United States (US) Cocoa Products Market | Share, Outlook, Size, Companies, COVID-19 IMPACT, Industry, Trends, Revenue, Growth, Forecast, Analysis & Value

| Product Code: ETC170840 | Publication Date: Jan 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Bhawna Singh | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

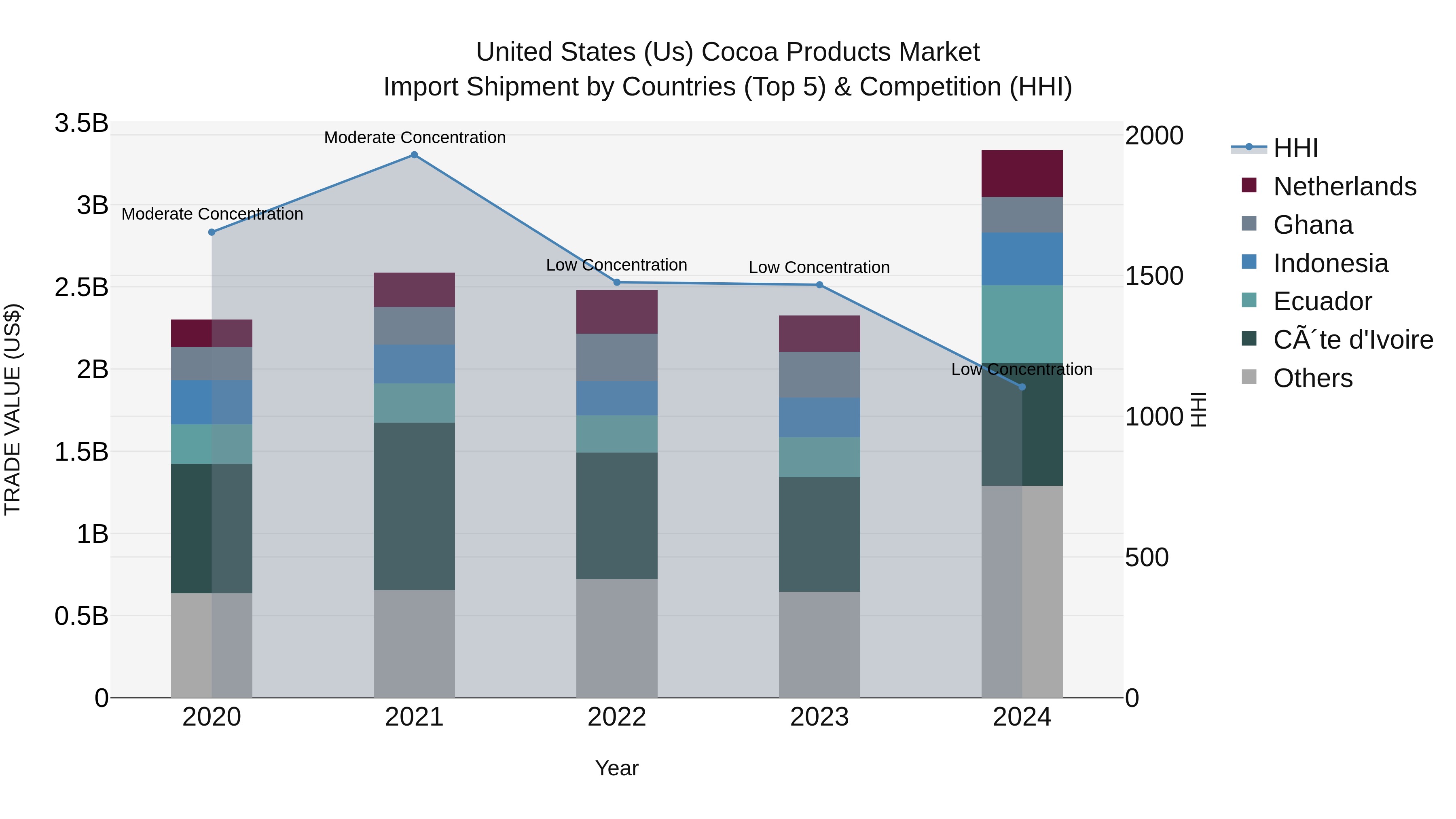

United States (US) Cocoa Products Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, the United States continued to receive significant cocoa product imports from key countries including Côte d`Ivoire, Ecuador, Malaysia, Indonesia, and the Netherlands. Despite the high growth rate of 43.3% in 2024, the market remains fairly diversified with a low Herfindahl-Hirschman Index (HHI) indicating low concentration among suppliers. The impressive compound annual growth rate (CAGR) of 9.68% from 2020 to 2024 suggests a strong and steady demand for cocoa products in the US market, reflecting a positive outlook for the industry.

USA Export Potential Assessment For Cocoa Products Market (Values in USD Thousand)

United States (US) Cocoa Products Market Overview

The United States Cocoa Products Market is a dynamic and competitive industry driven by consumer demand for chocolate and cocoa-based products. The market encompasses a wide range of products such as chocolate bars, cocoa powder, baking chocolate, and drinking chocolate. Key factors influencing market growth include changing consumer preferences towards premium and organic products, increasing popularity of dark chocolate for its health benefits, and growing adoption of cocoa products in various applications beyond traditional confectionery. Major players in the US Cocoa Products Market include Hershey`s, Mars, Ghirardelli, and Nestle, among others. The market is also witnessing a trend towards sustainable sourcing practices and ethical production, leading to the rise of certifications like Fair Trade and Rainforest Alliance. Overall, the US Cocoa Products Market is expected to continue growing as consumers seek indulgent yet healthier options in the chocolate and cocoa segment.

United States (US) Cocoa Products Market Trends

The US Cocoa Products Market is experiencing several key trends. Firstly, there is a growing demand for premium and ethically sourced cocoa products, driven by consumers` increasing awareness of sustainability and fair trade practices. Secondly, there is a rising interest in healthy and functional cocoa products, such as dark chocolate with high cocoa content that offers health benefits like antioxidants. Additionally, the trend of gourmet and artisanal cocoa products is gaining traction, with consumers seeking unique and high-quality offerings. Lastly, the influence of e-commerce and online retailing is shaping the market dynamics, enabling consumers to access a wider range of cocoa products and driving competition among manufacturers and retailers to offer convenience and variety to customers.

United States (US) Cocoa Products Market Challenges

The United States Cocoa Products Market faces several challenges including fluctuating cocoa prices due to weather conditions affecting cocoa bean production, increasing competition from other sweet treats and snacks, and consumers` shifting preferences towards healthier and organic food options. Additionally, issues related to sustainability and ethical sourcing practices have gained importance, pushing companies to address concerns around child labor and deforestation in cocoa-producing regions. Furthermore, the impact of the COVID-19 pandemic on supply chains and consumer behavior has added another layer of complexity to the market dynamics, requiring companies to adapt quickly to changing circumstances. Overall, navigating these challenges requires companies in the US Cocoa Products Market to innovate, differentiate their products, and establish transparent and sustainable practices to remain competitive and meet evolving consumer demands.

United States (US) Cocoa Products Market Investment Opportunities

The United States Cocoa Products Market presents various investment opportunities due to the increasing consumer demand for chocolate and cocoa-based products. Investors can consider investing in companies involved in the production and distribution of chocolate confectionery, cocoa powder, cocoa butter, and other cocoa products. Additionally, there is a growing trend towards premium and organic chocolate products, creating opportunities for investment in specialty and artisanal chocolate brands. With the rise in health-conscious consumers, investing in companies offering healthier alternatives such as dark chocolate or functional cocoa products could also be lucrative. Furthermore, the US market offers potential for innovation and product development, such as incorporating sustainable sourcing practices or introducing new flavors and product formats to cater to changing consumer preferences.

United States (US) Cocoa Products Market Government Policy

The US Cocoa Products Market is subject to various government policies and regulations aimed at ensuring food safety, fair trade practices, and environmental sustainability. The Food and Drug Administration (FDA) oversees the safety and labeling of cocoa products to protect consumer health. Additionally, the US Department of Agriculture (USDA) provides support and guidelines for cocoa farmers regarding sustainable farming practices and quality standards. Trade policies, such as tariffs and import regulations, also impact the cocoa market in the US. The government`s efforts to promote fair trade and ethical sourcing practices in the cocoa industry through initiatives like the Cocoa Protocol further shape the market landscape. Overall, government policies play a crucial role in shaping the US Cocoa Products Market by addressing various aspects of production, trade, and consumer protection.

United States (US) Cocoa Products Market Future Outlook

The United States Cocoa Products Market is expected to witness steady growth in the coming years, driven by increasing consumer awareness of the health benefits associated with cocoa products such as dark chocolate. The market is also likely to benefit from the growing trend of premiumization, with consumers showing a preference for high-quality, ethically sourced cocoa products. Additionally, the demand for cocoa products in various industries, including cosmetics and pharmaceuticals, is anticipated to contribute to market growth. However, challenges such as fluctuating cocoa prices and supply chain disruptions may impact market dynamics. Overall, innovation in product offerings, sustainable sourcing practices, and strategic marketing efforts are expected to play a crucial role in shaping the future of the US Cocoa Products Market.

Key Highlights of the Report:

- United States (US) Cocoa Products Market Outlook

- Market Size of United States (US) Cocoa Products Market, 2021

- Forecast of United States (US) Cocoa Products Market, 2031

- Historical Data and Forecast of United States (US) Cocoa Products Revenues & Volume for the Period 2018 - 2031

- United States (US) Cocoa Products Market Trend Evolution

- United States (US) Cocoa Products Market Drivers and Challenges

- United States (US) Cocoa Products Price Trends

- United States (US) Cocoa Products Porter's Five Forces

- United States (US) Cocoa Products Industry Life Cycle

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Type for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Cocoa Beans for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Cocoa Butter for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Cocoa Powder & Cake for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Cocoa Paste & Liquor for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Chocolate for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Application for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Confectionery for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Food & Beverages for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Cosmetics for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Cocoa Products Market Revenues & Volume By Pharmaceutical for the Period 2018 - 2031

- United States (US) Cocoa Products Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- United States (US) Cocoa Products Top Companies Market Share

- United States (US) Cocoa Products Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Cocoa Products Company Profiles

- United States (US) Cocoa Products Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Cocoa Products Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Cocoa Products Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Cocoa Products Market - Industry Life Cycle |

3.4 United States (US) Cocoa Products Market - Porter's Five Forces |

3.5 United States (US) Cocoa Products Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 United States (US) Cocoa Products Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 United States (US) Cocoa Products Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing consumer awareness about the health benefits of cocoa products |

4.2.2 Growing demand for organic and sustainable cocoa products |

4.2.3 Rising popularity of premium and artisanal cocoa products |

4.3 Market Restraints |

4.3.1 Fluctuating cocoa bean prices due to weather conditions and supply chain disruptions |

4.3.2 Health concerns related to sugar and fat content in cocoa products |

4.3.3 Intense competition from other snack and confectionery products |

5 United States (US) Cocoa Products Market Trends |

6 United States (US) Cocoa Products Market, By Types |

6.1 United States (US) Cocoa Products Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Cocoa Products Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 United States (US) Cocoa Products Market Revenues & Volume, By Cocoa Beans, 2021-2031F |

6.1.4 United States (US) Cocoa Products Market Revenues & Volume, By Cocoa Butter, 2021-2031F |

6.1.5 United States (US) Cocoa Products Market Revenues & Volume, By Cocoa Powder & Cake, 2021-2031F |

6.1.6 United States (US) Cocoa Products Market Revenues & Volume, By Cocoa Paste & Liquor, 2021-2031F |

6.1.7 United States (US) Cocoa Products Market Revenues & Volume, By Chocolate, 2021-2031F |

6.2 United States (US) Cocoa Products Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Cocoa Products Market Revenues & Volume, By Confectionery, 2021-2031F |

6.2.3 United States (US) Cocoa Products Market Revenues & Volume, By Food & Beverages, 2021-2031F |

6.2.4 United States (US) Cocoa Products Market Revenues & Volume, By Cosmetics, 2021-2031F |

6.2.5 United States (US) Cocoa Products Market Revenues & Volume, By Pharmaceutical, 2021-2031F |

7 United States (US) Cocoa Products Market Import-Export Trade Statistics |

7.1 United States (US) Cocoa Products Market Export to Major Countries |

7.2 United States (US) Cocoa Products Market Imports from Major Countries |

8 United States (US) Cocoa Products Market Key Performance Indicators |

8.1 Percentage increase in demand for organic and sustainable cocoa products |

8.2 Growth in sales of premium and artisanal cocoa products |

8.3 Number of new product launches in the cocoa products market |

8.4 Consumer sentiment towards health benefits of cocoa products |

8.5 Adoption rate of innovative cocoa product formulations |

9 United States (US) Cocoa Products Market - Opportunity Assessment |

9.1 United States (US) Cocoa Products Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 United States (US) Cocoa Products Market Opportunity Assessment, By Application, 2021 & 2031F |

10 United States (US) Cocoa Products Market - Competitive Landscape |

10.1 United States (US) Cocoa Products Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Cocoa Products Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero