India Fruit Market (2025-2031) | Analysis, Revenue, Share, Forecast, Size, Outlook, Growth, Value, Companies, Industry & Trends

Market Forecast By Applications (Supermarkets and Hypermarkets, Specialty Stores, Online), By Type (Fresh, Dried, Frozen, Others) And Competitive Landscape

| Product Code: ETC020024 | Publication Date: Jun 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

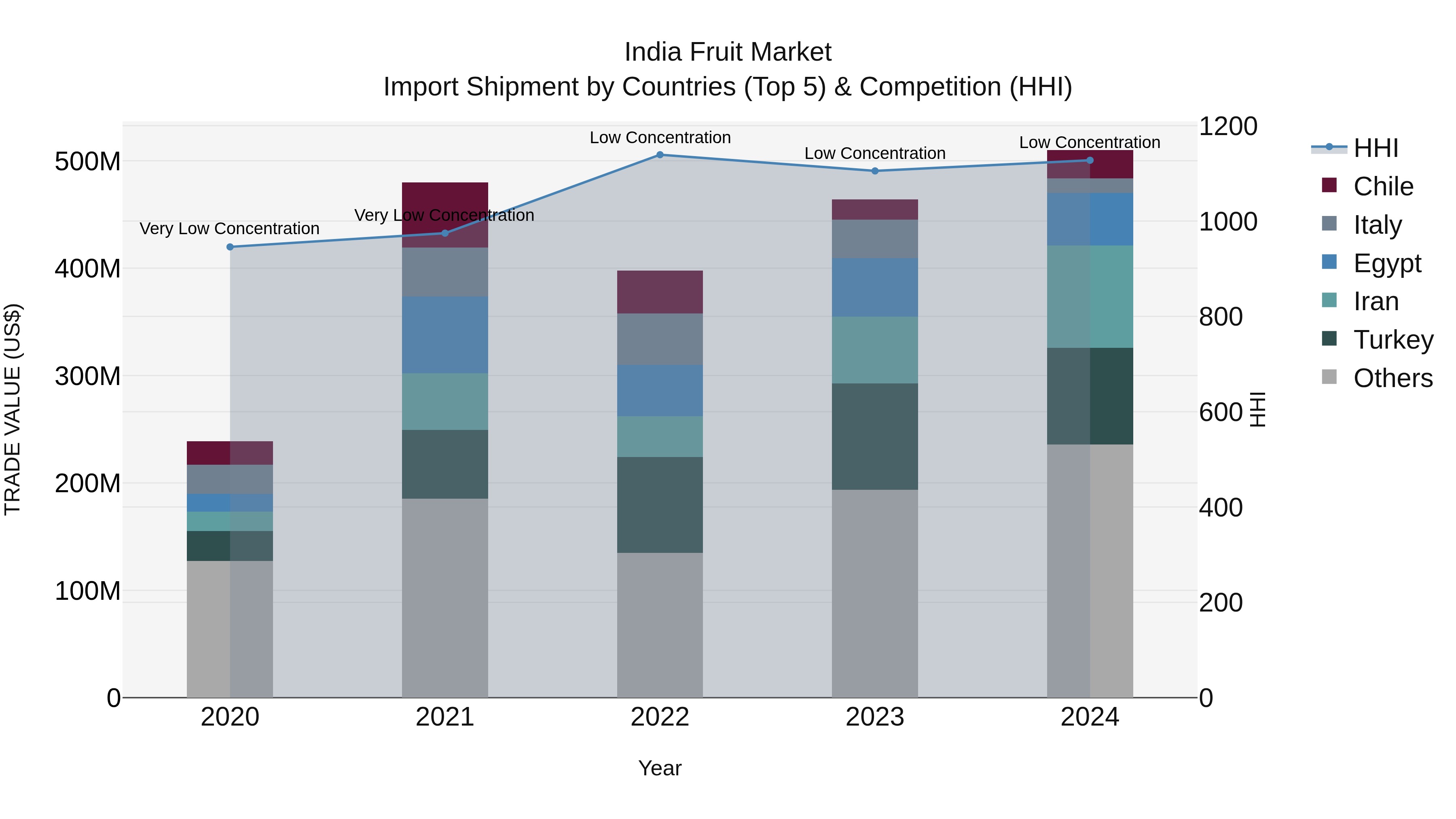

India Fruit Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s fruit import market in 2024 saw significant contributions from Iran, Turkey, South Africa, Egypt, and Afghanistan. The market remained relatively diverse with low concentration indicated by the Herfindahl-Hirschman Index (HHI). The compound annual growth rate (CAGR) from 2020 to 2024 was robust at 20.87%, showcasing a growing demand for imported fruits in India. Moreover, the growth rate from 2023 to 2024 was impressive at 9.88%, indicating a continued upward trajectory for fruit imports in the country.

India Fruit Market Growth Rate

According to 6Wresearch internal database and industry insights, the India Fruit Market is projected to grow at a compound annual growth rate (CAGR) of 7.7 % during the forecast period (2025–2031).

India Fruit Market Highlights

| Report Name | India Fruit Market |

| Forecast period | 2025-2031 |

| CAGR | 7.7% |

| Growing Sector | Agriculture and Horticulture |

Five-Year Growth Trajectory of the India Fruit Market with Core Drivers

Below mentioned are the evaluation of year-wise growth rate along with key drivers:

| Years | Est. Annual Growth (%) | Growth Drivers |

| 2020 | 0.042 | Stable household demand; kirana dominance; limited cold-chain. |

| 2021 | 0.051 | Uptake of organized retail and doorstep delivery; improved logistics. |

| 2022 | 0.06 | Health-conscious consumption; premium exotics and packaged cut-fruit. |

| 2023 | 0.068 | Expansion of cold storages and ripening chambers; wider private labels. |

| 2024 | 0.075 | Farmgate digitization, e-commerce penetration, and value-added processing. |

Topics Covered in the India Fruit Market Report

The India Fruit Market report thoroughly covers the market by applications and type. The report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high-growth areas, and market drivers that will help stakeholders devise and align strategies according to current and future market dynamics.

India Fruit Market Synopsis

The India Fruit Market is expected to experience substantial growth due to the rise in disposable income, growing health awareness among consumers, and the expansion of modern retailers and e-grocery platforms. The rise of investments in cold-chain systems, ripening facilities, and farm aggregation is enhancing product quality and length of shelf life. Government programs aimed at horticulture, logistics, and market linkages have increased profitability for farmers while ensuring there will always be fruit available year-round to urban and semi-urban markets. This market enhancement is providing long-term market expansion and distribution efficiencies throughout the nation.

Evaluation of Growth Drivers in the India Fruit Market

Below mentioned are some prominent drivers and their influence on the India Fruit Market dynamics:

| Drivers | Primary Segments Affected | Why it Matters (Evidence) |

| Cold-Chain & Ripening Infrastructure Expansion | Fresh, Frozen; Supermarkets & Hypermarkets | Reduces post-harvest losses, improves quality consistency, and enables all-season availability. |

| Health & Wellness Consumption Shift | Fresh, Dried; Specialty Stores | Boosts per-capita intake of vitamin-rich fruits and premium varieties (berries, citrus). |

| E-commerce & Quick Commerce Adoption | Online; Fresh, Dried | Broader SKU assortment, last-mile reach, dynamic pricing, and data-led merchandising. |

| Government Horticulture Support (e.g., MIDH, Operation Greens, Agri Infra Fund) | Fresh; Supermarkets & Hypermarkets | Subsidies for storage/transport and farmer FPOs improve throughput and price stability. |

| Value-Addition & Food Processing Growth | Frozen, Dried; Specialty Stores | Cuts wastage via pulps, IQF, dehydrated fruit; opens HoReCa and export channels. |

India Fruit Market is expected to grow steadily at 7.7 % CAGR between 2025 and 2031. The expansion of the India Fruit Market is being fueled by growing consumer inclination towards healthy eating, rapid urbanization, and the modernization of retail supply chains. The India Fruit Market Growth will be supported by improved cold-chain logistics, the penetration of organized retail, and improved digital solutions enabling both farmers and consumers to connect. Government programs aimed at improving post-harvest management and value addition, such as MIDH and Operation Greens, are going to make a positive impact on sector growth. Increasing demand for both fresh and processed fruits from supermarket, specialty, and online channels will fuel long-term resilient growth in the market.

Evaluation of Restraints in the India Fruit Market

Below mentioned are some major restraints and their influence on the India Fruit Market dynamics:

| Restraints | Primary Segments Affected | What this Means (Evidence) |

| High Post-Harvest Losses | Fresh | Handling gaps and temperature abuse erode margins and retail availability. |

| Price Volatility & Seasonality | Fresh; Specialty Stores | Monsoon variability and gluts/shortages impact retail pricing and procurement planning. |

| Fragmented Supply Base | Fresh; Online | Sourcing complexity raises costs; quality inconsistency across regions. |

| Import Competition in Select Categories | Fresh (Apples, Citrus) | Price/quality pressure on domestic growers in premium segments. |

| Compliance & Traceability Requirements | Fresh, Dried, Frozen | Additional investments in food safety, labeling, and farm documentation. |

India Fruit Market Challenges

There are many challenges facing the India Fruit Industry including fragmented supply chains, high post-harvest losses, and poor cold-chain infrastructure. Seasonal price instability and local inconsistencies negatively affect the potential to sell at retail and export prices. Reliance on smallholder farmers, who have limited access to technology, makes large-scale standardization challenging. Furthermore, the compliance of food safety and traceability regulations creates high levels of operational costs. Collectively, these barriers create inefficiencies in the distribution of fruit, constrain producer profit, and increase the time it takes to bring modernization and scale across the fruit supply ecosystem.

India Fruit Market Trends

Several significant trends are impacting India Fruit Market:

- Premiumization of Fresh Produce: Growth of seedless, residue-controlled, and exotic fruit lines, supported by branding and private labels.

- Rise of IQF & Ready-to-Use Packs: Frozen (IQF) berries/mango and fresh-cut packs for convenience-driven urban consumers and HoReCa.

- Digital Aggregation at Farmgate: Platforms enabling transparent pricing, demand pooling, and quality-linked payments to farmers.

- Sustainable Packaging & Traceability: Shift toward recyclable packs, QR-based origin tracing, and residue-compliance certifications.

- Year-Round Banana & Mango Programs: Programmatic sourcing with ripening protocols to ensure uniform taste and reduced wastage.

Investment Opportunities in the India Fruit Industry

Some of the notable investment opportunities are:

- Integrated Cold-Chain Assets: End-to-end pre-coolers, CA storages, and reefers to cut wastage and extend seasons.

- Ripening & Quality Labs: Ethylene-based ripening chambers and in-line sorting/grading with Brix testing to standardize output.

- Farmgate Collection & Packhouses: Near-farm packhouses for cleaning, grading, and MAP packaging to serve modern trade.

- IQF & Dehydration Units: Value-add via pulps, purees, freeze-dried snacks, and export-grade IQF lines.

- Omnichannel Retail Partnerships: Private-label development and subscription models with supermarkets and quick-commerce.

Top 5 Leading Players in the India Fruit Market

Below is the list of prominent companies leading in the India Fruit Market Share :

1. Reliance Retail (Fresh)

| Company Name | Reliance Retail (Fresh) |

|---|---|

| Headquarters | Mumbai, India |

| Established Year | 2006 |

| Official Website | Click Here |

Reliance Retail (Fresh) operates extensive fresh produce supply chains across India, featuring ripening centers, packhouses, and private-label programs that ensure freshness and traceability from farm to store.

2. ITC Limited (Farmland)

| Company Name | ITC Limited (Farmland) |

|---|---|

| Headquarters | Kolkata, India |

| Established Year | 1910 |

| Official Website | Click Here |

ITC’s Farmland brand focuses on graded, residue-controlled fruits sourced through farm-level extension services and stringent quality protocols, promoting safe and sustainable fresh produce.

3. Mother Dairy Fruit & Vegetable Pvt. Ltd. (Safal)

| Company Name | Mother Dairy Fruit & Vegetable Pvt. Ltd. (Safal) |

|---|---|

| Headquarters | New Delhi, India |

| Established Year | 1974 |

| Official Website | Click Here |

Safal, the fresh produce arm of Mother Dairy, aggregates directly from farmer cooperatives, offering fresh fruits, vegetables, juices, and pulps through its strong retail and processing network.

4. Adani Agri Fresh

| Company Name | Adani Agri Fresh |

|---|---|

| Headquarters | Ahmedabad, India |

| Established Year | 2006 |

| Official Website | Click Here |

Adani Agri Fresh is a pioneer in controlled-atmosphere apple storage, grading, and direct retail supply, ensuring premium quality produce through its farm-to-market infrastructure.

5. Tata Digital (BigBasket)

| Company Name | Tata Digital (BigBasket) |

|---|---|

| Headquarters | Bengaluru, India |

| Established Year | 2011 |

| Official Website | Click Here |

BigBasket, owned by Tata Digital, leads online fresh fruit distribution with an integrated cold-chain network, dark stores, and data-driven assortment and pricing systems for urban consumers.

Government Regulations Introduced in the India Fruit Market

According to Indian Government data, the Government of India has emphasized horticulture via schemes such as Mission for Integrated Development of Horticulture (MIDH) supporting nurseries, protected cultivation, and post-harvest infrastructure; Operation Greens (TOP to TOTAL) extending price support and value chain development to fruits like mango and banana; Agri Infrastructure Fund offering interest subvention for warehouses, cold storages, and packhouses; e-NAM enabling transparent digital trade; and PM Formalisation of Micro Food Processing Enterprises (PM-FME) aiding micro units for processing and branding.

These initiatives collectively strengthen supply chains, improve farmer returns, and increase availability of quality fruit for retail and processing.

Future Insights of the India Fruit Market

The fruit industry in India is poised for continued growth, supported by omnichannel retailing distribution networks and cold-chain coverage that lessen perishability factors. Programmatic sourcing provides a steady state of quality for consumers, and significant consumption growth will continue to come from Tier-2 and Tier-3 cities. Frozen and shelf-stable value-added formats (i.e., dried fruits) will only serve to contribute to market margins.

Investments in traceability, sustainable packaging, and export-grade processing will provide additional product benefits, enhance competitiveness, and reinforce market positioning to facilitate India’s place as an important centre for sustainable fruit production and distribution.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

By Applications – Supermarkets and Hypermarkets to Dominate the Market

According to Ritika Kalra, Senior Research Analyst, 6Wresearch, Supermarkets and Hypermarkets hold the largest share as organized chains provide consistent quality, temperature-controlled displays, in-store ripening, and private-label packaging.

Their centralized procurement and program-based sourcing lower shrink, while planogram-driven merchandising increases basket size.

Online is the fastest-growing channel, yet Supermarkets & Hypermarkets remain dominant in absolute value due to expansive footprints and trust in quality assurance.

By Type – Fresh to Dominate the Market

Fresh fruits are projected to dominate the India Fruit Market Share owing to daily household consumption, cultural preferences, and expanding modern retail with ripening and grading standards.

Fresh formats benefit from frequent purchases, wide regional varietals (banana, mango, apple, citrus), and improved last-mile cold-chain that preserves taste and texture, making Fresh the highest-volume and most visible category nationwide.

Key Attractiveness of the Report

- 10 Years of Market Numbers

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- India Fruit Market Outlook

- Market Size of India Fruit Market, 2024

- Forecast of India Fruit Market, 2031

- Historical Data and Forecast of India Fruit Revenues & Volume for the Period 2021-2031

- India Fruit Market Trend Evolution

- India Fruit Market Drivers and Challenges

- India Fruit Price Trends

- India Fruit Porter's Five Forces

- India Fruit Industry Life Cycle

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Supermarkets and Hypermarkets for the Period 2021-2031

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Specialty Stores for the Period 2021-2031

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Online for the Period 2021-2031

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Fresh for the Period 2021-2031

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Dried for the Period 2021-2031

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Frozen for the Period 2021-2031

- Historical Data and Forecast of India Fruit Market Revenues & Volume By Others for the Period 2021-2031

- India Fruit Import Export Trade Statistics

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Type

- India Fruit Top Companies Market Share

- India Fruit Competitive Benchmarking By Technical and Operational Parameters

- India Fruit Company Profiles

- India Fruit Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Application

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

By Type

- Fresh

- Dried

- Frozen

- Others

India Fruit Market (2025-2031) : FAQ's

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Fruit Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Fruit Market Revenues & Volume, 2021 & 2031F |

| 3.3 India Fruit Market - Industry Life Cycle |

| 3.4 India Fruit Market - Porter's Five Forces |

| 3.5 India Fruit Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 3.6 India Fruit Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 4 India Fruit Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing health consciousness and awareness about the benefits of consuming fruits |

| 4.2.2 Growing disposable income leading to higher purchasing power |

| 4.2.3 Rising demand for organic and exotic fruits |

| 4.2.4 Government initiatives to promote fruit cultivation and exports |

| 4.3 Market Restraints |

| 4.3.1 Seasonal variations affecting the availability and pricing of fruits |

| 4.3.2 Infrastructure challenges in storage and transportation leading to wastage |

| 4.3.3 Price fluctuations due to external factors such as weather conditions and global market trends |

| 5 India Fruit Market Trends |

| 6 India Fruit Market, By Types |

| 6.1 India Fruit Market, By Applications |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Fruit Market Revenues & Volume, By Applications, 2021-2031F |

| 6.1.3 India Fruit Market Revenues & Volume, By Supermarkets and Hypermarkets, 2021-2031F |

| 6.1.4 India Fruit Market Revenues & Volume, By Specialty Stores, 2021-2031F |

| 6.1.5 India Fruit Market Revenues & Volume, By Online, 2021-2031F |

| 6.2 India Fruit Market, By Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Fruit Market Revenues & Volume, By Fresh, 2021-2031F |

| 6.2.3 India Fruit Market Revenues & Volume, By Dried, 2021-2031F |

| 6.2.4 India Fruit Market Revenues & Volume, By Frozen, 2021-2031F |

| 6.2.5 India Fruit Market Revenues & Volume, By Others, 2021-2031F |

| 7 India Fruit Market Import-Export Trade Statistics |

| 7.1 India Fruit Market Export to Major Countries |

| 7.2 India Fruit Market Imports from Major Countries |

| 8 India Fruit Market Key Performance Indicators |

| 8.1 Average consumption of fruits per capita |

| 8.2 Adoption rate of online fruit purchasing platforms |

| 8.3 Number of fruit processing units established |

| 8.4 Percentage of agricultural land dedicated to fruit cultivation |

| 8.5 Rate of growth in demand for organic and exotic fruits |

| 9 India Fruit Market - Opportunity Assessment |

| 9.1 India Fruit Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 9.2 India Fruit Market Opportunity Assessment, By Type, 2021 & 2031F |

| 10 India Fruit Market - Competitive Landscape |

| 10.1 India Fruit Market Revenue Share, By Companies, 2024 |

| 10.2 India Fruit Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero