($ Million)

Figure 37 Australia Retail Sector Value of Construction Work Done, 3Q 2014-2Q 2017E ($ Million)

Figure 38 Australia Retail Market Revenues, 2011-2018 ($ Billion)

Figure 39 Australia Percentage Share of Small & Medium Business (2013)

Figure 40 Australia International Tourist Arrival, 2016-2025 (In Millions)

Figure 41 Australia Tourism Market Share, By Main Markets (2016 & 2024F)

Figure 42 Australia Visitor's Expenditure, 2016-2025 ($ Billions)

Figure 43 Australia Industrial Elevator and Escalator Market Volume, 2014-2023F ( $ Million)

Figure 44 Western Australia Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 45 Northern Territory Australia Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 46 South Australia Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 47 Queensland Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 48 New South Wales Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 49 Victoria Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 50 Tasmania Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 51 Australia Elevator and Escalator Market Revenues, By Companies, 2016 ($ Million)

Figure 52 Australia Elevator and Escalator Market Revenue Share, By Companies, 2016

Figure 53 New Zealand Elevator and Escalator Market Opportunity Matrix, By Verticals (2016 )

Figure 54 New Zealand Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 55 New Zealand Value of Construction Work Done, 2014-2016E ($ Billion)

Figure 56 New Zealand Value of Construction Work Done, By Building Type (2015-2016)

Figure 57 New Zealand Annual GDP Growth (%), 2012-2021F

Figure 58 New Zealand FDI Inflow, 2003-2015 ($ Billion)

Figure 59 New Zealand Elevator and Escalator Market Volume, 2014-2023F (Units)

Figure 60 New Zealand Elevator and Escalator Market Revenue Share, By Services (2016 & 2023F)

Figure 61 New Zealand Elevator and Escalator Market Revenue Share, By Verticals (2016 & 2023F)

Figure 62 New Zealand Elevator and Escalator Market Revenue Share, By Regions (2016 & 2023F)

Figure 63 New Zealand Elevator Market Revenues, 2014-2023F ($ Million)

Figure 64 New Zealand Elevator Market Volume, 2014-2023F (Units)

Figure 65 New Zealand Elevator Market Revenue Share, 2016 (Percentage)

Figure 66 New Zealand Elevator Market Revenue Share, By Types (2016 & 2023F)

Figure 67 New Zealand Passenger Elevator Market Revenues, 2014-2023F ($ Million)

Figure 68 New Zealand Home Elevator and Escalator Market Revenues, 2014-2023F ($ Million)

Figure 69 New Zealand Cargo Elevator Market Revenues, 2014-2023F ($ Million)

Figure 70 New Zealand Escalator Market Revenues, 2014-2023F ($ Million)

Figure 71 New Zealand Escalator Market Volume, 2014-2023F (Units)

Figure 72 New Zealand Escalator Market Revenue Share, 2016 (Percentage)

Figure 73 New Zealand Escalator Market Revenue Share, By Types (2016 & 2023F)

Figure 74 New Zealand Moving Stairs Escalator Market Revenues, 2014-2023F ($ Million)

Figure 75 New Zealand Moving Walkways Escalator Market Revenues, 2014-2023F ($ Million)

Figure 76 New Zealand Elevator and Escalator Service Market Revenue Share, By Types (2016)

Figure 77 New Zealand Residential Elevator and Escalator Market Revenues, 2014-2023F ( $ Million)

Figure 78 New Zealand Value of Residential Construction Work Done, 2014-2016E ($ Billion)

Figure 79 New Zealand Commercial Elevator and Escalator Market Revenues, 2014-2023F ( $ Million)

Figure 80 New Zealand Retail Market Revenues, 2011-2018 ($ Billion)

Figure 81 New Zealand Value of Non Residential Value of Construction Work Done, 2014-2016E ($ Billion)

Figure 82 New Zealand Requirement of New Hotel Rooms by 2025, By Key Regions

Figure 83 New Zealand Growth in Hotel Demand Between 2015-2025, By Hotel Preference, By Key Regions

Figure 84 New Zealand Industrial Elevator and Escalator Market Revenues, 2014-2023F ( $ Million)

Figure 85 New Zealand North Island Region Market Revenues, 2014-2023F ($ Million)

Figure 86 New Zealand South Island Region Market Revenues, 2014-2023F ($ Million)

Figure 87 New Zealand Elevator and Escalator Market Revenues, By Companies, 2016 ($ Million)

Figure 88 New Zealand Elevator and Escalator Market Revenue Share, By Companies, 2016

List of Tables

Table 1 Major Skyscrapers under Construction in Australia & New Zealand (2016)

Table 2 List of Double Decker Elevators, By Companies

Table 3 Australia Major Proposed Construction Projects

Table 4 Standard Moving Stairs Escalator Steps Width with Application

Table 5 Australia Elevator and Escalator Market Revenues, By Services, 2014-2023F ($ Million)

Table 6 Australia Residential Sector Major Construction Projects

Table 7 Australia Hospitality and Commercial Office Sector Major Construction Projects

Table 8 New Zealand Elevator and Escalator Market Revenues, By Services, 2014-2023F ($ Million)

Table 9 New Zealand Residential Sector Major Construction Projects

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero