India Vegetable oils Market (2025-2031) | Trends, Share, Forecast, Size, Value, Analysis, Industry, Revenue, Companies, Outlook & Growth

| Product Code: ETC020564 | Publication Date: Jun 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

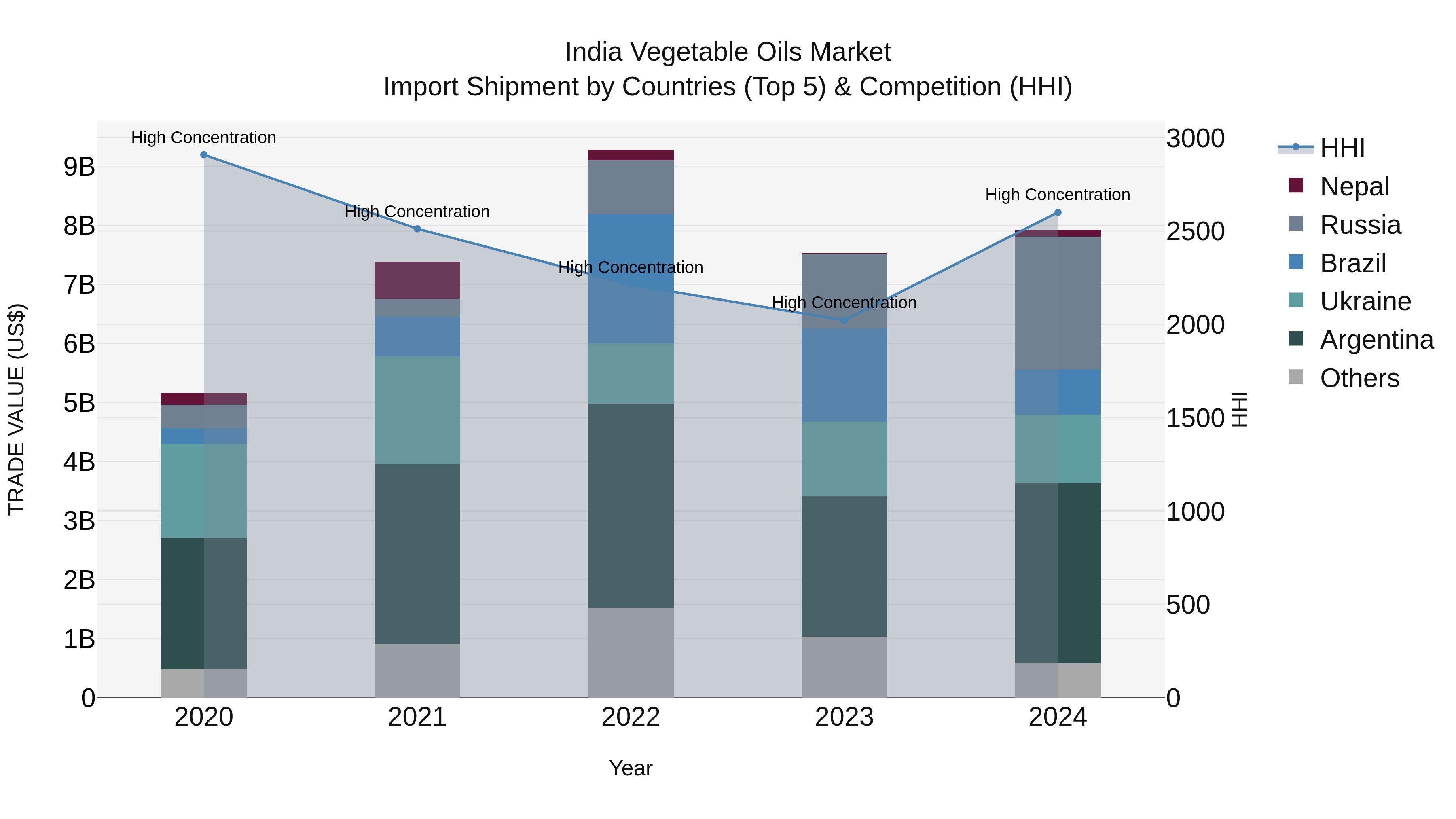

India Vegetable Oils Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s vegetable oils import market in 2024 continued to see significant contributions from top exporters such as Argentina, Russia, Ukraine, Brazil, and Nepal. The market concentration, as measured by the Herfindahl-Hirschman Index (HHI), remained at high levels, indicating a competitive landscape. With a compound annual growth rate (CAGR) of 11.29% from 2020 to 2024, the sector displayed robust expansion. Furthermore, the growth rate from 2023 to 2024 was recorded at 5.31%, demonstrating ongoing momentum in the importation of vegetable oils into India.

India Vegetable oils Market Synopsis

India is the world`s third-largest importer of vegetable oils in 2025 with an estimated 8.6 million metric ton, comprising of edible and non-edible oil varieties such as palm oil, soybean oil, sunflower seed oil and rapeseed/mustard seed oil. The Indian edible oils market has grown at a CAGR of 6.1% between 2015 to 2025 and is expected to grow further due to the rising population & income levels which are driving up demand for healthier cooking options like vegetable oils in India.

Drivers of the Market:

? Government Initiatives - The Government of India has also taken measures to encourage domestic production through subsidies on crop cultivation thus helping create opportunities for local manufacturers who can supply low cost products into the market place which will help keep prices down while stimulating growth potential.

? Growing Population & Increasing Income Levels ? With increasing disposable incomes coupled with a growing population, India?s consumption patterns have shifted towards convenience foods that require more use of vegetable oils during processing or preparation. This trend is also seen in urban households who are replacing traditional cooking methods such as ghee (clarified butter) by healthier cooking options like plant based alternatives like vegetable oils.

Challenges of the Market:

? Availability Of Low Cost Alternatives? Palm Oil is one of the most widely used cooking mediums globally due its low cost compared other types of edible fruits & vegetables available in the marketplace giving it an edge over other competitors especially if price plays an important role when it comes to consumer decisions making process. However Palm Oil has been viewed negatively due its high saturated fat content so this might be a challenge for industry players looking enter into this segment as they need offer healthy alternatives without compromising on taste or nutrition values which could potentially lead higher costs associated with production processes .

? Environmental Concerns - As majority manufacturing facilities involved extraction processes release pollutants air water sources there environmental concerns being raised regarding sustainability these practices long term effects ecosystem surrounding these areas particular related greenhouse gas emissions from burning fuels generate energy required complete tasks within their respective plants . In response government implementing stringent regulations aimed controlling emissions often large fines imposed companies found not comply laws governing same . Thus presents additional financial burden businesses already operating narrow profit margins under competitive conditions prevailing currently sector dissuade entry new entrants into field altogether hindering growth prospects entire segment going forward future dates .

Trends of the Market:

? Preference For Organic Oils ? Consumers are now increasingly preferring organic

Key Highlights of the Report:

- India Vegetable oils Market Outlook

- Market Size of India Vegetable oils Market, 2024

- Forecast of India Vegetable oils Market, 2031

- Historical Data and Forecast of India Vegetable oils Revenues & Volume for the Period 2021-2031

- India Vegetable oils Market Trend Evolution

- India Vegetable oils Market Drivers and Challenges

- India Vegetable oils Price Trends

- India Vegetable oils Porter's Five Forces

- India Vegetable oils Industry Life Cycle

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Types for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Palm Oil for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Soybean Oil for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Rapeseed Oil for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Sunflower Oil for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Olive Oil for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Food for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Feed for the Period 2021-2031

- Historical Data and Forecast of India Vegetable oils Market Revenues & Volume By Industrial for the Period 2021-2031

- India Vegetable oils Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Applications

- India Vegetable oils Top Companies Market Share

- India Vegetable oils Competitive Benchmarking By Technical and Operational Parameters

- India Vegetable oils Company Profiles

- India Vegetable oils Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Vegetable oils Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Vegetable oils Market Revenues & Volume, 2021 & 2031F |

3.3 India Vegetable oils Market - Industry Life Cycle |

3.4 India Vegetable oils Market - Porter's Five Forces |

3.5 India Vegetable oils Market Revenues & Volume Share, By Types, 2021 & 2031F |

3.6 India Vegetable oils Market Revenues & Volume Share, By Applications, 2021 & 2031F |

4 India Vegetable oils Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing urbanization leading to higher demand for convenience foods that use vegetable oils. |

4.2.2 Growing health consciousness among consumers promoting the consumption of vegetable oils over animal fats. |

4.2.3 Rising disposable incomes and changing lifestyles driving the demand for packaged and processed foods that use vegetable oils. |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials impacting the cost of production and pricing of vegetable oils. |

4.3.2 Competition from other cooking oils like palm oil, sunflower oil, and soybean oil affecting market share. |

4.3.3 Regulatory restrictions and quality standards posing challenges for market entry and product approval. |

5 India Vegetable oils Market Trends |

6 India Vegetable oils Market, By Types |

6.1 India Vegetable oils Market, By Types |

6.1.1 Overview and Analysis |

6.1.2 India Vegetable oils Market Revenues & Volume, By Types, 2021-2031F |

6.1.3 India Vegetable oils Market Revenues & Volume, By Palm Oil, 2021-2031F |

6.1.4 India Vegetable oils Market Revenues & Volume, By Soybean Oil, 2021-2031F |

6.1.5 India Vegetable oils Market Revenues & Volume, By Rapeseed Oil, 2021-2031F |

6.1.6 India Vegetable oils Market Revenues & Volume, By Sunflower Oil, 2021-2031F |

6.1.7 India Vegetable oils Market Revenues & Volume, By Olive Oil, 2021-2031F |

6.1.8 India Vegetable oils Market Revenues & Volume, By Others, 2021-2031F |

6.2 India Vegetable oils Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 India Vegetable oils Market Revenues & Volume, By Food, 2021-2031F |

6.2.3 India Vegetable oils Market Revenues & Volume, By Feed, 2021-2031F |

6.2.4 India Vegetable oils Market Revenues & Volume, By Industrial, 2021-2031F |

7 India Vegetable oils Market Import-Export Trade Statistics |

7.1 India Vegetable oils Market Export to Major Countries |

7.2 India Vegetable oils Market Imports from Major Countries |

8 India Vegetable oils Market Key Performance Indicators |

8.1 Consumer awareness and preference for healthier cooking oils. |

8.2 Adoption rate of vegetable oils in various food applications. |

8.3 Investment in research and development for product innovation in the vegetable oils market. |

9 India Vegetable oils Market - Opportunity Assessment |

9.1 India Vegetable oils Market Opportunity Assessment, By Types, 2021 & 2031F |

9.2 India Vegetable oils Market Opportunity Assessment, By Applications, 2021 & 2031F |

10 India Vegetable oils Market - Competitive Landscape |

10.1 India Vegetable oils Market Revenue Share, By Companies, 2024 |

10.2 India Vegetable oils Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero